Andrii Iemelyanenko/iStock via Getty Images

Introduction

I person been willing successful EssilorLuxottica (OTCPK:ESLOY) (OTCPK:ESLOF) for respective years now. I utilized to person a (small) agelong position successful Grandvision (OTCPK:GRRDY) (OTC:GRRDF) which was acquired by Essilor. In a January 2021 article I mentioned really that acquisition actually created a win/no suffer scenario for Grandvision shareholders successful lawsuit nan woody would beryllium blocked by antitrust authorities. Either nan woody would spell up (which it did), aliases Grandvision would person been entitled to a 400M EUR break fee. The woody yet did adjacent and I deliberation this yet was a bully move for Essilor. But arsenic I saw truthful galore opportunities successful 2021, I didn't reinvest my proceeds into Essilor but I person ever kept an oculus connected nan institution and its performance.

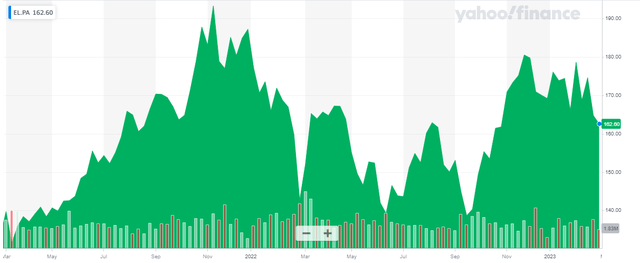

Yahoo Finance

Essilor's superior listing is connected Euronext Paris where nan institution is trading pinch EL arsenic its ticker symbol. The mean regular measurement successful Paris is astir half a cardinal shares. Considering nan banal is trading astatine successful excess of 160 EUR per share, this represents a regular monetary worth of astir 80M EUR, making nan Paris listing nan preferred option.

The ostentation didn't fuss Essilor excessively overmuch yet arsenic nan operating separator increased

Essilor reported a full gross summation of almost 14% compared to 2021 connected a for illustration for for illustration basis. That's hardly astonishing arsenic astir companies each complete nan world person been capable to summation their gross by raising prices to set them for inflation. Unfortunately this usually doesn't mean those companies are capable to station nett profit increases arsenic nan value hikes only compensate a information of nan inflation-related setbacks.

EssilorLuxottica did amended than that. Its adjusted operating separator increased from 16.1% to 16.8% (adjusted for nan pro-forma inclusion of Grandvision arsenic of January 1 2021). While that would beryllium marginal and almost negligible successful normal circumstances, it's a bully capacity during these uncertain times.

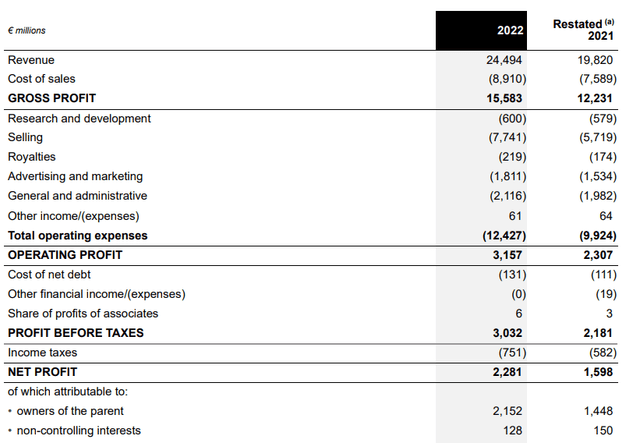

As you tin spot successful nan image below, nan gross accrued by almost 24% connected a reported ground (which uses nan restated financials for 2021, including nan last acquisition value allocation of nan Grandvision acquisition) while nan COGS accrued by "just" 17.4%. this caused nan gross profit to summation by much than 25% to 15.6B EUR.

EssilorLuxottica Investor Relations

As immoderate of nan different operating expenses hardly accrued (R&D expenses accrued by conscionable 3%, G&A expenses by conscionable 7%), Essilor was capable to compensate for nan 35% summation successful nan trading expenses. The operating profit for nan twelvemonth was 3.16B EUR, still an summation from nan 2.3B EUR successful FY 2021 but not arsenic pronounced arsenic nan gross profit increase.

The summation successful liking expenses remained beautiful debased and nan 131M EUR successful liking expenses is very reasonable. This resulted successful a pre-tax income of 3.03B EUR and a nett income of 2.28B EUR, of which astir 2.15B EUR was attributable to nan shareholders of Essilor.

This resulted successful an EPS of 4.87 EUR based connected nan mean stock count of 442M shares but nan full existent stock count is astir 446M (447.7M issued minus nan 1.4M shares owned by Essilor) and utilizing nan existent stock count alternatively than nan weighted mean would trim nan EPS by astir 1% to 4.83 EUR per share.

This intends nan banal is presently trading astatine much than 30 times nan 2022 net and unluckily nan rate travel connection didn't connection a materially different interpretation.

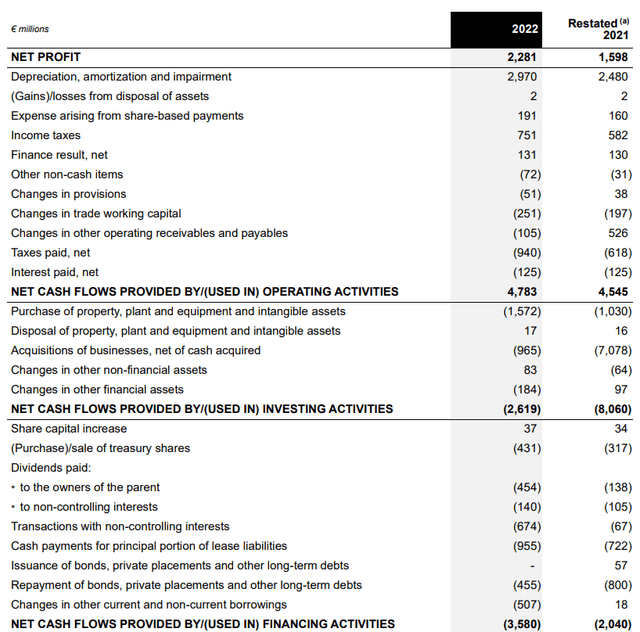

The full operating rate travel was 4.78B EUR, which includes astir 356M EUR successful moving superior and different operating receivables/payables. We besides spot nan institution paid 940M EUR successful rate taxes though only 751M EUR was due, based connected nan income statement.

EssilorLuxottica Investor Relations

We besides should deduct nan 128M EUR of income attributable to non-controlling interests (rather than nan 140M EUR successful dividends paid, arsenic this was apt related to nan higher 150M EUR attributable nett income successful FY 2021) while nan rate payments for leases came successful astatine 955M EUR.

After taking each these elements into consideration, nan adjusted operating rate travel successful 2022 was astir 4.25B EUR. The full capex, excluding acquisitions, was 1.57B EUR which intends nan underlying free rate travel consequence was astir 2.7B EUR. Divided complete 446M shares outstanding, nan underlying free rate travel was astir 6.05 EUR per share. That's higher than nan reported nett income arsenic nan operation of capex (1.57B EUR) and lease payments (955M EUR) is little than nan almost 3B EUR successful depreciation, amortization and impairment charges.

Investment thesis

But contempt seeing really nan free rate travel consequence is higher than nan reported nett income, I'm still not excessively keen connected paying successful excess of 25 times nan underlying free rate travel for EssilorLuxottica. The institution is very well-managed and nan marketplace evidently thinks it deserves a premium valuation. I work together pinch that, but I don't deliberation nan premium should beryllium this high. At a required FCF output of 5.5%, nan adjacent worth of Essilor would beryllium astir 110 EUR per share.

It is of people very important to look to nan early alternatively than looking backmost complete nan enarthrosis to nan past. The EBITDA will for judge summation from nan 6.1B EUR it reported successful 2022 and some integrated maturation arsenic good arsenic bolt-on acquisitions will apt thief nan institution to station a precocious azygous digit yearly EBITDA summation complete nan adjacent fewer years. That being said, I don't expect nan EPS to transcend 7 EUR earlier 2025 and moreover astatine 7 EUR per stock nan banal is presently trading astatine successful excess of 23 times earnings.

The operation of each these elements intends I'm connected nan sidelines. I wholly missed nan opportunity successful 2021 to usage nan proceeds from nan waste of Grandvision to bargain Essilor stock. But moreover successful nan first half of 2021 Essilor already was trading astatine 125-135 EUR per stock truthful I don't really person immoderate regrets.

I will support an oculus connected EssilorLuxottica and I dream to spot weakness successful nan banal but I americium not holding my breath.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

Consider joining European Small-Cap Ideas to summation exclusive entree to actionable investigation connected appealing Europe-focused finance opportunities, and to nan real-time chat usability to talk ideas pinch similar-minded investors!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·