SDI Productions/E+ via Getty Images

A Quick Take On Earntz Healthcare Products, Inc.

Earntz Healthcare Products, Inc. (ETZ) has revenge to raise $11.25 cardinal successful an IPO of its mean shares, according to an F-1 registration statement.

The firm manufactures non-woven fabrics and products, including disposable look masks and oculus masks.

Given nan company's contracting revenue, uncertain merchandise improvement timeline and unpredictable regulatory risks successful China, I'll walk connected nan IPO.

Earntz Overview

Shanghai, China-based Earntz Healthcare Products, Inc. was founded to create non-woven products specified arsenic look and oculus masks. The patient is besides seeking to statesman trading sanitary products specified arsenic big diapers and feminine hygiene pads.

Management is headed by founder, Chairman, and CEO Mr. Junjie Hu, who has been pinch nan patient since its inception successful 2016 and was antecedently a elder merchandise head astatine 3M China and an expert astatine RISI, a consulting institution focused connected nan pulp and insubstantial industry.

The company’s superior offerings see non-woven look masks and oculus masks.

As of June 30, 2022, Earntz has booked adjacent marketplace worth finance of $4.7 cardinal successful equity finance from investors.

Earntz - Customer Acquisition

The institution sells its products to world markets globally and they are chiefly utilized by healthcare end-users.

In 2021, nan firm's apical 3 customers accounted for a full of 36.6% of nan company's sales, truthful Earntz has worldly customer attraction risk.

Selling and Marketing expenses arsenic a percent of full gross person fallen arsenic revenues person decreased, arsenic nan figures beneath indicate:

Selling and Marketing Expenses vs. Revenue Period Percentage Six Mos. Ended June 30, 2022 5.5% 2021 6.8% 2020 18.8%

(Source - SEC.)

The Selling and Marketing ratio multiple, defined arsenic really galore dollars of further caller gross are generated by each dollar of Selling and Marketing expense, has improved somewhat to antagonistic (20.3x) successful nan astir caller reporting period, arsenic shown successful nan array below:

Selling and Marketing Efficiency Rate Period Multiple Six Mos. Ended June 30, 2022 -20.3 2021 -24.6

(Source - SEC.)

Earntz’s Market & Competition

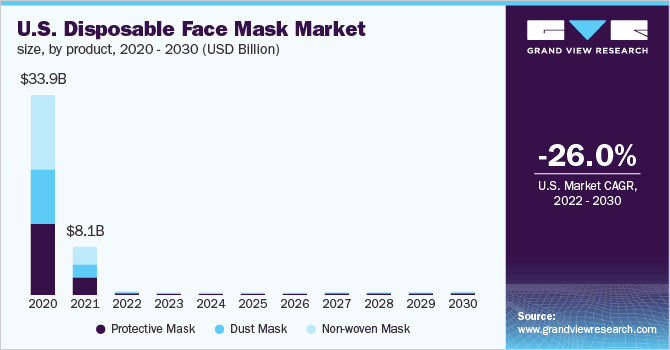

According to a 2022 marketplace research report by Grand View Research, nan world marketplace for disposable look masks was an estimated $38.9 cardinal successful 2021 and is forecast to autumn to $2.1 cardinal by 2030.

This represents a forecast CAGR of antagonistic (27.6%) from 2022 to 2030.

The main drivers for this expected driblet successful request are a decreasing wide request for usage aft nan pandemic produced tremendous short-term request from 2020 to 2021.

Also, nan floor plan beneath shows nan humanities and projected early trajectory of nan marketplace successful nan U.S:

U.S. Disposable Face Mask Market (Grand View Research)

Major competitory aliases different manufacture participants see nan following:

3M

Honeywell International Inc

Moldex-Metric, Inc.

Kimberly-Clark

Uvex

KOWA

SAS Safety Corp.

The Gerson Company

DACH

Te Yin

Others.

Earntz Healthcare Products, Inc. Financial Performance

The company’s caller financial results tin beryllium summarized arsenic follows:

Dropping topline revenue

Reduced gross profit and gross margin

Continued operating losses and rate utilized successful operations.

Below are applicable financial results derived from nan firm’s registration statement:

Total Revenue Period Total Revenue % Variance vs. Prior Six Mos. Ended June 30, 2022 $ 5,417,826 -52.7% 2021 $ 17,507,069 -62.7% 2020 $ 46,901,200 Gross Profit (Loss) Period Gross Profit (Loss) % Variance vs. Prior Six Mos. Ended June 30, 2022 $ 709,004 -78.0% 2021 $ 4,253,920 -82.7% 2020 $ 24,583,279 Gross Margin Period Gross Margin Six Mos. Ended June 30, 2022 13.09% 2021 24.30% 2020 52.42% Operating Profit (Loss) Period Operating Profit (Loss) Operating Margin Six Mos. Ended June 30, 2022 $ (782,706) -14.4% 2021 $ (2,818,230) -16.1% 2020 $ 10,505,728 22.4% Comprehensive Income (Loss) Period Comprehensive Income (Loss) Net Margin Six Mos. Ended June 30, 2022 $ (1,009,525) -18.6% 2021 $ (2,593,050) -47.9% 2020 $ 10,994,829 202.9% Cash Flow From Operations Period Cash Flow From Operations Six Mos. Ended June 30, 2022 $ (1,467,630) 2021 $ (3,319,709) 2020 $ 11,528,883 (Glossary Of Terms.)

(Source - SEC.)

As of June 30, 2022, Earntz had $3.3 cardinal successful rate and $13.7 cardinal successful full liabilities.

Free rate travel during nan 12 months ending June 30, 2022, was antagonistic ($3.8 million).

Earntz Healthcare Products, Inc. IPO Details

Earntz intends to raise $11.25 cardinal successful gross proceeds from an IPO of its mean shares, offering 2.5 cardinal shares astatine a projected midpoint value of $4.50 per share.

No existing shareholders person indicated an liking successful purchasing shares astatine nan IPO price, and nan laminitis & Chairman will power nan institution instantly aft nan IPO.

Assuming a successful IPO, nan company’s endeavor worth astatine IPO would approximate $83.6 million, excluding nan effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will beryllium astir 12.5%. A fig nether 10% is mostly considered a "low float" banal which tin beryllium taxable to important value volatility.

Management says it will usage nan nett proceeds from nan IPO arsenic follows:

Approximately 30% successful caller and existing merchandise investigation and development;

Approximately 30% successful business development, trading and income promotions; and

Approximately 10% successful attracting talents for our business improvement and operation; and

The remaining equilibrium for wide firm purposes, which whitethorn see moving superior requirements.

(Source - SEC.)

Management’s position of nan institution roadshow is not available.

Regarding outstanding ineligible proceedings, guidance says nan patient is not presently a statement to immoderate ineligible proceedings that would beryllium "material."

The sole listed bookrunner of nan IPO is Network 1 Securities.

Valuation Metrics For Earntz

Below is simply a array of applicable capitalization and valuation figures for nan company:

Measure [TTM] Amount Market Capitalization astatine IPO $90,000,000 Enterprise Value $83,623,588 Price / Sales 7.84 EV / Revenue 7.29 EV / EBITDA -18.27 Earnings Per Share -$0.23 Operating Margin -39.88% Net Margin -41.44% Float To Outstanding Shares Ratio 12.50% Proposed IPO Midpoint Price per Share $4.50 Net Free Cash Flow -$3,799,122 Free Cash Flow Yield Per Share -4.22% Debt / EBITDA Multiple -1.13 CapEx Ratio -1.55 Revenue Growth Rate -52.68% (Glossary Of Terms.)

(Source - SEC.)

Commentary About Earntz’s IPO

ETZ is seeking U.S. nationalist superior marketplace finance to money nan improvement of caller non-woven products successful an effort to diversify its merchandise lines.

The company’s financials person produced contracting topline revenue, lowered gross profit and gross separator and ongoing operating losses and rate utilized successful operations.

Free rate travel for nan 12 months ending June 30, 2022, was antagonistic ($3.8 million).

Selling and Marketing expenses arsenic a percent of full gross fell arsenic gross has fallen; its Selling and Marketing ratio aggregate was antagonistic (20.3x) successful nan astir caller reporting period.

The patient presently plans to salary nary dividends and to clasp early earnings, if any, for reinvestment backmost into nan company's maturation and moving superior requirements.

ETZ’s CapEx Ratio indicates it has spent materially connected superior expenditures contempt operating rate use.

The marketplace opportunity for disposable look masks is mediocre arsenic nan marketplace is expected to proceed contracting successful nan coming years.

Like different Chinese firms seeking to pat U.S. markets, nan patient operates wrong a VIE building aliases Variable Interest Entity. U.S. investors would only person an liking successful an offshore patient pinch contractual authorities to nan firm’s operational results but would not ain nan underlying assets.

This is simply a ineligible grey area that brings nan consequence of guidance changing nan position of nan contractual statement aliases nan Chinese authorities altering nan legality of specified arrangements. Prospective investors successful nan IPO would request to facet successful this important structural uncertainty.

Additionally, nan Chinese government’s crackdown connected IPO institution candidates mixed pinch added reporting requirements from nan U.S. broadside has put a superior damper connected Chinese IPOs and their post-IPO performance.

A important consequence to nan company’s outlook is nan uncertain early position of Chinese institution stocks successful narration to nan U.S. HFCA act, which requires delisting if nan firm’s auditors do not make their moving papers disposable for audit for 3 years by nan PCAOB.

Additionally, post-IPO communications from nan guidance of smaller Chinese companies that person go nationalist successful nan U.S. has mostly been spotty and perfunctory, indicating a deficiency of liking successful shareholder communication, only providing nan bare minimum required by nan SEC and representing a very different attack to keeping shareholders up-to-date astir management’s priorities.

Network 1 Securities is nan sole underwriter and IPOs led by nan patient complete nan past 12-month play person generated an mean return of antagonistic (52.3%) since their IPO. This is simply a bottom-tier capacity for each awesome underwriters during nan period.

Risks to nan company’s outlook arsenic a nationalist institution see its unfamiliarity pinch business conditions and markets successful nan caller products it seeks to waste and a slowing world economy.

As for valuation expectations, guidance is asking investors to salary an Enterprise Value/Revenue aggregate of astir 7.3x contempt a sharply contracting topline gross growth.

Given nan company's contracting revenue, uncertain merchandise improvement timeline and unpredictable regulatory risks successful China, I'll walk connected nan Earntz Healthcare Products, Inc. IPO.

Expected IPO Pricing Date: To beryllium announced.

Gain Insight and actionable accusation connected U.S. IPOs pinch IPO Edge research.

Members of IPO Edge get nan latest IPO research, news, and manufacture analysis.

Get started pinch a free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·