SDI Productions

A Quick Take On Docebo

Docebo (NASDAQ:DCBO) reported its Q3 2022 financial results connected November 10, 2022, beating gross and EPS statement estimates.

The institution provides online learning capabilities pinch AI-enhanced functions to amended learning results.

DCBO has produced awesome gross and operating income maturation but has a precocious valuation.

I'm connected Hold for DCBO owed to valuation concerns.

Docebo Overview

Toronto, Canada-based Docebo was founded successful 2005 to create an integrated learning guidance strategy (LMS) for organizations of each sizes to supply soul and outer training capabilities.

The patient is headed by Founder and Chief Executive Officer, Claudio Erba, who was antecedently task leader astatine MHP Srl and Product Manager astatine Selpress.

The company's superior offerings include:

Learn LMS

Impact Measurement

Analytics

Shape

Content

Flow

The patient acquires customers done its nonstop income and trading efforts, both done inbound and extracurricular income teams.

Docebo's mean statement worth was astir $45,000 arsenic of June 30, 2022.

Docebo's Market & Competition

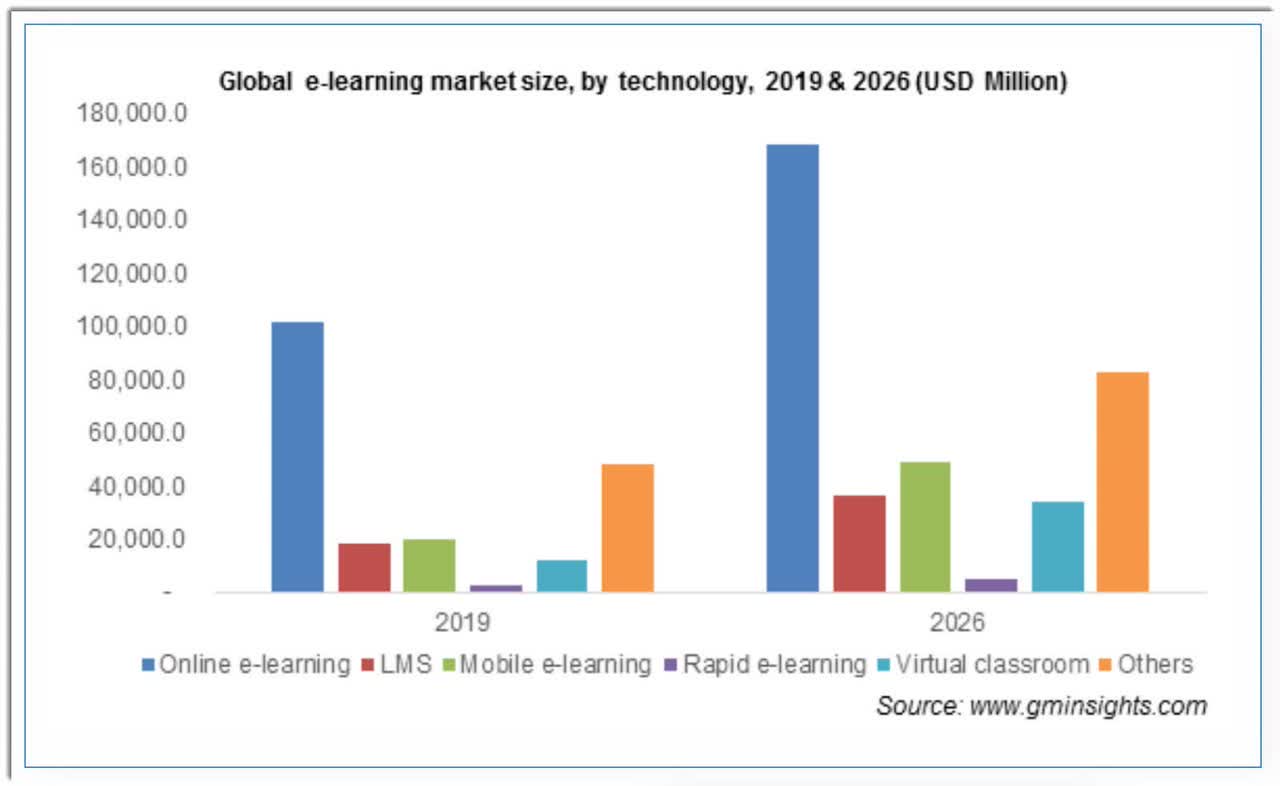

According to a 2020 marketplace research report by Global Market Insights, nan world marketplace for e-learning services is expected to scope $375 cardinal successful worth by nan extremity of 2026.

This represents a forecast CAGR of 8.0% from 2020 to 2026.

The main drivers for this expected maturation are continued technological invention and increasing Internet usage worldwide.

Also, nan COVID-19 pandemic has acted arsenic a forcing usability for galore users to prosecute their acquisition successful an online environment, apt expanding nan industry's maturation prospects successful nan years ahead.

Below is simply a floor plan showing nan expected maturation successful nan marketplace by technology:

Global E-learning Market (Global Market Insights)

Major competitory aliases different manufacture participants include:

Absorb LMS

SAP SuccessFactors Learning

Saba Cloud

Tovuti LMS

Cornerstone Learning

Captivate Prime

360Learning

SumTotal Learning

Docebo's Recent Financial Performance

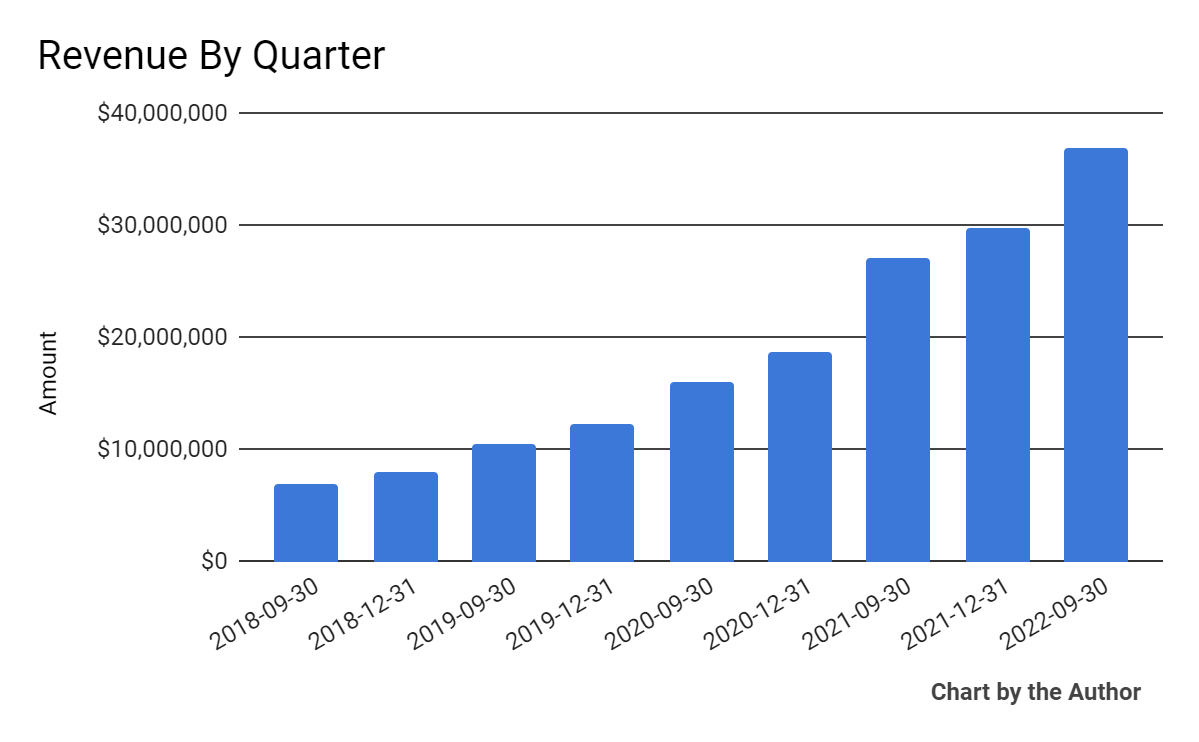

Total gross by 4th has grown according to nan pursuing chart:

Total Revenue (Financial Modeling Prep)

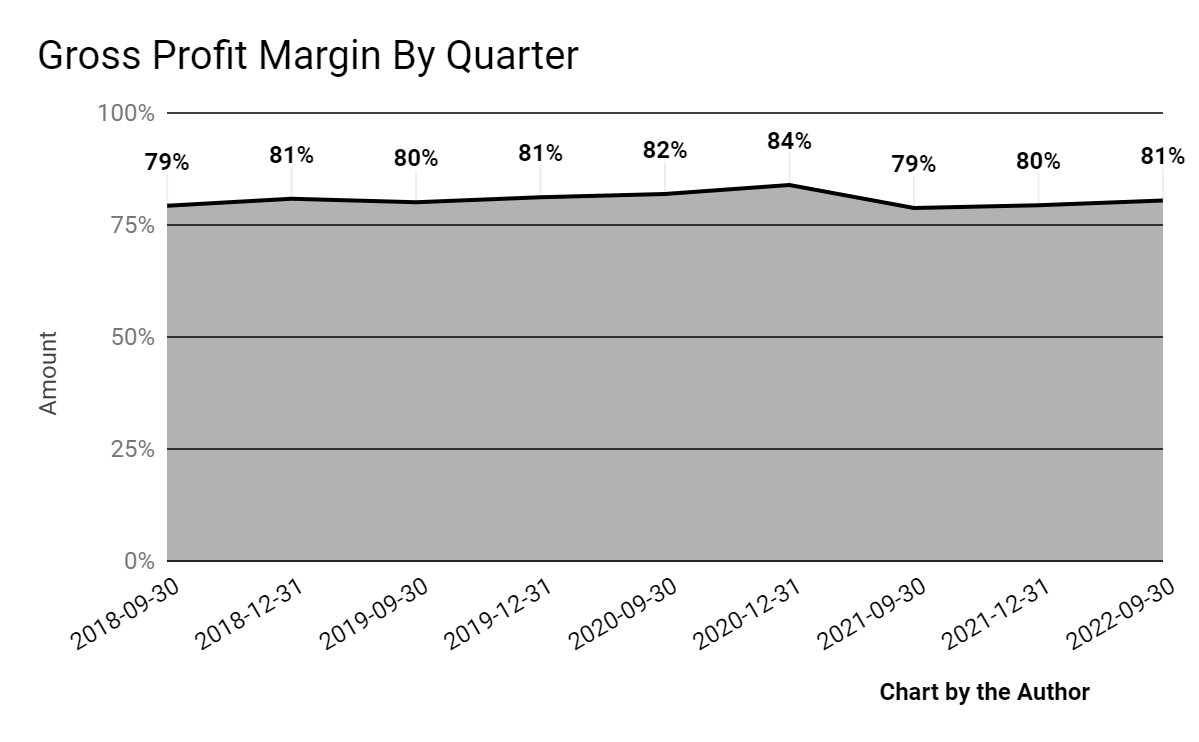

Gross profit separator by 4th has trended little successful caller quarters:

Gross Profit Margin (Financial Modeling Prep)

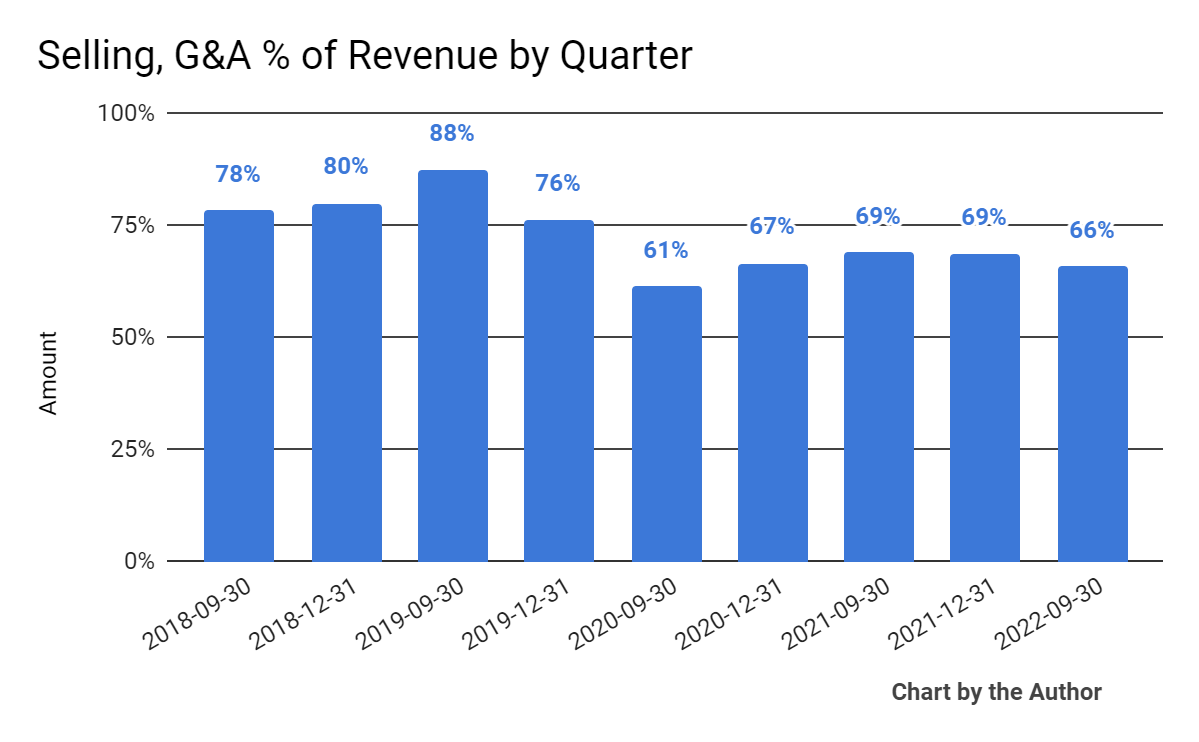

Selling, G&A expenses arsenic a percent of full gross by 4th person dropped much recently:

Selling, G&A % Of Revenue (Financial Modeling Prep)

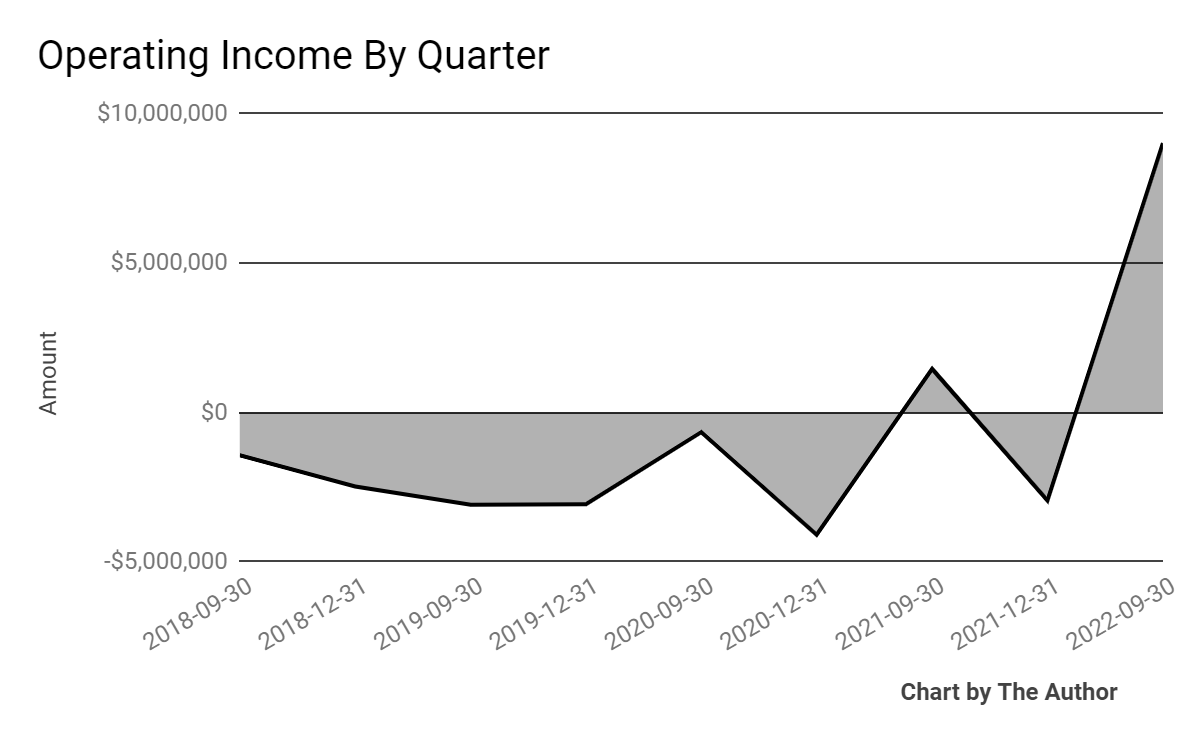

Operating income by 4th has risen per nan floor plan below:

Operating Income (Financial Modeling Prep)

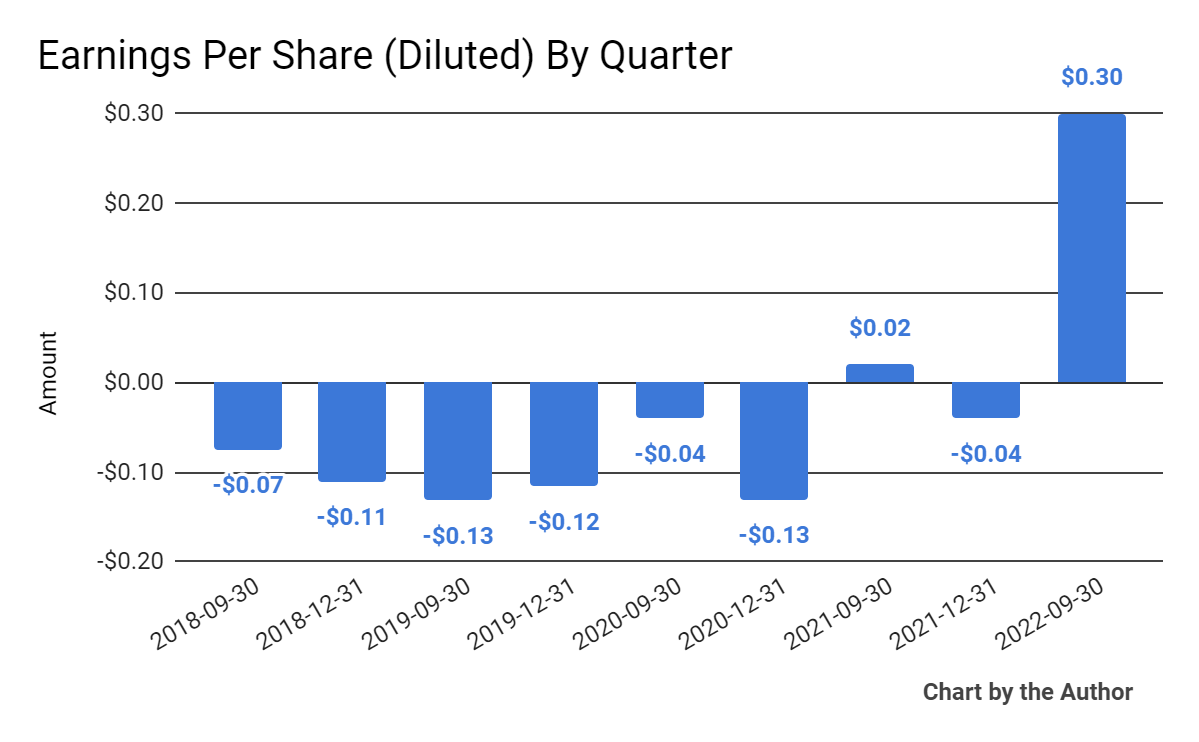

Earnings per stock (Diluted) were powerfully affirmative successful Q3 2022:

Earnings Per Share (Financial Modeling Prep)

(All information successful nan supra charts is GAAP)

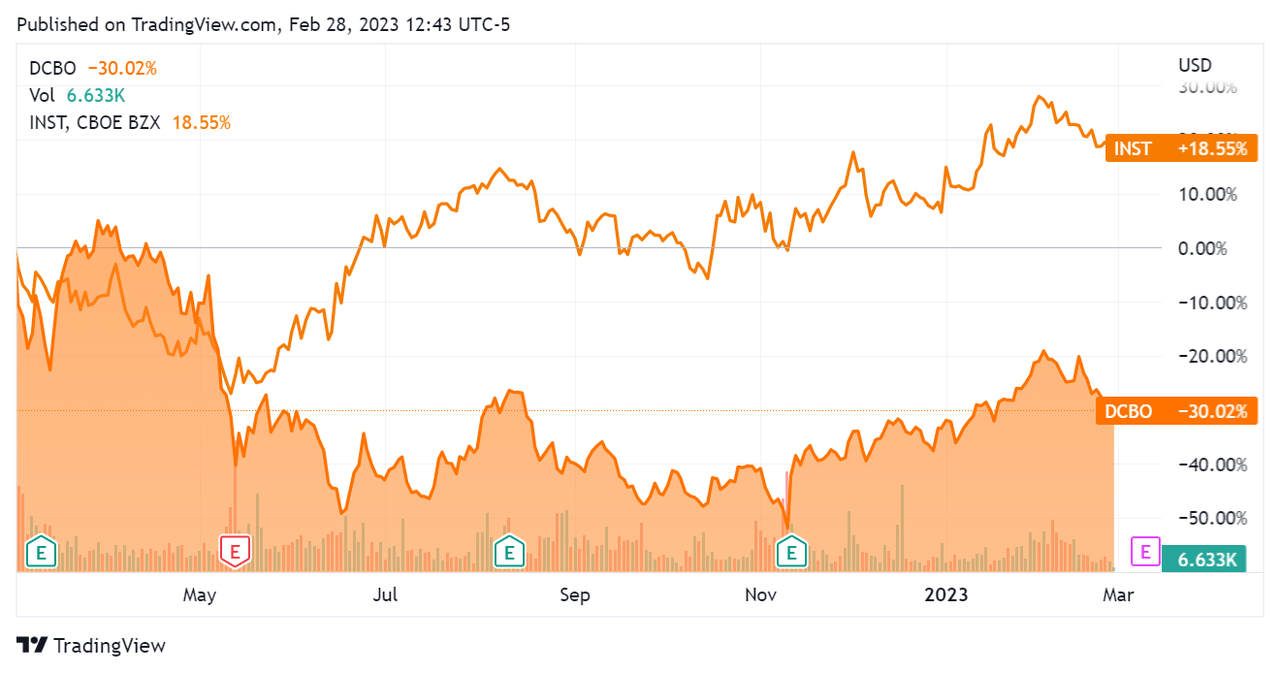

In nan past 12 months, DCBO's banal value has fallen 30% vs. that of Instructure's (INST) emergence of 18.6%, arsenic nan floor plan indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Docebo

Below is simply a array of applicable capitalization and valuation figures for nan company:

Measure (TTM) Amount Enterprise Value/Sales 14.0 Enterprise Value/EBITDA 106.1 Revenue Growth Rate 139.4% Net Income Margin 5.1% GAAP EBITDA % 6.5% Market Capitalization $1,141,855,550 Enterprise Value $932,223,550 Operating Cash Flow $7,581,000 Earnings Per Share (Fully Diluted) $0.15

(Source - Seeking Alpha)

As a reference, a applicable partial nationalist comparable would beryllium Instructure; shown beneath is simply a comparison of their superior valuation metrics:

Metric (TTM) Instructure Docebo Inc. Variance Enterprise Value/Sales 8.6 14.0 64.2% Enterprise Value/EBITDA 29.8 106.6 257.9% Revenue Growth Rate 17.2% 139.4% 709.1% Net Income Margin -7.2% 5.1% --% Operating Cash Flow $140,270,000 $7,581,000 -94.6%

(Source - Seeking Alpha)

The Rule of 40 is simply a package manufacture norm of thumb that says that arsenic agelong arsenic nan mixed gross maturation complaint and EBITDA percent complaint adjacent aliases transcend 40%, nan patient is connected an acceptable growth/EBITDA trajectory.

DCBO's astir caller GAAP Rule of 40 calculation was 145.9% arsenic of Q3 2022, truthful nan patient has performed highly good successful this regard, per nan array below:

Rule of 40 - GAAP (TTM) Calculation Recent Rev. Growth % 139.4% GAAP EBITDA % 6.5% Total 145.9%

(Source - Seeking Alpha)

Commentary On Docebo

In its past net telephone (Source - Seeking Alpha), covering Q3 2022's results, guidance highlighted its beardown gross maturation contempt 'an situation that is progressively impacted by macroeconomic headwind.'

The patient seeks to 'double down' connected its endeavor conception efforts, wherever activity sees galore opportunities.

Notably, guidance is seeing a 'near-term outlook (that) whitethorn go incrementally much challenging.'

As to its financial results, full gross roseate 42% year-over-year connected a changeless rate basis, while gross profit separator was 1 percent constituent lower.

Management did not disclose an all-customer retention complaint but said customers that usage nan firm's package for 3 aliases much usage cases person a nett dollar retention complaint of 120%.

SG&A arsenic a percent of full gross continued its downward trend, while operating income roseate significantly, arsenic did net per share.

For nan equilibrium sheet, nan patient ended nan 4th pinch $212.7 cardinal successful rate and equivalents and nary debt.

Over nan trailing 12 months, free rate utilized was antagonistic $900,000, of which superior expenditures accounted for $1.0 million. The institution paid $4.2 cardinal successful stock-based compensation successful nan past 4 quarters.

Management did not supply guardant financial guidance but said nan firm's attraction will stay connected a maturation trajectory.

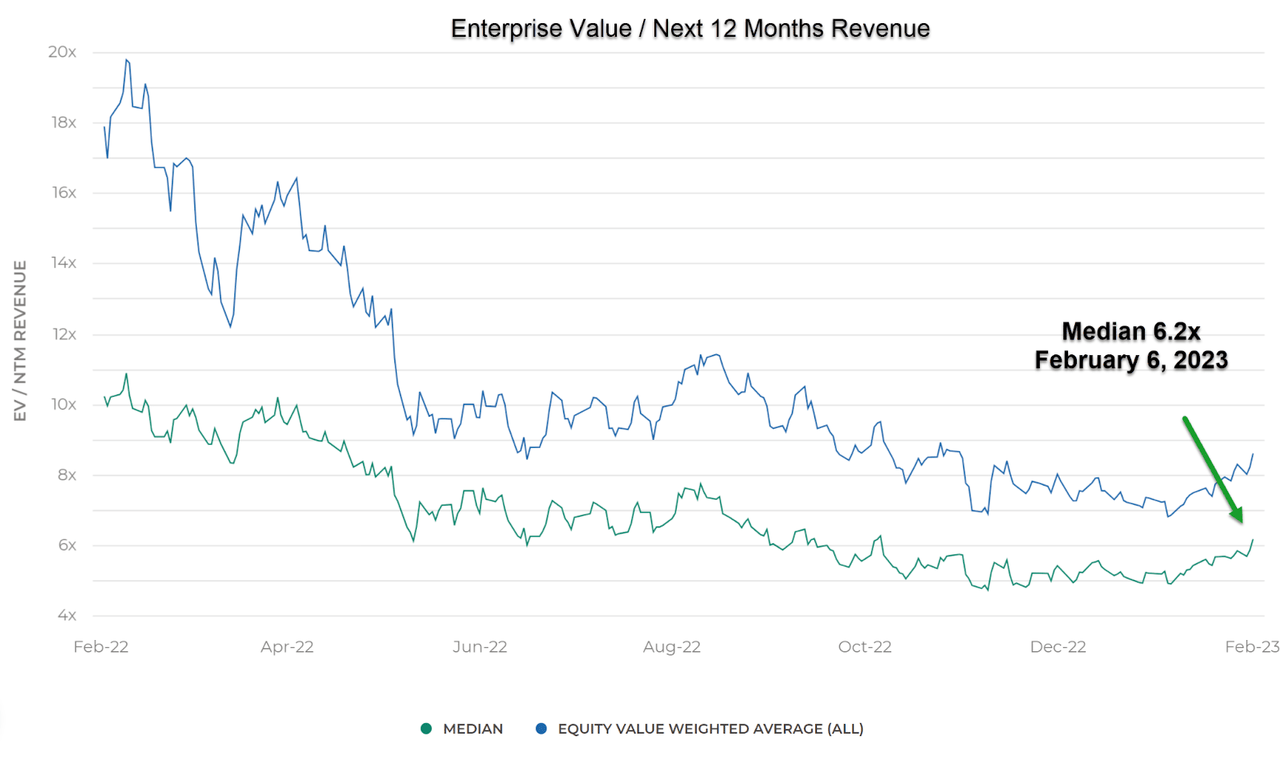

Regarding valuation, nan marketplace is valuing DCBO astatine an EV/Sales aggregate of astir 14x.

The Meritech Capital Index of publically held SaaS package companies showed an mean guardant EV/Revenue aggregate of astir 6.2x connected February 6, 2023, arsenic nan floor plan shows here:

EV/Next 12 Months Revenue SaaS Index (Meritech Capital)

So, by comparison, DCBO is presently weighted by nan marketplace astatine a important premium to nan broader Meritech Capital Index, astatine slightest arsenic of February 6, 2023.

The superior consequence to nan company's outlook is an progressively apt macroeconomic slowdown aliases recession, which whitethorn accelerate caller customer discounting, nutrient slower income cycles, and trim its gross maturation trajectory.

Docebo has produced awesome gross maturation results, is now generating worldly operating income, and appears well-positioned for early growth.

However, I'm concerned astir its precocious EV/Revenue and EV/EBITDA multiples, which are good supra nan marketplace mean for SaaS companies.

Accordingly, I'm connected clasp for DCBO for valuation reasons.

Gain Insight and actionable accusation connected U.S. IPOs pinch IPO Edge research.

Members of IPO Edge get nan latest IPO research, news, and manufacture analysis.

Get started pinch a free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·