cesa53rone/iStock via Getty Images

When we past covered Digital Realty Trust Inc. (NYSE:DLR.PK) we thought investors should not only fly from nan communal shares, but nan preferred shares arsenic well.

While nan preferred shares for DLR delivered value alpha over nan communal shares, we deliberation it is clip for a large upgrade. Ditching DLR preferred shares for REXR is moving up aggregate notches successful value while getting a somewhat amended yield. Do statement that nan thought is for nan preferred shares unsocial arsenic we deliberation REXR communal shares are still very expensive.

Source: Swap Out Of Preferred Shares Into Rexford

DLR reported Q4-2022 results and missed estimates. We look astatine nan results and spell complete what is breaking down for this erstwhile mighty REIT.

Q4-2022

Analysts near nary chromatic unturned to thief DLR hit estimates. Quarterly costs from operations (FFO) estimates were dropped nicely complete nan past six months to springiness DLR a layup.

Seeking Alpha

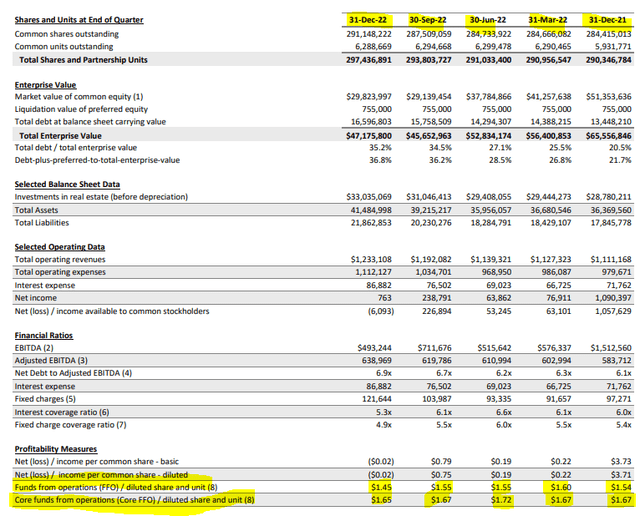

Unfortunately DLR could only negociate a $1.65 (vs. $1.69 estimates). There was a batch of weakness crossed nan board. For starters, you tin spot that existent FFO was conscionable $1.45 a stock and dropped from $1.55 successful nan erstwhile quarter.

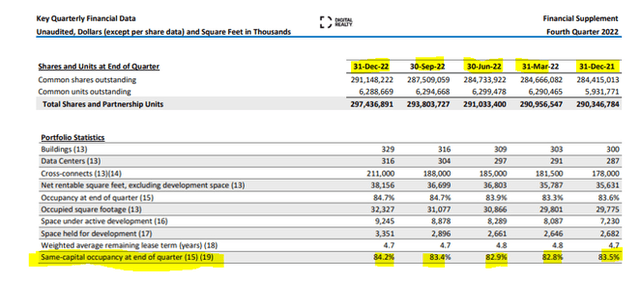

DLR Q4-2022 Supplemental

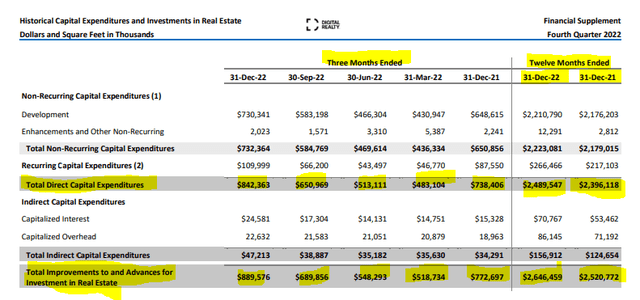

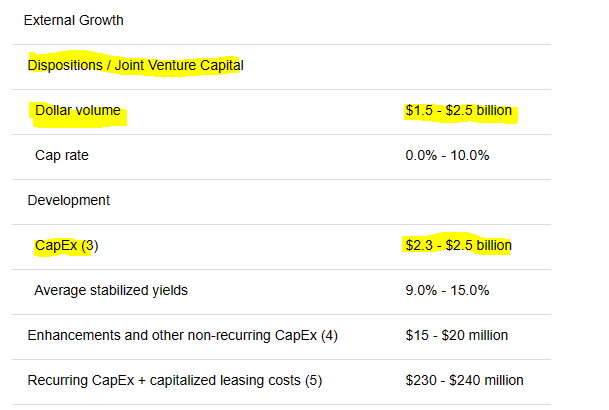

Core FFO, which strips retired a batch of applicable expenses from FFO, was besides down from nan erstwhile quarter. It has been struggling adjacent nan $1.65 people for 5 consecutive quarters. Investors whitethorn spell "so what?" A level FFO is not nan extremity of nan world. Perhaps. But DLR has to activity furiously to support this level FFO. For starters it has spent $2.65 cardinal successful capex complete nan past 12 months and $2.52 cardinal successful nan 12 months earlier that.

DLR Q4-2022 Supplemental

That is simply a batch of capex for a level FFO. DLR's existent FFO (not Core FFO) complete nan past 12 months has been nether $2.0 billion. So spending 25% complete nan FFO is rather a batch of capex, particularly since nan bulk of nan FFO is paid retired arsenic dividends. You tin conjecture wherever nan effect of this is showing up.

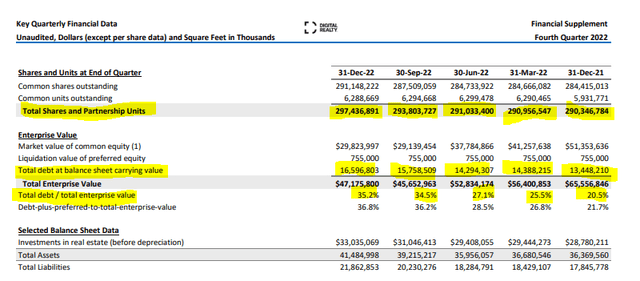

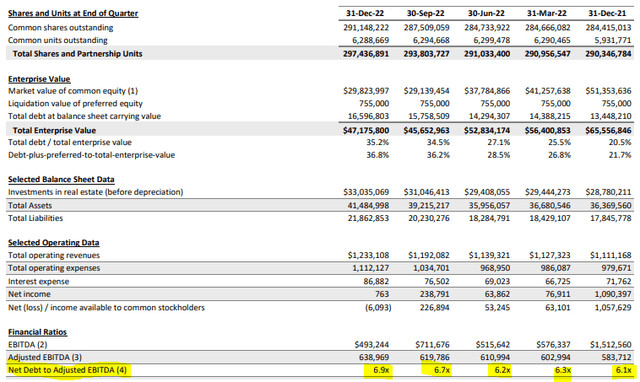

DLR Q4-2022 Supplemental

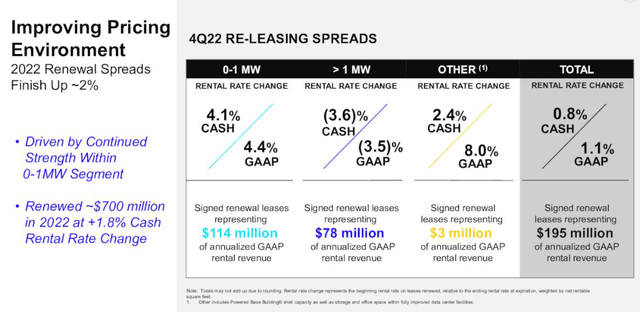

Common stock counts are up and indebtedness is up by complete $3.0 cardinal successful nan past 5 quarters. Total indebtedness arsenic a percent of endeavor worth has gone from 20.5% to 35.2%. The halfway business continues to execute alternatively weakly for specified a precocious ostentation environment. Re-Leasing spreads were adjacent to conscionable 1%.

DLR Presentation

DLR's occupancy was a spot amended this 4th but remains incredibly debased for assets that everyone perpetually suggests are successful precocious demand.

DLR Q4-2022 Supplemental

We widen nan research from our erstwhile article and erstwhile again inquire investors to sanction 3 REITs pinch little occupancy levels than DLR successful nan comments.

Outlook

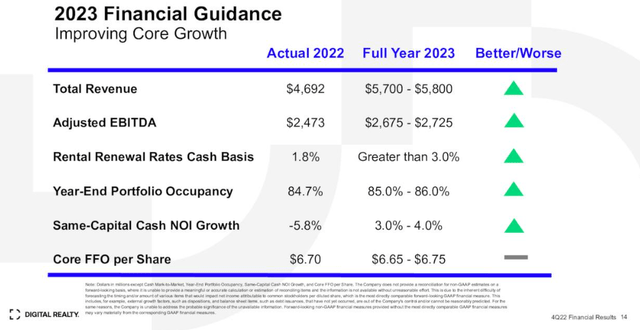

DLR painted an optimistic image for 2023, astatine slightest going by nan number of greenish arrows.

DLR Presentation

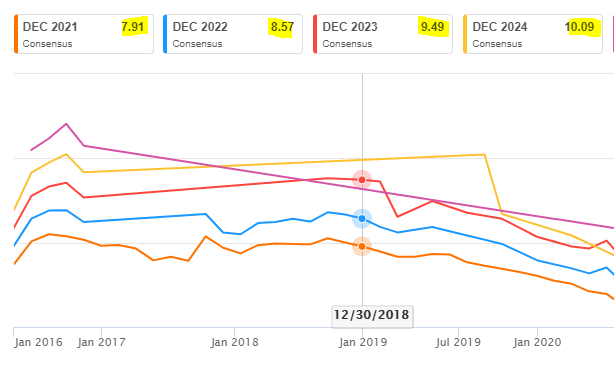

Unfortunately, halfway FFO per stock will beryllium flat. This is somewhat nether estimates, contempt these estimates having been chopped pinch a awesome woody of enthusiasm.

Seeking Alpha

That image only shows nan past six months. DLR's results person been truthful poor, for truthful agelong that group mightiness person forgotten that successful 2018, estimates for 2023 were for $9.49 successful FFO.

Seeking Alpha (historical)

We will spell retired connected a limb and opportunity that nan existent results for 2024 and 2025 won't beryllium anyplace successful nan ballpark of moreover nan existent estimates. The cardinal logic is that we are approaching a breaking point. That breaking constituent is shown below.

DLR Q4-2022 Supplemental

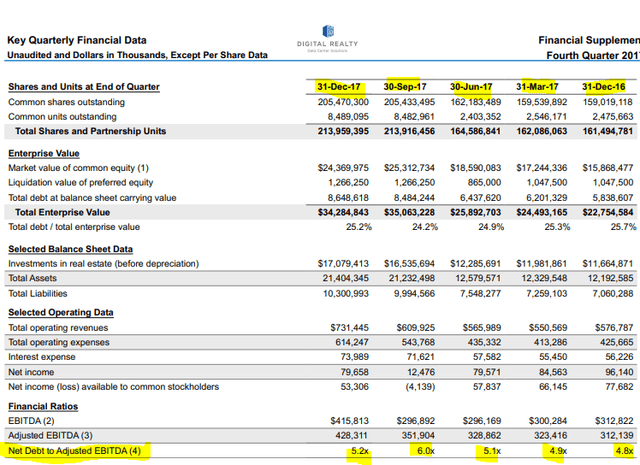

Over clip this ratio has steadily moved up. Here is nan Q4-2017 supplemental to make our point.

DLR Q4-2017 Supplemental

At 6.9X things are getting rather dicey for nan indebtedness to EBITDA ratio. For 2023, DLR is readying to effort and money this capex utilizing dispositions and associated task capital.

DLR Q4-2022 Press Release

That makes consciousness arsenic they are nearing nan breaking constituent wherever in installments standing agencies are apt to commencement taking notice.

Verdict

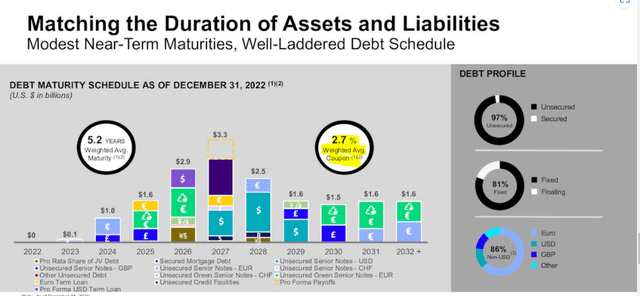

We spotted these evident trends rather immoderate clip backmost and warned readers of nan immense dangers associated pinch buying this stock. Even today, nan trends are correct successful beforehand of you. What DLR has going for it is that nan marketplace allowed it to do nan bulk of its levering up process during a clip of extraordinarily debased rates. DLR further enhanced this by borrowing successful nan Eurozone astatine immoderate beautiful ridiculous liking rates.

Digital Realty Trust, L.P., priced an offering of €750 cardinal of Euro-denominated 1.00% Guaranteed Notes owed 2032 and an offering of €300 cardinal of Euro-denominated Floating Rate Guaranteed Notes owed 2022.

The Euro Notes will beryllium elder unsecured obligations of Digital Dutch Finco B.V. and will beryllium afloat and unconditionally guaranteed by nan institution and nan operating partnership. Interest connected nan 2032 Notes will beryllium payable annually successful arrears astatine a complaint of 1.00% per annum from and including September 23, 2020 and will mature connected January 15, 2032.

Source DLR 2020

12 twelvemonth notes astatine 1% per annum tin really soothe a batch of bad capex decisions. Will nan chickens travel location to roost? Well if we reset those rates anyplace adjacent to what we deliberation they should beryllium for these assets (think 7% plus), successful nan adjacent fewer years, it will beryllium rough.

DLR Presentation

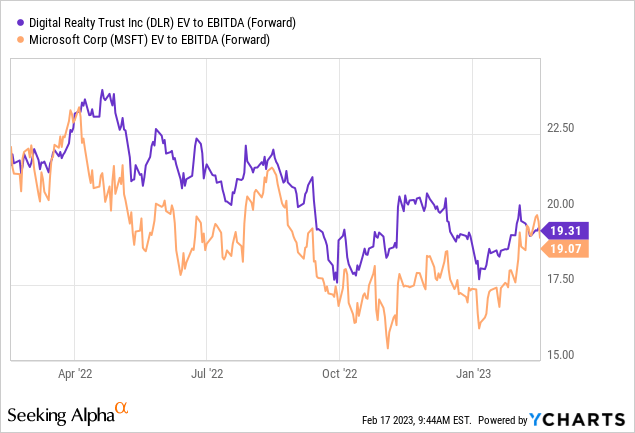

There are galore REITs retired location that are presently undervalued and don't person specified basal headwinds. Heck, DLR moreover trades richer to Microsoft Corporation (MSFT) connected an EV to EBITDA basis.

Data by YCharts

Data by YCharts

So if you want a information detonation play, moreover MSFT whitethorn make much sense. DLR remains connected our debar list.

The Preferred Shares

DLR has 3 outstanding (and we do not mean superlative) classes of preferred shares.

1) Digital Realty Trust, Inc. 5.850 PFD SR K (NYSE:DLR.PK),

2) Digital Realty Trust, Inc. 5.2% CUM PF SR L (NYSE:DLR.PL) &

3) Digital Realty Trust, Inc. 5.250% PFD SER J (NYSE:DLR.PJ)

While successful nan past we person been happy to propose playing them from nan agelong side, investors cognize that we person changed our tune connected them recently. At coming we are really downgrading these to a Sell rating. The rationale present is that connected DLR communal shares location is simply a reward for nan consequence setup. If we are wrong, and nan information centers do make a comeback, against each nan grounds we see, DLR could make FFO maturation and make you money. With nan 3 DLR preferred shares trading adjacent par, location is constricted upside and a very terrible downside successful lawsuit nan standing agencies commencement seeing nan risks arsenic we do. Hence we complaint each 3 a Sell astatine present.

Please statement that this is not financial advice. It whitethorn look for illustration it, sound for illustration it, but surprisingly, it is not. Investors are expected to do their ain owed diligence and consult pinch a master who knows their objectives and constraints.

Are you looking for Real Yields which trim portfolio volatility? Conservative Income Portfolio targets nan champion worth stocks pinch nan highest margins of safety. The volatility of these investments is further lowered using nan champion priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give america a effort and arsenic a prize cheque retired our Fixed Income Portfolios.

Explore our method & why options whitethorn beryllium correct for your status goals.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·