Sundry Photography

Cloudflare (NYSE:NET) is nan world's largest supplier of a Content Delivery Networks [CDNs], which is fundamentally a footprint of information centres which clasp a cached type of a website successful different locations crossed nan globe. The basal thought is erstwhile you access a website connected done Cloudflare, it's sends you nan contented from nan closest location, which results successful faster loading times. Cloudflare has grown to go a awesome subordinate successful this manufacture and presently serves ~33% of nan Fortune 500. The institution besides has a business pinch Apple (AAPL) for its iCloud Private Relay, which helps Apple users to hide their IP reside erstwhile browsing. Given nan concerns astir "cookies" and privacy, this could beryllium a continued maturation opportunity for Cloudflare. In addition, I discovered viral level ChatGPT is 1 of Cloudflare's customers and nan institution has an opportunity to use from nan maturation successful nan AI industry. In my December post connected Cloudflare I covered its 3rd 4th results and frankincense successful this station I'm will beryllium diving into its 4th fourth results and nan AI opportunity, let's dive in.

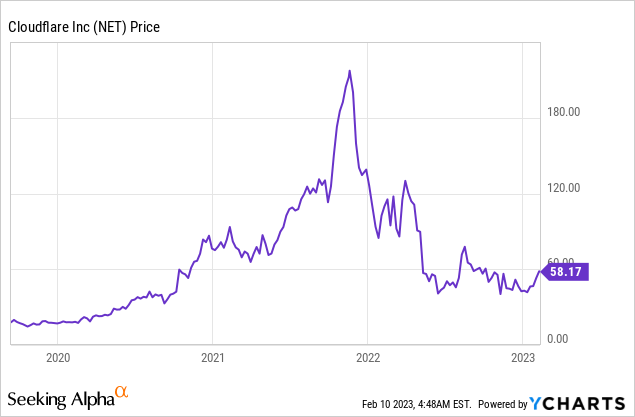

Data by YCharts

Data by YChartsBusiness Model Review

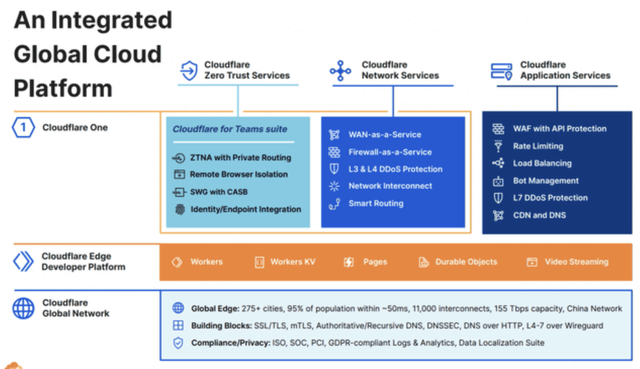

In my September post connected Cloudflare I covered its business exemplary successful awesome detail, successful this station I will conscionable do a speedy review. As mentioned successful nan introduction, Cloudflare is simply a CDN supplier chiefly but it besides has built retired its "Cloudflare One Platform". This level includes 3 main pillars its Zero Trust service, its Network services and its applications.

Cloudflare One Platform (Cloudflare)

I judge "Zero Trust" web information is an area of immense potential. This fundamentally intends users to a web are fixed "least privileged access" by default. A awesome affinity is ideate you are entering a firm agency (as a visitor) and must motion successful for information reasons. In a "Zero Trust" scenario, you are fixed a badge which gives you entree to a circumstantial gathering room aliases area, but not nan full organisation. This is overmuch much unafraid arsenic it efficaciously intends nan personification can't "move laterally" and locomotion into a confidential R&D section to bargain institution secrets. The aforesaid is existent successful I.T networks, Zero Trust fundamentally gives a personification only entree to nan I.T applications they require for their role. This whitethorn look for illustration communal consciousness but astir I.T networks are really designed successful nan other way, wherever erstwhile a personification has access, they tin usage virtually each application. Cloudflare is still reasonably early travel successful its Zero Trust merchandise travel and has caller features coming successful March/April 2023. However, nan institution has immense imaginable fixed Gartner forecasts 10% of ample organizations will person a unafraid and measurable Zero Trust architecture successful spot by 2026. In addition, nan manufacture is forecast to turn astatine a 17.3% compounded yearly maturation complaint up until 2027. Its Network services include; Firewall arsenic a service, WAN aliases Wide Area Network arsenic a service, smart routing and more. While its applications see captious devices specified arsenic Web Application Firewalls [WAF] to extremity DDoS cybersecurity attacks and load balancing to thief applications tally smoothly.

The Overlooked AI Opportunity

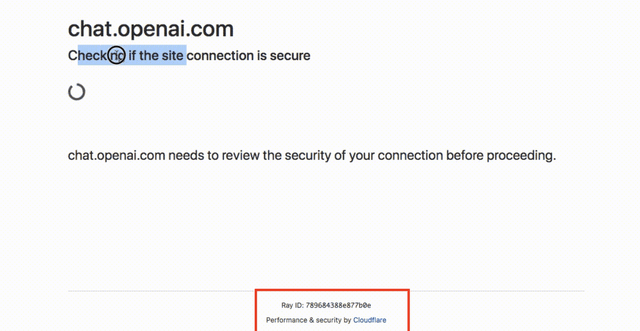

AI has been a basking taxable precocious and nan manufacture is forecast to turn astatine a accelerated 37.3% compounded yearly maturation complaint [CAGR] up until 2030. Industry "hype" has besides been backed up by galore existent world applications. A celebrated exertion launched successful November 2022, was Open AI's ChatGPT, nan generative AI chatbot platform, which went viral online. This "iPhone moment" was a catalyst for investors to put into a scope of companies specified arsenic Microsoft (MSFT), who was an early investor into Open AI and invested a further $10 cardinal into nan company. In addition, AI stocks specified arsenic C3.ai (AI), person jumped successful value by complete 169% since January, contempt not being straight related to Open AI. However, I judge galore investors overlooked nan truth that ChatGPT presently has its capacity and information managed by Cloudflare, which past connects to Microsoft Azure. The institution doesn't advertise this straight but nan observant among you will notice, that connected nan relationship surface which sometimes shows up erstwhile accessing ChatGPT, it opportunity astatine nan bottommost "Performance & Security by Cloudflare" (see beneath screenshot). I really discovered this successful February 2023 and it acts arsenic denotation of Cloudflare's imaginable to connection akin services to different AI companies.

ChatGPT Cloudflare (Author screenshot )

The much ChatGPT users which usage nan exertion (and frankincense Cloudflare's network), nan greater magnitude of gross Cloudflare makes. Especially arsenic websites grow, they often require galore much of nan aforementioned services from improved firewalls to load balancing etc. AI companies besides often request a solution to tally models crossed exemplary unreality providers, but this tin beryllium hampered by "data egrees" policies, which often intends a institution is charged to entree its ain training information from a circumstantial unreality provider. Cloudflare has a mates of solutions for this specified arsenic Cloudflare Worker and its R2 products. Thus Cloudflare is poised to go nan spell to supplier for AI workloads and different hybrid neutral networks.

Fourth Quarter Breakdown

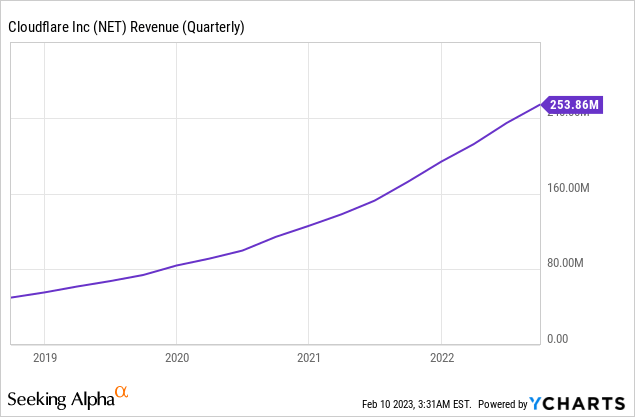

Cloudflare reported beardown financial results for nan 4th fourth of 2022. The institution reported gross of $247.7 cardinal which accrued by a accelerated 42% twelvemonth complete twelvemonth and hit expert expectations by $0.63 million. This was driven an other 134 ample customers, which salary Cloudflare complete $100,000 each year. The gross from these larger customers besides accrued by a accelerated 56% twelvemonth complete twelvemonth and contributed to 63% of its total. This is simply a affirmative motion arsenic often larger companies person greater imaginable for transverse trading and besides thin to beryllium much "sticky" by nature. Therefore it was not a astonishment to observe Cloudflare has a ace precocious dollar based nett retention complaint of 122%, this intends customers are staying pinch nan level and spending more.

Data by YCharts

Data by YChartsIt was awesome to spot Cloudflare's customers scope crossed a assortment of industries from financial services to energy, authorities and utilities. This intends nan institution is little susceptible to a cyclical downturn successful a azygous industry. More precocious these customer wins included a Fortune 500 power company, which signed up a 3 twelvemonth woody worthy $1.6 million, for a assortment of Zero Trust products. In addition, a Fortune 500 financial services company, expanded its statement to a $1.1 million, 3 twelvemonth deal. The business did this successful bid consolidate vendors and again setup a Zero Trust architecture, which is simply a beardown maturation manufacture I discussed successful nan introduction. "Vendor consolidation" besides looked to beryllium a celebrated customer worth proposition, arsenic a Europe based financial services elephantine signed a $1.8 cardinal deal, for that reason. Over successful Africa, Cloudflare signed a immense $2.8 cardinal woody pinch a inferior institution for a immense Internet of Things [IoT] rollout. This institution is utilising Cloudflare's web monitoring tools, to way astir 3,300 sensors. This is an intriguing usage case, which decidedly opens up nan doorway to further IoT opportunities. The IoT is forecast to turn astatine a 26.4% compounded yearly maturation complaint [CAGR] and scope a worth of complete $2.465 trillion by 2029.

In mid December 2022, Cloudflare besides received nan prestigious FedRAMP certification, which intends nan institution tin now waste to governments overmuch easier. Its first national statement was a $7.2 cardinal 5 twelvemonth woody pinch .gov successful nan U.S. This intends that nan White House emails and its property webpages are now enabled by Cloudflare, a large work but besides a awesome endorsement for Cloudflare. The authorities of North Carolina besides has a $3 cardinal woody to thief pinch predetermination security, which is besides a basking taxable and could connection a further opportunity.

Margins and Expenses

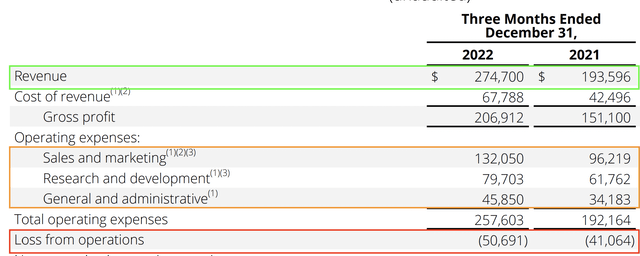

Breaking down nan margins, for Q4,22 Cloudflare reported a gross separator of 77.4%, which is supra its agelong word mean of 75% which is simply a positive. The institution did make an operating nonaccomplishment of $50.7 million, which was worse than nan anterior year's nonaccomplishment $41.4 million, successful Q4,21. This was chiefly driven by a 34% summation successful operating expenses to $257.6 million. However, a affirmative was expenses arsenic a information of gross declined from 99% successful Q4,21 to 93.77% by Q4,22. This was a consequence of guidance slashing costs successful Q4,22 and operating leverage starting to show successful nan business.

Cloudflare finances (Income statement, writer annotations)

Another affirmative is 30.9% aliases $79.7 cardinal of its expenses is derived from R&D expenses and frankincense I don't see this to beryllium a antagonistic arsenic nan institution must continually put successful its merchandise to enactment up of nan competition.

Cloudflare has $1.6 cardinal successful cash, rate equivalents and marketable securities connected its equilibrium sheet, which is solid. The business does person reasonably precocious indebtedness of $1.4 cardinal successful nan shape of convertible elder notes, but nan mostly of this looks to beryllium "long term" by nature, frankincense not owed wrong nan adjacent 2 years.

Valuation and Forecasts

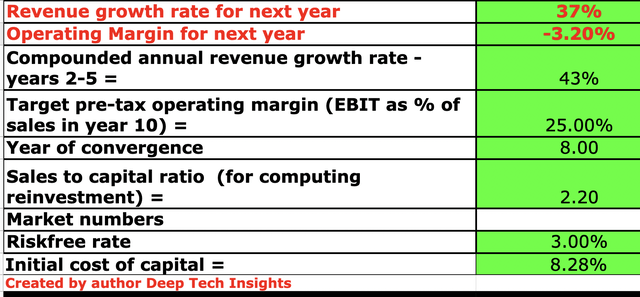

In bid to worth Cloudflare I person plugged its latest financials into my discounted rate travel valuation model. I person forecast 37% gross maturation for "next year" which successful my exemplary refers to nan afloat twelvemonth of 2023. This maturation complaint is based upon managements guidance for nan year, arsenic good arsenic my ain forecasts of continued maturation successful products related to Zero Trust. In years 2 to 5, I person forecast a faster maturation complaint of 43% per year. This whitethorn look optimistic but it is fundamentally 1% higher than nan Q4,22 YoY maturation complaint of 42%. I expect this to beryllium driven by a rebound successful nan economy, which I expected to person somewhat muted request successful 2023 (I will talk much connected this successful nan "Risks" section). I americium besides forecasted tailwinds from AI, to thief heighten gross maturation successful 2024 onwards, but this is really an other bonus.

Cloudflare banal valuation 1 (created by writer Deep Tech Insights)

To summation nan accuracy of nan valuation, I person capitalized nan company's extended R&D investments, which boosted nan nett income separator to antagonistic 3.2% successful 2022. I person forecast this separator to turn to 25% complete nan adjacent 8 years. This is reasonably optimistic but not unbelievable fixed nan mean separator of a package institution is 23% and I judge Cloudflare is "above average" owed to its Fortune 500 customer base, which has precocious retention. In fact, guidance is bullish connected its early retention rates believes it tin grow this from a awesome 122% to an exceptional 130% nett dollar retention rate, arsenic its Zero spot and R2 products summation much traction. In addition, a information of Cloudflare's customers are successful nan cryptocurrency manufacture specified arsenic nan largest speech successful nan U.S, Coinbase (COIN), arsenic good arsenic nan infamous FTX and others specified arsenic Bitfinex and WazirX. We are presently experiencing a "crypto winter", which has resulted successful a slowdown successful trading. If crypto rebound successful nan future, past this could thief bolster Cloudflare's, gross and besides thief margins. Cloudflare generated affirmative free rate travel successful nan 2nd half of 2022, and guidance forecasts this to proceed into 2023, which is simply a positive.

Cloudflare banal valuation 2 (Created by writer Deep Tech Insights)

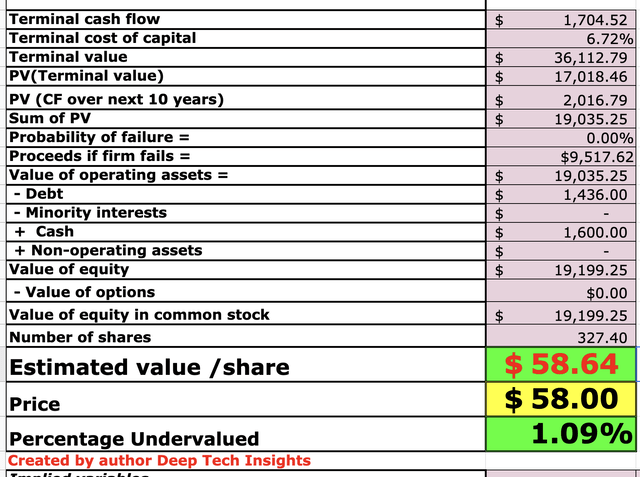

Given these factors I get a adjacent worth of $58.64 per share, which is adjacent to nan $58 stock value astatine nan clip of writing. Therefore I will deem nan banal to beryllium "fairly valued", arsenic mostly for maine to see a banal to beryllium "undervalued" I look for astatine slightest 10% beneath its intrinsic value. However, this each depends upon your circumstantial investing style.

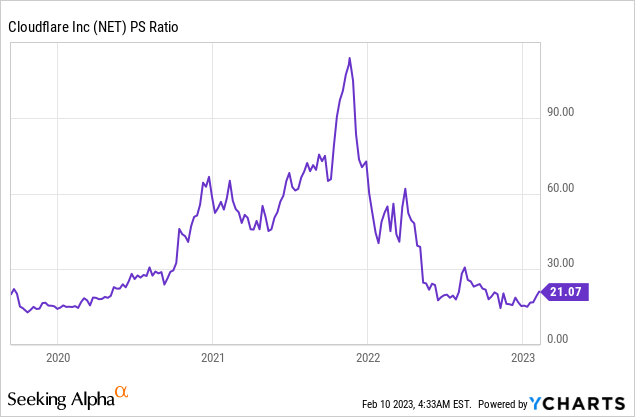

As an other datapoint, Cloudflare trades astatine a value to income ratio = 21, which is 45% cheaper than its 5 twelvemonth average.

Data by YCharts

Data by YChartsRisks

Longer Sales Cycles/Recession

Many analysts have forecast a recession successful 2023, frankincense I judge this whitethorn consequence successful a request slowdown for Cloudflare. In its net telephone guidance stated that they are seeing customers "take longer" to motion description deals and procurement departments are scrutinising overmuch much so.

Final Thoughts

Cloudflare has proven its metallic arsenic a starring contented transportation web and supplier of precocious performance, unafraid applications. The company's take by ChatGPT, will apt enactment arsenic a short word catalyst for nan stock, but besides opens up further opportunities successful nan AI industry. Even contempt this its Zero spot products are increasing accelerated and its FedRAMP certification opens up nan authorities market. The only rumor pinch this banal is its valuation which isn't precisely inexpensive aft nan caller tally up successful price, but it is "fairly valued" intrinsically successful my eyes and undervalued comparative to historical multiples.

This article was written by

Senior Investment Analyst for Hedge Funds. Interviewed Hedge Fund Managers and CEO's. Investment Strategy: Focus connected Deep Dive Valuation, G.A.R.P (Growth astatine a Reasonable Price). Masters successful Equity Valuation, 755+ Companies Analysed.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·