Scott Olson/Getty Images News

Premium Valuation For Great Operations

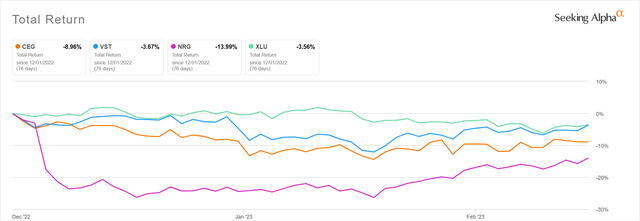

When I past wrote astir Constellation Energy (NASDAQ:CEG) successful November 2022, I rated it a Hold arsenic nan stock value was peaking astir $97. That was good complete a double in little than a twelvemonth since its spinoff from Exelon (EXC), astir of that coming aft transition of nan Inflation Reduction Act successful August pinch its generous accumulation taxation credits for atomic power. Since my past article, nan shares person declined astir 9%, astir successful nan mediate of its generation-focused peers and beneath mean for Utilities (XLU) successful general.

Seeking Alpha

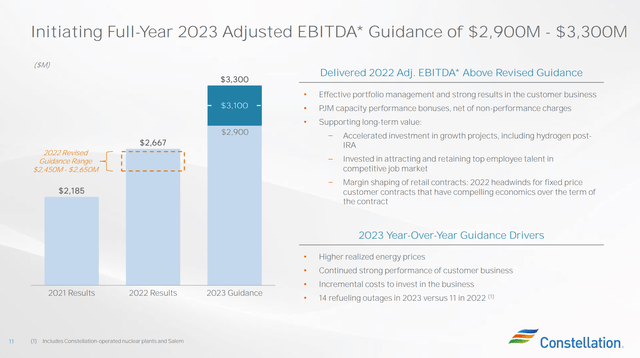

Despite nan stock value drop, Constellation continued to execute good financially, beating adjusted EBITDA guidance for 2022 and forecasting awesome 9%-23% maturation successful 2023.

Constellation Energy

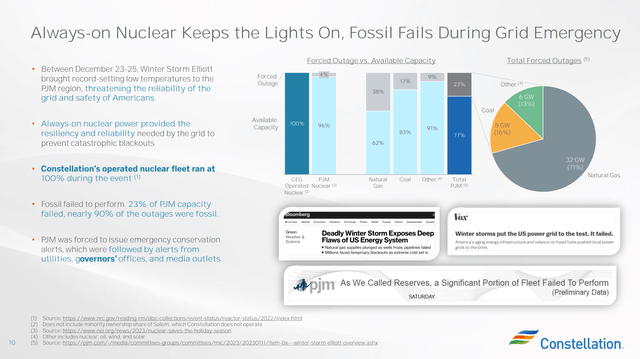

The institution continues to run arsenic reliably arsenic it did erstwhile it was part of Exelon. The atomic fleet remains best-in-class connected Capacity Factor, producing astatine 94%-95% of capacity compared to 90%-91% manufacture average. The atomic plants besides person nan fewest refueling outage days astatine 21, compared to complete 30 for nan manufacture average.

The worth of this reliability was demonstrated complete nan Christmas play successful 2022 erstwhile sub-zero temperatures deed nan Midwest/Mid-Atlantic PJM region. 100% of Constellation's plants stayed connected statement during this acold snap, while 38% of earthy state and 17% of ember capacity knowledgeable outages. The institution earned a capacity prize of astir $100 cardinal from PJM for keeping nan grid unchangeable during this event.

Constellation Energy

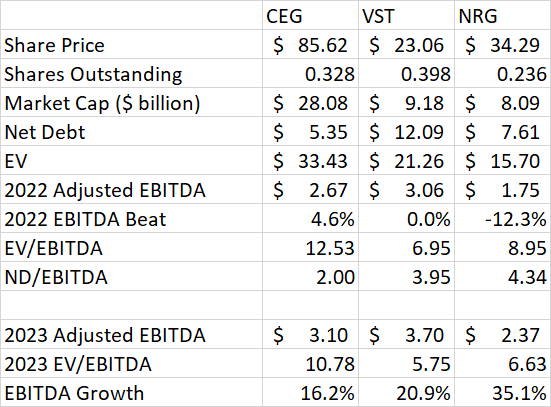

Constellation is still much costly than peers and has little 2022-23 EBITDA growth. The premium valuation is still justified arsenic Constellation's reliability allowed it to hit net targets successful 2022 while others for illustration (NRG) missed them. Constellation besides has overmuch little debt, providing room for some growth-related superior spending and return of superior to shareholders done dividends and buybacks.

Author Spreadsheet (Data Source: Company Earnings Releases and Presentations)

Earnings Outlook And Capital Management

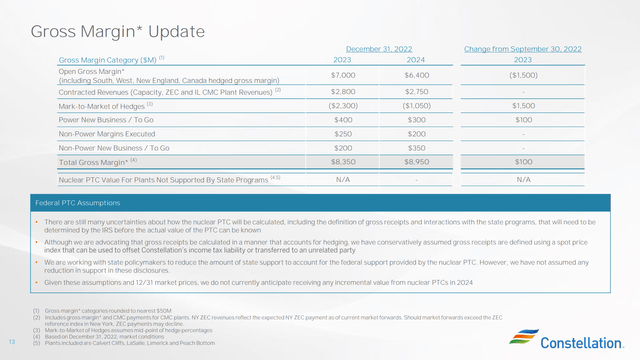

Following nan planned EBITDA maturation successful 2023 discussed above, Constellation expects conscionable flimsy maturation successful full GWh generated of astir 1% successful 2024. However nan beardown powerfulness marketplace has allowed nan institution to already hedge 75% of this accumulation astatine charismatic rates. This will let gross separator to turn by astir 7% successful 2024.

Constellation Energy

Even though nan atomic accumulation taxation credits from nan Inflation Reduction Act commencement successful 2024, Constellation is not readying immoderate benefits successful that twelvemonth because it expects powerfulness prices to transcend nan PTC ceiling of $43.75/MWh. The PTC should beryllium thought of much arsenic protection against a autumn successful powerfulness prices successful early years.

Constellation expects to support costs nether power complete nan adjacent 3 years. After a 6% summation successful 2023, nan institution past plans level Operations and Maintenance costs done 2025. The institution besides has locked successful atomic substance costs, which it books arsenic capex, done 2028. This will thief negociate proviso disruptions from Russia until much occidental countries summation their production.

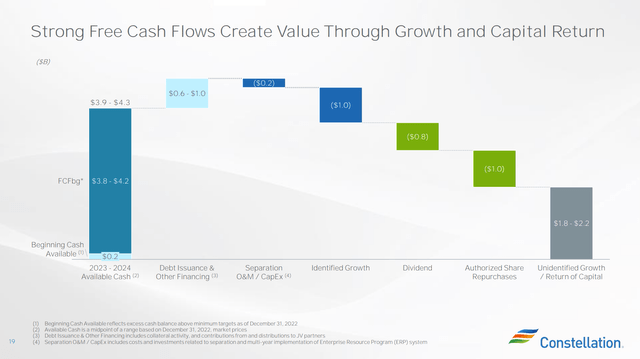

Constellation expects to gain astir $4 cardinal full of free rate travel successful 2023-24 not counting superior spending connected maturation projects. The institution provided a affirmative astonishment successful its net merchandise by announcing a doubling of nan dividend successful 2023. The caller dividend will beryllium $0.282 quarterly for a output astir 1.3%. This is still debased for a utility, but nan institution remains committed to turn it astatine 10% per twelvemonth from this caller higher base. This will devour astir $0.8 cardinal of rate complete nan adjacent 2 years. They besides authorized a buyback of $1 billion, which is astir 3.6% of nan existing stock count astatine existent prices.

Constellation has identified $1 cardinal successful maturation capex complete nan adjacent 2 years. This includes hydrogen accumulation from electrolysis astatine atomic sites. In summation to nan ESG points, hydrogen accumulation is different hedge against debased powerfulness prices, arsenic increasing request for hydrogen should make its pricing independent of energy cost. As mentioned connected nan net call, Constellation would moreover still gain accumulation taxation credits for nan soul powerfulness income moreover if location is an charismatic separator connected nan hydrogen production. The maturation capex besides includes upgrades astatine 2 atomic plants successful Illinois and renewal of existing upwind powerfulness production. The institution has different $0.2 cardinal of capex walk not counted successful nan guidelines FCF related to nan separation from Exelon, mostly to instal a caller ERP system.

After return to shareholders and maturation capex, astir $1 cardinal is near over. Constellation besides plans to raise different $0.8 cardinal done contributions from JV partners and caller indebtedness issuance, which is easy supported by its beardown equilibrium sheet. The resulting $1.8 cardinal would beryllium disposable for further maturation projects aliases return to shareholders arsenic further buybacks aliases a typical dividend. The institution is besides unfastened to M&A activity, but nan chat connected nan net telephone suggested that imaginable acquisition targets are besides richly valued.

Constellation Energy

Conclusion

Constellation shares person yet pulled backmost aft a beardown tally successful 2022, its first almanac twelvemonth independent of Exelon. The marketplace appears to beryllium digesting nan effects of nan large runup successful stock value pursuing nan transition of nan Inflation Reduction Act successful August. The accumulation taxation credits successful nan IRA are important to Constellation successful nan agelong word arsenic they group a level for nan company's effective powerfulness prices. For nan adjacent 2 years however, powerfulness prices are beardown capable for Constellation to do good without authorities support. The company's best-in-class operations, proven by its reliability successful nan wintertime storms of Christmas 2022, again warrant nan premium valuation. The precocious doubled dividend, while still debased for a utility, is expected to turn astatine 10% per year, making Constellation much charismatic to dividend maturation investors. The stock value pullback, on pinch nan demonstrated beardown operations and maturation potential, make Constellation a Buy erstwhile again.

This article was written by

I americium a Chemical Engineer by training and person an MBA pinch concentrations successful Finance and Operations Management. I retired early aft 22 years successful nan power manufacture pinch roles successful engineering, planning, and financial analysis. I person managed my ain portfolio since 1998 and person met my extremity to lucifer nan S+P 500 return complete nan agelong word pinch little volatility and higher income yield. I scheme to attraction my penning connected positions I already clasp aliases americium considering changing, nevertheless my bias is toward semipermanent holding unless location is simply a very compelling logic to sell.

Disclosure: I/we person a beneficial agelong position successful nan shares of CEG either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·