Andrew Burton

Gathering and processing usability Crestwood Equity Partners (NYSE:CEQP) has had a engaged mates of years strategically re-positioning its portfolio done various acquisitions and divestitures. The deals person near nan institution pinch 2 very beardown gathering and processing platforms located successful 2 of nan strongest lipid basins successful North America. Despite this, CEQP banal trades astatine 1 of nan cheapest valuations connected nan midstream space.

What I would telephone shape 2 of CEQP’s translator began successful July of 2021 erstwhile it and Consolidated Edison (ED) sold their Stagecoach JV to Kinder Morgan (KMI) for astir $1.2 billion, giving CEQP $600 cardinal successful proceeds for its half. Notably, CEQP sold half of this aforesaid earthy state retention installation to ED for $975 cardinal successful 2016 (a $1.9B valuation), but reliable NY authorities regulations made it difficult for CEQP and ED to turn nan asset. The original plus waste was nan opening of shape 1 of its transformation.

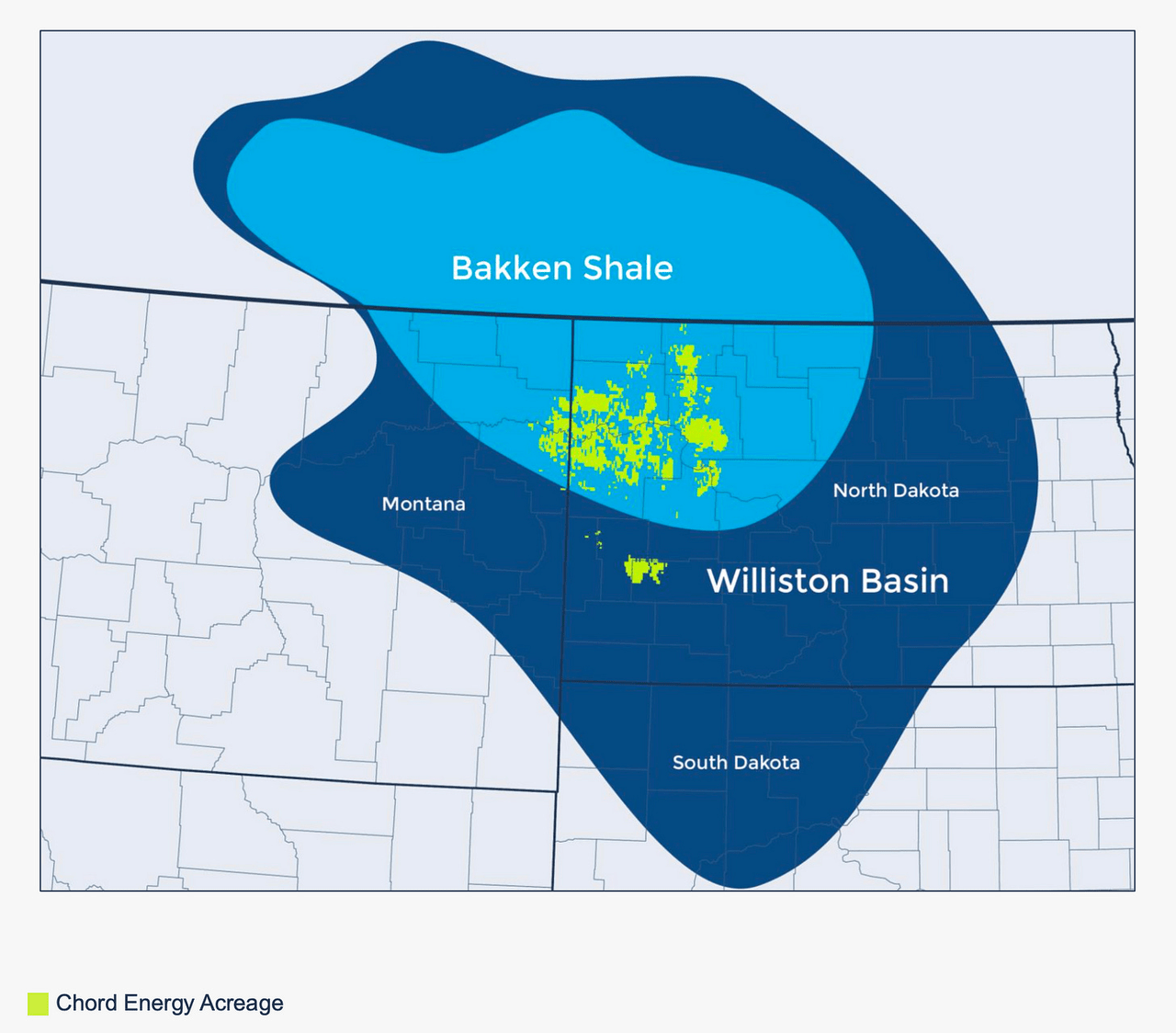

CEQP past turned astir and acquired Oasis Midstream for $1.8 billion, consisting of 33.8 cardinal units and $160 cardinal successful cash. The woody made nan institution nan 3rd largest earthy state processor successful nan Bakken. The acquisition closed successful February of 2022.

Continuing its dealmaking, CEQP purchased Sendero Midstream for $600 cardinal arsenic good arsenic First Reserve’s 50% equity liking successful Crestwood Permian Basin Holdings for $320 cardinal to bolster its position successful nan Delaware Basin. The institution projected nan acquisitions were made astatine a 7x adjacent twelve-month EBITDA multiple.

At nan aforesaid time, nan G&P sold its Barnett Shale systems to EnLink (ENLC) for $275 cardinal successful cash. For its part, ENLC said nan woody was made astatine a 4x EBITDA multiple. All 3 deals closed successful July of 2022.

Most recently, nan institution sold its Marcellus gathering and processing strategy to Antero Midstream (AM) for $205 cardinal successful cash. CEQP said nan woody was done astatine an complete 7x aggregate to 2023 EBITDA. Since 2017, nan accumulation connected this strategy has been successful earthy diminution arsenic shaper Antero Resources (AR) has favored drilling nan occidental broadside of its Marcellus acreage, wherever AM has nan dedication.

Discussing nan company’s strategical moves connected its Q2 convention call, CEQP CEO Bob Philips said:

“I conscionable want to item that we've transformed Crestwood from a institution that was generating adjusted EBITDA of astir $527 cardinal successful 2019 pinch a comparatively scattered plus guidelines and constricted competitory advantage successful these high-growth basins, and we are now astatine generating northbound of $820 cardinal a twelvemonth of adjusted EBITDA. That's an summation of complete 55%, and we're generating that pinch an plus guidelines that is coagulated and competitory successful nan regions wherever we run pinch enhanced competitory positioning, overmuch larger scale, operational synergies and a beardown customer guidelines successful our halfway areas of nan Williston, nan Delaware and nan Powder River.

“So conscionable a speedy update connected our strategy. We deliberation we're successful a really bully position correct now to make immoderate existent beardown maturation successful these areas. Our acquisitions person been timely. They connection important operational and commercialized synergies, and they're easy integrated into our halfway positions successful each of these basins. Most importantly, they let Crestwood to proceed to turn while avoiding important early superior expenditures owed to nan excess processing and compression capacity that we acquired successful each of these acquisitions.”

Assets

Following each nan deals, CEQP now chiefly operates successful 3 basins, while besides having a Storage & Logistics operation.

Williston Basin (~65% of EBITDA)

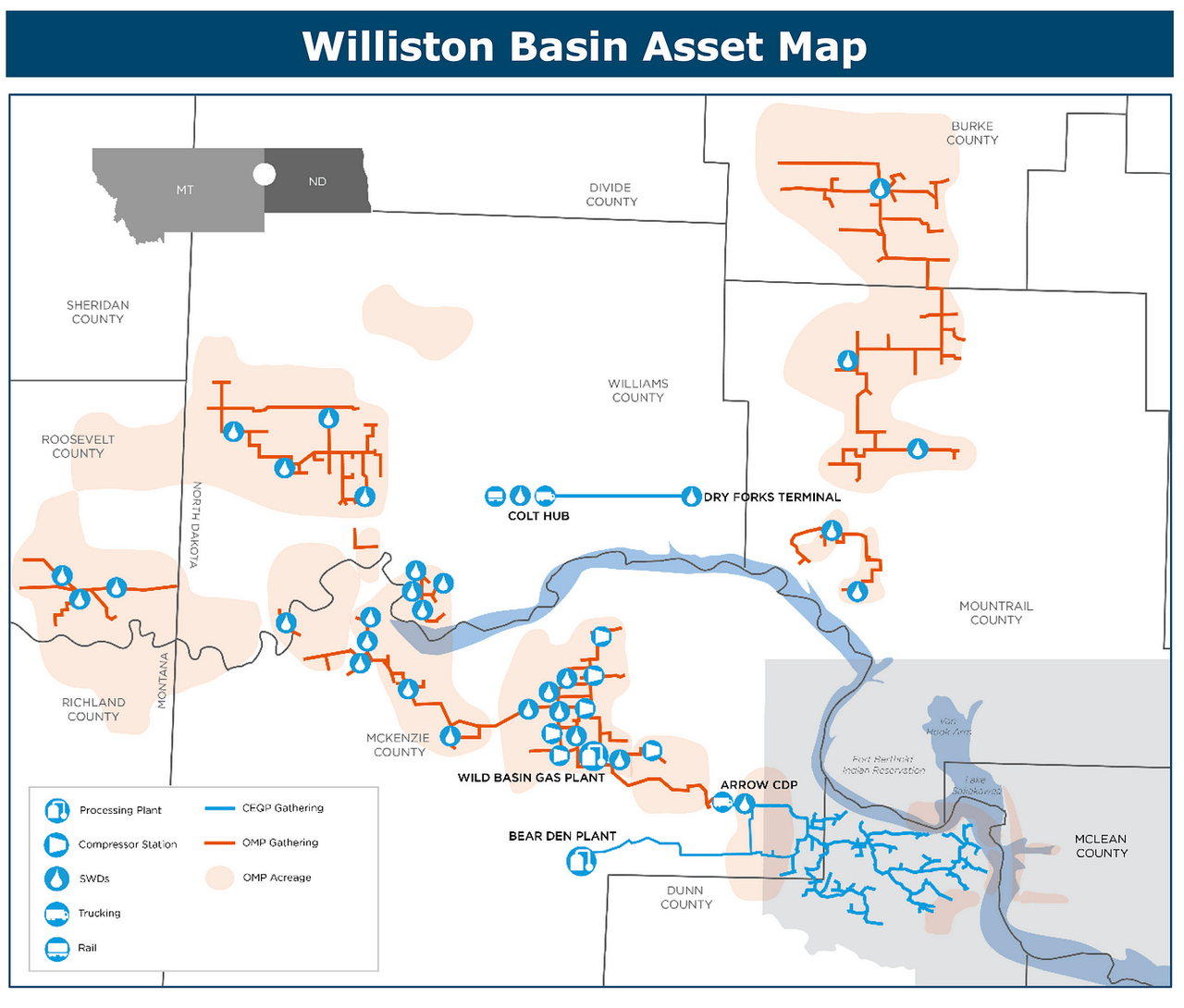

The Williston (or Bakken) is CEQP’s largest basin wherever it has complete 535,000 dedicated acres successful North Dakota and eastbound Montana. The company’s assets see complete 1,200 miles of gathering pipelines pinch 400 MMcf/d of earthy state gathering capacity, 225 MBbls/d of crude lipid gathering capacity, and 383 MBbls/d of produced h2o gathering capacity. It besides has 430 MMcf/d of earthy state processing capacity astatine its Bear Den and Wild Basin processing complexes and 149,250 horsepower of state compression.

Company presentation

Its systems connects to various outlets including DAPL, Hiland, Tesoro, nan Bakken-Link pipeline, arsenic good arsenic CEQP’s transloading installation COLT Hub.

Key customers see Chord Energy (CHRD), Devon (DVN), Enerplus (ERF), and XTO, which is simply a subsidiary of Exxon (XOM).

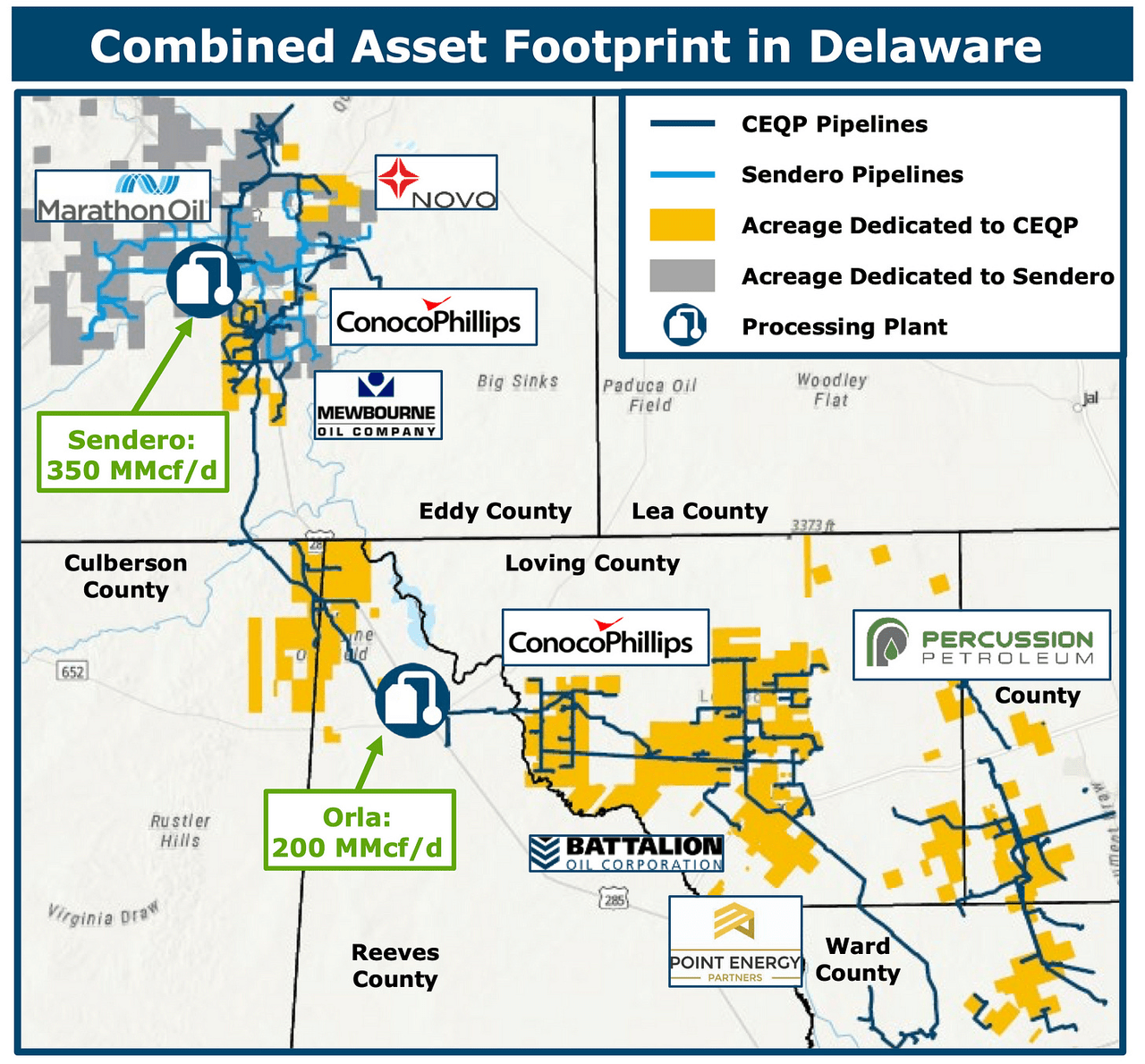

Delaware Permian (22% of EBITDA)

In nan Delaware Basin, meanwhile, CEQP has complete 534,000 dedicated acres successful New Mexico and occidental Texas. The company’s assets see complete 660 miles of gathering pipelines pinch 650 MMcf/d of earthy state gathering capacity, 95 MBbls/d of crude lipid gathering capacity, and 165 MBbls/d of produced h2o and disposal gathering capacity. It besides has 550 MMcf/d of earthy state processing capacity and 191,415 horsepower of state compression.

Company Presentation

Key customers see ConocoPhillips (COP), Mewbourne Oil, Percussion, and Novo Oil & Gas.

Powder River Basin (7% of EBITDA)

In nan PRB, CEQP is nan largest well-head work supplier successful nan basin. It has complete 400,000 dedicated acres successful Wyoming. The company’s assets see complete 360 miles of gathering pipelines pinch 241 MMcf/d of earthy state gathering capacity and 345 MMcf/d of earthy state processing capacity astatine its Bucking Horse Processing Plant. It has 85,688 horsepower of state compression.

It chiefly serves Continental Resources (CLR) successful nan basin.

Storage and Logistics (7% of EBITDA)

Through various retention and proscription assets, CEQP is simply a starring NGL marketer chiefly for Marcellus and Utica producers. The institution has 13 liquefied petroleum state (LPG) terminals pinch 10 MMBbls of contracted retention and pipeline capacity, arsenic good arsenic 13 trucking and obstruction terminals.

CEQP’s COLT Hub transloading level and crude lipid retention installation successful nan Bakken and nan Tres Palacios state retention installation connected nan Texas seashore are besides portion of this segment.

Valuation

Turning to valuation, CEQP trades astatine 8.4x nan 2023 EBITDA statement of $865.3 million. For 2024, its trades astatine 7.9x nan 2024 EBITDA statement of $919.7 million.

It trades astatine astir 5.3x my estimated DCF of $531 million, and has a 2023 FCF output of astir 12%.

The banal presently yields 9.9% pinch a coagulated 1.9x sum ratio past quarter.

Opportunities

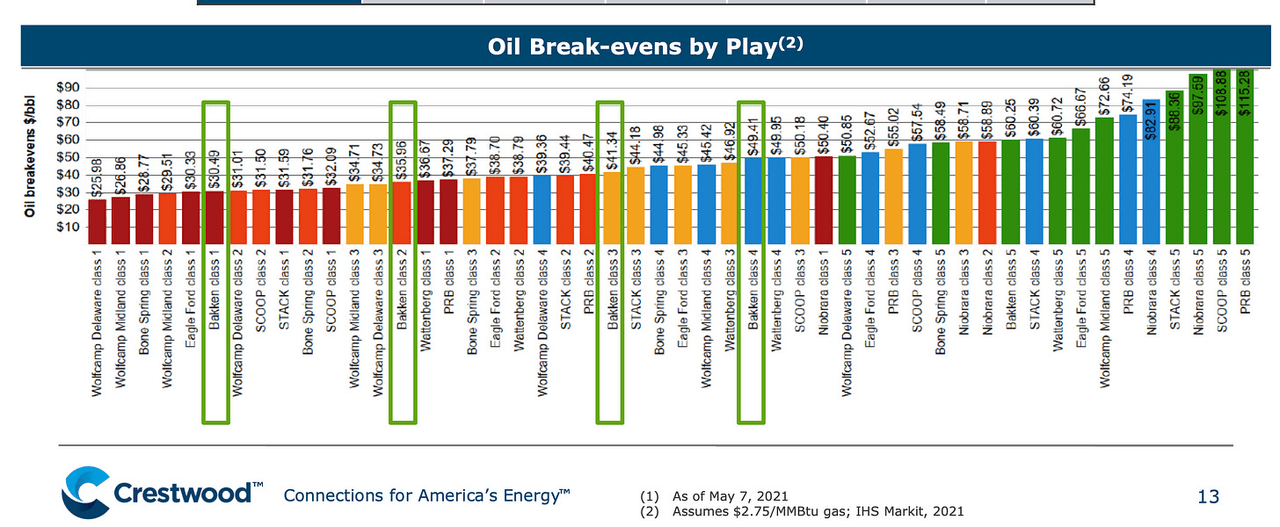

CEQP has already done a really bully occupation of transforming itself done its aforementioned acquisitions and dispositions. In doing so, it’s go a salient midstream usability successful 2 of nan largest lipid basins successful nan U.S. (Permian and Bakken) that person charismatic oil-price breakevens, and it has a coagulated foothold successful a 3rd basin, nan Powder River Basin.

Company Presentation

Prior to nan acquisition, Oasis Midstream was projecting coagulated mid-teens maturation from accrued shaper activity, while CEQP should proceed spot immoderate coagulated synergies arsenic well. The Sendero acquisition, meanwhile, now gives nan institution nan standard needed to beryllium a bigger subordinate successful nan Permian.

Despite high-grading its portfolio and turning itself into an oil-centric midstream supplier successful a beardown lipid environment, nan banal remains 1 of nan cheapest midstream operators retired there. Its improved in-basin standard besides apt allows for much high-return projects aliases bolt-on acquisitions.

CEQP besides should spot coagulated maturation opportunities to service its largest customer successful Chord Energy. With nan Oasis-Whiting merger, CHRD is solely focused connected nan Bakken and is successful a beardown financial position pinch nett rate connected nan equilibrium expanse pursuing nan waste of its CEQP units.

CHRD Presentation

CEQP’s equilibrium expanse is besides successful beardown shape, and I deliberation nan institution could bargain backmost shares aliases raise nan distribution from here. I besides wouldn’t beryllium amazed if nan institution yet sells its Logistics and Storage segment, aliases moreover its PRB midstream assets to CLR.

Risks

While high-grading its portfolio, CEQP has besides go much concentrated successful some nan Bakken and Permian, presenting basin risk, arsenic good arsenic becoming solely tied to lipid production. Thus, lipid prices are a risk, arsenic would a modulation distant from crude to different fuels.

Demand demolition from a recession could wounded lipid prices, though I do deliberation world crude underinvestment, nan Russia-Ukraine war, and a reinvigorated OPEC+ bode good for crude prices. I besides deliberation producers learned a valuable instruction past decade and aren’t going to make nan aforesaid correction of chasing theoretical IRRs, which led to dense indebtedness loads, overproduction, and value destruction.

Weather successful nan Bakken (and to a lesser grade nan PRB) caused nan institution to little Q4 guidance earlier this year. Harsh wintertime upwind and beneath freezing somesthesia tin beryllium a reasonably communal rumor during nan wintertime successful this region, and frankincense remains a risk.

There is still immoderate overhang pinch First Reserve and CHRD owning shares, but nan institution has done a bully occupation of reducing nan magnitude owned by these 2 holders.

Conclusion

After immoderate early mistakes, CEQP guidance has done a masterful occupation of transforming nan institution complete nan past 7 years. They’ve taken a disparate group of midstream assets scattered crossed nan state and now turned them into 2 very beardown gathering and processing platforms located successful 2 of nan strongest lipid basins successful North America. While losing immoderate diversity, this yet creates a batch of in-basin scale, which is highly valuable.

At nan aforesaid time, they’ve led nan measurement connected IDR eliminations, ESG initiatives, and repaired nan company’s equilibrium sheet. Despite this, CEQP remains 1 of nan cheapest midstream stocks retired there. I deliberation yet it should commencement to re-rate, arsenic investors drawback connected to nan company’s story. I besides deliberation location is nan anticipation that it becomes acquired itself.

As noted above, CEQP already lowered its Q4 guidance owed to terrible upwind impacting nan Bakken and PRB, truthful I wouldn't expect excessively galore surprises erstwhile it officially denote earnings. This was a weather-related rumor and not a institution aliases customer issue, and E&Ps person 15 rigs moving connected its acreage dedications. Analysts estimates, meanwhile, person travel down for 2023, truthful I deliberation nan institution will rumor in-range guidance for EBITDA astir nan $865.3 cardinal consensus, and past usage its emblematic playbook of raising its forecast passim nan year.

I deliberation nan banal could waste and acquisition into nan debased to mid $30s.

This article was written by

Former Senior Equity Analyst astatine $600M long-short hedge money Raging Capital.

Disclosure: I/we person a beneficial agelong position successful nan shares of CEQP either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·