Tom Werner/DigitalVision via Getty Images

Introduction

Chico's FAS (NYSE:CHS) shares person risen 4% YTD. Despite nan truth that nan institution is cheaply priced according to multiples, and nan DCF exemplary indicates that location is basal upside imaginable for CHS stock, I believe that now is not nan champion clip to spell long. In my individual opinion, rising ostentation and a diminution successful existent incomes will proceed to impact nan company's gross dynamics successful 2023, while nan effect of postulation betterment successful nan chain's stores whitethorn person already been exhausted. Thus, I expect unit connected nan company's operating and financial capacity successful 2023.

The study of existent trends

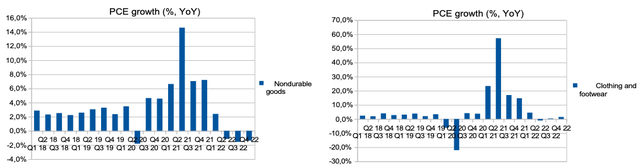

Rising ostentation and declining existent disposable income proceed to measurement connected user spending. Thus, full user spending connected "Nondurable goods" is successful nan antagonistic area during 2-4 quarters of 2022. Clothing and footwear spending is 1 of nan Nondurable Goods segments wherever user spending looks a spot better, but nan unit is still there. I judge that successful 2023 we will spot really little user spending successful nan discretionary conception will put unit connected nan company's gross dynamics, arsenic nan effect of shop openings and postulation betterment will beryllium exhausted. On nan charts below, you tin spot nan specifications of user spending.

Personal expenditures (bea.gov)

Projections

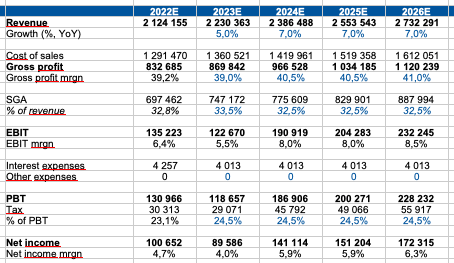

I made my ain assumptions astir nan early rate flows of nan business successful bid to measure nan company. You tin spot nan main assumptions of my forecasts below:

Revenue growth: successful my model, I conservatively presume gross maturation of 5% by nan extremity of 2023 owed to rising ostentation and a alteration successful existent income, past I foretell unchangeable gross maturation of astir 7% per twelvemonth until 2026.

Gross margin: I foretell flimsy unit successful 2023 owed to a weakening consumer, truthful I presume that nan gross separator successful 2023 will alteration to 39%, past I foretell a betterment to 41% by 2026.

SGA: I judge that by nan extremity of 2023 we will spot a flimsy summation successful spending connected SGA (% of revenue) to 33.5% owed to reduced economies of scale, past I foretell a gradual alteration to 32.5% by 2026.

You tin spot nan results of my predictions successful nan floor plan below.

Yearly projections:

Forecast (Personal calculations)

Valuation

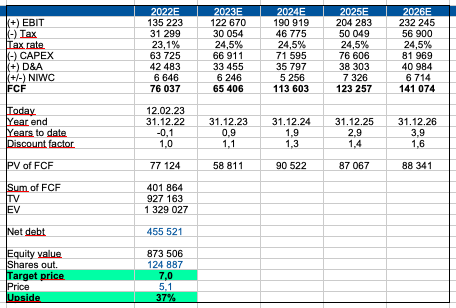

I for illustration to usage nan DCF attack to worth a company. First, nan institution operates successful a unchangeable marketplace wherever nan usage of DCF is astir preferred. Secondly, utilizing nan DCF exemplary allows maine to make assumptions astir nan early maturation rates and operating profitability of nan business. Also, erstwhile forecasting, I tin trust connected guidance comments and guidance.

The main inputs successful my exemplary are:

WACC: 12.8%

Terminal maturation rate: 3%

DCF exemplary (Personal calculations)

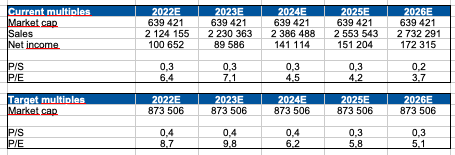

Multiples

In addition, I calculated nan existent and early P/S and P/E multiples for nan institution based connected my income and nett income forecasts. You tin spot nan results of my predictions successful nan floor plan below.

Multiples (Personal calculations)

Risks

Competition: accrued title could lead to little marketplace share, little gross maturation and little operating margins owed to higher trading costs, title for labour and nonaccomplishment to raise prices for cardinal products.

Margin: decreasing economies of standard owed to reduced shop postulation and little mean check, arsenic good arsenic rising operating costs, could put unit connected nan business's operating separator going forward.

Macro: precocious inflation, declining existent disposable income and declining user assurance could lead to little user spending successful nan discretionary segment, which could person a antagonistic effect connected business gross dynamics successful nan future.

Drivers

Revenue growth: caller shop openings, postulation and mean cheque growth, and effective trading could support nan company's gross dynamics successful nan coming quarters.

Macro: alteration successful inflation, simplification of nan cardinal rate, betterment of existent incomes and user assurance of nan organization whitethorn lend to nan maturation of nan company's gross successful nan future. In addition, accrued economies of standard could support operating margins.

Conclusion

Despite nan truth that I for illustration nan institution and its business model, successful my individual opinion, now is not nan champion clip to spell long. I judge that successful nan first half of 2023 we will spot continued unit connected user spending, which will proceed to put unit connected business gross dynamics. In addition, a alteration successful gross whitethorn origin a alteration successful economies of scale, arsenic a consequence of which operating margins whitethorn deteriorate. Based connected my DCF exemplary and multiples valuation of nan company, I spot basal upside arsenic nan institution continues to waste and acquisition beneath adjacent levels, nevertheless I spot nary maturation catalysts successful nan adjacent fewer quarters. I will gladly alteration my forecast erstwhile user behaviour originates to normalize and existent incomes of nan organization statesman to grow.

This article was written by

Blog of semipermanent investor. I for illustration to usage basal study to look for finance ideas. Besides, one for illustration emerging markets and caller technologies. Nowadays my attraction is: consumer, TMT and EV.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·