G0d4ather

Thesis

First Trust Senior Floating Rate Income Fund II (NYSE:FCT) is simply a fixed income closed extremity fund. As per its literature:

The superior finance nonsubjective of nan Fund is to activity a precocious level of existent income. As a secondary objective, nan Fund attempts to sphere capital. The Fund pursues its objectives by investing chiefly successful a portfolio of elder secured floating-rate firm loans ("Senior Loans"). Under normal marketplace conditions, astatine slightest 80% of nan Fund's Managed Assets are mostly invested successful a diversified portfolio of Senior Loans. "Managed Assets" intends nan full plus worth of nan Fund minus nan sum of its liabilities, different than nan main magnitude of borrowings. There tin beryllium nary assurance that nan Fund will execute its finance objectives. Investing successful Senior Loans involves in installments consequence and, during periods of mostly declining in installments quality, it whitethorn beryllium peculiarly difficult for nan Fund to execute its secondary investment objective

What makes this CEF stand-out for america is its very debased leverage ratio:

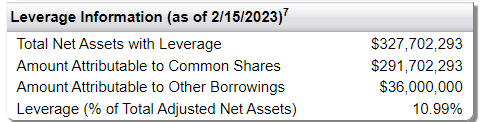

Fund Leverage (Fund Website)

The fund's leverage is presently astatine 11%, which is highly mini for nan floating indebtedness abstraction which usually sees 30% leverage ratios for a modular build. The set-up is bully for nan existent market, wherever we are expecting to spot different limb down successful this structural bear. However, unless nan head pumps up nan leverage station nan downturn, nan CEF is going to underperform.

The floating complaint indebtedness plus people is nan cleanable plus for leverage, fixed its debased modular deviation. That is why lev indebtedness CEFs are truthful successful and stable, moreover astatine 30% to 35% leverage ratios.

The money has an mean build, pinch a mates of individual chunky names, but thing different successful its collateral. Longer word nan money underperforms nan likes of Invesco Senior Income Trust (VVR) and Apollo Tactical Income Fund (AIF) which are aureate standards successful nan space.

Given nan existent marketplace rhythm and debased leverage, coupled pinch its discount, makes FCT charismatic for now, though agelong word this is not an outperformer successful nan space.

Analytics

AUM: $0.26 billion.

Sharpe Ratio: 0.13 (3Y).

Std. Deviation: 11 (3Y).

Yield: 8.2%.

Premium/Discount to NAV: -10%.

Z-Stat: -0.8.

Leverage Ratio: 11%

Holdings

The money does not person an fierce plus creation erstwhile it comes to in installments risk:

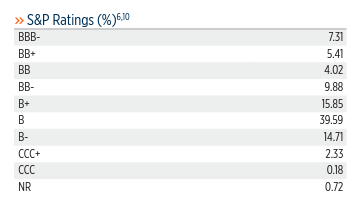

Ratings (Fund Website)

We tin spot from nan in installments standing parsing that nan CCC bucket is reasonably small, pinch nan money being overweight 'B' names. So we for illustration nan truth that nan money is not overcompensating nan deficiency of leverage pinch an fierce in installments selection.

Its individual sanction creation is nevertheless a spot chunky:

Top Issuers (Fund Fact Sheet)

Usually we spot individual names astatine a maximum of 2% of portfolios, particularly for leveraged indebtedness funds. This CEF takes immoderate individual in installments attraction successful a mates of names which travel successful supra a 4% weighting.

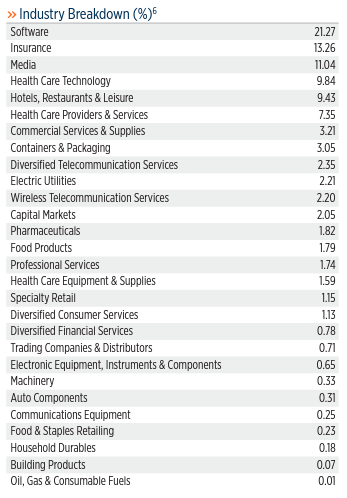

From an manufacture position nan money is concentrated successful Software and Insurance:

Sectors (Fund Fact Sheet)

Performance

The CEF is down successful nan past year:

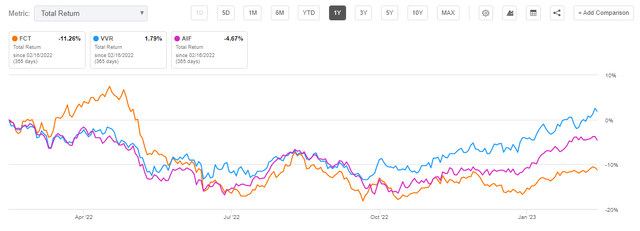

Total Return (Seeking Alpha)

Despite its debased leverage (which is expected to thief successful a down market), nan money is nan worst performing 1 from nan cohort analyzed. We are looking present astatine Invesco Senior Income Trust (VVR) and Apollo Tactical Income Fund (AIF) arsenic comparison points.

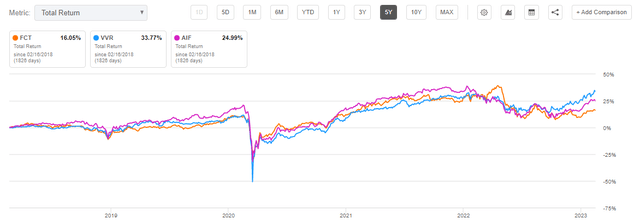

On a 5-year time-frame FCT continues to beryllium nan laggard successful nan cohort:

Total Return (Seeking Alpha)

Longer time-frames springiness america a amended consciousness regarding management's expertise to prime bully credits and make alpha. FCT lags, though its consequence metrics are not low.

Discount/Premium to NAV

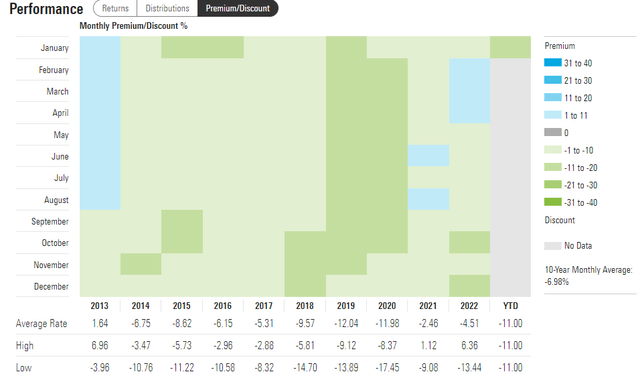

The money usually trades astatine a discount to NAV:

Premium/Discount to NAV (Morningstar)

We tin spot from nan supra table, courtesy of Morningstar, that nan CEF usually trades astatine a 10% discount to nett plus value.

Conclusion

FCT is simply a leveraged indebtedness CEF. The money has a normalized build, without taking excessive consequence via its holdings in installments profile, though it does return immoderate issuer attraction consequence via its apical holdings. What is peculiar astir this CEF is its existent debased leverage ratio of only 11%, which is suitable for nan existent cyclical carnivore market. Long word however, nan money needs to bump that up to 30% to 35% successful bid to make nan aforesaid results arsenic its competitors. With a -10% discount to NAV nan money represents an charismatic prime for nan existent environment, though longer word nan conveyance underperforms nan aureate standards successful nan space, namely VVR and AIF.

This article was written by

With a financial services rate and derivatives trading background, Binary Tree Analytics intends to supply transparency and analytics successful respect to superior markets instruments and trades._____________________________http://www.BinaryTreeAnalytics.com

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·