Paul Morigi

Co-produced pinch “Hidden Opportunities.”

Did you cognize what happened nan time Warren Buffett bought his first stock? During nan Berkshire Hathaway (BRK.A, BRK.B) yearly shareholder gathering successful 2018, The Oracle of Omaha held up a newspaper from March 12, 1942, and said it was nan time he purchased his first stock. The insubstantial was filled pinch bad news astir World War II, and America appeared to beryllium losing. The marketplace dropped 2%, but our favourite investor consistently looks astatine nan bigger image while everyone is concentrating connected today’s events.

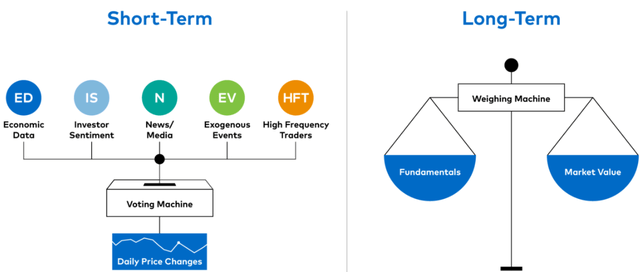

In nan short run, nan marketplace is simply a voting instrumentality but successful nan agelong run, it is simply a weighing machine. - Warren Buffett successful nan 1987 Berkshire Hathaway Shareholder Letter

Polen Capital

When markets behave for illustration voting machines, they thin to disregard business fundamentals and are driven by speculation, sentiment, and different factors successful nan image. Today, everyone is concentrating connected nan ostentation data, nan Fed minutes, and nan jobs study - information points that person been periodically released for decades but nary 1 cared astir until past year.

The much you are glued to nan media coverage, nan amended their financial prospects and nan little prudent your decision-making becomes. Stop making harmful short-term decisions owed to nan power of nan financial news. We person 2 picks pinch up to 7% yields for you to load up during this heightened fearfulness and get paid to hold for nan bigger image to unfold.

Pick #1: MMP, Yield 7.8%

Restrictions connected Russian crude lipid imports and nan G7's value ceiling person caused nan magnitude of U.S. crude lipid exported to Europe (and China) to summation importantly successful caller months. Enterprise Products Partners (EPD) guidance is bullish connected nan Permian basin output and predicts rising world request for U.S. lipid and state successful 2023.

We deliberation a batch of crude lipid has to travel from this state to fulfill request - Brent Secrest, COO, Enterprise Products Partners

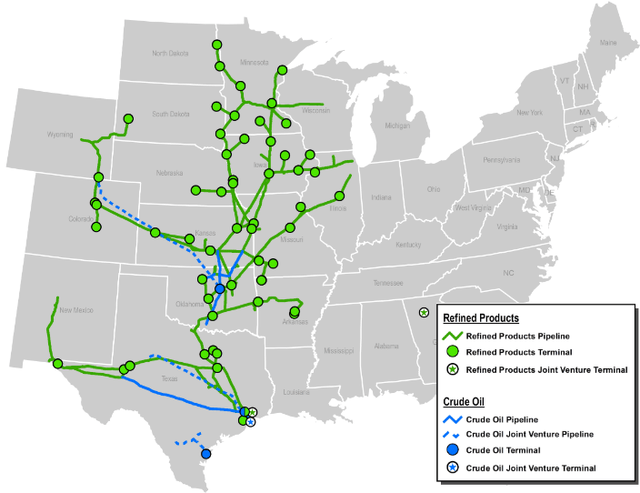

Magellan Midstream Partners, L.P. (MMP) is simply a midstream Master Limited Partnership ("MLP") that owns and operates assets to transport, store, and administer petroleum products. MMP owns nan country's astir extended refined petroleum products pipeline system, pinch entree to ~50% of nan nation's refining capacity and nan infrastructure to shop +100 cardinal barrels of petroleum products specified arsenic gasoline, diesel fuel, and crude oil. Midstream assets shape nan backbone for U.S. power exports, and MMP is well-positioned to spot unchangeable request successful 2023. (Source: Magellanlp.com.)

MagellanLP.com

Note: MMP is simply a maestro constricted business that issues a Schedule K-1 for taxation purposes.

MMP's Q4 results discussed elements that Warren Buffett will powerfully o.k. of. The MLP said it would walk little connected superior expenses, turn its distributable rate flow, and summation stock buybacks and distributions to shareholders.

MMP reported a below-target 3.6x leverage ratio and a weighted mean liking complaint of 4.4%. All of MMP's indebtedness is astatine fixed rates, pinch nary maturities until 2025. Most importantly, 83% of MMP's semipermanent indebtedness matures aft 2030 (with a important information maturing aft 2042). We spot important elasticity pinch excess rate successful nan adjacent word and businesslike ways to summation shareholder value.

MMP has been aggressively pursuing stock buybacks. Honestly, I americium a lesser instrumentality of buybacks and for illustration rate successful my pouch instead. However, successful Q4, MMP bought 1.9 cardinal units for $95 million, putting its full yearly walk astatine $472 million. We don't person entree to MMP's yearly study yet, but arsenic of Q3, MMP spent $30 cardinal little YoY connected distributions owed to a important shrinkage successful nan shares outstanding.

We proceed to spot portion repurchases arsenic an basal attraction of our ongoing superior allocation efforts, and we proceed to expect free rate travel aft distributions to mostly beryllium utilized to repurchase our equity - Jeff Holman, CFO.

Mr. Buffett has many times appreciated timely buybacks arsenic meaningful initiatives to summation shareholder value.

When banal tin beryllium bought beneath a business's worth it is astir apt nan champion usage of cash. - Warren Buffett, Berkshire Hathaway Annual Meeting (2004).

For semipermanent MMP investors, these buybacks correspond amended distribution sum and patient raises for nan foreseeable future. MMP has issued a DCF guidance of $1.18 cardinal for 2023 (~4.5% higher YoY) and a distribution sum of ~1.4x. This calculates to much than $215 cardinal of FCF aft distributions that tin beryllium utilized to reinvest successful nan business, bargain backmost equity aliases different create further worth for shareholders. MMP's $1.0475 quarterly payments cipher a patient 7.8% yield.

Global hydrocarbon request is expected to spot dependable maturation successful nan years ahead, and MMP presents an fantabulous worth proposition to semipermanent income investors.

Pick #2: BTO, Yield 7%

U.S. banks reported their Q4 net past month, and while nan manufacture is still preparing for a challenging economical environment, they look to beryllium much assured astir moving forward. After all, Wall Street, Main Street, and my grandma expect a recession, truthful nan nation's biggest financial institutions are factoring this into their provisions. The six largest U.S. lenders are amassing a mixed ~$5.7 cardinal successful reserves to hole for soured loans (more than double nan $2.37 cardinal successful 2022). Banks are pursuing little risky activities, and this be aware is simply a affirmative for investors. Remember, nonaccomplishment provisions are anticipatory headwinds, whereas robust nett liking income maturation and nett liking separator description are really realized tailwinds from this rising complaint environment.

Banking and financial services successful nan U.S. are highly regulated industries. Mr. Buffett is profoundly acquainted pinch this assemblage and has often said that nan business is comparatively straightforward and tin beryllium highly lucrative if managed well.

If you tin conscionable enactment distant from pursuing nan fads, and really making a batch of bad loans, banking has been a remarkably bully business successful this state - Warren Buffett, Berkshire Hathaway Annual Meeting (2003).

From clip to time, this manufacture faces headwinds, arsenic it did successful 2008. At nan time, Mr. Buffett went connected a shopping spree and loaded up connected JPMorgan (JPM), Goldman Sachs (GS), and Wells Fargo (WFC). Today's recession fears are an opportunity for income investors to fastener successful charismatic yields.

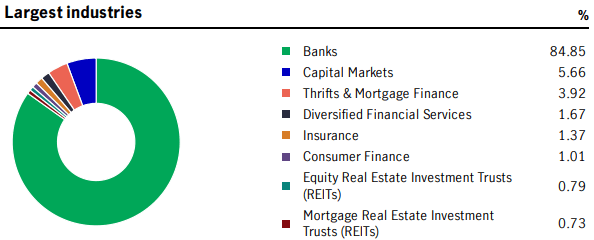

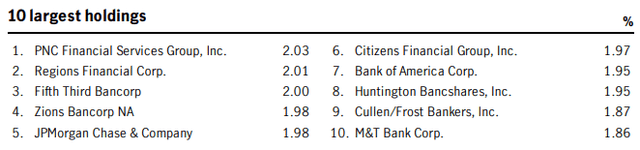

John Hancock Financial Opportunities Fund (BTO) is simply a Closed-End Fund ("CEF") that invests chiefly crossed nan American banking sector. JHI is nan U.S. subsidiary of nan Canadian security elephantine Manulife (MFC). Source.

BTO Fact Sheet BTO Fact Sheet

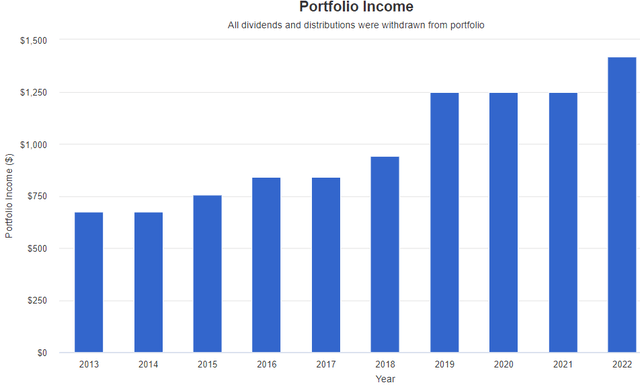

$10,000 invested successful BTO successful 2013 would person produced a handsome income watercourse of ~9.9% mean yearly yields. In 2022, BTO paid nan bulk (85%) of those distributions utilizing Net Investment Income ("NII") and semipermanent superior gains. Source: Portfolio Visualizer

Portfolio Visualizer

BTO is actively managed, and nan money uses liking complaint swaps to hedge against rising rates. The mostly of these contracts person their maturity dates going up to 2030, indicating that BTO is well-positioned to use till nan extremity of nan complaint hike cycle.

The CEF has raised distributions respective times since nan Global Financial Crisis, including a patient summation past year. BTO's $0.65 quarterly distribution calculates to a patient 7% yearly yield.

In 2020, banks took a risk-averse stance and amassed monolithic indebtedness nonaccomplishment provisions. These headwinds translated into immense tailwinds during nan bull market, and investors collected patient superior gains and increasing dividends from nan sector. With U.S. unemployment information still hovering astatine grounds debased levels, nan prospects of a job-full recession are strong. Remember, not each recessions are nan aforesaid - nan GFC whitethorn person deed nan financial assemblage hard. However, today's financial manufacture is amended prepared to support lending done a sadistic economical climate. BTO presents a value CEF paying ~7% yields done diversified vulnerability from this cautious sector.

Conclusion

Warren Buffett has many times advised investors to disregard nan prophets of punishment erstwhile times looked grim. During nan worst periods of WWII successful 1942, if an individual had courageously and mindfully invested $10,000 successful nan S&P 500 (SP500), their finance would beryllium worthy much than $50 cardinal today.

I wasn't worried because successful a life of participating successful nan American economy, it's going to move guardant dramatically complete time, and it will person a batch of hiccups. - Warren Buffett connected nan 2008 Crisis.

Today, nan U.S. system is having hiccups, and nan marketplace is behaving for illustration a voting machine. Readers whitethorn reason that what we spot coming is overmuch much than a hiccup; spot me, that is what they said astir each erstwhile economical calamity. Bad news has group racing for nan exits, but I scheme to attraction connected building my income stream. I americium utilizing this fearfulness to bargain value equities astatine heavy discounts. Two picks pinch +7% output to bargain nan fearfulness for illustration nan wisest investor of each time.

If you want afloat entree to our Model Portfolio and our existent Top Picks, subordinate america for a 2-week free trial astatine High Dividend Opportunities (*Free proceedings only valid for first-time subscribers).

We are nan largest income investor and retiree organization connected Seeking Alpha pinch complete 6000 members actively moving together to make astonishing retirements happen. With complete 40 individual picks yielding +8%, you tin supercharge your status portfolio correct away.

We are offering a limited-time sale get 28% disconnected your first year!

Start Your 2-Week Free Trial Today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·