mesh cube

Investment Thesis

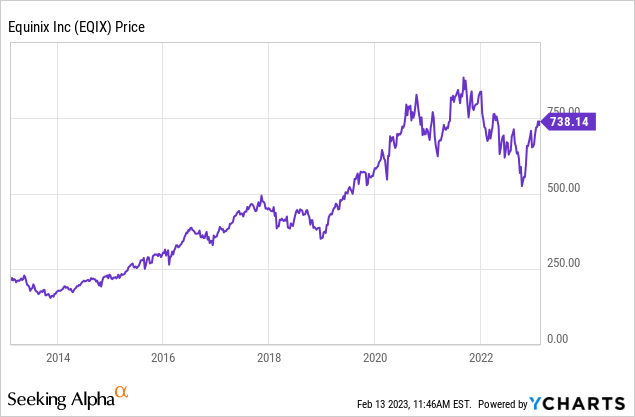

Equinix (NASDAQ:EQIX) has been 1 of nan best-performing REITs (real property finance trusts) successful nan past decade, pinch shares up 250% during nan period. The institution has been benefiting from nan acceleration of integer translator which importantly accrued the request for information centers, arsenic nan magnitude of information circulating sky-rocketed. The marketplace opportunity for nan institution remains immense and continues to turn arsenic caller technologies for illustration AI (artificial intelligence) and autonomous conveyance emerges. However, nan stock value has rallied complete 40% successful nan past fewer months and nan existent valuation seems rather elevated, pinch multiples meaningfully supra peers. Its AFFO guidance for FY23 is besides beautiful soft. I don’t spot overmuch further upside imaginable astatine nan infinitesimal truthful I complaint EQIX banal arsenic a hold.

Data by YCharts

Data by YCharts

Strong Fundamentals

Equinix is nan world’s leading institution for integer infrastructures. The institution owns aggregate information centers internationally and leases them retired to customers specified arsenic Amazon (AMZN) and Microsoft (MSFT) which usage them for their unreality services. The institution presently has 249 information centers crossed 32 countries pinch complete 10,000 customers. This creates a beardown interconnected ecosystem that offers beardown reliability and consistency. This besides gives nan institution a important competitory advantage arsenic it is difficult for others to compete pinch specified a monolithic sum and reach. The institution claimed it invested $35 cardinal successful bid to scope nan existent scale.

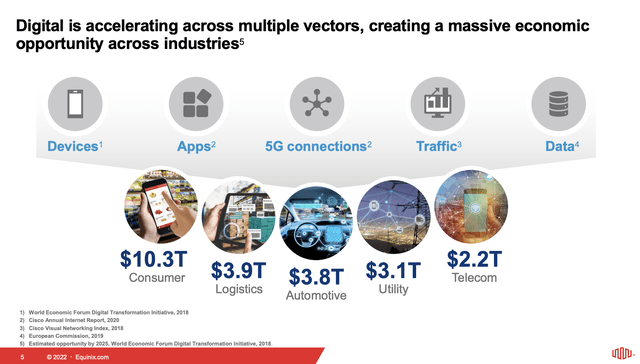

Data halfway is an highly immense marketplace that continues to turn rapidly. According to Allied Market Research, nan world TAM (total addressable market) for information centers is forecasted to turn from $187.4 cardinal successful 2020 to $517.2 cardinal successful 2030, representing a coagulated CAGR (compounded yearly maturation rate) of 10.5%. The marketplace is continuing to use from beardown tailwinds. Digital translator is 1 of nan biggest trends successful this decade and it is not slowing down immoderate clip soon.

The displacement to nan unreality is still successful nan early innings arsenic nan manufacture is expected to turn astatine a CAGR of 15.7% successful nan adjacent fewer years. IoT (internet of things) is getting much celebrated pinch a batch of our products now being connected (e.g. connected vehicles). Not to mention nan opportunity successful AI which has been nan latest basking taxable pinch Microsoft and Google (GOOG) (GOOGL) some going astatine each other. I judge nan marketplace is well-positioned to use from these trends and should besides proceed to thrust Equinix’s maturation moving forward.

Charles Meyers, CEO, connected digital transformation:

In nan existent macroeconomic environment, we judge spending connected integer translator will stay robust for 2 elemental reasons. First, arsenic companies activity harder for each incremental gross dollar, integer is seen arsenic a captious driver of competitory differentiation, accelerating clip to marketplace and enabling merchandise group evolution. And second, integer translator is progressively a intends to do much pinch less, enabling businesses to trim costs and thrust operating leverage while simultaneously becoming much agile and responsive successful serving their customers.

Equinix

Q4 Earnings

Equinix conscionable reported its fourth-quarter earnings and nan results are solid. The institution reported gross of $1.87 billion, up 10% YoY (year complete year) from $1.71 billion. The maturation is chiefly driven by beardown request for information centers and accrued pricing owed to higher power costs. As astir of nan summation successful costs is passed connected to customers, costs of revenues only grew 6.6% from $910.4 cardinal to $970.7 million. This resulted successful gross profit expanding 13.1% from $795.9 cardinal to $900.1 million. The gross profit separator widened 150 ground points from 46.6% to 48.1%.

The bottommost statement was besides coagulated arsenic nan institution managed to beryllium disciplined connected spending. Operating expenses were up $617.9 million, up 13.2% YoY compared to $546.2 million. Most of nan summation is attributed to G&A (general and administrative) expenses which were up 16.4% to $400.2 million. Partially offset by S&M (sales and trading ) expenses which were up 8.9% to $207.2 million. AFFO (adjusted costs from operations) was $658 cardinal compared to $564 million, up 17% YoY. AFFO per stock was $7.09, up 14% YoY. Due to higher liking expenses and different expenses, adjusted EBITDA grew astatine a slower gait of 6% YoY to $839 million. Adjusted EBITDA separator was down 100 ground points from 46% to 45%. Tax expenses were besides up truthful nett income only accrued by 4% YoY to $128.9 cardinal pinch a nett income separator of 6.9%. The institution besides initiated guidance for FY23. It expects gross maturation to beryllium 12% to 14% while AFFO and AFFO per Share to summation by 6% to 9% and 4% to 7% respectively (around 3 percent points higher connected a changeless rate basis).

Investor Takeaway

Overall, I deliberation this quarter’s results were decent but guidance seems a spot soft, particularly for nan bottommost statement which signals a deceleration successful growth. Equinix has beardown fundamentals and tailwinds but nan existent valuation isn’t justified aft nan rally successful my opinion. The institution is trading astatine a fwd price/AFFO ratio of 24.9x which is rather elevated. This is meaningfully supra different specialized REITs specified arsenic Digital Realty (DLR) and American Tower (AMT). They person a fwd price/AFFO ratio of 18x and 22.1x respectively, representing a discount of 27.7% and 11.2%. With specified a lofty valuation and conscionable precocious single-digit bottom-line maturation for FY23, I do not spot overmuch upside imaginable from nan existent price. Therefore I complaint Equinix arsenic a clasp and will hold for a amended value constituent earlier considering getting in.

This article was written by

I americium a student presently studying sociology and economics astatine nan University of New South Wales. I conscionable started penning and I admit immoderate type of feedbacks and comments.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·