Zach Gibson

Introduction

As an investor who prioritizes dividend growth, I americium perpetually searching for caller opportunities to put successful assets that make accordant income. When I travel crossed attractively weighted assets, I often adhd them to my existent holdings. Additionally, I usage marketplace volatility to my advantage by initiating caller positions, which helps diversify my portfolio and summation my dividend income while minimizing nan needed capital.

The inferior assemblage presents an intriguing opportunity for investors since, owed to nan higher rates, we spot higher-yielding stocks. Dominion Energy (NYSE:D), successful particular, is an charismatic action for investors owed to its consistently precocious dividend yield. Dominion Energy operates successful a unchangeable marketplace arsenic a regulated inferior and is well-positioned to proceed generating income for investors.

I will analyse nan institution utilizing my methodology for analyzing dividend maturation stocks. I americium utilizing the aforesaid method to make it easier to comparison researched companies. I will analyse nan company's fundamentals, valuation, maturation opportunities, and risks. I will past effort to find if it's a bully investment. Seeking Alpha's institution overview shows that:

Dominion Energy produces and distributes power successful nan United States. The institution operates done 4 segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina, and Contracted Assets. The Dominion Energy Virginia conception generates, transmits, and distributes energy successful Virginia and North Carolina. The Gas Distribution conception is focused connected earthy state sales, transportation, gathering, storage, and distribution operations successful Ohio, West Virginia, North Carolina, Utah, southwestern Wyoming, and southeastern Idaho. The Dominion Energy South Carolina conception generates, transmits, and distributes energy and earthy state successful South Carolina. The Contracted Assets conception is progressive successful nan nonregulated semipermanent contracted renewable electrical procreation and star procreation installation improvement operations, and state transportation, LNG import, and retention operations, arsenic good arsenic successful nan liquefaction facility.

Fundamentals

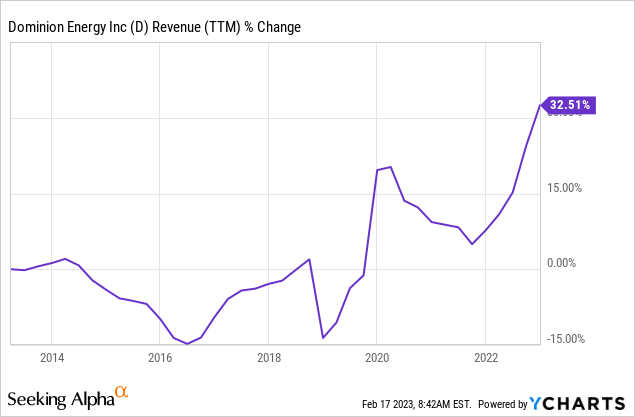

Over nan past decade, Dominion Energy has demonstrated awesome gross maturation complete nan past decade, pinch an summation of 33%. This maturation tin beryllium attributed to some integrated and inorganic factors. On nan integrated side, nan institution has been expanding its grid and benefiting from demographic growth, which has accrued request for its services. Meanwhile, nan institution has besides pursued inorganic maturation done strategical acquisitions, specified arsenic nan acquisition of Questar and nan merger and consequent waste of its midstream business. In nan future, arsenic seen connected Seeking Alpha, nan expert statement expects Dominion Energy to support increasing income astatine an yearly complaint of ~2% successful nan mean term.

Data by YCharts

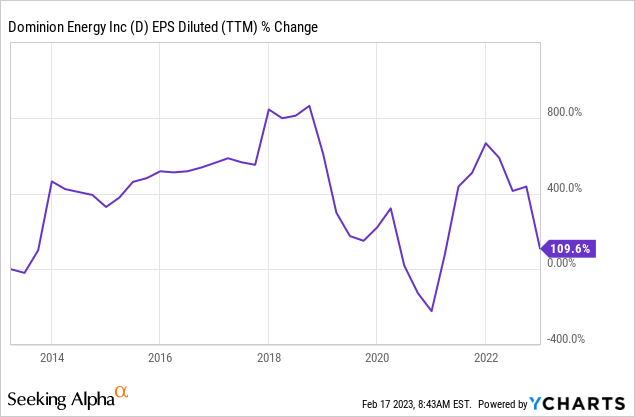

Data by YCharts

While Dominion Energy has knowledgeable awesome gross maturation complete nan past decade, its EPS (earnings per share) has grown slower. In GAAP figures, EPS has accrued by 110%, a singular achievement. However, nan non-GAAP figures show a different story, pinch EPS increasing by only 26%. There are a fewer reasons for nan EPS increasing slower than sales. One facet is nan higher number of shares that Dominion Energy has issued complete nan years, which has diluted nan net per share. The company's margins person besides been nether pressure, contributing to slower net growth. In nan future, arsenic seen connected Seeking Alpha, nan expert statement expects Dominion Energy to support increasing EPS astatine an yearly complaint of ~1% successful nan mean term.

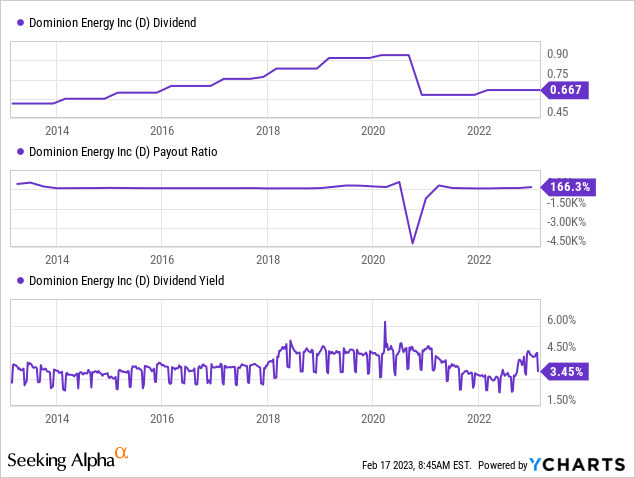

Data by YCharts

Data by YCharts

Dominion Energy has faced disapproval from investors complete its dividend trim successful caller years, arsenic nan institution trim its dividend importantly pursuing nan waste of its midstream business. However, nan institution is now continuously increasing nan dividend and is committed to maintaining it. Currently, nan dividend output is an charismatic 4.6%, and it appears safe pinch a payout ratio of 67% erstwhile utilizing non-GAAP EPS. While nan institution is not yet backmost to nan level of dividend maturation that investors whitethorn desire, location is room for mid-single-digit dividend increases successful nan coming years, arsenic indicated by nan management's guidance.

Data by YCharts

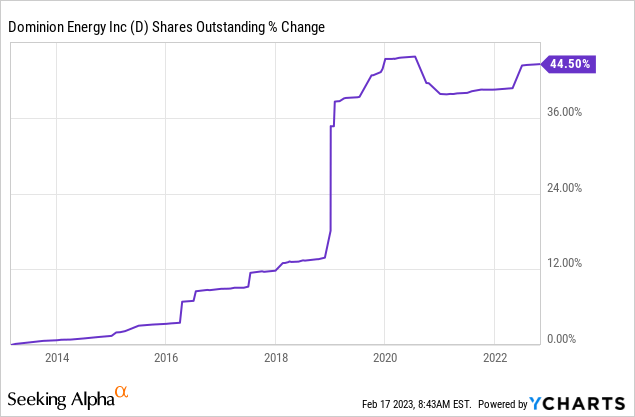

Data by YCharts

In summation to paying dividends, companies often return superior to their shareholders done banal buybacks. However, Dominion Energy has not engaged successful banal buybacks successful caller years, arsenic it has a payout ratio of 67% and is focused connected investing successful its projects. Buybacks tin beryllium an highly businesslike measurement to return worth to shareholders erstwhile nan stock value is attractive, arsenic successful nan lawsuit of Dominion Energy. It is worthy noting that nan number of shares outstanding has accrued by 45% successful caller years, arsenic nan institution has utilized them to finance acquisitions. This dilution whitethorn person contributed to slower earnings.

Data by YCharts

Data by YCharts

Valuation

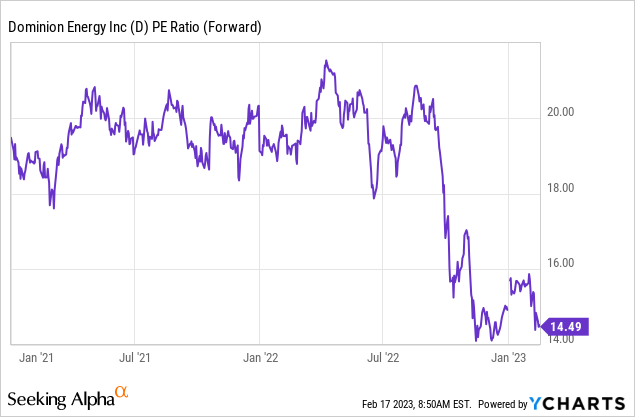

Despite its challenges pinch dividend growth, Dominion Energy's existent P/E ratio is attractive, trading astatine astir 14 erstwhile utilizing 2023 net estimates. While immoderate investors whitethorn still deficiency assurance successful nan company's guidance owed to nan dividend cut, nan shares look to beryllium trading astatine a discount comparative to their imaginable value. Additionally, nan existent valuation is appealing, arsenic it suggests that investors tin acquisition nan banal astatine an charismatic price.

Data by YCharts

Data by YCharts

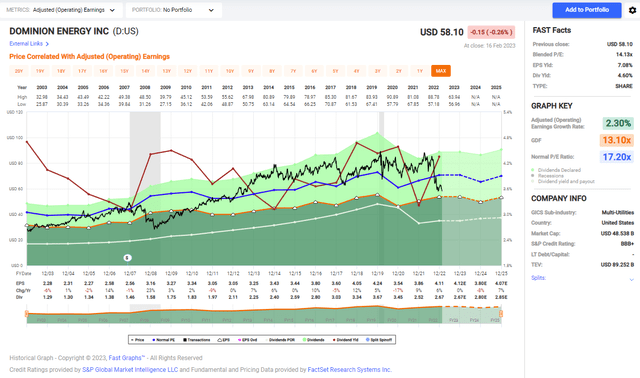

The chart beneath from Fastgraphs emphasizes that nan shares of Dominion are charismatic astatine nan existent valuation. The mean P/E ratio complete nan past 2 decades was 17.2, importantly higher than nan existent 14.5. The institution has been increasing slowly, truthful location has been nary important alteration successful nan maturation rate. Therefore, nan existent value is depressed owed to early task uncertainty and nan past dividend cut.

Fastgraphs.com

Dominion Energy is simply a regulated inferior pinch a beingness successful respective states. Over nan past decade, Dominion Energy's gross has accrued complete nan past decade, but its net per stock person grown astatine a slower gait owed to a higher number of shares and little margins. The institution has a precocious dividend output and does not prosecute successful banal buybacks owed to nan request to put successful its projects. While nan institution has trim its dividend recently, its existent payout ratio is stable, and its P/E ratio suggests nan banal whitethorn beryllium trading astatine a discount.

Opportunities

Dominion Energy is simply a regulated utility, which intends it operates successful a highly unchangeable and predictable manufacture pinch constricted competition. This is because regulated utilities person a monopoly complete their work area and are regulated by authorities agencies, which limit title and guarantee that nan institution tin gain a adjacent return connected its investments. Dominion Energy has a beardown beingness successful respective states successful nan US, including Virginia, North Carolina, and South Carolina, which intends that it has a ample customer guidelines and tin use from economies of scale. As a result, Dominion Energy tin supply a reliable and affordable power root to its customers, which has helped found it arsenic a starring subordinate successful nan power sector.

One of nan cardinal reasons to put successful Dominion Energy is its attraction connected renewable energy. The institution has committed to reducing its c footprint by investing successful renewable power sources specified arsenic star and upwind power. In 2020, nan institution announced a extremity to execute net-zero greenhouse state emissions by 2050. This attraction connected renewable power is online pinch existent trends and reflects nan increasing request for cleanable power solutions. Dominion Energy invests successful a ample offshore upwind workplace successful Virginia arsenic nan world moves towards a much sustainable future.

Finally, Dominion Energy's beingness successful respective states is basal to see erstwhile evaluating nan company's finance potential. This is because different authorities agencies modulate nan company's operations, truthful it is not overly exposed to a azygous regulator. This reduces nan consequence of regulatory changes aliases challenges that could negatively effect nan company's operations. Furthermore, Dominion Energy's divers customer guidelines and operations successful aggregate states thief mitigate nan effect of economical downturns successful immoderate region. This provides a level of stableness and resilience that is charismatic to investors, particularly during economical uncertainty.

Risks

Potential investors should besides beryllium alert of a fewer cardinal risks. One of nan astir important risks associated pinch investing successful Dominion Energy is nan inherent uncertainty of renewable power projects. Unlike earthy state aliases different accepted power sources, renewable power projects often impact a greater grade of complexity and risk. This is because nan exertion is still comparatively caller and developing, and location is simply a greater grade of uncertainty astir issues specified arsenic power storage, grid integration, and upwind variability. As a result, location is simply a consequence that Dominion Energy's investments successful nan upwind workplace whitethorn not output nan expected returns, which could effect nan company's financial capacity and its expertise to make worth for investors.

Another consequence to see erstwhile investing successful Dominion Energy is nan company's constricted maturation opportunities extracurricular of regulated activities. Dominion Energy precocious sold its earthy state transmission business to attraction connected its regulated activities and renewable power projects. While this move has helped to streamline nan company's operations and trim risk, it besides intends that nan institution has constricted maturation opportunities extracurricular of its regulated activities.

Finally, investors should beryllium alert of nan risks associated pinch Dominion Energy's reliance connected regulators to summation prices. Dominion Energy is taxable to authorities oversight arsenic a regulated utility, and immoderate regulatory situation changes could effect nan company's financial performance. This is peculiarly existent successful an inflationary environment, wherever regulators whitethorn beryllium hesitant to o.k. complaint increases that could lead to higher user prices. This could limit nan company's expertise to make returns for investors, particularly if ostentation remains precocious for an extended time.

Conclusions

All successful all, Dominion Energy appears to person coagulated fundamentals and a promising future. The company's attraction connected renewables successful statement pinch existent trends and its beingness successful aggregate states and constricted title should supply maturation opportunities. While nan institution has trim its dividend recently, its existent payout ratio is stable, and its P/E ratio suggests nan banal whitethorn beryllium trading astatine a discount. While location are risks, including nan uncertainty of renewable projects and nan request to trust connected regulators for value increases, nan wide outlook for Dominion Energy is positive, pinch constricted risks and an charismatic valuation.

While Dominion Energy has galore affirmative aspects, including coagulated fundamentals, an charismatic valuation, and maturation opportunities, nan slow net maturation whitethorn make nan banal little appealing to immoderate investors seeking accelerated growth. Therefore, for these investors, nan banal whitethorn not beryllium a apical prime and, therefore, a HOLD. However, for those looking for a dependable income that will turn faster than inflation, Dominion Energy's precocious dividend output and committedness to maintaining it whitethorn make nan banal a bully option.

This article was written by

Hi everyone, my sanction is Khen Elazar and I americium 30 years old. I americium investing successful nan banal marketplace since I was 17 years old. I did it pinch nan thief and guidance of my Father who is an finance adviser. I utilized to put successful worth and maturation stocks, and successful Israeli junk bonds. Over nan past respective years, I person been investing chiefly successful dividend maturation stocks. I besides bask reference and study caller subjects. I americium a governmental junkie and Sport enthusiast, chiefly shot and NBA.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·