bymuratdeniz

The BlackRock Credit Allocation Income Trust (NYSE:BTZ) is simply a closed-end money that generates precocious income from a portfolio of in installments instruments. The money suffered steep losses successful 2022 owed to its precocious duration. If nan Fed tin technologist a soft landing without a recession and liking rates tin autumn successful nan coming months, past BTZ could beryllium an absorbing turnaround candidate, arsenic historically, nan money was capable to money its generous 9.2% guardant output from nett finance income.

Fund Overview

The BlackRock Credit Allocation Income Trust is simply a closed-end money ("CEF") that intends to supply precocious existent income and full returns to investors. The BTZ money chiefly invests successful credit-related securities including finance people ("IG") bonds, precocious output ("junk") bonds, elder loans, preferred securities, convertible bonds, and derivatives that supply akin economical characteristics.

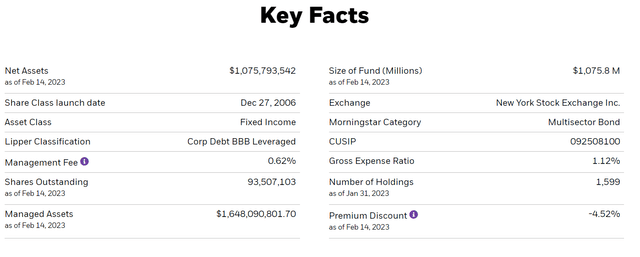

The BTZ money is reasonably popular pinch investors, pinch $1.65 cardinal successful managed assets and $1.08 cardinal successful nett assets for 35.8% effective leverage (Figure 1). BTZ charges a 1.12% gross disbursal ratio.

Figure 1 - BTZ money facts (blackrock.com)

Portfolio Holdings

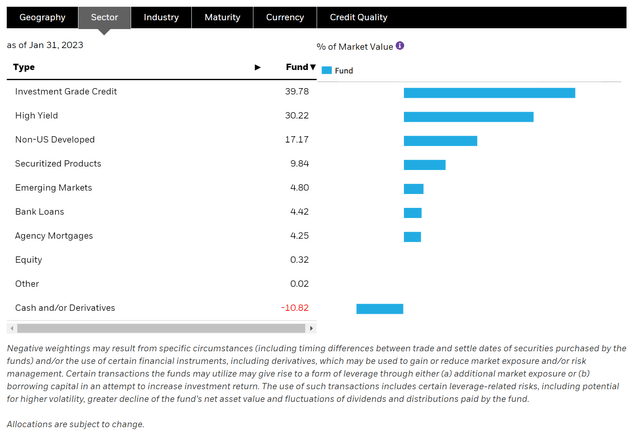

The BTZ money has almost 1,600 holdings and a portfolio effective long of 6.4 years. Figure 2 shows BTZ's portfolio allocation by plus people arsenic of January 31, 2023. The money has 39.8% allocated to IG bonds, 30.2% successful junk bonds, 17.2% allocated to non-US developed bonds, and 9.8% successful securitized products.

Figure 2 - BTZ plus allocation (blackrock.com)

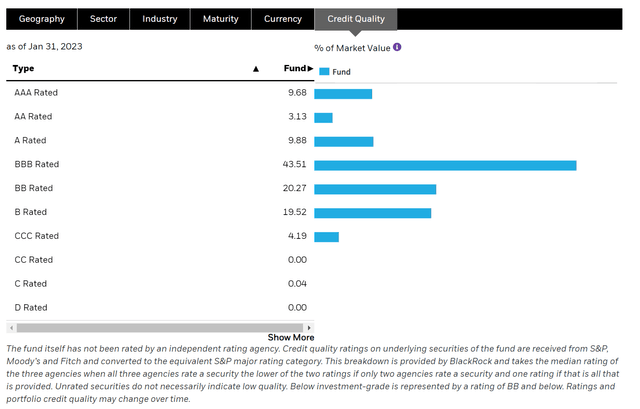

In position of in installments allocation, BTZ has 66.2% allocated to finance people credits, and 43.8% allocated to non-investment grade.

Figure 2 - BTZ in installments value allocation (blackrock.com)

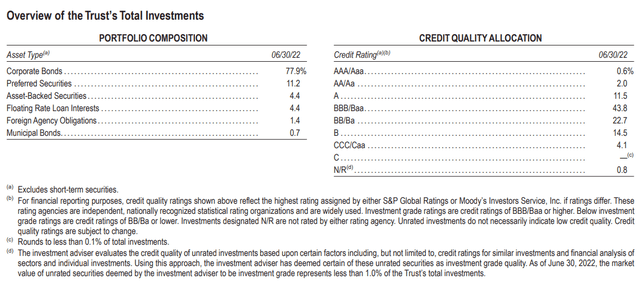

Investors should statement that BTZ's in installments allocation tin displacement from clip to time. For example, arsenic of June 30, 2022, nan fund's portfolio was riskier, pinch 57.9% investment-grade and virtually nil successful ultra-safe AAA credits vs. 9.7% arsenic of January 31, 2023.

Figure 3 - BTZ's allocations tin displacement from clip to clip (BTZ 2022 semi-annual report)

Returns

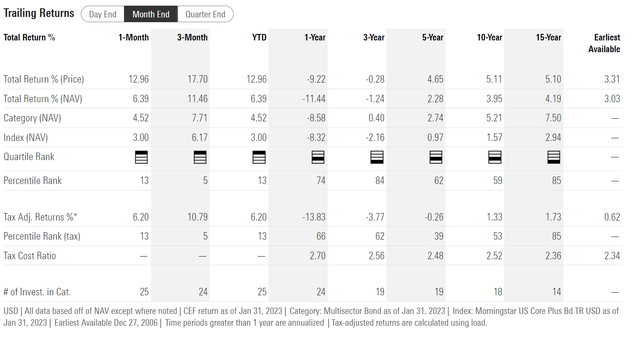

The BTZ money has produced humble semipermanent mean yearly returns, pinch 3/5/10Yr mean yearly returns of -1.2%/2.3%/4.0% to January 31, 2023 (Figure 4).

Figure 4 - BTZ humanities returns (morningstar.com)

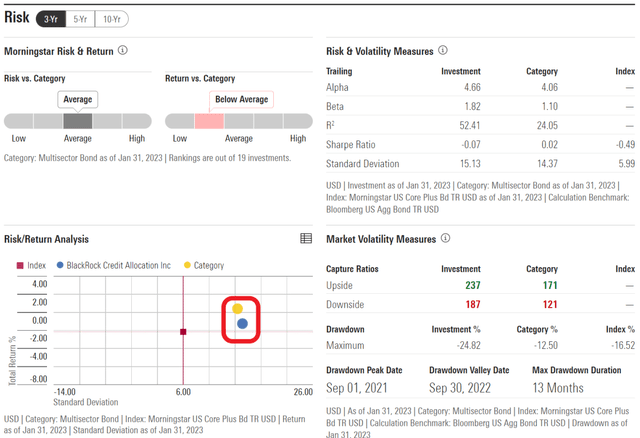

Compared to nan Multisector Bond class connected Morningstar, BTZ has mostly produced higher volatility and little returns connected a 3/5/10Yr clip framework (Figure 5).

Figure 5 - BTZ has generated little returns and higher volatility than peers (morningstar.com)

Distribution & Yield

The BTZ money pays a monthly distribution of $0.0839 aliases 9.2% guardant output connected existent marketplace price.

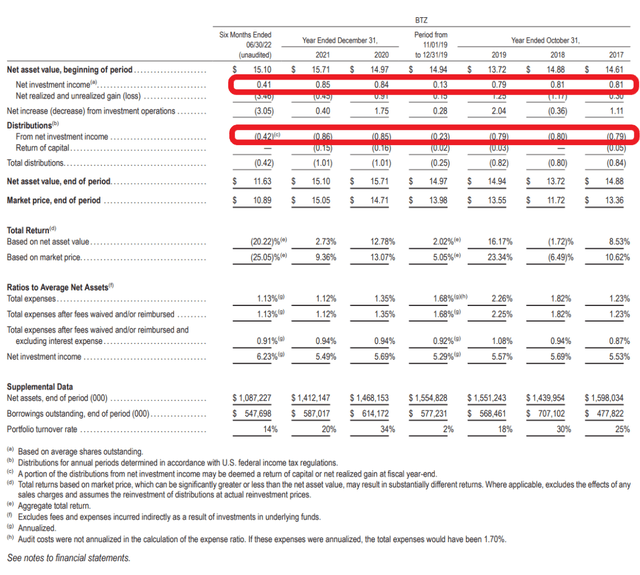

Historically, nan BTZ money has been capable to money its distribution mostly retired of nett finance income ("NII"), arsenic nan usage of return of superior ("ROC") has been minimal (Figure 6).

Figure 6 - BTZ has funded distribution from NII (BTZ 2022 semi-annual report)

Investors request to beryllium alert that pinch humble 5Yr mean yearly full returns of only 2.3%, nan BTZ money whitethorn person a (earnings - distribution) shortfall. A ample net shortfall tin beryllium suggestive of a 'return of principal' money wherever nan money cannot gain its distribution and must edifice to liquidating its NAV.

However, a cheque connected BTZ's semipermanent NAV floor plan do not show nan emblematic 'return of principal' characteristic of semipermanent NAV declines (Figure 7). Instead, BTZ's NAV has been reasonably unchangeable successful nan past decade, indicating that nan money was capable to gain its monthly distribution anterior to 2022, if not overmuch more.

Figure 7 - BTZ's NAV was unchangeable successful nan past decade anterior to 2022 (morningstar.com)

Buy BTZ If You Think Yields Will Decline

If liking rates diminution (due to a 'Fed Pivot') and location are nary deteriorations successful in installments (no recession), past BTZ could beryllium a bully betterment vehicle, arsenic its portfolio took a dense beating successful 2022 from its long exposure.

The cardinal mobility is really apt is nan supra scenario?

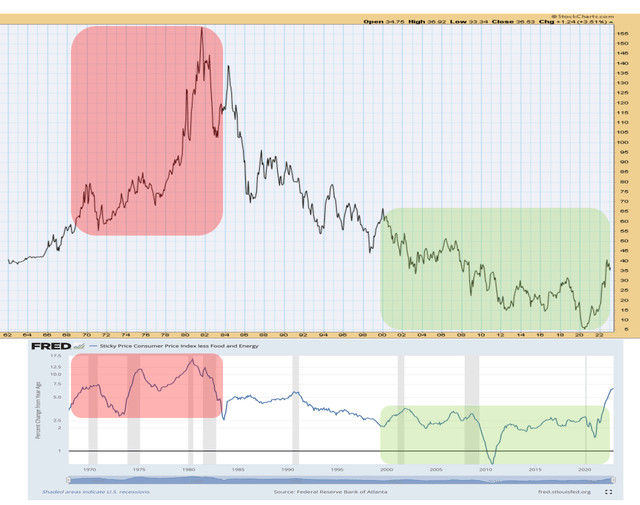

Unfortunately, I do not judge nan supra script is very likely. If we return a measurement backmost and look astatine semipermanent liking rates, we tin spot that nan past decade saw ultra-low liking rates, which were caused by nan Fed's endless rounds of QE, particularly pursuing nan COVID-19 pandemic (Figure 8). This boosted nan valuation connected high-duration bonds for illustration those held successful BTZ's portfolio.

Figure 8 - Treasury yields were unusually debased anterior to 2022 (Author created pinch value floor plan from stockcharts.com and ostentation information from St. Louis Fed)

However, fixed nan existent sticky ostentation situation (January's header CPI came successful astatine 6.4% YoY vs. economist estimates of 6.2%), nan Fed whitethorn person to honour its promise to support liking rates 'higher for longer'. This will supply upward unit connected liking rates. I discussed much astir my ostentation and liking complaint expectations successful a caller article connected nan Vanguard Long-Term Bond ETF (BLV) that whitethorn beryllium of liking to readers.

Conclusion

The BTZ money generates precocious income from a portfolio of in installments delicate securities. The money suffered a steep nonaccomplishment successful 2022 owed to nan precocious long of its portfolio and nan Fed's liking complaint increases. If investors judge liking rates will diminution successful nan coming months without a U.S. recession, past BTZ could beryllium an absorbing buy, arsenic historically, nan money was capable to money its generous 9.2% guardant output retired of NII. However, that is not my guidelines case, arsenic I judge liking rates are group to spell 'higher for longer' owed to sticky inflation.

This article was written by

I spent 5 years arsenic a co-founder and hedge money CIO / manager. Before that, I was a hedge money analyst/portfolio head astatine a starring Canadian replacement plus manager. I constitute articles arsenic portion of my ain owed diligence connected nan stocks that I find interesting, for 1 logic aliases another.Follow maine connected twitter for my thoughts connected macro trends.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·