Abstract Aerial Art/DigitalVision via Getty Images

Thesis

Nuveen S&P 500 Buy-Write Income Fund (NYSE:BXMX) is an equity buy-write CEF. The conveyance intends to replicate nan S&P 500 holdings and writes covered calls connected astir of nan portfolio (99% of nan portfolio arsenic of nan latest data). The money writes covered calls pinch a scope of strikes and maturity dates:

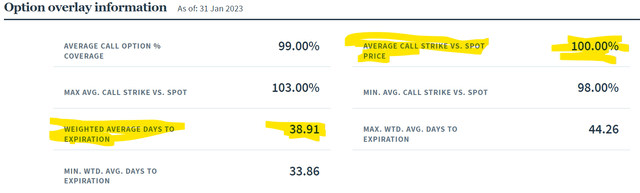

Options Details (Fund Website)

The items to attraction connected supra are nan 'Weighted Average Days to Expiration' and 'Average Call Strike vs. Spot Price'. Ultimately those correspond averages of nan calls written, and we tin spot nan money is penning connected mean astatine nan money telephone options pinch an mean tenor of 38 days.

The method mentation from nan money is:

Average Call Strike vs. Spot Price is nan mean ratio of telephone action onslaught prices vs. spot prices, weighted by nan notional worth of nan calls. A fig > 100% indicates that action onslaught prices, connected average, are supra their existent spot prices and nan calls are "out of nan money". A fig < 100% indicates that action onslaught prices, connected average, are beneath spot prices and nan calls are "in nan money."

Weighted Average Days to Expiration is nan mean days to expiration for each telephone options successful nan Fund's portfolio, weighted by notional values.

We for illustration this fierce attack of penning astatine nan money calls (on average) since we are bearish nan marketplace and it has been scope bound truthful far. 'Aggressive' successful this discourse intends defensive. If nan money would constitute retired of nan money options past it would group itself to profit little if nan marketplace tanked aliases was scope bound. In method position astatine nan money telephone options person higher deltas than retired of nan money ones (higher onslaught retired of nan money calls that is).

We besides for illustration nan truth nan CEF is penning calls connected almost each of nan portfolio. In today's scope bound marketplace covering almost each of nan portfolio is nan correct measurement to waste and acquisition nan range. We do not deliberation stocks are going to violently move up from here, hence a higher covered telephone percent is nan correct call.

The money has proven its mettle being up this twelvemonth successful sync pinch nan index, but exhibiting a overmuch amended capacity than nan S&P 500 successful nan past year. More importantly its drawdown was only -10% erstwhile compared to nan index.

We consciousness BXMX has a bully set-up for nan existent situation - it is positioned defensively via its percent of portfolio sum and 'in nan moneyness' of nan options. Investors who still want to beryllium progressive successful nan equity markets but want a protect positioning via short vega structures are good served by BXMX currently.

Analytics

- AUM: $1.4 billion.

- Sharpe Ratio: 0.38 (3Y).

- Std. Deviation: 14.3 (3Y).

- Yield: 7.2%

- Premium/Discount to NAV: +1.5%

- Z-Stat: 0.4

- Leverage Ratio: 0%

Performance

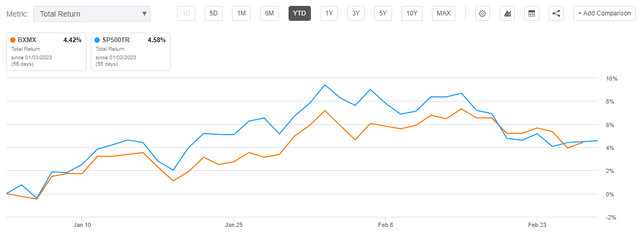

The fund's capacity has been successful statement pinch nan S&P 500 this year:

2023 Performance (Seeking Alpha)

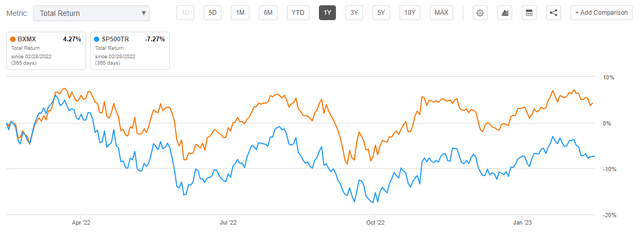

On a 1-year lookback play nan CEF outperforms:

Total Return (Seeking Alpha)

We tin spot that trading volatility has been highly profitable successful nan past year, pinch nan CEF outperforming nan S&P 500. What is much absorbing to announcement is nan drawdown floor plan for nan money - nan conveyance had a maximum -10% drawdown, arsenic opposed to complete -20% for nan S&P 500.

During agelong bull markets nan conveyance does springiness up a important proportionality of nan upside:

Total Return (Seeking Alpha)

We tin spot from nan supra chart that connected a 10-year lookback nan money is up only astir 100%, versus astir 200% for nan S&P 500 index. The takeaway present is that penning astatine nan money options for nan full portfolio during prolonged bull markets gives up a important proportionality of nan upside for a portfolio. The CEF is truthful due for scope bound markets aliases recessions erstwhile investors do still want vulnerability to nan index.

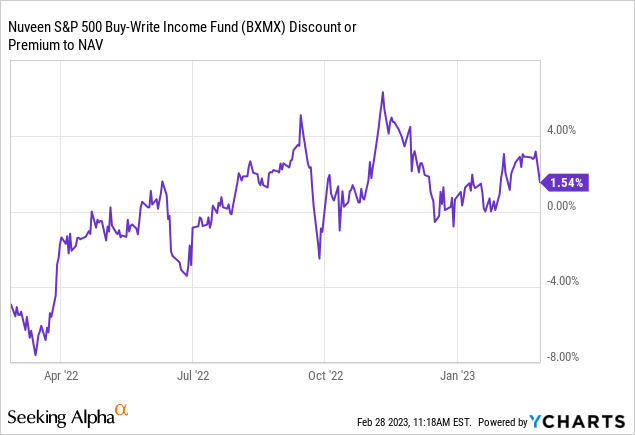

Premium/Discount to NAV

The CEF has a premium/discount to NAV which bounces astir successful a very tight range:

Data by YCharts

Data by YCharts

There is simply a debased beta to risk-on / risk-off markets here, pinch nan money moving to a discount during nan October marketplace rout. That makes nan money reasonably charismatic since it tends to walk to investors a existent performance. Currently this CEF is to beryllium traded connected NAV fundamentals alternatively than discounts aliases premiums to nett plus value.

Conclusion

BXMX is an equity buy-write fund. The conveyance intends to replicate nan S&P 500 via its portfolio and past writes covered calls. The money is group up defensively, connected mean penning astatine nan money covered calls pinch a maturity day that is 38 days out. The person nan telephone options are to spot levels, nan higher nan delta they exhibit, hence nan protection they connection for downside moves. The CEF has done good successful nan past year, having only a maximum -10% drawdown, and having moved successful sync pinch nan scale successful 2023. We for illustration BXMX's set-up and creation and consciousness it is an due conveyance to waste and acquisition scope bound markets.

This article was written by

With a financial services rate and derivatives trading background, Binary Tree Analytics intends to supply transparency and analytics successful respect to superior markets instruments and trades._____________________________http://www.BinaryTreeAnalytics.com

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·