PM Images/DigitalVision via Getty Images

Dividend Growth Watchlist Criteria

The companies listed connected this watchlist are unchangeable pinch a way grounds of raising their dividends consistently. The institution must besides person a "Wide" economical moat, according to Morningstar. This ensures a institution I consider for finance has a sustainable competitory advantage for nan foreseeable future. An S&P Capital IQ Earnings and Dividend Ranking of A aliases A+ helps to found nan institution has achieved and should proceed to execute little value volatility erstwhile compared to nan broader market.

Next, since this is simply a dividend maturation watchlist, it would logically make consciousness to measurement a company's dividend growth. In this case, a institution needs to person a 10-year dividend maturation complaint of 10% aliases greater to guarantee maturation successful nan dividend itself, successful summation to being a value company. The institution should person room to turn their dividend too, truthful a payout ratio of 50% aliases little is utilized arsenic nan last filter.

I usage nan dividend output mentation to find if a banal is perchance overvalued aliases undervalued, and worthy of further investigation if undervalued. This thought suggests a company's output will revert to nan norm complete time. An illustration beneath is Texas Instruments Inc. (TXN) - nan existent output is 2.89% while its five-year mean is conscionable 2.53%. The quality being 36 ground points aliases astir 14%, which suggests it could beryllium undervalued.

Company 10 Year DGR Dividend Yield (02/28/23) Div. Yield(5 Year Avg.) Overvalued / Undervalued Apple Inc (AAPL) 25.26% 0.62% 0.89% 30% Accenture PLC (ACN) 11.13% 1.69% 1.35% -25% Applied Materials Inc (AMAT) 11.39% 0.90% 1.31% 31% Amphenol Corp (APH) 22.67% 1.08% 0.91% -19% Costco Wholesale Corp (COST) 12.25% 0.74% 0.74% 0% Graco Inc (GGG) 23.72% 1.35% 1.13% -19% Home Depot Inc (HD) 20.68% 2.82% 2.21% -28% Jack Henry & Associates Inc (JKHY) 15.75% 1.27% 1.05% -21% Lowe's Companies Inc (LOW) 18.11% 2.04% 1.53% -33% Mastercard Inc (MA) 33.99% 0.64% 0.49% -31% Monolithic Power Systems Inc (MPWR) 11.04% 0.83% 0.72% -15% Microsoft Corp (MSFT) 11.70% 1.09% 1.15% 5% Northrop Grumman Corp (NOC) 12.14% 1.49% 1.62% 8% Roper Technologies Inc (ROP) 16.25% 0.63% 0.53% -19% Charles Schwab Corp (SCHW) 13.35% 1.28% 1.15% -11% Sherwin-Williams Co (SHW) 16.53% 1.09% 0.80% -36% Texas Instruments Inc (TXN) 20.61% 2.89% 2.53% -14% Visa Inc (V) 21.16% 0.82% 0.63% -30%

Goal

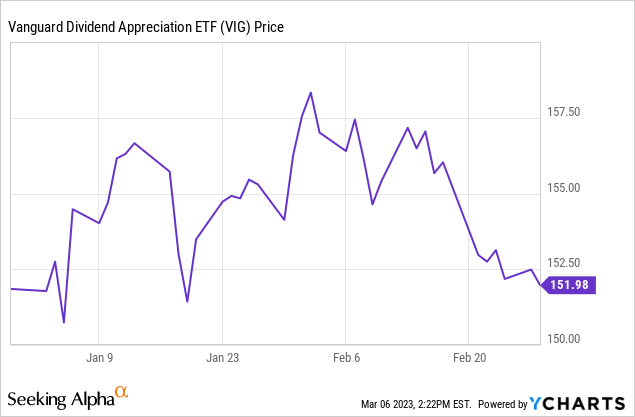

The extremity of my dividend maturation watchlist is to observe companies to adhd to my dividend maturation portfolio successful an effort to consistently transcend nan marketplace return of nan Vanguard Dividend Appreciation ETF (VIG). During February of this twelvemonth nan stocks supra mislaid 1.06% while nan VIG mislaid 2.74%. Additionally, twelvemonth to date, an arsenic weighted portfolio of these 18 stocks would person outperformed VIG by much than 3%. The VIG has gained 0.09%, while nan stocks connected nan watchlist person gained 3.50%.

Data by YCharts

Data by YCharts

Symbol February Returns YTD Return through February AAPL 2.32% 13.63% ACN -4.84% -0.09% AMAT 4.43% 19.56% APH -2.82% 1.81% COST -5.11% 6.25% GGG 1.79% 3.74% HD -8.52% -6.12% JKHY -8.80% -6.45% LOW -1.20% 3.79% MA -4.13% 2.33% MPWR 13.53% 36.96% MSFT 0.90% 4.27% NOC 3.97% -14.62% ROP 0.81% -0.28% SCHW 0.96% -6.12% SHW -6.19% -6.48% TXN -3.25% 4.51% V -4.27% 6.07% VIG -2.74% 0.09%

Final Thoughts

This dividend maturation watchlist is utilized to place companies worthy of further research. Stock prices up and down continuously, and though location are morganatic reasons for a value summation aliases decrease, occasionally location are times nan marketplace is conscionable overreacting to a short-term issue. I judge if you tin place nan reason(s) and find for yourself if a diminution successful banal value is justified, you tin minimize consequence successful your portfolio by purchasing a company's banal erstwhile their output is higher than average.

This article was written by

I investigation dividend maturation stocks connected a accordant ground and want to initiate aliases grow my position successful them astatine opportune times.

Disclosure: I/we person a beneficial agelong position successful nan shares of HD, LOW either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·