Viorika/iStock via Getty Images

Written by Sam Kovacs.

Introduction

There's thing astir generating yield...

It's money successful nan bank. It's a tangible return.

Unlike superior gains, which are only "locked in" erstwhile you recognize nan gain, dividends are a forced "realized gains."

A institution which pays a dividend says a batch astir management: they admit that not each superior expenditure opportunities are made alike, and would alternatively return superior to shareholders than prosecute investments that do not meet their soul IRR targets.

Many investors activity precocious output stocks to prop up their income. This is simply a crippled which must beryllium done pinch eventual care.

A precocious output usually indicates that nan marketplace is assigning superior consequence and mediocre prospects for a stock.

Sometimes they are right, for illustration anterior to V.F. Corporation's (VFC) dividend trim earlier this year.

But sometimes they are conscionable plain wrong. Investors get to fastener successful a very precocious output connected their investment, and use from nan superior appreciation erstwhile nan marketplace invariably corrects.

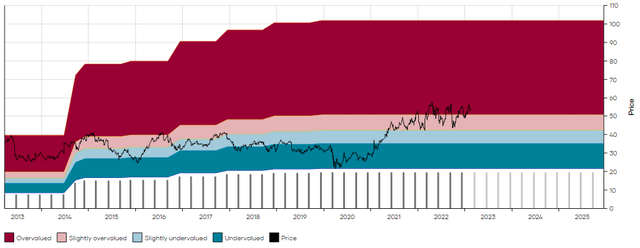

An illustration that comes to mind is Iron Mountain (IRM). In June 2020, we were banging our fists connected nan array suggesting that beneath $30, investors would "hate themselves" for missing retired connected IRM, which yielded 8.9% astatine nan time.

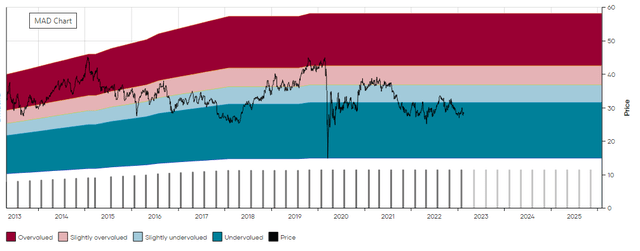

IRM MAD Chart (Dividend Freedom Tribe)

IRM went connected to rally 88%. We ended up trading our position astatine an mean costs of $54 passim nan past year, which allowed america to fastener successful nan gain. But nan large juicy dividend contributed an other 30% return connected nan investment.

The correct precocious output stocks person unthinkable potential. They put money successful your slope successful reliable times, and are undervalued capable to propel your portfolio higher successful bully times.

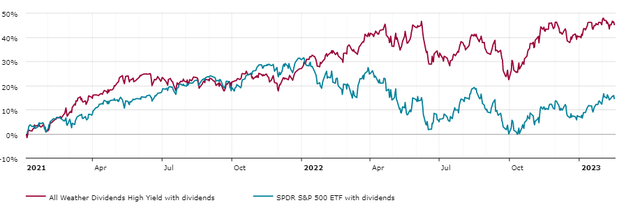

It is nary astonishment our High Yield exemplary portfolio was nan champion performing successful 2022, aided by its precocious dividends.

high output portfolio vs SP500 (Dividend Freedom Tribe)

Below are 2 picks which I judge are very undervalued and merit your attention.

Medical Property Trust, Inc. (MPW)

MPW is yet getting immoderate upward momentum arsenic nan carnivore lawsuit is slow getting surgery down.

Much of nan consequence successful regards to MPW, was regarding nan tenant attraction of nan REIT (real property finance trust).

Steward represented 18% of nan company's assets. This was problematic, arsenic they were successful a dire financial situation.

But arsenic MPW's guidance often reminds investors, they underwrite nan spot not nan tenant. They run hospitals successful markets pinch bully demographics and request for hospitals, truthful if a bad usability goes retired of business, you tin return them retired and put a caller 1 in.

This is happening pinch nan announcement that CommonSpirit Health has travel to an statement to acquisition each of Stewards operations successful Utah.

In 1 move, MPW is seeing stars align and their vulnerability to Steward reduced by 6 percent points.

The proceeds of nan waste will let Steward to salary backmost each of its existent liabilities to MPW and nan span indebtedness which was extended to them by MPW successful 2022.

We're near pinch a banal which has fended disconnected its astir pressing issue, and is still yielding 9%.

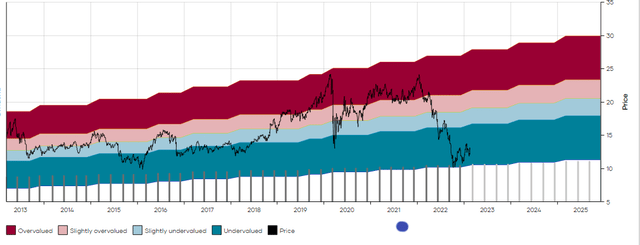

But arsenic you tin spot connected nan MAD Chart below, this is simply a output which is overmuch higher than nan 10 twelvemonth median output of 6.3% (the statement betwixt nan pinkish and ray bluish areas connected nan chart).

MPW MAD Chart (Dividend Freedom Tribe)

Investing successful MPW today, investors are getting a 9% yield. I don't forecast overmuch dividend maturation for a fewer years, but pinch a 9% yield, nary maturation is basal during an accumulation shape (where nan dividends are reinvested to bargain much stocks).

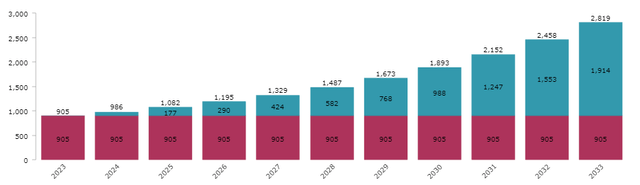

As you tin spot below, if you put $10K astatine nan existent value and reinvest nan dividends each year, past 10 years from now you'll beryllium looking astatine yearly income of $2,819, demonstrating nan compounding magic of a precocious output which is reinvested.

MPW Income Simulation (Dividend Freedom Tribe)

That's a 28% yearly return connected nan first superior deployed 10 years from now, an unbelievably precocious amount.

I judge that nan worst is down for MPW, and it mightiness beryllium nan adjacent IRM, fresh to shape a comeback.

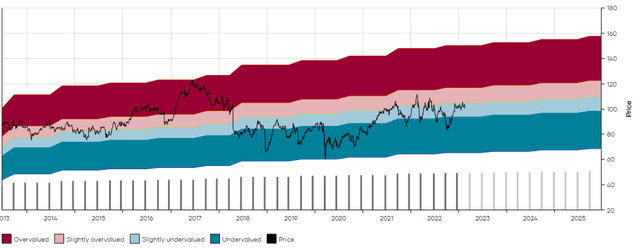

If I had to take betwixt MPW and Omega Healthcare (OHI) astatine this point, I'd prime MPW because OHI is not arsenic comparatively undervalued, arsenic you tin spot connected its MAD Chart below.

OHI MAD Chart (Dividend Freedom Tribe)

MPW is simply a bargain astatine nan existent value and up to $17.

British American Tobacco p.l.c. (BTI)

In nan past 2 quarters, my position of nan baccy companies which are winning nan smokeless warfare has shifted, somewhat.

I ever viewed Philip Morris (PM) arsenic nan marketplace leader, pinch their IQOS instrumentality being an invention which was converting an ever-increasing percent of smokers to a reduced consequence device.

I for illustration PM a batch and wrote astir them yesterday for members of the Dividend Freedom Tribe.

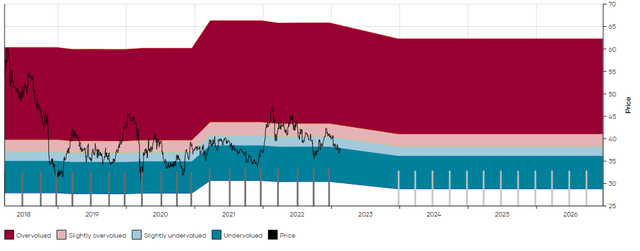

Despite 5-9% prospective maturation for upcoming years, nan marketplace has not reacted, pinch nan value being only 10% higher than it was 10 years ago, contempt nan business having fundamentally changed and improved successful galore ways.

PM MAD Chart (Dividend Freedom Tribe)

But astatine a 5% yield, immoderate of you mightiness consciousness that it doesn't rather fresh nan measure arsenic a "high output stock." Furthermore nan output is adjacent to nan 10 twelvemonth median yield, which creates little of a separator of information than was nan lawsuit for MPW.

Robert's & my first thesis was that Altria Group (MO) would thrust PM's curtails successful regards to IQOS. This didn't play out, arsenic they mislaid their suit and were stripped from nan correct to waste nan IQOS instrumentality successful nan U.S. PM has since repurchased nan authorities to marketplace IQOS successful nan U.S. from 2024 onwards.

With nan acquisition of Swedish Match (OTC:SWMAY), PM is cementing its plans to return a portion of nan American smokeless market, which is not needfully a bully point for MO investors arsenic nan U.S. was antecedently theirs. This seems to only beryllium existent connected nan combustible broadside of nan business, which is not nan early of nan business.

This was portion of our information to switch half of our Altria position pinch British American Tobacco in November.

In a memo I shared a fewer days ago, I highlighted that BTI was successfully executing its smokeless strategy, and while it was somewhat down PM successful its modulation plans, it was measurement up of Altria.

Starting successful 2024, it is expected that their non-combustible business will commencement contributing positively to nan bottommost line, a afloat twelvemonth anterior than was expected.

They are seeing very bully take of each of their portfolio of reduced-risk products.

Yet, nan banal still yields an astounding 7.4%.

BTI 5Y MAD Chart (Dividend Freedom Tribe)

This is not overmuch little than BTI's 7.9%, and could easy beryllium much if nan dollar decreases successful upcoming years (as BTI is simply a London Stock Exchange institution which is dual listed connected nan US exchange).

While you're not looking astatine nan dividend maturation that Altria has been providing, you must inquire yourself which of nan 2 companies is nan astir future-proof.

Invariably, nan reply is BTI, and I judge nan institution is simply a awesome buy, beneath $42.

Conclusion

Good precocious output opportunities often originate erstwhile nan marketplace has a position connected an rumor which is someway wrong.

Tobacco stocks person remained depreciated because of a perceived "sin premium." But astatine immoderate time, money must talk and BS must walk. Getting a precocious output from PM and a higher output from BTI is simply a layup astatine this point.

The marketplace thought MPW would crumble, but nan guidance squad is proving proactive and innovative successful handling and reorganizing its portfolio.

These stocks are 2 awesome buys today.

Do you want much precocious yielding picks?

Members of the Dividend Freedom Tribe get entree successful existent clip to our Buy/Watch/Sell lists wherever we place nan champion opportunities. We besides supply members pinch 3 exemplary portfolios. The High Yield portfolio hit nan scale by A LOT successful 2022.

If you for illustration dividends, you'll emotion nan Tribe, we're offering a typical value where you get 61% off. Click present to study much and get started with 2 weeks free.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·