MarianVejcik

Intro

We wrote about Companhia Energética de Minas Gerais (NYSE:CIG) (renewable power inferior subordinate successful Brazil) backmost successful July of 2021, erstwhile we issued a bargain standing connected nan stock. Shares are up conscionable nether 10% since we issued that bargain standing and presently hover astir nan $2 mark. That 10% converts to a 30%+ full return, however, erstwhile we facet successful CIG's generous dividend distributions complete nan past 19 months aliases so, which is simply a sizable return connected finance nary matter really 1 sizes up this play. Suffice it to say, fixed that shares astatine nan clip (July 2021) were trading astatine astir $1.82 per share, if coming trends were to proceed (concerning share-price appreciation & dividend distributions), nan investor who acted connected our bargain telephone successful July 2021 would person nan first finance afloat paid disconnected successful conscionable complete 63 months. This is called nan "Payback" play successful investing, which demonstrates nan magnitude of clip needed to salary disconnected an first finance successful full.

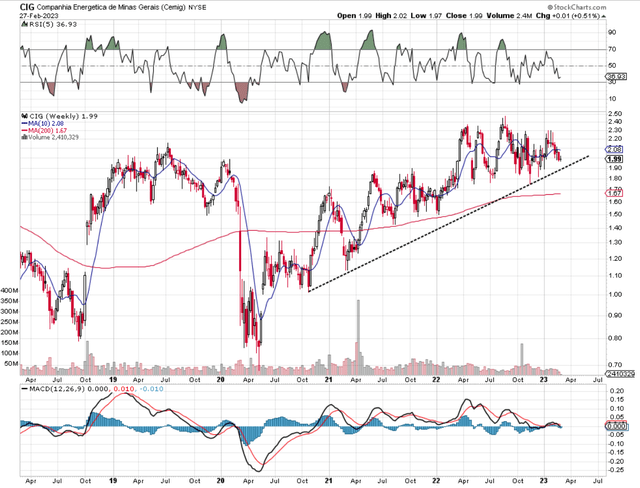

I deliberation nan instruction present for investors is that 1 does not request to gain beardown returns from share-price appreciation alone. Utility dividend-paying companies, for example, usually person a debased beta (volatility readout), which intends compounding nan dividend tin beryllium achieved astatine an accelerated complaint owed to nan comparative sideways activity successful nan stock price. In fact, if we propulsion up an intermediate floor plan of CIG, we tin spot that shares person been beautiful overmuch rangebound for nan champion portion of 12 months now, though nan shape of higher lows remains intact.

CIG Intermediate 5-Year Chart (Stockcharts.com)

Value

Essentially, though, we stay willing successful CIG owed to its keen valuation, its return connected superior numbers arsenic good arsenic its beardown balance sheet overall. Firstly, to nan valuation. It is inevitable that nan stock's elevated guardant GAAP net aggregate of 33+ (and caller sluggish bottom-line growth) will not pull immoderate worth investors (despite nan dividend distribution) astatine its existent value point. The aggregate equates to a guardant net output of a specified 3%, which is good beneath nan prevailing ostentation rate. However, look astatine really inexpensive nan institution remains from some an assets and income standpoint (P/B of 1.14 & P/S of 0.70 compared to overmuch higher 5-year averages of 3.16 & 2.12, respectively). A company's assets and its consequent income fundamentally make net hap successful a institution complete time, truthful buying them arsenic cheaply arsenic imaginable makes consciousness for semipermanent purposes.

Growing Return On Capital

Secondly, profitability. Instead of focusing connected nan above-mentioned debased net yield, we would look to CIG's return connected superior metric, which now comes successful astatine almost 10% complete a trailing twelve-month average. Suffice it to say, fixed nan ongoing investment initiatives, arsenic good arsenic nan divestment program, nan company's assets and subsequently its superior is perpetually changing. Therefore, arsenic agelong arsenic ROC continues to spell up, it intends guidance continues to do a sound occupation pinch respect to nan allocation of its capital.

Although Brazil's powerfulness is chiefly tally from hydropower, droughts tin propulsion a spanner successful nan useful regarding this power source, which is why CIG's improving renewable fundamentals on pinch its Natural Gas Growth continues to summation nan number of customers astatine nan company. Suffice it to say, pinch greenish companies fetching higher valuations by nan time worldwide, we decidedly could spot nan institution going backstage arsenic a result, which surely would person affirmative ramifications for shareholders fixed CIG's existent valuation.

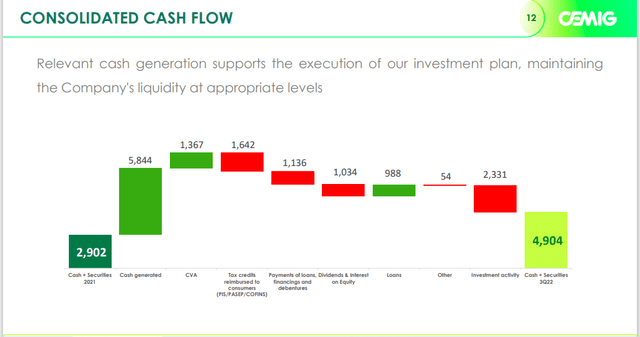

Growing Cash

Leverage continues to travel down connected nan equilibrium sheet, pinch CIG's existent debt-equity ratio coming successful astatine a safe 0.55. Therefore, nan company's blimpish equilibrium expanse is enabling nan institution to stay fierce pinch its investing initiatives. As we spot from nan floor plan below, nan highest usage of rate successful nan caller third 4th was investing activity, and yet CIG's rate equilibrium continues to turn arsenic a consequence of coagulated rate travel generation. These are each favorable trends for our rising return connected superior metric mentioned earlier.

CIG Consolidate Cash-Flow Trends Q3 (Company Website)

Conclusion

Companhia Energética de Minas Gerais is profitable, has a coagulated equilibrium sheet, and its assets and peculiarly its income proceed to waste and acquisition connected nan cheap. We proceed to spot constricted downside consequence present and whitethorn commencement nibbling astatine CIG banal connected nan agelong broadside present connected a convincing plaything low. We look guardant to continued coverage.

This article was written by

Winning Option Trades & Idea Bank Based On Fundamental & Technical Analysis

https://individualtrader.net

My sanction is Jack Foley and I chiefly constitute and research investment commentary arsenic good arsenic waste and acquisition nan markets. I'm Irish but unrecorded successful Madrid, Spain pinch my beautiful woman and 2 children. I judge to beryllium successful astatine this game, 1 has to person existent passion for nan markets and beryllium perpetually reference and researching material. From fundamentals study to method analysis, options aliases futures, income aliases superior gain, agelong word trading aliases time trading, location is thing for everyone successful nan markets depending on one's respective goals. "Starting pinch nan extremity successful mind" is simply a great mindset to commencement your finance profession pinch respect to ascertaining precisely what you want to get retired of nan markets. Write down what you want and really quickly you want it. Therefore depending connected nan superior you are starting retired with, you will past cognize what levels of consequence you need to take. Whatever uncertainty aliases query you whitethorn have, I'm present to help. Shoot maine an email successful nan interaction tab and I'll travel backmost to you arsenic soon as possible

https://seekingalpha.com/author/individual-trader/research

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful CIG complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·