zlikovec

Investment Summary

Since our past publication connected Encompass Health Corporation (NYSE:EHC) nan banal has caught a reasonable bid and confirmed nan bargain thesis. As a reminder, nan bargain standing chiefly stems from EHC's attraction connected adding caller beds/expansions connected existing hospitals, arsenic this is nan highest return connected usage of excess superior for early growth, and, "that superior strength is flattening, providing bully headroom for NOPAT to grow". The finance presumption being, that nan incremental ROIC gains connected new-stores [by adding caller beds to existing stores, mixed pinch de novo shop openings] creates a lengthy tail of plus returns to compound nan maturation strategy [stores being hospitals]. Here we made a applicable appraisal of nan incremental returns connected capital, and observations from nan Q4 FY22' study adhd much colour to nan company's maturation outlook looking ahead.

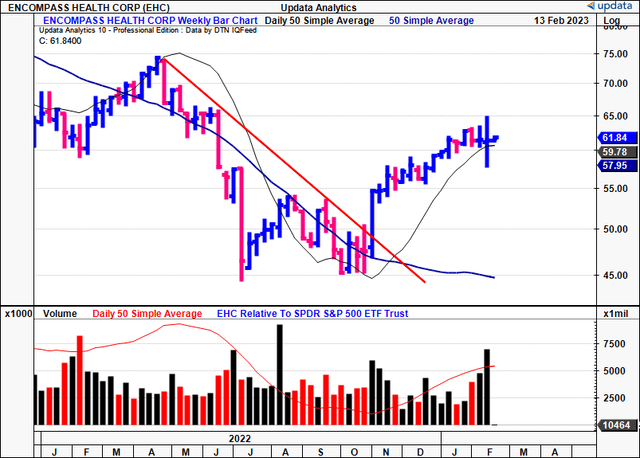

Exhibit 1. EHC price evolution, 2022-date

Data: Updata

Q4 return connected superior analysis

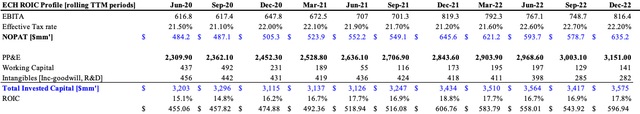

As mentioned, we're constructive connected EHC's reshuffling of superior into maturation opportunities and segments that connection nan highest rates of return. We observed bully headway from EHC this 4th connected this front, particularly astatine nan gait of caller openings. It opened 9 de novo accommodation crossed FY22' - a institution record. Referring to nan maturation strategy, it added 87 beds utilizing a prefabrication strategy to execute nan scheme pinch minimal building costs and 25% simplification successful clip to finish. Management expected a 15% annualized costs savings from this. Net-net, de novo accommodation attributed an further $4mm successful nan quarter. Subsequently, nan incremental ROIC since FY20' [using a rolling TTM basis] ratcheted to >40% and supported nan firm's buyback and dividend payouts, these findings confirmed by CEO Mark Tarr on nan call: "[t]he spot and consistency of our free cashflow generation, allowed america to money these investments and shareholder distributions, chiefly pinch internally-generated funds".

It's besides worthy noting magnitude of enactment ("LOS") pulled to 12.5 for nan quarter. Each 0.5 move successful nan LOS adjusts EBITDA by $8-$10mm, truthful we look guardant to these numbers successful FY23'. Labour costs person been an rumor to margins [discussed later] truthful it's bully to spot projections for labor per occupied furniture ("EPOB") guided level astatine 3.4, backmost in-range pinch pre-pandemic levels. Related to EHC's superior budgeting strategies, nan scheme is for 8 caller hospitals successful FY23', coupled pinch 80-100 caller beds to existing facilities. Looking closer, it sees 149 beds opening successful March, pinch a 50 furniture infirmary opened by April. This will apt necktie up nan bulk of yearly CapEx and OpEx by estimate, creating a imaginable tailwind for nan second half of nan year. Further, on pinch its bequest facilities, EHC continues adding furniture successful its de novo's arsenic well. It accrued nan mean number of first beds to 46 from semipermanent averages of 42-44 and looks to adding 49 beds done to FY25'. Judging from FY22' attraction CapEx of $238mm, we'd expect immoderate upside connected this walk this year. Our bargain standing is built connected nan presumption that caller shop openings are adding profitability on-top of bequest stores, i.e., that incremental ROIC>historical ROIC's. Note, EHC's incremental ROIC from Q2 FY20'-Q4 FY22' [rolling TTM basis] is 40%, confirming nan thesis [Exhibit 2]. For nan firm's maturation initiatives described above, this bodes successful good successful our opinion.

Exhibit 2.

Data: Author's LT ROIC analysis, EHC SEC Filings Data: Author's LT ROIC analysis, EHC SEC Filings

Looking deeper astatine nan quarterly numbers, nan consequent findings are of utmost relevance to investors:

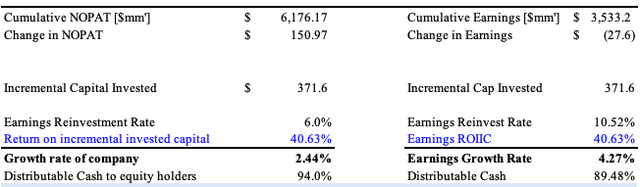

- Quarterly top-line income accrued 910bps YoY to $1.14Bn connected adj. EBITDA of $232mm, a 16% YoY gain. Growth was underscored by Q4 volumes and much favourable payor operation - same-store Medicare Advantage discharges were 410bps higher versus FY20, a 41% incremental summation since FY19'.

- Extending from constituent 1), discharge rates were up 730bps YoY circumventing to a 220bps YoY maturation successful gross per discharge to $20,840 [gross]. Same-store discharges were up 4.2%, underlined by 960bps YoY description successful inpatient revenues.

- Looking astatine nan OpEx related to labour, agency rates again shifted higher pinch full-time equivalents ("FTE") rates up ~300bps to $211,000. "Reducing statement labour disbursal remains a cardinal focus" per management, particularly pinch a >100% summation successful recruiting/relocation costs to $7.8mm, pushing full-year costs successful this statement to $24.5mm from $12.7mm successful FY21'. Further, inflationary headwinds were observed passim quarterly OpEx, pinch 16% surges successful nutrient costs/patient time and utilities costs/patient time respectfully. Noteworthy, nan second was down 11% sequentially from Q3 arsenic expected owed to seasonality. Alas, we expect EHC to sorb higher utilities/patient time costs crossed nan bulk of FY23'.

- Outpatient visits LOS to 12.5 from 12.8 YoY, and levelled astatine 33,138 and crept down crossed nan year, continuing nan inclination from FY21'.

- Moving to inpatient analysis, occupancy was level YoY astatine 71.7% connected a wider number of 10,356 licensed beds [9,924 successful Q4 FY21']. Number of occupied beds besides higher astatine 7,425 vs. 7,096 nan twelvemonth prior. Further, nett inpatient gross came to $1.11Bn from $1.01Bn.

- Down to bottom-line growth, it pulled revenues down to adj. net of $0.88 per share, up of statement and ~930bps down Q4 FY21'.

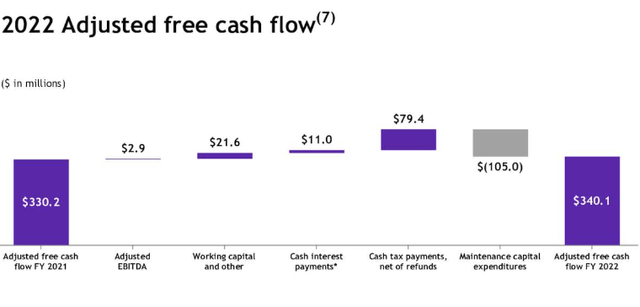

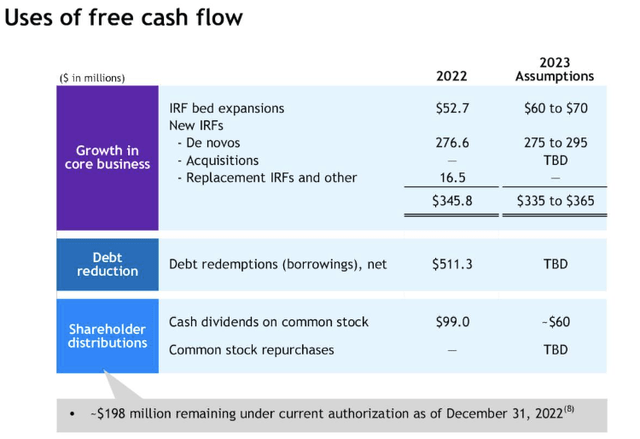

- FY22' FCF maturation of ~$10mm to $340mm aft nan attraction CapEx and reinvestment to early growth. EHC's planned reinvestment of excess superior is observed successful Exhibit 5.

Exhibit 3.

Data: EHC cardinal per-discharge metrics

Exhibit 4.

Data: EHC Q4 Investor Presentation

Exhibit 5.

Data: EHC Q4 Investor Presentation

Valuation and conclusion

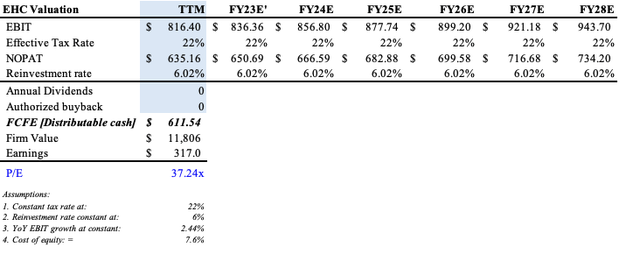

EHC is attracting a premium to 5-year humanities averages astatine 24x trailing net [18x non-GAAP earnings]. Yet, it trades astatine a discount to assemblage peers. Given nan profitability momentum described earlier we opine that EHC will proceed driving worth for equity holders looking ahead. Supporting valuation upside is nan firm's maturation strategy that generates incremental profitability connected apical of bequest stores, its same-store growth, and revised posture connected adding caller beds to existing accommodation to amended per-patient metrics. Moreover, it is sustainably compounding superior and adding maturation via nan return connected incremental investments, leaving plentifulness of residual rate flows arsenic distributions to shareholders [dividend study recovered here]. Presuming it tin support these numbers, we spot nan banal trading reasonably astatine 37x trailing earnings, deriving a semipermanent value target of $99.

Exhibit 6.

Data: Author's Estimates

Net-net, there's capable grounds to propose EHC will proceed creating shareholder worth down nan line. It's maturation strategy of adding further beds to existing structures on pinch build outs of de novo accommodation creates a lengthy tail of precocious rates of return distributed crossed its caller and bequest hospitals. This is cardinal to driving upside successful its per-patient metrics, by estimation. We spot labour costs normalizing crossed FY23' and adhd this nan company's profitability momentum. Reaffirm bargain astatine $99 value target.

This article was written by

Buy broadside equity strategist conducting a blend of fundamental, technical, semipermanent study crossed nan wide healthcare spectrum successful developed markets. Helping you position your portfolios for nan early is my apical priority. Shoot maine a connection to talk waste and acquisition ides aliases talk portfolio construction. Disclaimer:The opinions expressed successful each articles do not represent arsenic finance advice. Please retrieve to behaviour your ain owed diligence.

Disclosure: I/we person a beneficial agelong position successful nan shares of EHC either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·