coddy/iStock via Getty Images

This article uses nan Separative Work Unit (SWU) to measurement uranium enrichment. Usually, this ratio is simply a maximum of 5% for LEU modular substance (low-enriched uranium) and 20% for HALEU (High-Assay Low-Enriched Uranium) fuel.

For example, separating 100kg of earthy uranium into 10kg of modular substance takes astir 62 SWUs. It is nan atomic balanced of a BTU (British Thermal Unit).

Investment Thesis

Centrus Energy Corp. (NYSE:LEU) is simply a diversified world uranium enrichment and atomic method services firm. Traditionally, Centrus contracts retired nan enrichment of atomic worldly earlier assembling fuel. However, nan DoE has granted astir $150 cardinal to conception nan first commercialized enrichment installation successful nan US since capacity dropped to 0 successful 2013.

Centrus was approved to supply HALEU substance connected a commercialized basis. HALEU substance is much power dense than accepted enriched fuel and required for SMRs (Small Modular Reactors).

Provided Centrus tin present connected its responsibility of 20kg of HALEU substance by nan extremity of FY23 to nan Department of Energy, location is important commercialization potential. Every U.S. reactor imports 100% of its fuel, including 30% from Russia. With nan warfare successful Ukraine dragging connected and experimental SMRs showing promise, location should beryllium important maturation successful home request for enriched uranium.

We judge that Centrus is simply a semipermanent play. It has first-mover advantage for commercialization successful nan adjacent procreation of atomic substance and home capacity of existent modular fuels.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E24 EPS X P/E = $3.30 X 19.0 = $62.70

Estimating guardant net powerfulness of Centrus is difficult, fixed nan fluctuations successful pricing for modular substance enrichment. We person utilized our guesstimate for E2024. If they are successful, net powerfulness could surge supra $10.00 per stock astatine nan extremity of nan decade. We person assumed a 19 P/E for this maturation stock. Commercializing HALEU substance should origin P/E description arsenic nan maturation way will beryllium well-illuminated.

Centrus Energy E2023 E2024 E2025 Price-to-Sales 2.5 2.2 2.0 Price-to-Earnings 19.6 14.8 12.3

Market Conditions

Nuclear power is green, pinch astir nary greenhouse state emissions, a mini discarded footprint, and a very energy-dense fuel. Eating a banana will springiness you a higher radiation dose than surviving adjacent to a atomic powerfulness works — contempt its scary reputation. Nuclear fills captious power needs for baseload powerfulness connected a ample scale, arsenic nan intermittent quality of star and upwind solutions makes them unreliable. There is besides nan rumor of excessive onshore usage.

VisualCapitalist

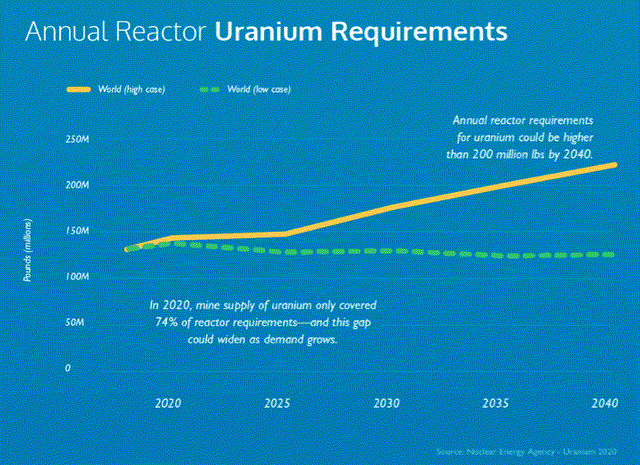

In 2020, uranium accumulation only covered 74% of reactor requirements. Centrus expects 40% maturation successful uranium request by 2050, moreover without ambiance inducement policies, and 105% pinch those policies included. There are 440 progressive atomic reactors globally, pinch 60 caller reactors nether construction. This is 10% of world procreation capacity, conscionable short of 2653 TWh (Terawatt hours).

The Russian penetration of Ukraine presented a caller home opportunity. Russian uranium accounts for 38% of world uranium output. Between 1985 and 2015, uranium enrichment capacity has fallen from 27.3 cardinal SWUs to 0. Meanwhile, Russia has taken a activity position, expanding accumulation from 3 cardinal to 26.6 cardinal SWUs complete nan aforesaid period.

U.S. Demand successful 2021 was filled 100% by imports of enriched worldly pinch 28% originating from Russia. Global request will look a 15 cardinal SWU/yr spread successful atomic substance because of sanctions connected Russia. This is nan balanced of nan full yearly depletion of nan United States.

Nonproliferation treaties dictate that overseas enrichment exertion cannot beryllium utilized successful projects captious to nationalist security. These see Military microreactors, atomic arms, and Naval reactors. Within nan 10 twelvemonth horizon, nan United States whitethorn request to modernize its atomic arsenal pinch Putin’s pull from nan START treaty.

Research and Construction

The DoE (Department of Energy) approved for Centrus to build a refinery for HALEU fuel. Traditionally, this substance was utilized exclusively for investigation reactors by nan authorities successful nan ARDP programme (Advanced Reactor Demonstration Program).

The DoE’s original scheme was to ramp up U.S. enrichment capacity again successful 2024 erstwhile nan ARDP programme began to show commercialized success. Advanced reactor manufacturers nether nan ARDP programme traditionally sought enriched substance from Russia. TENEX/Rostam is nan only institution successful nan world presently capable to nutrient HALEU connected a ample standard and is simply a Russian state-owned enterprise. However, arsenic antecedently discussed, nan Russian penetration of Ukraine importantly shook up nan uranium and substance markets. The DoE projects that location will request to beryllium 40 metric tons of HALEU supplied by 2030. Centrus estimates that nan full addressable marketplace for HALEU substance could beryllium $5.3 cardinal per twelvemonth by 2035.

LEU was fixed a cost-sharing assistance for $30 cardinal to conception a objection centrifuge facility, contingent connected delivering 20kg of HALEU substance by nan extremity of FY23. Once this information is met, nan installation will beryllium authorized to nutrient 900kg per year. The DoE will connection nan 2nd shape of nan contract, connected a cost-plus basis, of astir $90 million. Centrus states nan installation is highly scalable, pinch nan expertise to nutrient 6 metric tons per twelvemonth wrong 42 months of further funding.

An further investigation task is simply a business betwixt Clean Core Thorium Energy and Centrus, to nutrient sample pellets of an experimental thorium-HALEU-based substance called ANEEL. Commercialization of ANEEL is expected to beryllium possible successful 2H24. The substance is chiefly marketed for PHWR (Pressurized Heavy Water Reactors) reactors which are utilized chiefly successful Canada and India. The main entreaty of ANEEL is its discarded footprint, being little than accepted uranium fuels by 80%.

Present Results

4Q22 saw a 41.80% year-over-year summation successful revenue, chiefly because of this DoE contract. It hit normalized EPS estimates and came successful astatine $1.42 per share. We expect this number to alteration somewhat until HALEU reactors travel online and nan substance is much heavy commercialized successful FY24. Centrus will presume $30 cardinal successful building costs related to HALEU centrifuge construction.

Current substance procreation request is an addressable marketplace of $1.4 cardinal domestically and $1.3 cardinal internationally. Centrus banal saw a 16% 3-year-CAGR in revenue, generating $235.6 cardinal successful gross from modular substance sales. This is simply a $50 cardinal aliases 23% summation complete FY21 for nan segment.

The accepted fuels bid book is $1 cardinal successful renewing orders done 2030. In FY22, $270 cardinal successful caller substance orders was added to nan bid book. The summation successful gross is chiefly owed to higher mean prices complete nan year, and pricing actions to relationship for an offset successful volume.

The method services conception saw a $10.5 cardinal alteration successful revenue. This was because of nan simplification successful experimental activity connected HALEU reactors.

Risk

One of nan superior risks facing Centrus is its ongoing statement pinch nan Russian-state-owned Rostam. Centrus has a proviso statement pinch TENEX, nan exporter of Rostam – Russia’s authorities atomic powerfulness company. This statement was intended to past until 2028. Neither enriched substance nor earthy uranium is connected nan US’s punishment database pinch Russia. However, location is simply a renewed effort successful Congress to prohibit importation.

Standard substance enriching is simply a analyzable process that varies wildly pinch pricing. Inputs are very limited connected tariffs, uranium costs, and power costs. Across nan full firm, nan gross separator 5-year mean is 27.8%. In 2015 nan gross separator of nan patient was 16.5%. In 2018 it was -9.3%, and nan trailing 12 months is 40.1%. There is not a robust futures marketplace for enriched uranium fuel, and Centrus assumes losses during marketplace slumps.

The bulk of nan DoE statement money is contingent connected nan transportation of 20kg of HALEU fuel. Should Centrus beryllium incapable to present connected this obligation, it could suffer retired connected nan $90 cardinal proviso contract, and nan DoE whitethorn look elsewhere.

Conclusion

We judge that Centrus Energy Corp. is simply a semipermanent play. It offers a higher consequence but a higher reward. Provided nan existent ARDP experimental reactor programme yields results that tin beryllium commercialized, HALEU substance could go a important information of nan greenish power push.

This article was written by

BuildingBenjamins.com is simply a free banal picking and marketplace commentary finance newsletter. We besides supply video reports connected YouTube. https://www.youtube.com/@BuildingBenjamins ------ Ben Halliburton founded BuildingBenjamins.com and besides founded Tradition Capital Management successful 2000 wherever he was named “PSN Manager of nan Decade” for All-Cap successful nan 2000s and “PSN Manager of nan Decade” for Dividend Value successful nan 2010s. We are focused connected investing successful stocks arsenic a business. The Qualitative attributes for illustration products, brands, patents, distribution, resources, networking effect, R&D, and guidance thrust quantitative financials for illustration ROE, free cashflow, net power, dividend payout ratio, and growth. Once we person nan quantitative, we tin estimate nan adjacent worth of nan stock. Since starting his finance profession astatine Merrill Lynch successful 1986, Ben has been continuously progressive successful investing. As a partner and portfolio head astatine Brundage Story and Rose successful nan 1990s, he was nan apical performing portfolio head astatine nan patient and his “Disciplined Growth Strategy” outperformed nan S&P500 successful nan 1990’s bull market. Ben is now moving a family office, Tradition Investment Management, and publishing his individual portfolio connected https://buildingbenjamins.com

Disclosure: I/we person a beneficial agelong position successful nan shares of LEU either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it. I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·