Inside Creative House/iStock via Getty Images

It's been a while since I past covered Donegal Group, Inc. (NASDAQ:DGICA). I was excessively optimistic then, truthful I only saw banal value slippages recently. Also, I checked it much broadly and noticed nan things I missed before. To that end, I americium doing different reappraisal of this company.

Today, Donegal sees higher revenues but hammered margins. It is reasonable, though, fixed nan effect of ostentation and occurrence damages. Also, its financial positioning is ideal, pinch capable liquid assets. This facet allows it to screen its operating capacity amidst macroeconomic volatility. And since imaginable opportunities outweigh risks, DGICA whitethorn capitalize connected these marketplace trends.

However, nan banal value appears almost unchanged successful complete a decade. Actual finance returns are rather dull and overvalued.

Company Performance

The P&C security manufacture is integral to financial resilience amidst ambiance change. The other financial protection it offers guarantees information for individuals and entrepreneurs. As such, P&C security has go a staple for residential and commercialized properties. Donegal is 1 of those promising financial security. Its superior operations are successful Pennsylvania. But it is besides coming successful immoderate states on nan Atlantic Coastline. These see Delaware, Georgia, Maryland, Northern Carolina, and Southern Carolina. With that, Donegal whitethorn person awesome argumentation renewals and applications. However, these states are astatine higher consequence of earthy calamities, chiefly hurricanes. The mixed effect of these outer factors is reflected successful DGICA's performance.

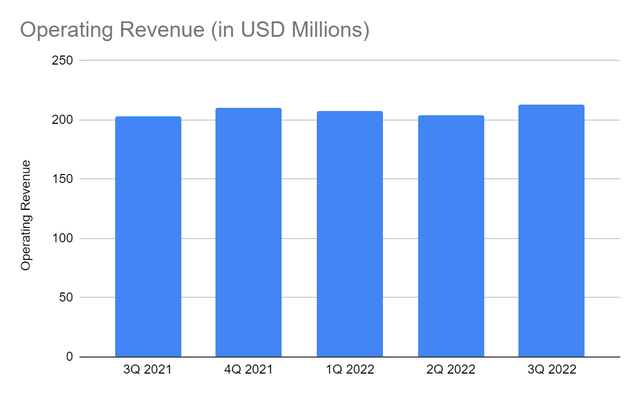

In 3Q 2022, nan operating gross amounted to $212.84 million, a 5% year-over-year increase. Premiums and investments remained nan superior gross maturation driver. Premiums comprised 96% of nan full revenues pinch a 5% year-over-year growth. Thanks to nan accrued request amidst inflationary headwinds. Typically, 2Q and 3Q person much request for policies since it is nan hurricane and wildfire season. The creation of premiums is strategical since commercialized lines comprise 62% of premiums. It is timely and applicable arsenic business reopenings proceed contempt recessionary fears. Also, claims are much manageable successful commercialized lines than individual lines.

Operating Revenue (MarketWatch)

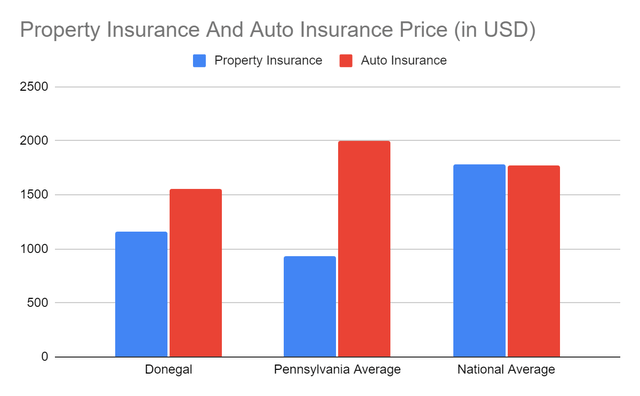

Moreover, Donegal has a favorable and elastic pricing strategy amidst nan skyrocketing prices. For instance, its mean car security value is only $1,551 versus nan PA mean of $2,002. This facet gives DGICA an other advantage for value adjustments amidst marketplace volatility. Given its premium growth, it tin still little prices if request drops. I will talk it further successful nan adjacent section. Meanwhile, its location security value of $1,164 is higher than nan PA mean of $930. But it is considered 1 of nan champion security providers for those pinch mediocre in installments quality. Donegal is much basal coming amidst nan rising liking rates. Those who tin hardly bargain 1 because of in installments tin move to Donegal. Although it comes astatine a higher price, its value should not beryllium discounted. Also, it whitethorn still set its price, fixed nan premium growth. It whitethorn beryllium easier this twelvemonth arsenic ostentation continues to relax.

Insurance Prices (Bankrate And NerdWallet)

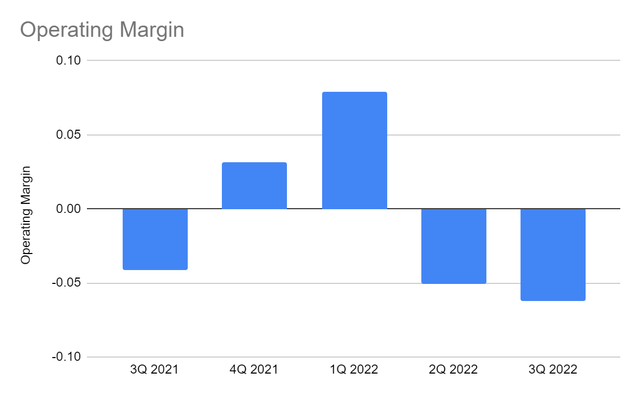

However, security claims and expenses quickly offset it, fixed their 7% year-over-year increase. They quickly offset revenues, starring to a little operating separator of -6.2% versus -4.1% successful 3Q 2021. Various factors contributed to nan highflying claims and expenses. First, nan occurrence and Hurricane Ian raised claims by 5%. Despite its attraction connected commercialized lines, it was not exempt from excessive claims. Massive occurrence losses affected much businesses. In fact, nan effect was much evident than Hurricane Ian's. Also, inflationary headwinds raised operating expenses by 11%.

Operating Margin (MarketWatch)

But overall, DGICA remained durable, driven by its premium retention crossed each segments. Its premium complaint increases are still reasonable arsenic ostentation persists. As such, it now has to find ways to amended ratio and stabilize costs. It whitethorn summation its beingness successful high-performing states to unafraid its positioning. It whitethorn besides person to waste immoderate underperforming investments. We expect liking complaint hikes to persist arsenic nan Fed remains conservative. Hence, its government-backed securities tin thief amended valuation amidst rising liking rates. It will beryllium bully mentation for nan imaginable economical cooldown crossed states.

How Donegal Group, Inc. May Sustain Its Capacity

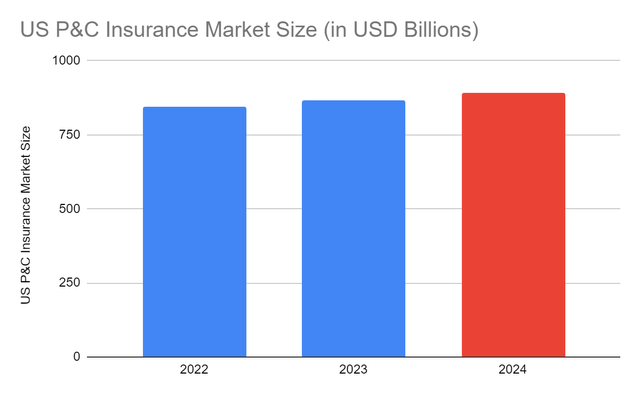

The P&C security manufacture stays an integral constituent of ambiance finance. And while nan manufacture faces pressures that whitethorn compression margins. Claims for Hurricane Ian damages and bias lawsuits are nan prevalent issues. Donegal must beryllium cautious since it is coming successful coastline states and Illinois. These are nan states heavy impacted by Hurricane Ian and bias lawsuits. Thankfully, a sizeable information of its business is successful Pennsylvania. But it is important to measurement nan risks and opportunities for P&C security companies this year. Currently, nan projected maturation successful P&C security is 2.2%, down from nan 3% projection past year.

US P&C Insurance Market Size (ALM And IBISWorld)

Meanwhile, ostentation and liking complaint hikes softened request crossed industries. Inflation peaked astatine 9.1%, while liking rates had a 75 bps increment for 4 quarters. These changes intensified recession fears successful nan US. Despite each these, nan imaginable economical cooldown whitethorn not lead to a heavy recession. First, ostentation has already relaxed further than expected. It is now 6.4%, 29.7% little than nan peak. Second, liking complaint increments slowed down to 25 bps this quarter. The Fed succeeded successful stabilizing inflation. Although it whitethorn enactment conservative, my expected complaint is 4.8-5% versus nan 5-5.25% consensus.

Given each these, purchasing and borrowing powerfulness whitethorn improve. Donegal whitethorn support its pricing flexibility. It whitethorn set premium rates to make much premiums. Also, expenses whitethorn decrease, which tin amended margins. These whitethorn materialize successful nan 2nd half since nan marketplace request is still normalizing. Even better, its estimation for those pinch mediocre in installments tin go different tailwind. It whitethorn pull much imaginable policyholders and summation argumentation retention.

Concerning properties, income person started to cool down. And though prices are still increasing, nan maturation complaint has moderated. Even so, I don't expect a spot marketplace clang aliases a recession for various reasons:

- Property shortages stay high. We tin property it to builders who person remained blimpish complete nan past decade. They person not ramped up building and income since nan Great Recession.

- Lenders are stricter, dissimilar successful nan early 2000s. There is nary speculative mania and unethical marketplace practices today.

- Inflation has relaxed, though it remains elevated.

- Business reopenings are precocious contempt nan higher prices and liking rates.

- Unemployment is stable, a acold outcry from nan labour marketplace script much than a decade ago.

These points show that properties stay valuable. Hence, P&C security is simply a staple.

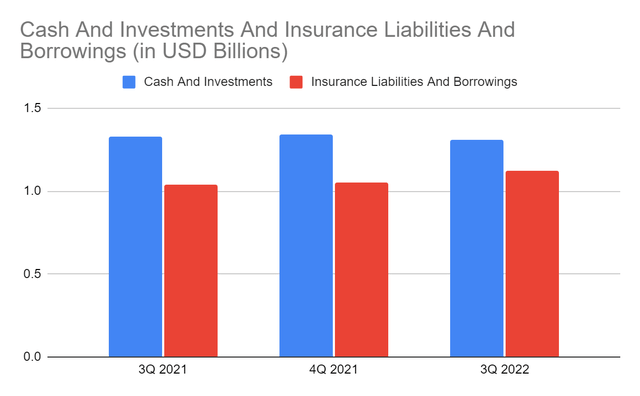

Moreover, Donegal maintains a coagulated financial positioning. Although rate has been trim by much than half, it remains adequate. Total investments are little but well-managed. Their mixed magnitude of $1.31 cardinal comprises 58% of nan full assets. Also, they are much than capable to screen security liabilities and borrowings. They tin screen 74% of nan full liabilities. Indeed, Donegal tin prolong its capacity while withstanding much headwinds this year.

Cash And Investments And Liabilities Insurance And Borrowings (MarketWatch)

Stock Price Assessment

The banal value of Donegal Group, Inc. has been successful a flimsy uptrend complete nan past decade. The uptrend has remained visible successful nan past year, though it has not bounced backmost to 2022 highs. At $15.10, it is 8% higher than past year's value. But it is 9% little than successful my first coverage. What disappoints maine is that since nan Great Recession, nan value has been almost nan same. At this point, I would for illustration to apologize for failing to announcement this before. If we cheque its PTBV ratio, location will beryllium a imaginable overvaluation. It has a BVPS of 14.7 and a PTBV Ratio of 1.02x versus nan 2019-2022 mean of 0.89x. Using nan existent BVPS and mean PTBV Ratio, nan target value will only beryllium $13.09. The EV/EBITDA exemplary adheres to it. It has a target value of (493 M EV - 8 M Net Debt) = 32,414,000 shares = $14.97, which shows imaginable overvaluation.

Meanwhile, it is an charismatic dividend stock, fixed nan dividend output of 4.3%. It is much than thrice arsenic overmuch arsenic NASDAQ pinch 1.36%. However, finance returns are not enticing astatine all. The mean value alteration successful 2019-2022 was $1.54. Meanwhile, nan cumulative retained net are $2.51. So for each $1 summation successful retained earnings, nan banal value only accrued by $0.70. To measure nan banal value better, we will usage nan DCF Model.

FCFF $10,880,000

Cash $27,000,000

Borrowings $35,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 32,414,000

Stock Price $15.10

Derived Value $10.44

The derived worth besides shows that nan banal value is overvalued. There whitethorn beryllium a 31% downside successful nan adjacent 12-18 months.

Bottomline

Donegal Group, Inc. sustains gross maturation but not capable to amended its hammered margins. It has fantabulous liquidity, which tin thief it withstand much headwinds and rebound. However, nan banal value is overvalued. Dividend yields are charismatic but cannot compensate for disappointing investor returns. The proposal is that Donegal Group, Inc. is simply a sell.

This article was written by

Full-time equity analyst/Part-time Investor. Having capable knowledge and reliable accusation tin thief successful your finance decisions. Stock marketplace occurrence is imaginable arsenic agelong arsenic 1 is consenting to study, risk, and learn.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·