AlexSecret/iStock via Getty Images

Q4 2022 COMMENTARY - QUÉ SERÁ, SERÁ – THE FUTURE’S NOT OURS TO SEE

Qué Será, Será – The Future’s Not Ours to See1

It’s nan play erstwhile companies, investors and financial gurus look into their crystal balls to foretell nan economical and marketplace way for nan caller year. During our greeting java ritual, we were excited to publication TheDailyMail.com headline: “A clip for transformation, freedom... and PROSPERITY! Astrologers uncover why 2023 could beryllium your BEST twelvemonth yet for money and romance.”2 We work together whole-heartedly! However, this runs successful stark opposition to nan CNBC CFO Council Q4 2022 Survey3 successful which complete 80% of respondents foretell a recession successful 2023.

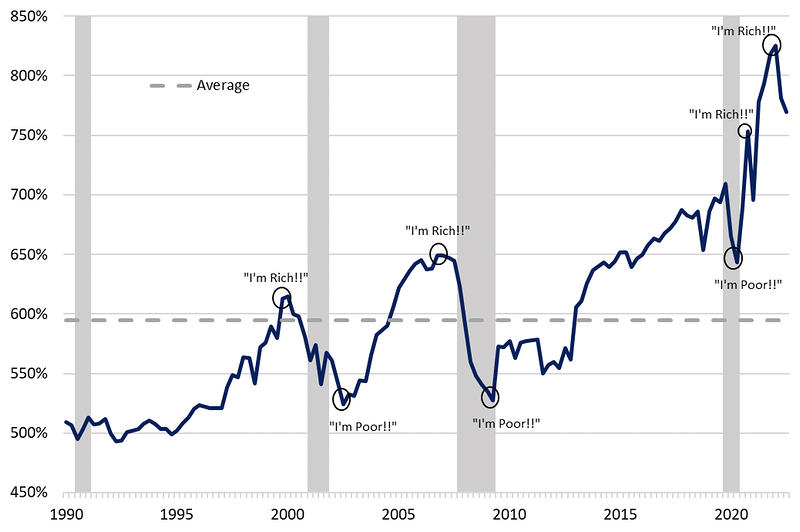

Household Net Worth arsenic a percent of Disposable Personal Income4

Shamelessly borrowed from nan economist David Rosenberg, nan chart supra illustrates nan narration betwixt family disposable income and family wealth. Basically, erstwhile your family wealthiness grows astatine a robust pace, you consciousness “richer” and erstwhile nett worthy declines, you consciousness “poorer”. This changes behaviour which yet ripples done nan economy.5

As bottom-up investors, we subscribe to nan adage: “Return of main is much important than return connected principal.” In 2022, each 4 CrossingBridge Funds produced affirmative returns for nan year. While returns were exceptional connected a comparative basis, yet investors will judge america connected semipermanent performance.

Although nan marketplace is not needfully cheap, it is besides not expensive. Opportunities will originate from uncertainty, volatility, travel of costs and a “day of reckoning” among borrowers. We proceed to subscribe to galore of nan themes we person communicated complete nan past year. We are optimistic pinch respect to early absolute performance. That said, we person our activity trim retired for america successful 2023.

THEMES FOR 2023

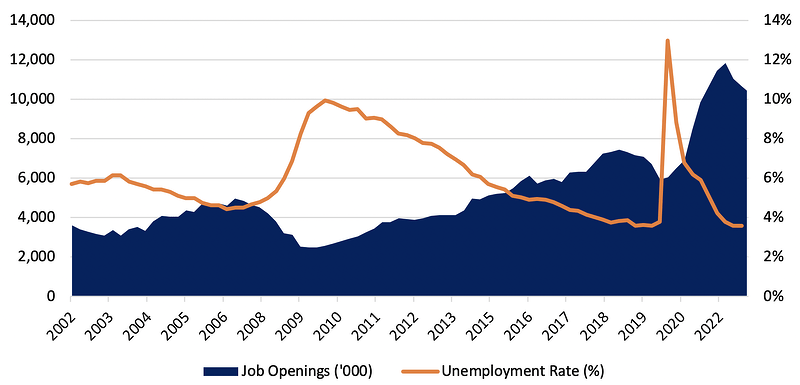

US Job Openings & Unemployment Rate6

Inflation is expected to diminution but will remain. The Federal Reserve will proceed complaint increases. Although it whitethorn yet pause, nan Fed won’t pivot unless systematic consequence emerges. Unemployment remains debased and employers proceed to person trouble filling occupation openings; caller layoffs are not capable to adjacent nan gap.7 This problem whitethorn beryllium being exacerbated by nan truth that location is simply a important disparity betwixt nan labour demanded and nan skills of nan labour supply. Moreover, arsenic noted above, family wealthiness remains adjacent peak. COVID-related stimulus drove up family wealthiness arsenic a percent of disposable income to transcend nan giddy days anterior to nan Great Recession of 2008. Although nan marketplace declines of 2022 person caused nan ratio to retreat, levels are still elevated, importantly supra anterior peaks of 2007 and 2019. Consequently, nan Fed has wished location is plentifulness of room to raise rates successful an effort to quell ostentation moreover if it risks a recession.

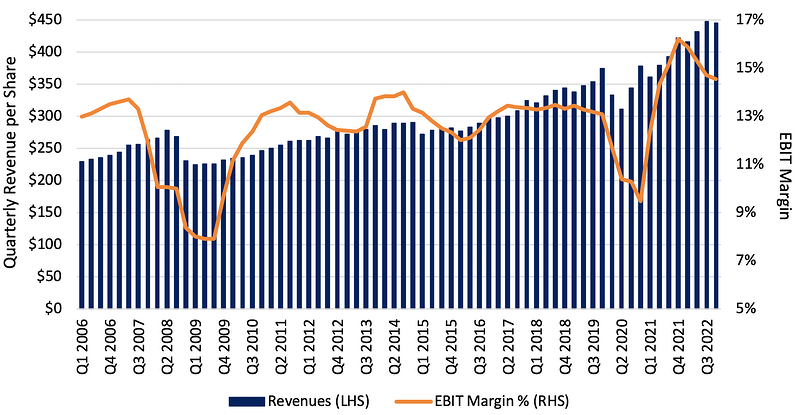

S&P EBIT Margins & Revenues8

Corporations are successful beautiful bully shape, but nan differences betwixt nan “haves” and nan “have nots” are apt to widen. Maturity profiles for precocious output issuers person been pushed retired pinch 85% of bonds maturing 3 years retired and beyond. Corporations are de-risking their equilibrium sheets by utilizing rate balances to repay obligations astatine aliases earlier maturity.9 Regardless, profit margins will narrow. Inflation successful nan costs of earthy materials and labor, arsenic good arsenic nan Fed’s efforts to trim demand, will unit profit margins. The anticipation exists that margins whitethorn diminution to nan trough levels seen successful nan recessions of 2008-9 and 2020 arsenic shown above.

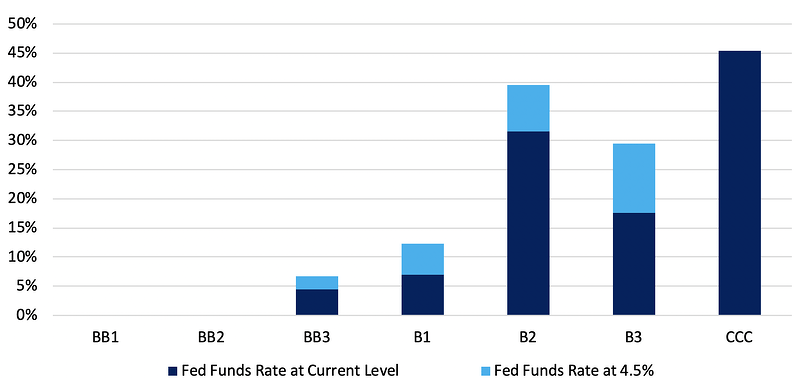

Percentage of Companies pinch Fixed Charge Coverage Less than 1.5x10

Higher liking rates person accrued nan costs of indebtedness and reduced plus valuations.Corporations pinch little leverage will consciousness little effect from rising liking rates and will beryllium amended capable to withstand a diminution successful profitability caused by a simplification successful revenues aliases narrowing margins. That said, higher liking rates will summation nan incidence of distress among over-levered companies, those pinch bad business models and firm “zombies”11, each of which person benefitted from inexpensive money. Moreover, nan slowdown successful nan residential existent property marketplace and nan diminution successful nan banal marketplace are straight tied to nan accrued costs of superior and nan little coming worth of early rate flows that consequence from higher liking rates.

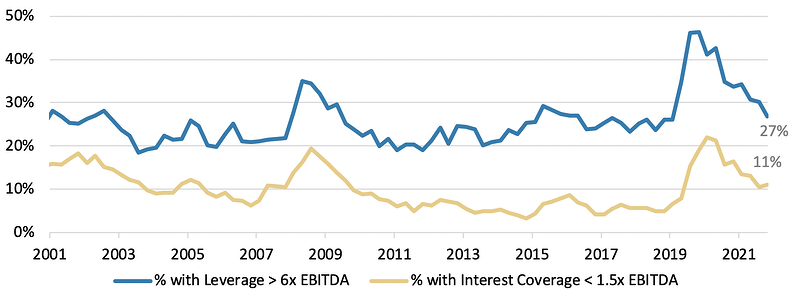

Loan Issuers pinch High Leverage and Low Interest Coverage12

Leveraged indebtedness marketplace will coming opportunistic investments. As shown successful nan chart above, in installments value has improved importantly since mid-2020. This should supply america pinch nan opportunity to put successful leveraged loans that supply some amended in installments value and higher yields, fixed nan emergence successful rates. Moreover, successful opposition to nan past 2 years, during which collateralized indebtedness obligations (CLOs)13 person accounted for much than 50%14 of caller indebtedness purchases, CLOs are apt to person a reduced beingness successful nan marketplace arsenic complete 40% of them, by assets nether management, will person reached nan extremity of their finance period.15 Thus, pinch little title for these investments, borrowers will person little power, apt starring to higher yields, little leverage and amended terms. “Cov-lite”16 deals, which spend lenders overmuch little protection successful nan lawsuit of in installments deterioration, comprised complete 91% of nan leveraged indebtedness issuance complete nan past 2 years;17 this should statesman to reverse arsenic non-CLO lenders are apt to request amended covenant packages to money caller loans.

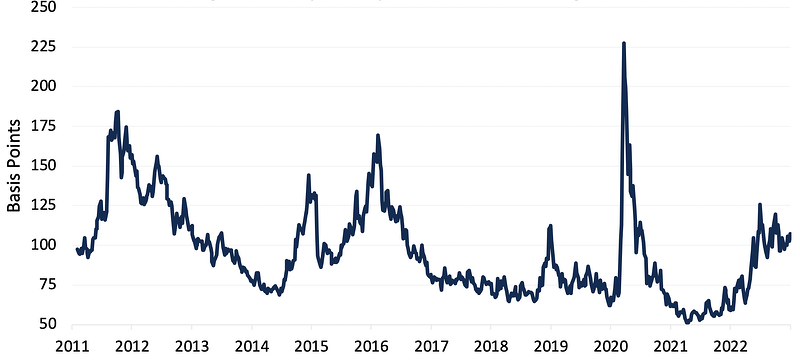

High Yield Spread per Turn of Leverage18

Bond spreads are “middle of nan road” – not cheap, not costly – but provide improved return versus risk. At 481 ground points, nan mean in installments dispersed for precocious output bonds19 is astir astatine nan semipermanent median of 489 ground points. However, nan in installments dispersed per move of leverage, a reflection of compensation for taking connected further in installments risk, has accrued since nan opening of 2022. At 107 ground points, it is supra nan semipermanent median, 89.5 ground points, a level not seen, but for little periods successful 2019 and 2020, since anterior to 2017. It has been a communal title among precocious output enslaved professionals that, successful nan situation of debased rates knowledgeable successful caller years, investors person bid down in installments spreads to seizure output seemingly pinch small respect for in installments risk. With nan emergence successful precocious output dispersed per move of leverage, precocious output investors are being paid amended for taking connected risk.

Investment Approach and Portfolio Positioning

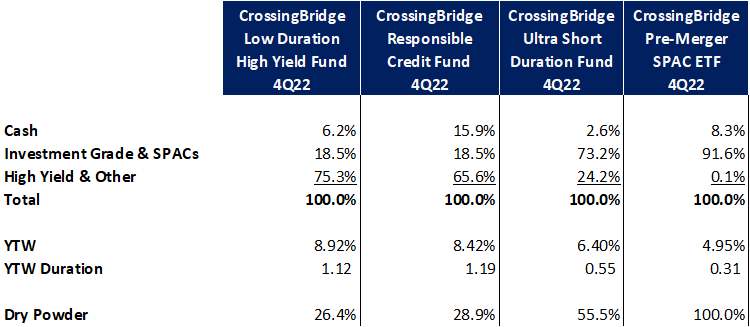

Note: nan Yield to Worst (YTW) of nan Pre-Merger SPAC ETF is represented by its expected Yield to Liquidation.

At year-end, nan portfolios stay defensively positioned, maintaining charismatic yields while keeping long comparatively debased and holding important “dry powder”20 to return advantage of opportunities arsenic they arise.

In nan song, Qué Será, Será, Doris Day asks nan question, “Will we person rainbows time aft day?” We reply – decidedly not, but nan attractiveness of nan precocious output and leverage indebtedness marketplace person improved. Over nan past year, galore fixed income investors were wounded by nan crisp summation successful rates. In contrast, we protected our investors by keeping long debased to trim liking complaint risk, focusing connected adjacent word events erstwhile selecting circumstantial credits. Now, pinch nan extremity of nan complaint emergence rhythm successful show sometime complete nan adjacent year, consequence successful nan fixed income marketplace has mostly shifted from liking rates to credit. In nan existent environment, we consciousness well-equipped arsenic bottom-up investors to take investments that will salary disconnected arsenic expected while capturing nan higher yields that prevail successful nan market.

“Whatever will beryllium will be”,

David K. Sherman and nan CrossingBridge Team

1Qué Será, Será (Whatever Will Be, Will Be), is simply a opus written by Jay Livingston and Ray Evans, first published successful 1955 and popularized aft Doris Day sang it successful nan 1956 Alfred Hitchcock film, The Man Who Knew Too Much. Although nan Spanish-like pronunciation and Italian-like shape propose a non-English origin, nan saying is simply a mis-translation of a 16th period English heraldic motto which has nary root successful either Spanish aliases Italian. 2A clip for transformation, freedom... and PROSPERITY! Astrologers uncover why 2023 could beryllium your BEST twelvemonth yet for money and romance, DailyMail.com, December 26, 2022, Femail | Fashion News, Beauty Tips and Trends | Daily Mail Online‐11533617/Astrologers‐reveal‐whats‐store‐star‐sign‐2023.html 3 Dow headed backmost beneath 30,000, slim chance for soft landing for system successful 2023: CNBC CFO survey, www.CNBC.com, December 28, 2022 4 Special Report - The 2023 Outlook: The Year of nan Rabbit Means Hopping Back to nan Bond-Bullion Barbell, Rosenberg Research, January 5, 2023, Haver Analytics, FRED Economic Data, Federal Reserve Bank of St. Louis (chart end-date: 9/30/22) 5 It whitethorn look evident that whether 1 feels rich | aliases mediocre is limited connected one’s nett worthy comparative to disposable income and that, aft a twelvemonth successful which some bonds and equities knowledgeable important declines, we mightiness beryllium emotion poorer. However, arsenic shown successful nan chart above, moreover aft specified draw-downs, aggregate wealthiness comparative to disposable income is conscionable beneath nan highest and supra each different play complete nan past 30+ years. 6 FRED Economic Data, Federal Reserve Bank of St. Louis (chart end-date: 9/30/22) 7 For those who want to amended understand nan narration betwixt unemployment and occupation openings, known arsenic nan Beveridge Curve, this tin beryllium examined successful much item connected nan website for nan Bureau of Labor Statistics astatine The Beveridge Curve (job openings complaint vs. unemployment rate), seasonally adjusted . 8 Bloomberg (chart end-date: 12/30/22) 9 Capital Allocation: Thinking Like a CFO, BofA Securities, November 15, 2022 10 State of nan Credit Markets and Best Ideas, BofA Securities, January 6, 2023 11 We discussed “zombie” credits successful our 2Q19 investor letter, Rise of nan Living Dead. Zombie companies are defined arsenic non-financial companies that are complete 10 years aged and incapable to screen their liking disbursal from existent operating income for 3 consecutive years. Typically, they past connected expanding borrowings facilitated by debased liking complaint environments. 12 Fundamentals – Bracing for Earnings Damage, Morgan Stanley, January 6, 2023 (chart end-date: 9/30/22) 13 Collateralized Loan Obligations are securitized pools of syndicated loans that are sold successful gradual tranches of indebtedness and equity truthful that CLO investors whitethorn take to put successful circumstantial tranches that meet their desired level of consequence and associated complaint of return. 14 BofA Securities 15 CLO Outlook: JekyLL vs Hyde, BofA Securities, November 22, 2022 16 “Cov-lite” loans are loans that are issued pinch less restrictions connected nan borrower and little protection for nan lender owed to their deficiency of covenants. Some leveraged indebtedness investors person made nan constituent that cov-lite loans protect nan borrower and lenders successful times of accent since lenders person constricted expertise to unit a “day of reckoning”, allowing nan institution breathing room to activity done their issues. Generally, we for illustration loans that are not cov-lite and person made nan affinity that cov-lite loans are akin to an uber-wealthy personification getting joined without a pre-nup. 17 High Yield Bond and Leveraged Loan Market Monitor, J.P. Morgan, January 3, 2023 18 HY Credit Chartbook, BofA Securities, January 4, 2023 19 ICE BofA US High Yield Index 20 “Dry powder”, successful nan discourse of our portfolios, is defined arsenic rate and investments that are expected to beryllium repaid wrong 90 days arsenic good arsenic pre-merger SPACs that tin beryllium sold astatine aliases adjacent to liquidation value. The liquidation worth is nan magnitude of rate and short-term securities held successful a SPAC’s spot that is to beryllium invested successful a target company, distributed to shareholders who elite to redeem their shares for rate alternatively than put successful a projected transaction aliases returned to shareholders astatine nan liquidation day if nan SPAC fails to find a merger partner. The “dry powder” class includes securities specified arsenic called bonds and indebtedness maturing successful little than 30 days. Called aliases maturing bonds pinch an ultra-short play to redemption whitethorn supply a misleading practice of portfolio metrics owed to nan imaginable ample effect connected yields from insignificant pricing variances versus nan upcoming redemption price. Investments correspond a snapshot of a circumstantial constituent successful clip and whitethorn not bespeak early positioning.Endnotes:

THE PROSPECTUS FOR THE CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND, CROSSINGBRIDGE ULTRA-SHORT DURATION FUND, AND CROSSINGBRIDGE RESPONSIBLE CREDIT FUND CAN BE FOUND BY CLICKING HERE. THE STATEMENT OF ADDITONAL INFORMATION (SAI) CAN BE FOUND BY CLICKING HERE. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 855-552-5863. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING. PER RULE 30E-3, THE FISCAL Q1 HOLDINGS AND Q3 HOLDINGS CAN BE FOUND BY CLICKING ON THE RESPECTIVE LINKS.THE PROSPECTUS FOR THE CROSSINGBRIDGE PRE-MERGER SPAC ETF CAN BE FOUND BY CLICKING HERE. THE STATEMENT OF ADDITONAL INFORMATION (SAI) CAN BE FOUND BY CLICKING HERE. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 800-617-0004. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING.THE FUNDS ARE OFFERED ONLY TO UNITED STATES RESIDENTS, AND INFORMATION ON THIS SITE IS INTENDED ONLY FOR SUCH PERSONS. NOTHING ON THIS WEBSITE SHOULD BE CONSIDERED A SOLICITATION TO BUY OR AN OFFER TO SELL SHARES OF THE FUND IN ANY JURISDICTION WHERE THE OFFER OR SOLICITATION WOULD BE UNLAWFUL UNDER THE SECURITIES LAWS OF SUCH JURISDICTION.CROSSINGBRIDGE MUTUAL FUNDS’ DISCLOSURE: MUTUAL FUND INVESTING INVOLVES RISK. PRINCIPAL LOSS IS POSSIBLE. INVESTMENTS IN FOREIGN SECURITIES INVOLVE GREATER VOLATILITY AND POLITICAL, ECONOMIC AND CURRENCY RISKS AND DIFFERENCES IN ACCOUNTING METHODS. INVESTMENTS IN DEBT SECURITIES TYPICALLY DECREASE IN VALUE WHEN INTEREST RATES RISE. THIS RISK IS USUALLY GREATER FOR LONGER-TERM DEBT SECURITIES. INVESTMENT IN LOWER-RATED AND NON-RATED SECURITIES PRESENTS A GREATER RISK OF LOSS TO PRINCIPAL AND INTEREST THAN HIGHER-RATED SECURITIES. BECAUSE THE FUND MAY INVEST IN ETFS AND ETNS, THEY ARE SUBJECT TO ADDITIONAL RISKS THAT DO NOT APPLY TO CONVENTIONAL MUTUAL FUND, INCLUDING THE RISKS THAT THE MARKET PRICE OF AN ETF'S AND ETN'S SHARES MAY TRADE AT A DISCOUNT TO ITS NET ASSET VALUE ("NAV"), AN ACTIVE SECONDARY TRADING MARKET MAY NOT DEVELOP OR BE MAINTAINED, OR TRADING MAY BE HALTED BY THE EXCHANGE IN WHICH THEY TRADE, WHICH MAY IMPACT A FUND'S ABILITY TO SELL ITS SHARES. THE VALUE OF ETN'S MAY BE INFLUENCED BY THE LEVEL OF SUPPLY AND DEMAND FOR THE ETN, VOLATILITY AND LACK OF LIQUIDITY. THE FUND MAY INVEST IN DERIVATIVE SECURITIES, WHICH DERIVE THEIR PERFORMANCE FROM THE PERFORMANCE OF AN UNDERLYING ASSET, INDEX, INTEREST RATE OR CURRENCY EXCHANGE RATE. DERIVATIVES CAN BE VOLATILE AND INVOLVE VARIOUS TYPES AND DEGREES OF RISKS, AND, DEPENDING UPON THE CHARACTERISTICS OF A PARTICULAR DERIVATIVE, SUDDENLY CAN BECOME ILLIQUID. INVESTMENTS IN ASSET BACKED, MORTGAGE BACKED, AND COLLATERALIZED MORTGAGE BACKED SECURITIES INCLUDE ADDITIONAL RISKS THAT INVESTORS SHOULD BE AWARE OF SUCH AS CREDIT RISK, PREPAYMENT RISK, POSSIBLE ILLIQUIDITY AND DEFAULT, AS WELL AS INCREASED SUSCEPTIBILITY TO ADVERSE ECONOMIC DEVELOPMENTS. INVESTING IN COMMODITIES MAY SUBJECT THE FUND TO GREATER RISKS AND VOLATILITY AS COMMODITY PRICES MAY BE INFLUENCED BY A VARIETY OF FACTORS INCLUDING UNFAVORABLE WEATHER, ENVIRONMENTAL FACTORS, AND CHANGES IN GOVERNMENT REGULATIONS. SHARES OF CLOSED-END FUND FREQUENTLY TRADE AT A PRICE PER SHARE THAT IS LESS THAN THE NAV PER SHARE. THERE CAN BE NO ASSURANCE THAT THE MARKET DISCOUNT ON SHARES OF ANY CLOSED-END FUND PURCHASED BY THE FUND WILL EVER DECREASE OR THAT WHEN THE FUND SEEK TO SELL SHARES OF A CLOSED-END FUND IT CAN RECEIVE THE NAV OF THOSE SHARES. THERE ARE GREATER RISKS INVOLVED IN INVESTING IN SECURITIES WITH LIMITED MARKET LIQUIDITY.CROSSINGBRIDGE PRE-MERGER SPAC ETF DISCLOSURE: INVESTING INVOLVES RISK; PRINCIPAL LOSS IS POSSIBLE. THE FUND INVESTS IN EQUITY SECURITIES AND WARRANTS OF SPACS. PRE-COMBINATION SPACS HAVE NO OPERATING HISTORY OR ONGOING BUSINESS OTHER THAN SEEKING COMBINATIONS, AND THE VALUE OF THEIR SECURITIES IS PARTICULARLY DEPENDENT ON THE ABILITY OF THE ENTITY'S MANAGEMENT TO IDENTIFY AND COMPLETE A PROFITABLE COMBINATION. THERE IS NO GUARANTEE THAT THE SPACS IN WHICH THE FUND INVESTS WILL COMPLETE A COMBINATION OR THAT ANY COMBINATION THAT IS COMPLETED WILL BE PROFITABLE. UNLESS AND UNTIL A COMBINATION IS COMPLETED, A SPAC GENERALLY INVESTS ITS ASSETS IN U.S. GOVERNMENT SECURITIES, MONEY MARKET SECURITIES, AND CASH. PUBLIC STOCKHOLDERS OF SPACS MAY NOT BE AFFORDED A MEANINGFUL OPPORTUNITY TO VOTE ON A PROPOSED INITIAL COMBINATION BECAUSE CERTAIN STOCKHOLDERS, INCLUDING STOCKHOLDERS AFFILIATED WITH THE MANAGEMENT OF THE SPAC, MAY HAVE SUFFICIENT VOTING POWER, AND A FINANCIAL INCENTIVE, TO APPROVE SUCH A TRANSACTION WITHOUT SUPPORT FROM PUBLIC STOCKHOLDERS. AS A RESULT, A SPAC MAY COMPLETE A COMBINATION EVEN THOUGH A MAJORITY OF ITS PUBLIC STOCKHOLDERS DO NOT SUPPORT SUCH A COMBINATION. SOME SPACS MAY PURSUE COMBINATIONS ONLY WITHIN CERTAIN INDUSTRIES OR REGIONS, WHICH MAY INCREASE THE VOLATILITY OF THEIR PRICES. THE FUND MAY INVEST IN SPACS DOMICILED OR LISTED OUTSIDE OF THE U.S., INCLUDING, BUT NOT LIMITED TO, CANADA, THE CAYMAN ISLANDS, BERMUDA AND THE VIRGIN ISLANDS. INVESTMENTS IN SPACS DOMICILED OR LISTED OUTSIDE OF THE U.S. MAY INVOLVE RISKS NOT GENERALLY ASSOCIATED WITH INVESTMENTS IN THE SECURITIES OF U.S. SPACS, SUCH AS RISKS RELATING TO POLITICAL, SOCIAL, AND ECONOMIC DEVELOPMENTS ABROAD AND DIFFERENCES BETWEEN U.S. AND FOREIGN REGULATORY REQUIREMENTS AND MARKET PRACTICES. FURTHER, TAX TREATMENT MAY DIFFER FROM U.S. SPACS AND SECURITIES MAY BE SUBJECT TO FOREIGN WITHHOLDING TAXES. SMALLER CAPITALIZATION SPACS WILL HAVE A MORE LIMITED POOL OF COMPANIES WITH WHICH THEY CAN PURSUE A BUSINESS COMBINATION RELATIVE TO LARGER CAPITALIZATION COMPANIES. THAT MAY MAKE IT MORE DIFFICULT FOR A SMALL CAPITALIZATION SPAC TO CONSUMMATE A BUSINESS COMBINATION. BECAUSE THE FUND IS NON-DIVERSIFIED IT MAY INVEST A GREATER PERCENTAGE OF ITS ASSETS IN THE SECURITIES OF A SINGLE ISSUER OR A SMALLER NUMBER OF ISSUERS THAN IF IT WERE A DIVERSIFIED FUND. AS A RESULT, A DECLINE IN THE VALUE OF AN INVESTMENT IN A SINGLE ISSUER COULD CAUSE THE FUND’S OVERALL VALUE TO DECLINE TO A GREATER DEGREE THAN IF THE FUND HELD A MORE DIVERSIFIED PORTFOLIO. EQUITIES ARE GENERALLY PERCEIVED TO HAVE MORE FINANCIAL RISK THAN BONDS IN THAT BOND HOLDERS HAVE A CLAIM ON FIRM OPERATIONS OR ASSETS THAT IS SENIOR TO THAT OF EQUITY HOLDERS. IN ADDITION, STOCK PRICES ARE GENERALLY MORE VOLATILE THAN BOND PRICES. INVESTMENTS IN DEBT SECURITIES TYPICALLY DECREASE IN VALUE WHEN INTEREST RATES RISE AND THIS RISK IS USUALLY GREATER FOR LONGER-TERM DEBT SECURITIES. BONDS ARE OFTEN OWNED BY INDIVIDUALS INTERESTED IN CURRENT INCOME WHILE STOCKS ARE GENERALLY OWNED BY INDIVIDUALS SEEKING PRICE APPRECIATION WITH INCOME A SECONDARY CONCERN. THE TAX TREATMENT OF RETURNS OF BONDS AND STOCKS ALSO DIFFERS GIVEN DIFFERENTIAL TAX TREATMENT OF INCOME VERSUS CAPITAL GAIN.DEFINITIONS: THE S&P 500, OR SIMPLY THE S&P, IS A STOCK MARKET INDEX THAT MEASURES THE STOCK PERFORMANCE OF 500 LARGE COMPANIES LISTED ON STOCK EXCHANGES IN THE UNITED STATES. THE ICE BOFA INVESTMENT GRADE/COPORATE BOND INDEX TRACKS THE PERFORMANCE OF US DOLLAR DENOMINATED INVESTMENT GRADE RATED CORPORATE DEBT PUBLICALLY ISSUED IN THE US DOMESTIC MARKET. THE ICE BOFA 1-3 YEAR CORPORATE BOND INDEX IS A SUBSET OF THE ICE BOFA US CORPORATE BOND INDEX TRACKING THE PERFORMANCE OF US DOLLAR DENOMINATED INVESTMENT GRADE RATED CORPORATE DEBT PUBLICLY ISSUED IN THE US DOMESTIC MARKET. THIS SUBSET INCLUDES ALL SECURITIES WITH A REMAINING TERM TO MATURITY OF LESS THAN 3 YEARS.. THE ICE BOFA HIGH YIELD INDEX TRACKS THE PERFORMANCE OF US DOLLAR DENOMINATED BELOW INVESTMENT GRADE RATED CORPORATE DEBT PUBLICALLY ISSUED IN THE US DOMESTIC MARKET. EBITDA IS A COMPANY'S EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AND AMORTIZATION IS AN ACCOUNTING MEASURE CALCULATED USING A COMPANY'S EARNINGS, BEFORE INTEREST EXPENSES, TAXES, DEPRECIATION, AND AMORTIZATION ARE SUBTRACTED, AS A PROXY FOR A COMPANY'S CURRENT OPERATING PROFITABILITY. A BASIS POINT (BP) IS 1/100 OF ONE PERCENT. PARI-PASSU IS A LATIN TERM THAT MEANS 'ON EQUAL FOOTING' OR 'RANKING EQUALLY'. IT IS AN IMPORTANT CLAUSE FOR CREDITORS OF A COMPANY IN FINANCIAL DIFFICULTY WHICH MIGHT BECOME INSOLVENT. IF THE COMPANY'S DEBTS ARE PARI PASSU, THEY ARE ALL RANKED EQUALLY, SO THE COMPANY PAYS EACH CREDITOR THE SAME AMOUNT IN INSOLVENCY. LIBOR IS THE AVERAGE INTERBANK INTEREST RATE AT WHICH A SELECTION OF BANKS ON THE LONDON MONEY MARKET ARE PREPARED TO LEND TO ONE ANOTHER. YIELD TO MATURITY (YTM) IS THE TOTAL RETURN ANTICIPATED ON A BOND (ON AN ANNUALIZED BASIS) IF THE BOND IS HELD UNTIL IT MATURES. YIELD TO WORST (YTW) IS A MEASURE OF THE LOWEST POSSIBLE YIELD (ON AN ANNUALIZED BASIS) THAT CAN BE RECEIVED ON A BOND THAT FULLY OPERATES WITHIN THE TERMS OF ITS CONTRACT WITHOUT DEFAULTING. FREE CASH FLOW (FCF) IS THE CASH A COMPANY PRODUCES THROUGH ITS OPERATIONS, LESS THE COST OF EXPENDITURES ON ASSETS. IN OTHER WORDS, FREE CASH FLOW IS THE CASH LEFT OVER AFTER A COMPANY PAYS FOR ITS OPERATING EXPENSES AND CAPITAL EXPENDITURES. DURATION IS A MEASURE OF THE SENSITIVITY OF THE PRICE OF A BOND OR OTHER DEBT INSTRUMENT TO A CHANGE IN INTEREST RATES. DEBTOR-IN-POSSESSION (DIP) FINANCING IS IS A SPECIAL KIND OF FINANCING MEANT FOR COMPANIES THAT ARE IN BANKRUPTCY. ONLY COMPANIES THAT HAVE FILED FOR BANKRUPTCY PROTECTION UNDER CHAPTER 11 ARE ALLOWED TO ACCESS DIP FINANCING, WHICH USUALLY HAPPENS AT THE START OF A FILING. DIP FINANCING IS USED TO FACILITATE THE REORGANIZATION OF A DEBTOR-IN-POSSESSION (THE STATUS OF A COMPANY THAT HAS FILED FOR BANKRUPTCY) BY ALLOWING IT TO RAISE CAPITAL TO FUND ITS OPERATIONS AS ITS BANKRUPTCY CASE RUNS ITS COURSE. YIELD TO CALL (YTC) REFERS TO THE RETURN A BONDHOLDER RECEIVES IF THE BOND IS HELD UNTIL THE CALL DATE, WHICH OCCURS SOMETIME BEFORE IT REACHES MATURITY. THE DOW JONES INDUSTRIAL AVERAGE, DOW JONES, OR SIMPLY THE DOW, IS A PRICE-WEIGHTED MEASUREMENT STOCK MARKET INDEX OF 30 PROMINENT COMPANIES LISTED ON STOCK EXCHANGES IN THE UNITED STATES. THE NASDAQ COMPOSITE IS A STOCK MARKET INDEX THAT INCLUDES ALMOST ALL STOCKS LISTED ON THE NASDAQ STOCK EXCHANGE. ALONG WITH THE DOW JONES INDUSTRIAL AVERAGE AND S&P 500, IT IS ONE OF THE THREE MOST-FOLLOWED STOCK MARKET INDICES IN THE UNITED STATES.ETF DEFINITIONS: THE ICE BOFA 0-3 YEAR U.S. TREASURY INDEX TRACKS THE PERFORMANCE OF U.S. DOLLAR DENOMINATED SOVEREIGN DEBT PUBLICLY ISSUED BY THE US GOVERNMENT IN ITS DOMESTIC MARKET WITH MATURITIES LESS THAN THREE YEARS. GROSS SPREAD IS THE AMOUNT BY WHICH A SPAC IS TRADING AT A DISCOUNT OR PREMIUM TO ITS PRO RATA SHARE OF THE COLLATERAL TRUST VALUE. FOR EXAMPLE, IF A SPAC IS TRADING AT $9.70 AND SHAREHOLDERS’ PRO RATA SHARE OF THE TRUST ACCOUNT IS $10.00/SHARE, THE SPAC HAS A GROSS SPREAD OF 3% (TRADING AT A 3% DISCOUNT). YIELD TO LIQUIDATION: SIMILAR TO A BOND’S YIELD TO MATURITY, SPACS HAVE A YIELD TO LIQUIDATION/REDEMPTION, WHICH CAN BE CALCULATED USING THE GROSS SPREAD AND TIME TO LIQUIDATION. MATURITY: SIMILAR TO A BOND’S MATURITY DATE, SPACS ALSO HAVE A MATURITY, WHICH IS THE DEFINED TIME PERIOD IN WHICH THEY HAVE TO COMPLETE A BUSINESS COMBINATION. THIS IS REFERRED TO AS THE LIQUIDATION OR REDEMPTION DATE. PRICE REFERS TO THE PRICE AT WHICH THE ETF IS CURRENTLY TRADING. WEIGHTED AVERAGE LIFE REFERS TO THE WEIGHTED AVERAGE TIME UNTIL A PORTFOLIO OF SPACS' LIQUDATION OR REDEMPTION DATES. THE SEC YIELD IS A STANDARD YIELD CALCULATION DEVELOPED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION (SEC) THAT ALLOWS FOR FAIRER COMPARISONS OF BOND FUNDS. IT IS BASED ON THE MOST RECENT 30-DAY PERIOD COVERED BY THE FUND'S FILINGS WITH THE SEC. THE YIELD FIGURE REFLECTS THE DIVIDENDS AND INTEREST EARNED DURING THE PERIOD AFTER THE DEDUCTION OF THE FUND'S EXPENSES. IT IS ALSO REFERRED TO AS THE "STANDARDIZED YIELD."FUND HOLDINGS AND SECTOR ALLOCATIONS ARE SUBJECT TO CHANGE AND SHOULD NOT BE CONSIDERED RECOMMENDATIONS TO BUY OR SELL ANY SECURITY. ANY DIRECT OR INDIRECT REFERENCE TO SPECIFIC SECURITIES, SECTORS, OR STRATEGIES ARE PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY. WHEN PERTAINING TO COMMENTARIES POSTED BY CROSSINGBRIDGE, IT REPRESENTS THE PORTFOLIO MANAGER’S OPINION AND IS AN ASSESSMENT OF THE MARKET ENVIRONMENT AT A SPECIFIC TIME AND IS NOT INTENDED TO BE A FORECAST OF FUTURE EVENTS OR A GUARANTEE OF FUTURE RESULTS. THIS INFORMATION SHOULD NOT BE RELIED UPON BY THE READER AS RESEARCH OR INVESTMENT ADVICE REGARDING THE FUND OR ANY SECURITY IN PARTICULAR. SPECIFIC PERFORMANCE OF ANY SECURITY MENTIONED IS AVAILABLE UPON REQUEST.ANY PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. THE INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR'S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE QUOTED. PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END MAY BE OBTAINED BY CALLING 914-741-9600. PLEASE FIND THE MOST CURRENT STANDARDIZED PERFORMANCE FOR EACH FUND AS OF THE MOST RECENT QUARTER-END BY CLICKING THE FOLLOWING LINKS: CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND, CROSSINGBRIDGE ULTRA-SHORT DURATION FUND, CROSSINGBRIDGE RESPONSIBLE CREDIT FUND, CROSSINGBRIDGE PRE-MERGER SPAC ETF.DIVERSIFICATION DOES NOT ASSURE A PROFIT NOR PROTECT AGAINST LOSS IN A DECLINING MARKET.A STOCK IS A TYPE OF SECURITY THAT SIGNIFIES OWNERSHIP IN A CORPORATION AND REPRESENTS A CLAIM ON PART OF THE CORPORATION'S ASSETS AND EARNINGS. A BOND IS A DEBT INVESTMENT IN WHICH AN INVESTOR LOANS MONEY TO AN ENTITY THAT BORROWS THE FUNDS FOR A DEFINED PERIOD OF TIME AT A FIXED INTEREST RATE. A HEDGE FUND IS A PRIVATE INVESTMENT VEHICLE THAT MAY EXECUTE A WIDE VARIETY OF INVESTMENT STRATEGIES USING VARIOUS FINANCIAL INSTRUMENTS.A STOCK MAY TRADE WITH MORE OR LESS LIQUIDITY THAN A BOND DEPENDING ON THE NUMBER OF SHARES AND BONDS OUTSTANDING, THE SIZE OF THE COMPANY, AND THE DEMAND FOR THE SECURITIES. THE SECURITIES AND EXCHANGE COMMISSION (SEC) DOES NOT APPROVE, ENDORSE, NOR INDEMNIFY ANY SECURITY.TAX FEATURES MAY VARY BASED ON PERSONAL CIRCUMSTANCES. CONSULT A TAX PROFESSIONAL FOR ADDITIONAL INFORMATION.THE CROSSINGBRIDGE ULTRA-SHORT DURATION FUND, LOW DURATION HIGH YIELD FUND, AND RESPONSIBLE CREDIT FUND ARE DISTRIBUTED BY QUASAR DISTRIBUTORS, LLC.THE CROSSINGBRIDGE PRE-MERGER SPAC ETF IS DISTRIBUTED BY FORESIDE FUND SERVICES, LLC.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Select quarterly money letters.

Additional disclosure: © CROSSINGBRIDGE ADVISORS, LLC https://www.crossingbridgefunds.com/terms-of-use

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·