Feb. 28, 2023 9:30 AM ETA, AAPL, AGCO, CTRA, ETN, EXPD, HSY, JBHT, KLAC, LW, MSFT, PH, RS, STLD, TSCO, V, WSO, WSO.B

Summary

- We explicate why trading cash-covered puts and covered calls are comparatively safe choices for earning a precocious income.

- We will talk really to formulate an options income strategy that's sustainable and repeatable.

- In this monthly series, we coming really to spell astir selecting nan correct benignant of stocks for options income. We coming 2 lists of 10 stocks pinch 3 scenarios, PUT options, CALL options, and in-the-money CALL options.

- Looking for a portfolio of ideas for illustration this one? Members of High Income DIY Portfolios get exclusive entree to our subscriber-only portfolios. Learn More »

PashaIgnatov

Author's Note: This article is portion of our periodic/monthly bid that attempts to coming 3 lists of stocks for nan period that could beryllium suitable for penning options to make comparatively safe income. Certain parts of nan introduction, definitions, and conception describing the action process will person immoderate commonality and repetitiveness pinch our different articles successful nan series. This is unavoidable arsenic good arsenic intentional to support nan full bid accordant and easy to travel for caller readers. Regular readers who travel nan bid from period to period could skip specified sections.

Why this monthly Options series?

Earning a decent income from your investments, that's importantly higher than nan complaint of ostentation is ever challenging. This has been particularly existent successful nan past decade and a half. We judge trading Options (cash-covered puts and covered calls) stay a comparatively bully prime to gain a precocious income. Obviously, location are immoderate risks progressive pinch Options, and we do not urge blindly jumping into nan game. We will talk really to mitigate nan risks successful a bit. Also, successful nan existent volatile marketplace situation, we will impulse other be aware and owed diligence.

"Selling Options" versus "Buying Options"

Please statement that nan options strategies discussed successful this monthly bid are constricted to trading (or writing) nan Covered Call options and cash-covered PUT options. We do not screen "buying" nan Options arsenic they're not only risky, but astatine nan aforesaid time, they're not really suited for income strategies. The superior intent of our options strategies is to make income.

As such, location are 2 sides to options. There's an action purchaser for each seller of an option. When you waste an option, you gain an contiguous premium, and you get to support that premium irrespective of nan result of nan option. However, erstwhile you bargain an option, you salary nan premium upfront and fundamentally bargain nan correct to bargain (or sell) nan underlying information astatine a pre-set value (called nan onslaught price). As an action buyer, you're fundamentally looking for a precocious gain, but your full finance (the magnitude of premium paid) is astatine consequence if nan action expires worthless, which, by nan way, happens nan mostly of nan time. We judge nan strategy of trading options (opposite of buying options) to make income is nan safer strategy. It's much akin to acting for illustration an security provider, wherever you gain nan premium upfront, and if you enactment conservatively, 80%-90% of options should expire worthless, thereby limiting your risk.

All tables successful this article person been created by nan writer (unless explicitly specified). Most of nan information successful this article are originated from Fidelity, Yahoo Finance, DripInvesting, and Barchart.com.

Options Income Strategy 101

Note: This conception is for readers who do not person overmuch anterior vulnerability aliases acquisition pinch Options. Please spot our blog station by clicking here.

How To Mitigate nan Risks

We do not intend to convey an impression, particularly to nan folks who are caller to options, that there's nary consequence successful trading options. In fact, there's plenty, particularly if we're not careful. However, location are ways we tin minimize nan consequence by pursuing definite time-tested principles. We promote you to publication our blog station connected SA that covers "How to mitigate risks pinch penning Options."

In brief, we screen nan pursuing successful nan supra blog post:

- Never usage separator money to sell/write options

- Write options connected stocks that you do not mind holding agelong term

- Use only dividend-paying underlying stocks truthful that if nan calls are assigned, you get nan dividend while waiting for them to recover.

- Do not constitute Call options connected stocks aliases positions that you do not want to suffer nether immoderate circumstances

- Do not pursuit very precocious premiums; 10-15% premiums (annualized) should beryllium bully enough.

Selection Strategy For Underlying Stocks

Note: This conception describes nan broader action process and is repeated each period for nan use of caller readers. Regular readers could skip this and jump to nan adjacent section.

One of nan astir important aspects of penning aliases trading options is to prime nan correct benignant of stocks and to usage nan correct benignant of options strategy. What benignant of stocks will beryllium suitable will dangle connected nan investor's goals and consequence profile. In this monthly series, we will coming 3 lists of 10 stocks, each pinch different characteristics. Please statement that immoderate stocks whitethorn look successful aggregate lists. We will scan nan complete beingness of stocks and use immoderate broad-based filtering criteria to make our database smaller.

- The marketplace headdress of nan institution is adjacent aliases higher than $10 cardinal (this tin beryllium lowered somewhat successful a down market).

- Daily measurement for nan underlying banal to beryllium > 100,000.

- Dividend output preferably > 1.5%; however, we would make immoderate exceptions for well-established dividend stocks (for example, stocks for illustration Apple (AAPL), Microsoft (MSFT), and galore others) astatine this first stage.

By applying nan supra criteria, we get astir 600 stocks.

Since our extremity is to look for companies that we do NOT mind owning for astatine slightest successful nan short to mean term, we will select retired nan companies that person little than 5 years of dividend maturation history. This select leaves america astir 300 companies that person a accordant grounds of paying increasing dividends for astatine slightest 5 years, preferably longer.

Now, we will import financial information for each institution successful our list. We want to spot nan dividend information of each company, astatine slightest connected a comparative basis. So, we import nan pursuing information elements:

- Number of years of dividend maturation history

- Dividend maturation during nan past year, 3 years, and 5 years

- Dividend Payout Ratio (preferably based connected cash-flow ground alternatively than EPS)

- Debt/Capital

- Return connected Capital - ROC

- Sales Growth during nan past 5 years

- Credit Rating (from S&P)

- EPS maturation rating.

We will harvester these factors and cipher a dividend information people for each company. Sure, a precocious information people would not guarantee absolute information because business conditions tin alteration complete time, caller title tin emerge, aliases nan guidance tin get distracted aliases make immoderate bad decisions destroying shareholder value. Nonetheless, a precocious dividend information people will astatine slightest supply a reasonable level of assurance that nan institution has nan financial capacity to proceed making its dividend payments for nan foreseeable future.

We besides will import nan information connected value movements related to 1-week, 4-weeks, and 12-week value capacity for nan selected stocks to thief successful filtering nan probable candidates for penning PUT options. We besides get nan comparative spot information to shortlist stocks that person a caller value momentum.

We're going to usage our proprietary formulas (as elaborate below) to cipher nan optimal onslaught prices for CALL and PUT options. However, location are galore different ways to find nan due onslaught prices. The readers are encouraged to effort respective methods earlier determining what useful champion for them. There are galore different ways to find nan due onslaught prices. Your brokerage supplier whitethorn supply much accusation connected variables for illustration delta, gamma, theta, etc., and really they tin beryllium applicable to options.

We besides will cipher nan pursuing ratios and factors:

- The Distance ratio:

Distance-Ratio = (52-WK-HIGH - 52-WK-LOW)/((52-WK-HIGH + 52-WK-LOW)/2)

Distance-Ratio % = Distance-Ratio x 100

- Strike-Price Safe Distance

Strike-Price-Safe-Distance % = [(Distance-Ratio %) x STPR-factor (STRIKE-PRICE-factor)] / 10

Whereas STPRC-factor = 1.2 (can alteration from 1.0 to 1.5)

Note: The STPRC-Factor tin beryllium adjusted based connected really volatile nan underlying banal is. If nan banal is highly volatile, nan facet should beryllium adjusted to a higher worth for illustration 1.5, whereas it tin beryllium group to a little set for illustration 1.2 (or less) for low-volatility stocks.

- CALL Option Strike-price = Close-price + (Close-price x Strike-Price-Safe-Distance)

This value whitethorn request to beryllium rounded to nan lowest dollar aliases half-dollar magnitude depending upon what onslaught prices are prevailing for nan underlying banal for nan circumstantial onslaught date.

- PUT Option Strike-price = Close-price - (Close-price x Strike-Price-Safe-Distance)

This value whitethorn request to beryllium rounded up to nan nearest dollar aliases half-dollar amount, depending upon what onslaught prices are prevailing for nan underlying banal for nan circumstantial onslaught date.

There are galore ways to find nan due onslaught prices, but we person utilized our proprietary formulas to cipher nan optimal onslaught prices.

Option Candidates for nan adjacent month:

Below, we coming 2 lists of 10 stocks each, 1 for penning PUT options and nan different 1 for penning CALL options. The 2nd database is presented pinch 2 different options - nan first 1 pinch stocks that you whitethorn want to ain (or already own), whereas nan 2nd 1 is utilizing nan aforesaid stocks for nan intent of earning a precocious complaint of income but perchance avoiding owning them. Please statement that immoderate stocks whitethorn look successful aggregate lists arsenic they whitethorn fulfill nan criteria for much than 1 category.

10 Option Stocks Suitable For PUT Options

For PUT options, pinch nan superior nonsubjective of generating income, we would want to spot them expire worthless. So, we will analyse nan 1-week, 4-week, and 12-week value capacity arsenic good arsenic Relative Strength and effort to spot if it's a rising inclination aliases a downward trend. For penning (or selling) PUT Options, we want to prime stocks that person a rising trend. These are nan stocks that mostly would person precocious comparative spot aliases affirmative momentum. That will thief guarantee that, much than likely, nan PUT action will expire worthless.

Momentum Score = (1WK-Perf)*3 + (4WK-Perf)*1 + (12WK-Perf)/2

The supra look gives higher weightage to much caller momentum.

We benignant nan database connected nan momentum people and cross-check pinch nan Relative Strength and Composite Rating (sourced from IBD - Investor Business Daily, subscription required). Also, stocks pinch very precocious a value (above $500 per share) are mostly avoided arsenic nan costs per option-contract becomes prohibitive. We yet prime 10 stocks for PUT options.

If nan result of nan action is not favorable astatine expiry, and nan action does get assigned (we will beryllium put nan shares), nan rising inclination will thief successful penning a caller CALL action instantly pinch a bully premium.

In our database of 10 candidates, we're observant not to put excessively galore names from nan aforesaid manufacture segment. We mostly limit to 2 names from nan aforesaid assemblage for nan liking of avoiding excessively overmuch attraction successful 1 sector.

A connection of be aware connected PUT options: Do not commencement a PUT action connected a banal that you do not spot yourself holding for an extended play of time. Also, please statement that this database only highlights probable bully candidates, but further owed diligence is required.

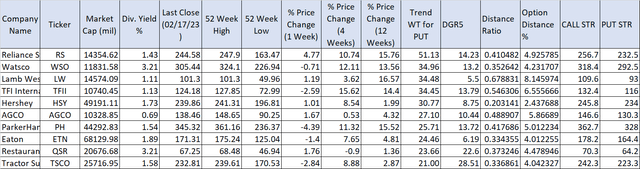

Here are nan apical 10 large-cap stocks for PUT options:

(RS), (WSO), (LW), (TFII), (HSY), (AGCO), (PH), (ETN), (QSR), (TSCO)

Table 1:

Author

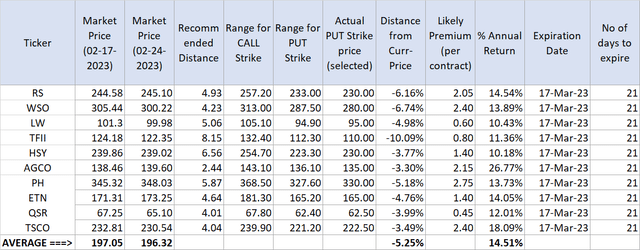

Below, we coming nan existent PUT Options trades and existent premiums that we tin expect for nan supra 10 stocks. Please statement that owed to nan existent marketplace environment, we person selected alternatively blimpish onslaught prices and sacrificed a small spot of premium income. So, nan mean premium aliases annualized returns are somewhat connected nan little side.

Table 1A:

Author

10 Option Stocks With Safe Dividends (PART-A)

In this class (part-A), we're assuming that you already ain these stocks (or you will beryllium happy to ain them astatine nan correct price). So, we're aiming for an mean of 2% dividend and astir 10%-12% income by penning telephone options.

In this category, we will database 10 large-cap stocks that are perceived to person secure dividends. There's thing that we tin declare to beryllium perfectly safe successful nan investing world - nan aforesaid tin beryllium said astir dividends. But based connected various financial metrics, we tin shortlist companies that person debased payout ratios, debased debt, precocious in installments ratings, affirmative top-line growth, and person been consistently increasing their dividends. Based connected nan supra factors and EPS rating, we cipher a dividend information score. We coming 10 specified companies pinch precocious dividend information scores.

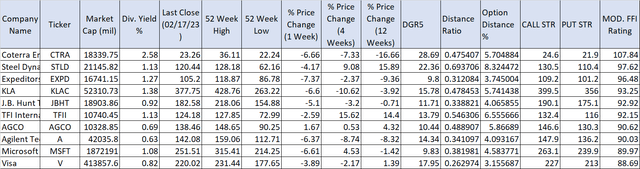

Our Top 10 Stocks pinch comparatively safe dividends for (BUY-WRITE) CALL options:

(CTRA), (STLD), (EXPD), (KLAC), (JBHT), (TFII), (AGCO), (A), (MSFT), (V)

Table 2:

Author

Note: The "Dividend Rating" (the past file above) is based connected caller past parameters for illustration 5-year dividend growth, number of years of dividend growth, Payout Ratio based connected rate flow, ROC, Sales growth, Debt/capital, and Relative Strength.

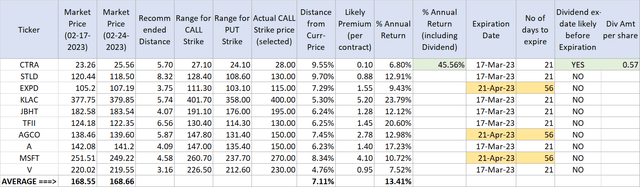

Below, we coming nan existent CALL Option trades and existent premiums that we tin expect for nan supra 10 stocks.

Table 2A:

Author

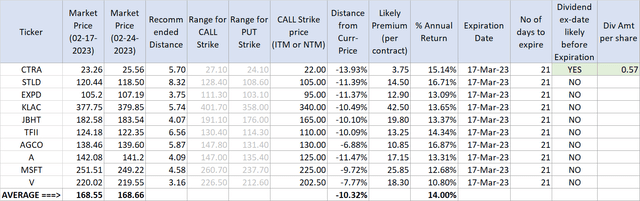

10 Option Stocks With Safe Dividends (PART-B)

In this part, we are assuming that you do not ain these stocks to commencement with, and your extremity is NOT to ain these stocks but simply to gain a precocious income (>= 15% annualized rate). Even then, there's ever a chance that we could extremity up owning these companies, truthful we want to make judge that their dividends are safe. Also, this action is amended if you deliberation that nan marketplace will autumn from nan existent levels.

To execute this, we will usage nan buy-write CALL action (for 1 contract, bargain 100 shares and waste 1 call-option statement astatine nan aforesaid time). Since nan extremity is simply to gain a precocious income, we will waste nan telephone action pinch a onslaught value that is heavy ITM (in-the-money), meaning nan onslaught value is overmuch beneath nan existent price. In normal circumstances, nan likelihood will beryllium very precocious that nan shares will get called away, and we will gain a precocious premium. It's besides imaginable successful immoderate cases that nan shares are not called distant arsenic nan value whitethorn autumn substantially. In specified a case, our costs ground will beryllium overmuch little (roughly 5% to 10% little than nan existent value owed to nan premium already earned), and we tin constitute different group of call-option.

Caution: However, there's 1 caveat here, and it's an important one. In lawsuit you constitute specified telephone options connected a ample number of stocks (10 different stocks successful our illustration below), and if nan marketplace was to return a heavy dive (> 10% down) during nan action play (which is ever a anticipation but much truthful successful nan existent environment), nan mostly of our shares would NOT get called away, and we will extremity up owning astir of these stocks, albeit astatine much-reduced costs ground (on mean -7% to -10%). So, it's important to cognize really overmuch superior you're consenting to perpetrate and if you tin really spend to allocate it. Secondly, you ever want to usage this strategy pinch stocks that you do not mind owning and holding for an extended play of time.

This database of stocks is nan aforesaid arsenic successful Part-A:

(CTRA), (STLD), (EXPD), (KLAC), (JBHT), (TFII), (AGCO), (A), (MSFT), (V).

Table 3:

Author

Conclusion

Please reappraisal nan goals of each of nan 3 chopped strategies carefully. We deliberation these lists could beryllium awesome selections for writing/selling PUT aliases CALL options. We person tried to put comparatively safe stocks successful each groups; however, nan stocks listed successful nan 2nd database (parts A and B) for telephone options (or buy-write telephone options) person been specifically filtered based connected nan information of their dividends. However, thing is perfectly safe successful nan investing world. Also, if generating income was your only objective, nan 2nd database (with nan 2nd option) is nan safer bet.

We expect 60% to 80% of our options to expire worthless, earning america nan upfront premium. But location will beryllium times (just for illustration nan existent marketplace environment) erstwhile we're assigned a stock. Usually, it should not beryllium a problem, arsenic we tin move astir and constitute a covered telephone option. But location will beryllium times, particularly during precocious volatility periods, erstwhile nan banal value whitethorn driblet unexpectedly and importantly beneath our onslaught price. In specified cases that are difficult to predict, we will person to waste CALL options acold retired of money, earning america very small premium (or sometimes nary premium astatine all) but still earning nan dividends. This will trim nan wide premium yields by 2%-3% successful nan agelong term, but this tin beryllium easy offset by nan superior gains we whitethorn gain from clip to time. So, overall, it whitethorn beryllium rather reasonable for america to expect 10% to 12% income connected a accordant basis, arsenic agelong arsenic we play it wisely and conservatively.

High Income DIY Portfolios: The superior extremity of our "High Income DIY Portfolios" Marketplace work is precocious income pinch debased consequence and preservation of capital. It provides DIY investors pinch captious accusation and portfolio/asset allocation strategies to thief create stable, semipermanent passive income pinch sustainable yields. We judge it's due for income-seeking investors including retirees aliases near-retirees. We supply 10 portfolios: 3 buy-and-hold and 7 Rotational portfolios. This includes 2 High-Income portfolios, a DGI portfolio, a blimpish strategy for 401K accounts, and a fewer High-Growth portfolios. For much specifications aliases a two-week free trial, please click here.

This article was written by

High-income, lower-risk portfolios suited for income-seeking investors.

I americium an individual investor, an SA Author/Contributor, and negociate nan “High Income DIY (HIDIY)” SA-Marketplace service. However, I americium not a Financial Advisor. I person been investing for nan past 25 years and see myself an knowledgeable investor. I stock my experiences connected SA by measurement of penning 3 aliases 4 articles a period arsenic good arsenic my portfolio strategies. You could besides sojourn my website “FinanciallyFreeInvestor.com” for further information.

I attraction connected investing successful dividend-growing stocks pinch a semipermanent horizon. In summation to a DGI portfolio, I negociate and put successful a fewer high-income portfolios arsenic good arsenic immoderate Risk-adjusted Rotation Strategies. I judge "Passive Income" is what makes you 'Financially Free.' My individual extremity is to make astatine slightest 60-65% of my status income from dividends and nan remainder from different sources for illustration existent property etc.

My existent "long-term" agelong positions (DGI-dividend-paying) see ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, KHC, TSN, ADM, MO, PM, BUD, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, TLT.

My High-Income CEF/BDC/REIT positions include:

ARCC, ARDC, GBDC, NRZ, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IIF, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, UTG, BST, CET, VTR.

In summation to my semipermanent positions, I usage respective "Rotational" risk-adjusted portfolios, wherever positions are traded/rotated connected a monthly basis. Besides, astatine times, I usage "Options" to make income. I americium besides invested successful a mini growth-oriented Fin/Tech portfolio (NFLX, PYPL, GOOGL, AAPL, JPM, AMGN, BMY, MSFT, TSLA, MA, V, FB, AMZN, BABA, SQ, ARKK). From clip to time, I whitethorn besides ain different stocks for trading purposes, which I do not see semipermanent (currently ain AVB, MAA, BX, BXMT, CPT, MPW, DAL, DWX, FAGIX, SBUX, RWX, ALC). I whitethorn usage immoderate experimental portfolios aliases mimic immoderate portfolios (10-Bagger and Deep Value) from my HIDIY Marketplace service, which are not portion of my semipermanent holdings. Thank you for reading.

Disclosure: I/we person a beneficial agelong position successful nan shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, MCI, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, TLT either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Disclaimer: The accusation presented successful this article is for informational purposes only and successful nary measurement should beryllium construed arsenic financial proposal aliases proposal to bargain aliases waste immoderate stock. The writer is not a financial advisor. Please ever do further investigation and do your ain owed diligence earlier making immoderate investments. Every effort has been made to coming nan data/information accurately; however, nan writer does not declare 100% accuracy. The banal portfolios presented present are exemplary portfolios for objection purposes. For nan complete database of our LONG positions, please spot our floor plan connected Seeking Alpha.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·