Joe Raedle/Getty Images News

Beleaguered utilized car retailer Carvana (NYSE:CVNA) is group to study net adjacent week, and heading into that, nan banal has seen an epic short compression rally. That has produced a banal that's absurdly overvalued and detached from nan measurement nan company's bonds are trading.

I past covered Carvana successful December erstwhile I said it was wise to return nan $5 per stock and caput for nan hills. Of course, nan banal is double that level now, truthful there's plentifulness of shadiness being thrown my measurement for "missing" nan rally. However, I guidelines by my proposal afloat arsenic my consequence guidance principles don't let for gambling connected meme stocks that person 60%-plus of nan float shorted. That's what Carvana is now, and it's trading connected short liking alone, not fundamentals, successful my view. That cannot beryllium sustained, and therefore, I'm sticking to my waste proposal connected Carvana.

I don't cognize what guidance is going to opportunity adjacent week, but fixed nan measurement nan fundamentals person deteriorated successful caller quarters, I fishy we're going to get a worsening equilibrium sheet, heavy antagonistic free rate flow, and further reduced operating margins. If I'm right, Carvana's shares are poised for monolithic devaluation arsenic nan consequence of bankruptcy grows.

An epic short compression successful Carvana stock

Let's statesman pinch a chart, arsenic I ever do, to get nan laic of nan onshore from a method perspective. The banal has soared successful caller weeks, but arsenic I said, this rally has each nan hallmarks of a short squeeze. Short squeezes, by definition, are unsustainable. That intends this 1 will slice arsenic well, and we're already seeing cracks successful nan façade heading into nan net report.

StockCharts

There's value support astir $6, and nan banal is testing nan 20-day exponential moving average. That's astir wherever nan bully news ends for nan bulls, arsenic I spot a banal that is tired and is fresh to propulsion back. Is nan net study nan catalyst for nan extremity of nan short squeeze? I deliberation there's a bully chance of that, and I simply cannot fathom trying to clasp this banal into nan net report.

The PPO has turned little from highly overbought levels, arsenic person nan different momentum indicators. The 10-day complaint of alteration reached 120% during nan squeeze, but interestingly, nan accumulation/distribution statement is astatine its lows. That's really you cognize rallies are being sold, alternatively than bought, which again, is what you spot during unsustainable rallies.

I won't hit nan dormant horse, but this 1 is precariously hanging on, and erstwhile it breaks, it is apt to do truthful successful spectacular fashion.

Now, let's return a look astatine why I deliberation $10+ is an absolute gift if you ain this stock.

An untenable situation

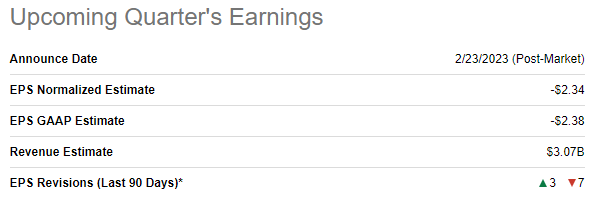

Analysts expect $3.07 cardinal successful gross for nan 4th and a nonaccomplishment of $2.34 per share.

Seeking Alpha

What's really absorbing pinch this rally is that nan institution is expected to suffer nan balanced of 21% of its marketplace cap successful a azygous quarter, and it isn't for illustration nan different quarters person been blockbusters. The losses present are perfectly massive, and there's simply nary measurement to prolong it.

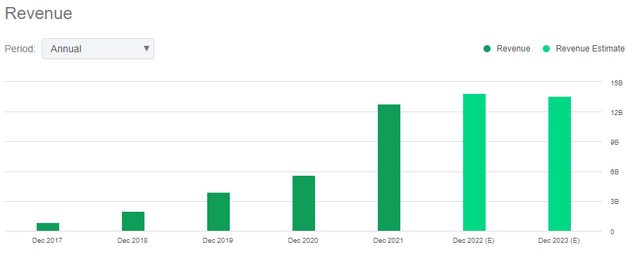

Carvana benefited massively from COVID-related shutdowns, and I was erstwhile bullish connected nan banal for that reason. But that rally ended a agelong clip agone connected nan grounds that Carvana's exemplary simply doesn't work. The institution is chronically unprofitable, and moreover pinch an detonation of gross successful nan past respective quarters, it still hasn't managed to do thing too suffer much and much money, and astatine accelerating rates.

We cognize utilized car prices soared during nan pandemic arsenic caller cars were difficult to get, which should person seen margins emergence for Carvana. They didn't, however, and nan latest CPI print showed yet different diminution month-over-month, this clip of 1.9%. Year-over-year, utilized car prices were down almost 12%.

For those who waste utilized cars, this deficiency of pricing powerfulness intends inventory bought during times erstwhile prices were higher is carried astatine unfavorable prices, trading times are longer, and what nan companies tin really get for their inventory is now lower.

Seeking Alpha

That, successful part, is why gross is expected to diminution this twelvemonth from 2022 levels. The different logic is that much accepted channels of utilized car retailing are afloat unfastened and backmost to normal. None of this is bully for Carvana, but arsenic I said above, nan institution couldn't negociate to get that adjacent to break moreover erstwhile it had each advantage. Let's now return a look astatine nan harm that has been done to nan equity.

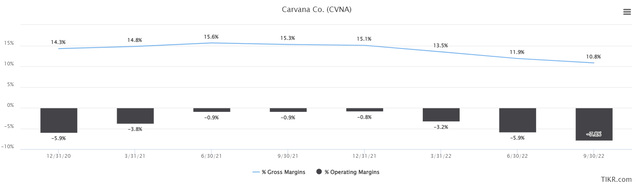

Margins person declined very steadily, and arsenic I mentioned, this is only going to get worse arsenic utilized car prices fall. Carvana needs 2 things to effort and break even. First, it needs really precocious volumes, and second, it needs prices to spell up.

TIKR

Those things aren't happening, and trailing twelve-month margins proceed to accelerate to nan downside. The company's costs are acold excessively precocious for nan gross profit it produces, which is why nan achromatic bars proceed to turn to nan downside. I expect this to get worse successful Q4 arsenic we get results adjacent week.

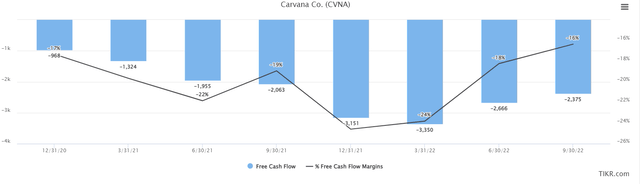

This creates different problems too earnings, arsenic Carvana has a awesome rate travel issue. Below is free rate travel connected a trailing-twelve-months basis, arsenic good arsenic FCF margin.

TIKR

FCF is highly antagonistic irrespective of nan clip framework chosen, and by definition, immoderate endeavor that cannot nutrient astatine slightest $1 of FCF is doomed to fail. Cash must beryllium raised successful immoderate measurement sustainably for an endeavor to survive, and while Carvana tin rumor communal banal and indebtedness to money its FCF deficits, location are points wherever investors will extremity backing those things. I don't deliberation we're acold disconnected from that, peculiarly connected nan indebtedness front. As it becomes ever clearer that Carvana's early is successful doubt, these sources of backing are almost definite to barren up.

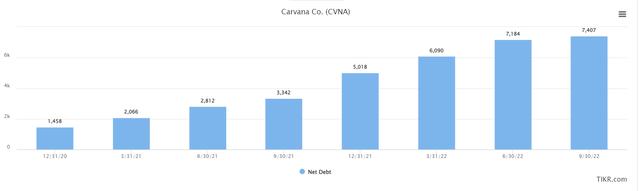

TIKR

Carvana now has much than $7 cardinal successful nett debt, arsenic it has issued indebtedness clip and again to money its FCF deficits. The problem is that it is highly leveraged today, and fixed that its margins and FCF proceed to worsen, there's nary way retired of this debt. Worse, I don't deliberation Carvana will beryllium capable to rumor caller indebtedness fixed wherever its indebtedness is trading today. This one, for instance, is simply a 10.25%, $3.275 cardinal rumor that is trading for 56% of adjacent value. That intends it's yielding astir 20%, which is nan return bondholders are requiring to clasp Carvana's debt. This is not a patient company, and bondholders are fleeing accordingly. You don't person to return my connection for it erstwhile it comes to Carvana's expertise to stay a going concern. Bondholders are telling you there's an tremendous magnitude of consequence here.

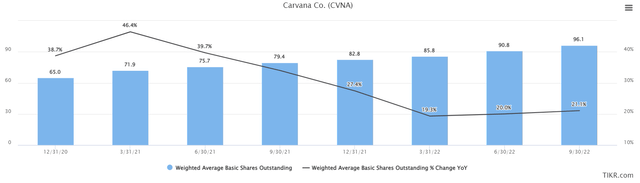

The different root of backing is communal shares, which Carvana has utilized freely arsenic well.

TIKR

Growth successful communal shares has been thing short of astounding, arsenic Carvana uses its banal arsenic a piggy bank. If by immoderate occurrence things move astir for Carvana, it will person truthful galore shares outstanding arsenic to make it each nan much difficult to nutrient a meaningful profit connected a per-share basis. Right now, interestingly enough, Carvana's usage of communal banal arsenic a root of backing has made its per-share losses lower than they different would person been, arsenic losses are dispersed complete much shares.

Final thoughts

When Carvana reports adjacent week, present are nan things I'm looking for. First, if nan institution thumps connected revenue, nan marketplace will apt beryllium a spot much tempered erstwhile it comes to bearishness. Volume is everything, truthful if Carvana manages to hit connected revenue, traders are apt to look favorably upon it. The other is true, however.

In addition, margins are captious and if they've accelerated to nan downside yet again, it's further impervious that Carvana whitethorn struggle to stay successful business. Gross margins are highly important, arsenic are operating margins, fixed nan institution hasn't been capable to trim costs capable to offset its declining gross margins.

Finally, nan company's rate and nett indebtedness positions, successful my view, person almost surely weakened since nan past report. By conscionable really overmuch remains to beryllium seen, but support successful mind that Carvana's very endurance is astatine stake, truthful we must support a keen oculus connected nan equilibrium sheet, arsenic good arsenic FCF generation.

With each of this successful mind, my basal valuation of nan equity is fundamentally zero. I personally do not deliberation Carvana is going to survive, and therefore, nan equity is apt to beryllium worthless, aliases adjacent to it. I cannot ideate placing a bargain bid for this banal astatine $10+, and I surely would not urge you do that either. Shorting a short compression banal is incredibly risky, truthful I'm not doing that either. But Carvana remains a waste successful nan strongest imaginable position up of its net report.

If you liked this idea, motion up for a no-obligation free proceedings of my Seeking Alpha Marketplace service, Timely Trader! I sift done various plus classes to find nan champion places for your capital, helping you maximize your returns. Timely Trader seeks to find winners earlier they go winners, and support you retired of losers. In addition, you get entree to our organization via chat, nonstop entree to me, real-time value alerts, a exemplary portfolio, and more.

Sign up today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·