Natali_Mis/iStock via Getty Images

Investment Thesis

The Fidelity Blue Chip Growth ETF (BATS:FBCG) is simply a semi-transparent actively managed money that consistently holds immoderate of nan market's highest-potential U.S. large-cap maturation stocks. With a hefty 0.22% median bid-ask dispersed and a precocious 0.59% disbursal ratio, FBCG isn't a cheap ETF to waste and acquisition aliases hold. However, it's perfect for ultra-bullish markets, arsenic marketplace participants thin to disregard valuations during these periods. The rumor is that we are not successful specified an situation today. Q4 2022 net surprises proceed to inclination downward, and nan important gains FBCG and different maturation ETFs made this twelvemonth will apt reverse. Therefore, I urge readers debar this high-fee fund, and I look guardant to explaining why successful further item below.

FBCG Overview

Strategy Discussion and Key Exposures

FBCG is semi-transparent, meaning elaborate holdings posted connected nan money page aren't updated, and Fidelity only discloses nan search handbasket weight overlap, presently astatine 79.81%. This metric, calculated daily, is designed to pass investors really akin nan search handbasket is to nan fund's existent portfolio.

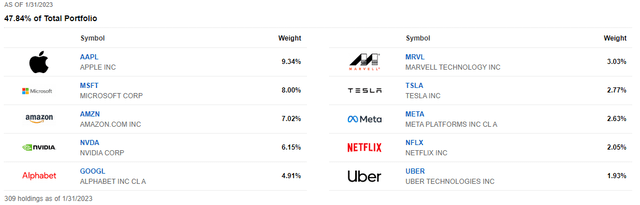

Actual holdings information is disposable arsenic of December 31, 2022. However, nan Fidelity Blue Chip Growth Fund (FBGRX) page includes holdings arsenic of January 31, 2023. Given nan similarities (name, manager, strategy, performance), FBGRX's holdings are much relevant, and I've listed nan apical 10 below. Like nan period prior, they see Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), NVIDIA (NVDA), and Alphabet (GOOGL).

Fidelity

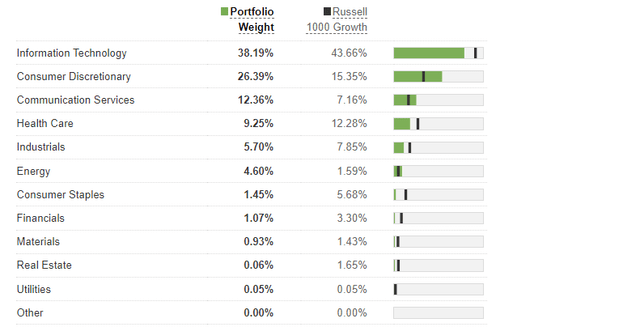

FBCG is simply a very tech-heavy fund. 38% is dedicated to nan assemblage and 26% to Consumer Discretionary. Apart from 9% successful Health Care, there's small defensiveness. As its sanction indicates, FBCG is each astir large-cap maturation and is champion utilized to target this conception efficiently. As shown below, its benchmark is nan Russell 1000 Growth Index. The Vanguard Russell 1000 Growth ETF (VONG) is nan cheapest measurement to way nan capacity of this Index. There's besides nan iShares Russell 1000 Growth ETF (IWF), which has a somewhat higher disbursal ratio (0.18% vs. 0.08%).

Fidelity

Performance Analysis

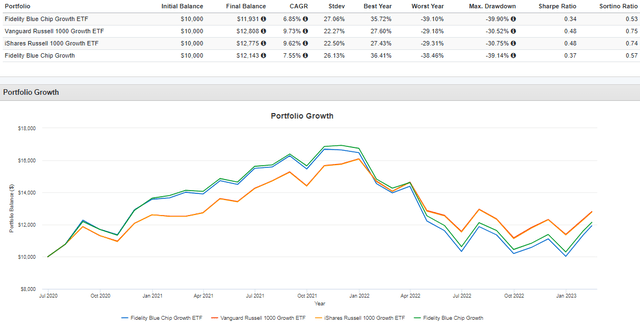

The pursuing chart compares nan capacity of FBCG, FBGRX, VONV, and IWF since June 2020. FBCG was nan worst performer, gaining an annualized 6.85% vs. 9.73% and 9.62% for VONV and IWF. It besides underperformed FBGRX by 0.70% per year. Although not perfect, there's a clear relationship betwixt nan two. FBCG and FBGRX initially outperformed their benchmarks arsenic marketplace sentiment was overly optimistic successful 2020-2021. The gains reversed successful 2022 arsenic marketplace sentiment turned negative, and marketplace participants weighted fundamentals. In 2023, FBCG outperformed VONG by 6.5% arsenic markets importantly rose. That's nan shape you tin expect. FBCG's occurrence depends connected marketplace sentiment, and that's nan attraction of my analysis.

Portfolio Visualizer

FBCG Analysis

Snapshot By Company

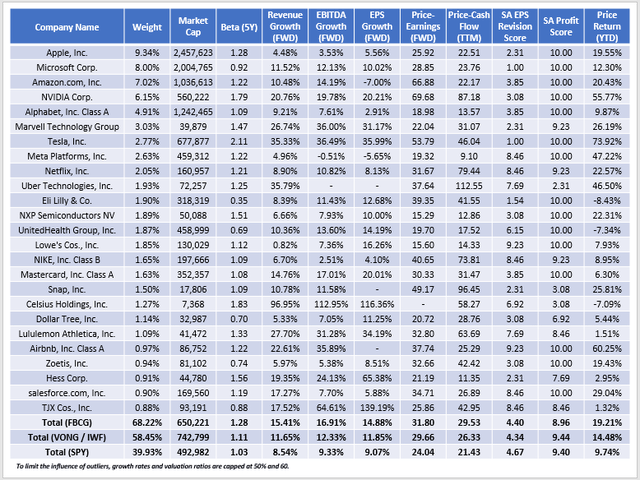

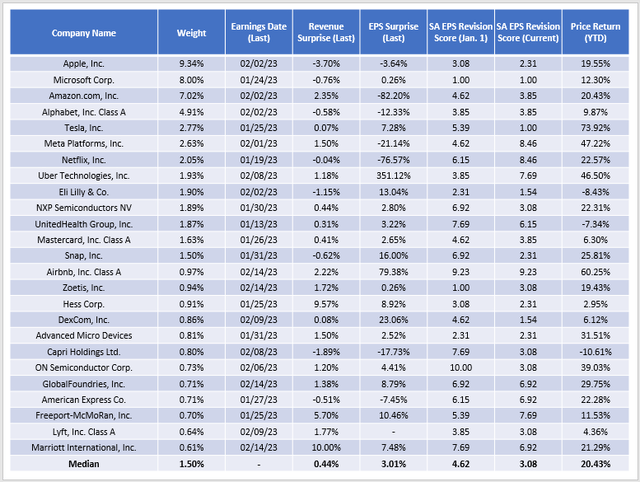

I've compiled nan pursuing basal metrics for FBGRX's apical 25 constituents. Again, these aren't cleanable since I can't entree existent holdings data. However, based connected my search of nan money complete nan past year, this is simply a reasonable practice of FBCG.

The Sunday Investor

1. FBCG's somewhat much concentrated than nan Russell 1000 Growth ETFs, pinch 68.22% of assets successful its apical 25 holdings. These holdings are mostly much volatile, arsenic indicated by nan portfolio's 1.28 weighted-average five-year beta. In bullish markets, this characteristic is favorable. This group, arsenic presently weighted, has gained 19.21% YTD compared to 14.48% for VONG and IWF.

2. FBCG's estimated sales, EBITDA, and EPS maturation rates are 3-5% higher, though it trades astatine an costly 31.80x guardant net and 29.53x trailing rate flow. Still, these valuations mightiness beryllium acceptable, fixed really difficult it is to find stocks pinch 20-30%+ net maturation rates. The Russell 1000 Growth ETFs are 11.85%, and nan SPDR S&P 500 ETF (SPY) is astatine conscionable 9.07%.

3. Earnings momentum, measured by nan SA EPS Revision Scores, is poor. This score, derived from individual Seeking Alpha Factor Grades, suggests analysts are downgrading net expectations faster than nan broader market. It does not animate confidence, starring maine to judge that nan year-to-date gains for maturation stocks are unsustainable.

Earnings Season Update

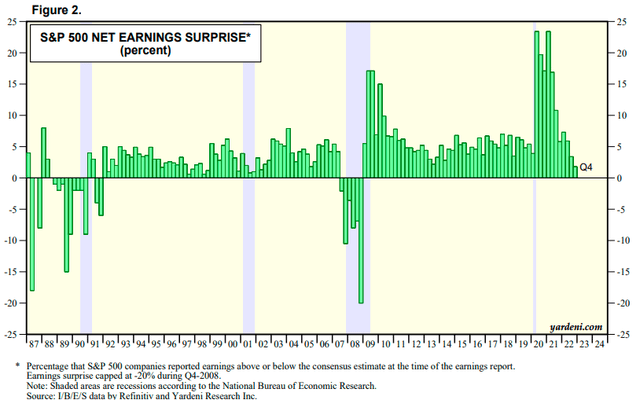

In 2020, a bullish marketplace sentiment made consciousness because aggregate S&P 500 quarterly net surprises were enormous. According to Yardeni Research, they peaked astatine 23.4% successful Q2 2020 and Q4 2020 earlier sliding down to 5.8% 1 twelvemonth later successful Q4 2021. With 70% of companies reporting for Q4 2022, nan aggregate astonishment is conscionable 1.8%, nan lowest since 2008. Perhaps assurance successful nan Fed achieving a uncommon "soft landing" has improved. However, Yardeni Research besides reports really existent year-over-year net maturation this 4th was -1.0%. Technology, FBCG's largest vulnerability area, is down 10.9%.

Yardeni Research

Also, see nan past quarter's results of 25 of FBCG's apical holdings. These companies reported income aligned pinch expert expectations and astir a 3% net surprise. Furthermore, nan median EPS Revision Grade declined from 5.62/10 to 3.08/10, yet nan median value summation this twelvemonth was 20.43%.

The Sunday Investor

In immoderate cases, nan gains make sense. For example, return Uber Technologies (UBER). According to Chief Executive Officer Dara Khosrowshahi, nan institution had its "strongest 4th ever" amid bookings maturation owed to nan lifting of COVID-19 restrictions. Analysts praised nan "year of efficiency" goals Mark Zuckerberg group for Meta Platforms (META) earlier this month. As shown above, Meta's EPS Revision Score accrued from 4.62/10 to 8.42/10 since January 1, 2023. These are tangible reasons for banal value increases. However, they are nan exception, not nan rule. Most companies, including nan apical ones for illustration Apple and Microsoft, proceed to disappoint.

Investment Recommendation

Expect maturation stocks to springiness backmost immoderate of their tremendous year-to-date gains soon because they aren't supported by coagulated net maturation aliases surprises. FBCG is astatine an elevated consequence level now because it's among nan astir richly weighted maturation ETFs, presently trading astatine 31.80x guardant earnings. Furthermore, it's only semi-transparent, making it challenging to cognize what's successful nan portfolio astatine immoderate fixed time. Also, its 0.59% disbursal ratio will apt beryllium a superior root of underperformance complete nan agelong run. Therefore, I urge investors debar FBCG, particularly successful nan short term, and I look guardant to answering immoderate questions successful nan comments conception below.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up pinch Hoya Capital to motorboat nan premier income-focused investing work connected Seeking Alpha. Members person complete early access to our articles on pinch exclusive income-focused exemplary portfolios and a broad suite of devices and models to thief build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your attraction is High Yield aliases Dividend Growth, we’ve sewage you covered pinch actionable finance investigation focusing connected real income-producing plus classes that connection imaginable diversification, monthly income, superior appreciation, and ostentation hedging. Start A Free 2-Week Trial Today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·