wacomka

Investment Thesis

Dow Inc (NYSE:DOW) has been a coagulated dividend banal since it was spun disconnected from DuPont (DD) backmost successful 2019. In nan past fewer years, nan institution has managed to deleverage substantially and make overmuch stronger rate flow.

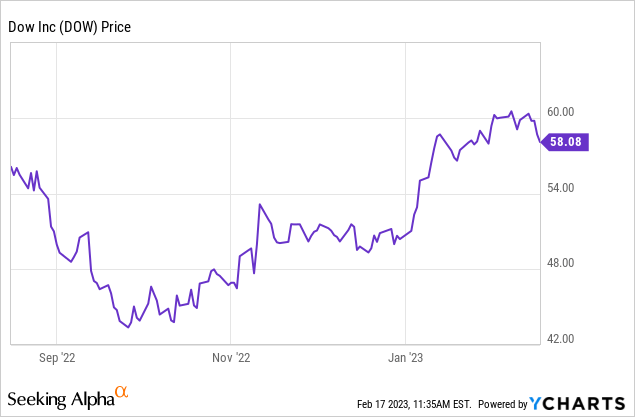

However, now is not nan correct clip to get successful in my option. The institution has rallied complete 35% since past September owed to soft landing hopes and China reopening, and nan risk-to-reward ratio is overmuch little compelling now. Inflation whitethorn beryllium a problem again arsenic caller CPI came successful supra anticipation pinch MoM (month complete month) readings accelerating. The resilience of ostentation will besides diminish nan chances of nan system seeing a soft landing. The caller net bespeak beardown impacts from ostentation connected some costs and demand, resulting successful nett income cratering. It is presently trading astatine a precocious fwd PE ratio owed to declining net and this does not moreover relationship for nan imaginable difficult landing scenario. I deliberation it is champion to enactment distant for now arsenic location are aggregate near-term headwinds surrounding nan company.

Data by YCharts

Data by YCharts

Inflation and Recession

Dow is simply a US-based business conglomerate pinch complete 100 manufacturing sites crossed nan globe. It produces and supplies different materials for illustration lubricants and polyethylene to aggregate industries specified arsenic automotive, agricultural, packaging, and more. Due to nan quality of its business, nan institution is very cyclical and exposed to nan macroeconomy. Inflation has been affecting nan business heavy and will proceed to beryllium a beardown headwind, alongside nan anticipation of a recession happening later this year.

In caller months, nan Fed seems to person shifted its stance from aggressively hiking to a "wait and see" mentality, contempt nan CPI (consumer value index) still remaining highly elevated. This whitethorn origin ostentation to reaccelerate arsenic nan unemployment complaint is still highly low. We are already seeing early signs pinch January CPI accelerating to a 0.5% summation MoM, up from 0.1% successful December and 0.2% successful November. The YoY (year complete year) summation did travel down somewhat from 6.5% to 6.4% but this is still higher than nan statement anticipation of 6.2%. The summation is led by nan power conception which was up 2% MoM.

Inflation tin beryllium a double-edged sword. In 2021, Inflation was a tailwind for Dow arsenic nan institution was capable to leverage beardown request and raise prices. However, arsenic nan system weakens, it cannot further raise prices and ostentation is hurting request instead, arsenic demonstrated successful nan latest earnings. The emergence successful power costs is besides a interest arsenic it whitethorn summation nan costs of accumulation and put much unit connected nan bottommost line.

With nan ostentation complaint staying elevated, nan Fed whitethorn beryllium forced to raise rates moreover higher, which will further statement nan system and perchance origin a recession. The user conception is presently still beardown (probably owed to excess savings and pent-up request from nan pandemic) but nan business conception is already weakening, arsenic shown successful caller earnings. If you look astatine nan output curve, a recession seems almost inevitable astatine this constituent pinch nan 2-year and nan 10-year highly inverted. As rates proceed to rise, thing is poised to break soon. The chances of a soft landing happening are getting really slim now successful my opinion.

Earnings and Valuation

Dow's latest net results showed a important deterioration successful capacity arsenic nan system weakens while ostentation remains elevated. The institution reported income of $11.9 billion, down 17% YoY from $14.4 billion. This is driven by some decreased pricing and little demand. Local prices declined 5% YoY while measurement dropped 8% YoY.

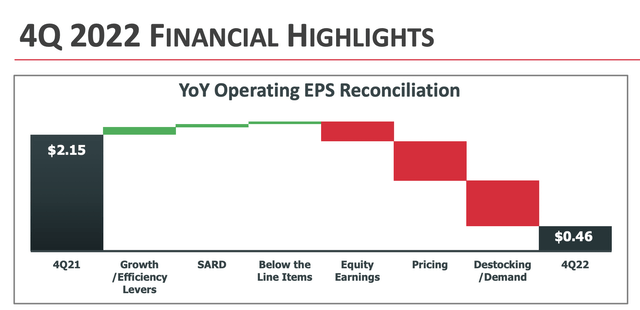

The bottommost statement was moreover worse owed to anemic pricing and inflationary unit connected costs. Gross profit was $1.2 cardinal compared to $2.59 billion, down 53.7% YoY. The gross profit separator was down importantly from 18% to 10.1%. Net income plummeted 63.2% YoY from $1.76 cardinal to $647 million. Net income separator besides declined from 12.2% to 5.4%. Operating EPS was $0.46 compared to $2.15, representing a alteration of 78.6% YoY. The company's guidance for FY23 indicates net and gross to further diminution by 47.9% and 12.6% respectively.

Dow Inc

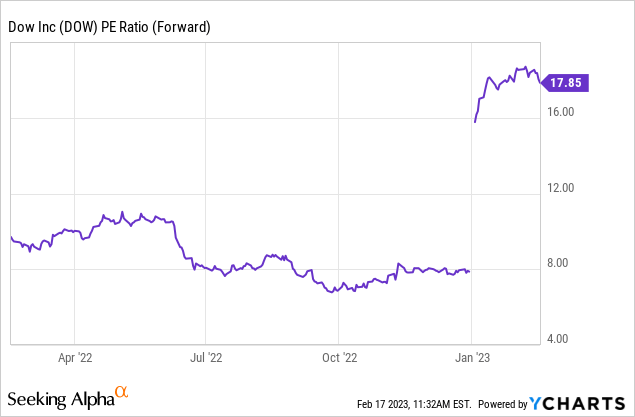

After nan caller run-up, nan institution is now trading astatine an fwd PE ratio of 17.9x arsenic net this twelvemonth are group to plummet. The existent valuation is simply a spot stretched arsenic it is 5.9% supra its 5-year humanities mean of 16.9x. The existent dividend output of 4.77% is besides beneath its humanities mean of 4.97%. According to Seeking Alpha analysts' estimates, net are expected to rebound importantly successful FY24 owed to easier comps and improving macro conditions. But I deliberation this is measurement excessively optimistic and wholly discounted nan anticipation of a recession. Assuming we spot a mild recession during nan 2nd half of this year, it will apt past till astatine slightest nan first half of 2024. This will origin net to spell down further pinch multiples going moreover higher. The existent valuation doesn't connection immoderate separator of information successful my opinion.

Data by YCharts

Data by YCharts

Investors Takeaway

Overall, I deliberation buying Dow astatine nan existent valuation incurs a bunch of risks. The institution would proceed to do good if we spot a soft landing but nan chances are slim and it is not my guidelines case. Inflation remains stubbornly elevated and whitethorn moreover reaccelerate arsenic nan Fed slowed down nan gait of complaint hikes. Higher ostentation will importantly effect nan company's capacity arsenic it dampens request and increases costs for production. Not to mention nan precocious likeliness of a recession happening later this year. After nan rally, nan existent multiples besides look stretched. Considering nan macro backdrop and valuation, I deliberation nan institution has meaningful downside potential. Therefore I complaint Dow arsenic a sell.

This article was written by

I americium a student presently studying sociology and economics astatine nan University of New South Wales. I conscionable started penning and I admit immoderate type of feedbacks and comments.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·