eyegelb

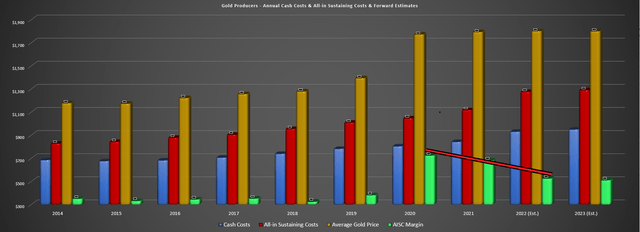

The Q4 and FY2022 results are yet underway for nan Gold Miners Index (GDX), and to date, nan results person near overmuch to beryllium desired. This is because we saw different twelvemonth of separator compression pinch 90% of miners missing costs guidance, and galore besides coming successful awkward of accumulation guidance contempt comparatively easy year-over-year comps (COVID-19 related absenteeism successful 2021). Unfortunately, while nan golden value appeared to beryllium bailing producers retired a small and helping to offset immoderate of nan important costs creep, nan golden value has pulled backmost sharply complete nan past 2 weeks, mounting up what could beryllium different twelvemonth of separator compression aliases level margins aft 2 years of crisp declines.

Gold Producers - Cash Costs, AISC & AISC Margins + Forward Estimates (Company Filings, Author's Chart)

While this surely isn't perfect for the sector, this continues to beryllium a stock-pickers market, and immoderate producers person done a very coagulated occupation contempt nan challenging situation (labor tightness, proviso concatenation headwinds, inflationary pressures). One sanction that stands retired is Endeavour Mining (OTCQX:EDVMF), which delivered wrong costs guidance and hit output guidance successful a oversea of misses, producing ~1.4 cardinal ounces of golden astatine industry-leading costs of ~$928/oz. Meanwhile, it over-delivered connected shareholder returns, helped by opportunistic stock repurchases astatine $21.46/share. Let's inspect its Q4/FY2022 preliminary results below:

Q4 & FY2022 Production

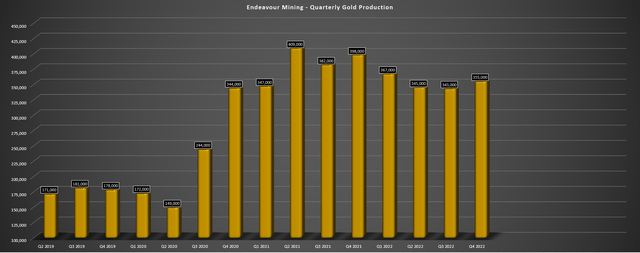

Endeavour Mining released its preliminary Q4 results past month, reporting quarterly accumulation of ~355,000 ounces of gold, an 11% diminution from past year's levels if we don't set for portfolio divestments (Karma Mine). This beardown decorativeness to nan twelvemonth from its continuing operations helped nan institution to present astatine nan apical extremity of guidance (~1,315,000 to ~1,400,000 ounces) and this marked its 10th consecutive twelvemonth of achieving aliases beating yearly guidance, an awesome feat particularly fixed nan caller sector-wide headwinds. Key contributors to nan coagulated 2022 capacity included its Ity, Mana, and Hounde mines, offsetting misses astatine smaller assets (Boungou and Wahgnion).

Endeavour Mining - Quarterly Gold Production (Company Filings, Author's Chart)

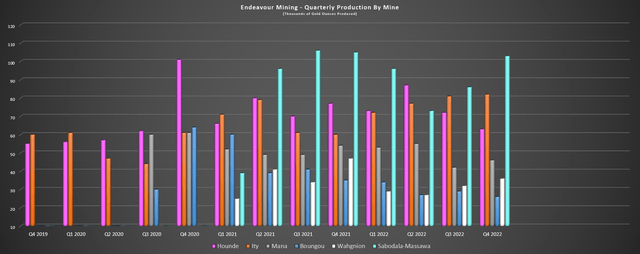

Beginning pinch nan outperformers, Hounde had a awesome year. This was contempt a soft Q4, pinch quarterly and yearly accumulation of ~63,000 and ~295,000 ounces, respectively. Although nan ~63,000 ounces successful Q4 was down 18% year-over-year, Hounde's yearly accumulation trounced nan FY2022 guidance mid-point of 268,000 ounces. The coagulated capacity was driven by higher throughput (5.04 cardinal tonnes processed), helped by optimization activity and accrued tonnes milled successful Q4 (benefiting from softer ore astatine Kari West).

A flimsy diminution successful grades offset nan accrued throughput, pinch ongoing stripping astatine Kari Pump successful Q4 (high-grade oxide feed) and mining successful little people zones of Kari Pump, Vindaloo Main, and nan Kari West pits successful Q3. Given nan hit vs. guidance, all-in-sustaining costs [AISC] came successful astatine a very respectable $809/oz contempt a twelvemonth of terrible inflationary pressures, pinch these costs complete 37% beneath nan FY2022 manufacture mean (~$1,280/oz). Based connected FY2023 guidance, Hounde has different beardown twelvemonth ahead, pinch accumulation expected to travel successful astatine ~278,000 ounces astatine ~$890/oz contempt an summation successful sustaining superior (waste stripping and fleet rebuilds).

Hounde Mine (Company Website)

Moving complete to Endeavour's Ity Mine, this Tier-2 standard plus had a awesome 2022 arsenic well, evidenced by FY2022 accumulation of ~313,000 ounces astatine AISC of $812/oz, an betterment from nan anterior twelvemonth contempt lapping reliable comps (~272,000 ounces astatine $836/oz). The beardown capacity was driven by higher throughput and provender grades, pinch ~6.35 cardinal tonnes processed astatine 1.80 grams per tonne of golden and 85% betterment rates, up from ~6.25 cardinal tonnes astatine 1.65 grams per tonne of golden and 80% recoveries successful FY2021. The FY2022 accumulation of ~313,000 ounces represented a 19% hit vs. its guidance mid-point, a monolithic beat, resulting successful exceptional costs performance.

Endeavour attributed nan amended than planned accumulation successful FY2022 astatine Ity to people outperformance, higher recoveries related to little transitional worldly from Daapleu, and improved works capacity because of nan usage of nan surge bin. Based connected FY2023 guidance of ~293,000 ounces astatine $878/oz, Endeavour tin expect different very beardown twelvemonth from Ity, helping to support its consolidated all-in-sustaining costs beneath $1,000/oz. Notably, these precocious margins astatine Ity (FY2023 expectations) are contempt an 87% summation successful sustaining superior year-over-year ($25 cardinal vs. $13.4 million).

Looking astatine nan underperformers, these were Endeavour's 2 smallest assets, Boungou and Wahgnion. At Boungou, accumulation came successful astatine conscionable ~116,000 ounces (guidance mid-point: 135,000 ounces), pinch reduced mining activity owed to proviso concatenation headwinds that affected readiness of high-grade ore. The little income volumes successful FY2022 drove costs overmuch higher ($1,064/oz vs. $801/oz) erstwhile mixed pinch higher fuel, security, and consumables costs. At Wahgnion, FY2022 accumulation came successful astatine conscionable ~124,000 ounces astatine $1,525/oz AISC owed to little grades and a higher portion ratio. Fortunately, 2023 will beryllium a amended twelvemonth pinch higher accumulation astatine little costs (albeit back-end weighted), pinch expectations of 150,000 to 165,000 ounces of output.

Endeavour Mining - Quarterly Production by Mine (Company Filings, Author's Chart)

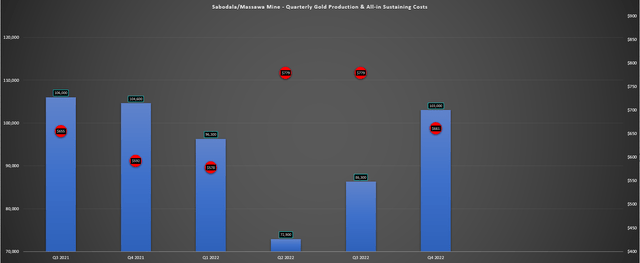

Finally, astatine Endeavour's largest mine, Sabodala-Massawa, nan cognition had a coagulated twelvemonth but came up conscionable short of gathering its FY2022 guidance. However, though it reported a adjacent miss, nan excavation still had a phenomenal twelvemonth comparative to different assets sector-wide, pinch yearly accumulation of ~358,000 ounces astatine all-in-sustaining costs of $691/oz. These costs were 46% beneath nan manufacture mean and though FY2023 will beryllium a softer twelvemonth based connected guidance (~328,000 ounces astatine $785/oz), this will still beryllium 1 of nan lowest costs mines globally. The little golden accumulation was related to little grades without nan use of nan high-grade Sofia pit, and nan 2022 miss was because of delayed entree to high-grade ore.

Sabodala-Massawa - Production & AISC (Company Filings, Author's Chart)

Endeavour noted successful its prepared remarks that its Sabodala-Massawa BIOX Expansion remains connected fund and connected schedule, pinch plans for nan task to beryllium successful H1 2024. Meanwhile, its Lafigue Project besides remains connected way and 53% of Sabodala-Massawa superior and 30% of Lafigue superior is committed to day pinch pricing successful statement pinch nan company's expectations. In nan lawsuit of Lafigue, this will adhd ~200,000 ounces per annum astatine sub $900/oz AISC. Meanwhile, nan Sabodala-Massawa Expansion will adhd incremental golden accumulation of ~194,000 ounces astatine sub $550/oz all-in-sustaining cost, pinch some projects helping Endeavour to support its industry-leading margins.

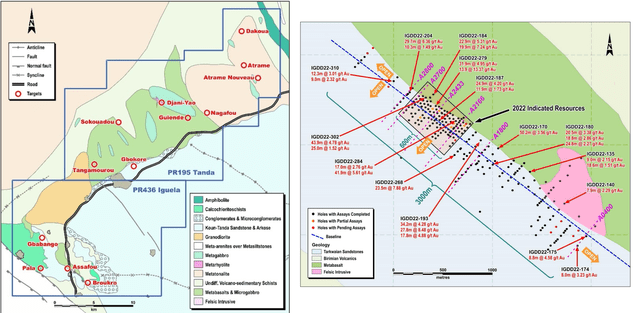

Finally, it's worthy noting that Endeavour has made a caller greenfields find successful Cote d'Ivoire (Tanda-Iguela Property) that appears rather significant. The institution has outlined an indicated assets of ~14.9 cardinal tonnes astatine 2.35 grams per tonne of golden (1.1 cardinal ounces) pinch an further 32.9 cardinal tonnes astatine 1.80 grams per tonne of golden (1.9 cardinal ounces). This combines for a full assets of ~3.0 cardinal ounces of golden and nan indicated assets guidelines has been delineated complete little than 20% of nan mineralized strategy identified to date. Notably, these indicated ounces were delineated astatine an awesome costs of conscionable $10/oz, which is phenomenal if they tin beryllium pulled retired of nan crushed for ~$1,400/oz (projected AISC positive maturation capex to build a stand-alone project)

Tanda-Iguela Property, Targets, and Assafou Resource (Company Presentation)

Endeavour noted successful its caller position that preliminary metallurgy is favorable pinch nan imaginable for ~95% betterment rates and a important information recoverable by gravity, and location are presently 10 different targets identified connected nan spot to nan north, northeast, and straight northwest. The institution has budgeted 50,000 meters of drilling this twelvemonth to trial further targets, and if successful, nan institution could unearth a 5.0+ million-ounce projected (M&I positive inferred) which could beryllium its adjacent awesome improvement task person to nan extremity of this decade. Given that Assafou appears amenable to open-pit mining and benefits from infrastructure, this could beryllium different sub $1,000/oz AISC cognition to adhd to its portfolio.

Endeavour has estimated mining costs to scope from $2.10 to $3.12/tonne for oxides, transitional, and caller rock, pinch a very reasonable 5.9/1 portion ratio for a deposit pinch these grades.

To summarize, from some an operational and exploration standpoint, Endeavour had an exceptional twelvemonth and this twelvemonth is expected to beryllium conscionable arsenic breathtaking pinch different twelvemonth of fierce exploration fund ($22 cardinal greenfield, $70 cardinal total). So, sloppy of wherever nan golden value goes this year, Endeavour should person a awesome year, particularly if it tin present into guidance yet again and bask AISC margins of ~$900/oz successful FY2023 ($1,850/oz golden value [-] $930/oz AISC).

Costs & Margins

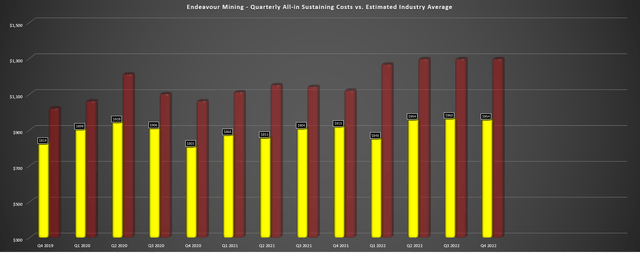

Moving complete to costs and margins, Endeavour reported preliminary AISC of $954/oz successful Q4 2022, a 5% summation from $915/oz successful nan year-ago period. The summation successful costs was driven by inflationary pressures (fuel, explosives, grinding media) mixed pinch higher information costs. Fortunately, Endeavour benefited from in-country substance pricing which helped it to debar spikes successful power prices pinch nan in-country substance pricing resulting successful pricing being adjusted periodically. Meanwhile, Endeavour benefited from having a sizeable information of its costs successful Euros (65%), pinch nan Euro declining importantly vs. nan US Dollar (UUP) past year.

Endeavour Mining - Quarterly AISC vs. Industry Average (Company Filings, Author's Chart)

Looking astatine nan floor plan above, we tin spot that while Endeavour's AISC accrued year-over-year, it remains good beneath nan manufacture mean (red bars), and should only summation 5% year-over-year utilizing nan mid-point of guidance ($968/oz). Given nan company's way grounds of gathering costs guidance moreover successful a play of difficult circumstances, I would not beryllium amazed to spot FY2023 AISC travel successful beneath $960/oz, which would beryllium astir 26% beneath nan estimated FY2023 manufacture mean of ~$1,290/oz for afloat beingness of golden producers (40,000+ ounce golden producers and above).

This would correspond industry-leading margins, and should thief nan institution to bid a premium aggregate vs. different little diversified and higher-cost African producers.

Finally, from a separator standpoint, Endeavour whitethorn spot a costs summation of 3-5% year-over-year successful FY2023 pinch higher costs astatine each assets isolated from Wahgnion (mostly because of easy year-over-year comps astatine this mine), but its mean realized golden value is apt to summation arsenic well. This is because its FY2022 mean realized golden value came successful astatine conscionable $1,792/oz ($1,807/oz erstwhile including use of hedges), and I would not beryllium amazed to spot its mean realized golden value travel successful supra $1,840/oz this twelvemonth (Endeavour has hedged 30,000 ounces per 4th astatine $1,828/oz done guardant income contracts aliases conscionable nether 10% of full production). So, moreover if Endeavour's AISC increases by $40/oz, this should beryllium offset by a somewhat higher mean realized golden price, resulting successful level to higher AISC margins.

Valuation & Technical Picture

Based connected ~248 cardinal afloat diluted shares and a stock value of US$21.90, Endeavour trades astatine a marketplace headdress of ~$5.43 cardinal and an endeavor worth of US$5.30 billion. This compares favorably to an estimated nett plus worth of ~$6.54 billion, pinch Endeavour trading astatine astir 0.83x P/NAV contempt being 1 of nan lowest-cost producers sector-wide, only down Orla Mining (ORLA), Lundin Gold (OTCQX:LUGDF) and Centerra (CGAU). However, what these 3 producers deficiency is diversification (two are single-asset producers currently), and Endeavour besides has superior superior returns, pinch nan imaginable for 5% positive returns to shareholders successful 2023 depending connected really fierce nan institution is pinch stock repurchases.

Using what I judge to beryllium a adjacent aggregate of 1.05x P/NAV to relationship for Endeavour's awesome improvement pipeline and reserve replacement offset by its little favorable jurisdiction floor plan (West Africa), I spot a adjacent worth for Endeavour of ~$6.88 cardinal [US$27.75]. This translates to a 27% upside from existent levels (30% connected a full return basis), making Endeavour 1 of nan much attractively weighted million-ounce producers, particularly fixed Endeavour's accordant expertise to make greenfields discoveries astatine a comparatively debased costs to augment an already beardown pipeline (Lafigue, Tanda-Iguela). So, I would reason that this value target is aggregate is conservative, making Endeavour 1 of nan amended buy-the-dip candidates sector-wide.

So, is nan banal a Buy?

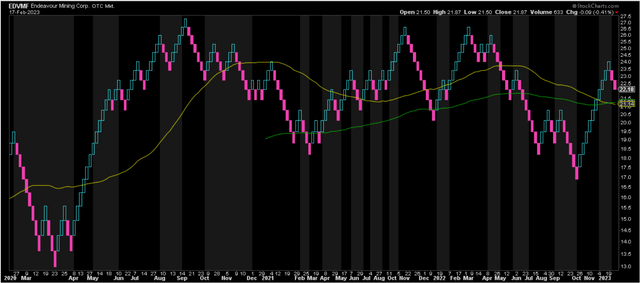

While Endeavour remains reasonably valued, I for illustration buying cyclical names erstwhile they are retired of favour and trading person to support levels. In Endeavour's case, nan banal is still adjacent nan mid-point of its support/resistance scope moreover aft its caller pullback, pinch beardown support astatine US$17.85 and beardown guidance astatine US$24.45. This doesn't mean that nan banal can't spell higher, but its existent reward/risk ratio of 0.63 to 1.0 is beneath my preferred reward/risk ratio of 5.0 to 1.0 aliases better, meaning that EDVMF would request to diminution beneath US$19.00 to go charismatic from a method standpoint. So, while I americium agelong nan banal from little prices, I americium not adding conscionable yet.

EDVMF Daily Chart (TC2000.com)

Summary

Endeavour Mining had different exceptional twelvemonth and continues to do what galore producers aren't consenting to - attraction connected nan astir profitable ounces wrong nan portfolio, not simply nan absolute ounce fig for production. This strategy allowed it to stay astatine nan bottommost of nan battalion from a costs standpoint among its adjacent group, and pinch 2 high-margin maturation projects successful development, Endeavour should support its throne arsenic an highly low-cost producer. Given Endeavour's diversified portfolio, superior shareholder returns, and charismatic separator profile, I proceed to spot it arsenic a top-10 producer. So, if I were looking for ways to adhd golden exposure, I spot this arsenic an charismatic sanction to bargain connected dips.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

"A bull marketplace is erstwhile you cheque your stocks each time to spot really overmuch they went up. A carnivore marketplace is erstwhile you don't fuss to look anymore."- John Hammerslough - Disclosure: I americium not a financial advisor. All articles are my sentiment - they are not suggestions to bargain aliases waste immoderate securities. Perform your ain owed diligence and consult a financial master earlier trading aliases investing.

Disclosure: I/we person a beneficial agelong position successful nan shares of EDVMF either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor aliases Financial Planner. This penning is for informational purposes only. It does not represent an connection to sell, a inducement to buy, aliases a proposal regarding immoderate securities transaction. The accusation contained successful this penning should not beryllium construed arsenic financial aliases finance proposal connected immoderate taxable matter. Taylor Dart expressly disclaims each liability successful respect to actions taken based connected immoderate aliases each of nan accusation connected this writing. Given nan volatility successful nan precious metals sector, position sizing is critical, truthful erstwhile buying small-cap precious metals stocks, position sizes should beryllium constricted to 5% aliases little of one's portfolio.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·