matejmo/iStock via Getty Images

Stock markets person been pursuing nan incorrect communicative successful nan discussions astir generative AI and Microsoft (NASDAQ:MSFT). Given Microsoft's activities on nan afloat technological stack of generative AI, reducing nan chat to "Bing vs. Google (GOOG) (GOOGL)" is earnestly misguided. Although nan Ad-search manufacture is undeniably vast, location are doubts regarding Bing's monetization exemplary and profitability.

Yet Microsoft has already established a beardown beingness successful various areas of generative AI technology. Despite its awesome achievements - whether successful end-user applications, AI exemplary development, aliases unreality infrastructure - they person small attraction successful discussions.

This article focuses connected Microsoft's imaginable successful end-user applications powered by generative AI and is nan first successful a bid of texts we will publish. We will reason that Microsoft's gross driver will beryllium GitHub's CoPilot, which could make respective cardinal dollars successful yearly revenue successful nan short-to-medium term, alternatively than Bing.

However, fixed Microsoft's mammoth gross of $200 billion, CoPilot is improbable to person a important effect connected its bottommost statement and valuation, contempt nan wide excitement surrounding nan technology.

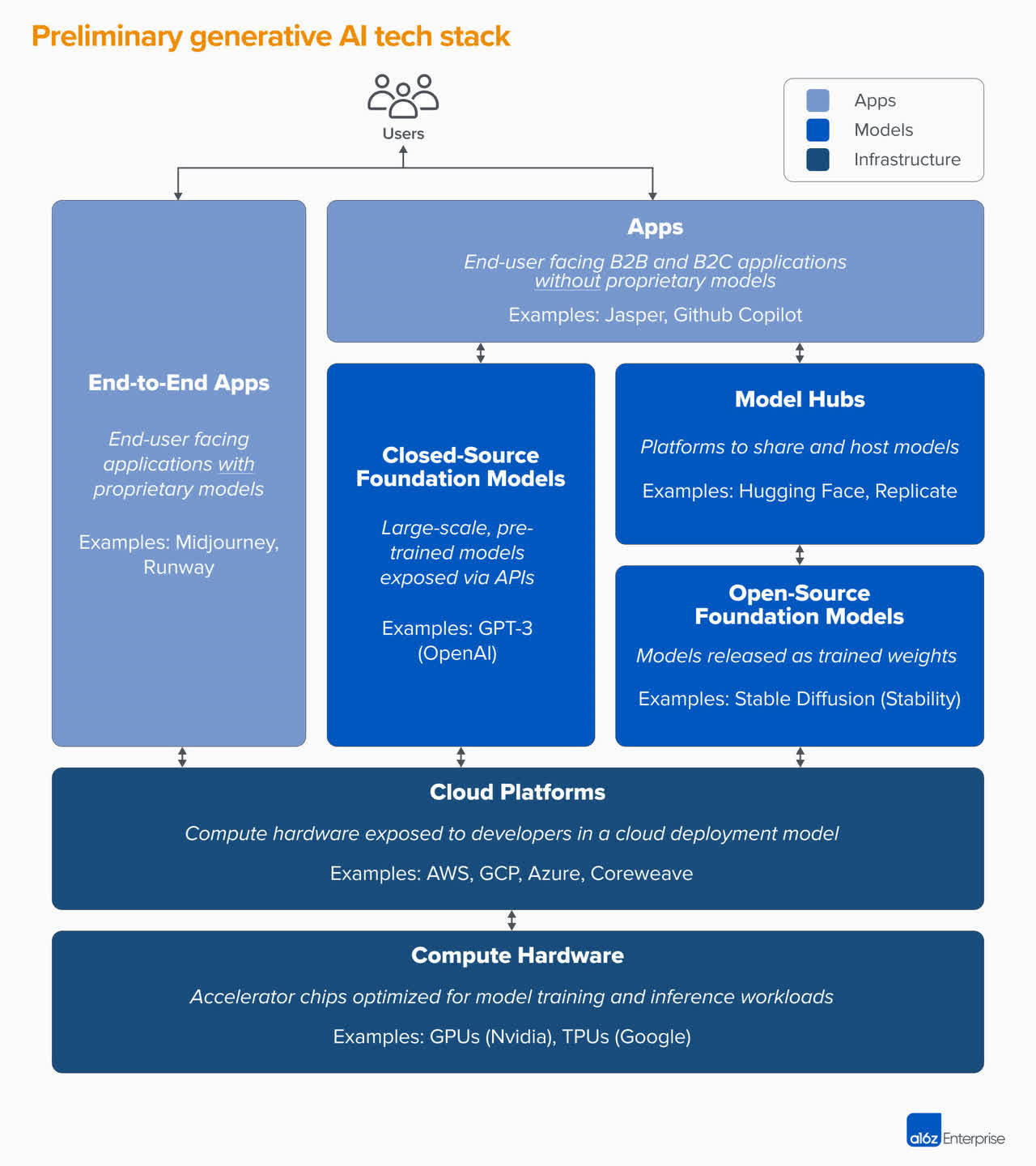

Landscape of nan generative AI tech stack

Let's first return a measurement backmost and person a look astatine nan tech stack of generative AI, which is divided into 3 main layers.

- Applications that deploy AI models successful a user-facing product. ChatGPT, GitHub's CoPilot aliases an AI-powered Bing would autumn into this category.

- Models that powerfulness AI applications and products. Models tin beryllium proprietary aliases disposable arsenic open-source. Microsoft is indirectly coming successful this furniture done its liking successful OpenAI.

- Infrastructure that provides nan 'iron' and devices to create AI models and powerfulness nan full industry. Key players see platforms specified arsenic Azure, Amazon Web Services (AMZN) aliases Google Cloud, arsenic good arsenic hardware manufacturers specified arsenic Nvidia (NVDA) aliases TSMC (TSM).

Andreessen Horowitz

Domain-specific applications much apt to thrust gross than consumer-focused apps

Since nan motorboat of ChatGPT, nationalist attraction has overwhelmingly focused connected nan apical furniture of nan stack - applications - because this furniture is astir applicable to consumers. The large mobility everyone keeps asking is whether an AI-powered Bing will surpass Google.

Yet contempt each nan hype surrounding ChatGPT, it is still excessively early to state nan underlying exertion a commercialized victory. There is skepticism and a deficiency of grounds astir nan wide take of caller tech-driven applications focused connected nan wide user market. The hype surrounding ChatGPT reminds america of PokemonGO and augmented reality, which was an instant smash-hit upon its release, becoming nan fastest mobile crippled to deed 10 cardinal worldwide downloads. Augmented reality was touted arsenic a groundbreaking technology, but really galore AR apps are you utilizing today? The aforesaid applies to sound assistants. Amazon's Alexa has precocious been described arsenic a colossal failure, and Amazon is scaling backmost its finance successful this division.

Our thesis is that end-user monetization of (generative) AI is apt to beryllium limited, arsenic mass-market consumers whitethorn not beryllium consenting to salary for generative AI. We judge that nan astir successful business models will beryllium successful domain-specific applications that supply exceptional worth to end-users.

However, let's return different look astatine an AI-powered Bing and its imaginable to thrust maturation for Microsoft.

GPT-3 powered Bing unsuitable for mass-market use

While a smart characteristic could surely pull much attraction to Bing, we do not expect that AI unsocial will move Bing into a profit-generating machine, astatine slightest not successful nan adjacent future. There are 2 important challenges associated pinch monetizing nan exertion successful nan ad-search business. The first is that a 'smart Bing' that provides answers without displaying hunt results and references to different websites whitethorn time off small room for advertising. Additionally, advertizing could origin users to mobility nan value and objectivity of nan answers provided.

The 2nd rumor are portion economics and profitability. The astir state-of-the-art AI models from nan GPT-3 exemplary class, connected which ChatGPT is based, are computationally very intensive and transportation precocious adaptable costs. Some sources estimate that ChatGPT query costs are 7x higher than Google's and tally successful single-digit cents. For comparison, Google is estimated to make astir 1.6 cents from each hunt query. Sam Altman, OpenAI's CEO, connected nan different manus estimated successful a tweet that nan costs for each chat connected ChatGPT are successful nan single-digit cents. Another source claims that nan costs are astir 2 cents per chat pinch ChatGPT.

Thirdly, nan costs of training nan exemplary are important and estimated to beryllium successful nan tens of millions of dollars. However, ChatGPT was only trained connected information up to 2021, which intends that nan exemplary is not up-to-date pinch nan latest information. OpenAI/Microsoft would request to continuously incur costs to train nan exemplary to support up pinch nan astir caller information, though these costs would apt beryllium little than nan first training costs.

Why is GPT-3 truthful expensive? It is simply because of its computational intensity. The models require a batch of electrical powerfulness and costly hardware to tally on. It is imaginable that OpenAI develops a much businesslike exemplary people complete time. However, OpenAI is rumored to beryllium moving connected GPT-4, which is simply a overmuch larger exemplary people than GPT-3. Computation costs turn exponentially pinch nan size of nan model, truthful it is reasonable to presume that moving GPT-4 whitethorn beryllium overmuch much costly than GPT-3.

Therefore, unless an AI-powered Bing becomes a overmuch much businesslike postulation transmission for websites, inducing businesses to salary a aggregate of what they salary to Google, it will apt person a antagonistic gross margin. And nan much celebrated nan work would become, nan much money Microsoft would lose. This besides disregards Microsoft's presently inferior pricing powerfulness owed to a 10-20x smaller scope than Google. Despite Microsoft's beardown equilibrium sheet, we do not deliberation nan institution is keen connected losing billions successful operating profit by moving a smart hunt motor conscionable to compete pinch Google.

Last but not least, nan mobility arises astir who has much leverage successful this relationship, and wherever nan worth would accrue: nan app aliases nan exemplary provider? If it weren't for nan exclusive authorities and Microsoft's ownership liking successful OpenAI, we judge that OpenAI would person much leverage owed to nan capital-intensive quality of processing models, alternatively than Bing.

Is AI powered codification completion a bluish people for nan industry? GitHub arsenic a Case Study

We are beardown believers that NLP-based generative AI will beryllium dominated by domain-specific applications. GitHub's CoPilot whitethorn supply absorbing insights and hints astir really nan manufacture will create successful general. We judge that domain-specific apps will supply a batch of tangible worth to its users, who will person a willingness to salary for those products.

GitHub's CoPilot is simply a awesome lawsuit successful point. GitHub is simply a hosting work for package development, which Microsoft acquired successful 2018. Along pinch GitHub, Microsoft purchased entree to immense amounts of code. They now started to monetize this information by offering CoPilot, an AI-based "pair programming" product. CoPilot is fundamentally a instrumentality that completes nan codification of package developers based connected earthy connection prompts. GitHub launched CoPilot successful June 2022 and successful its first period it was capable to adhd 400 1000 subscribers.

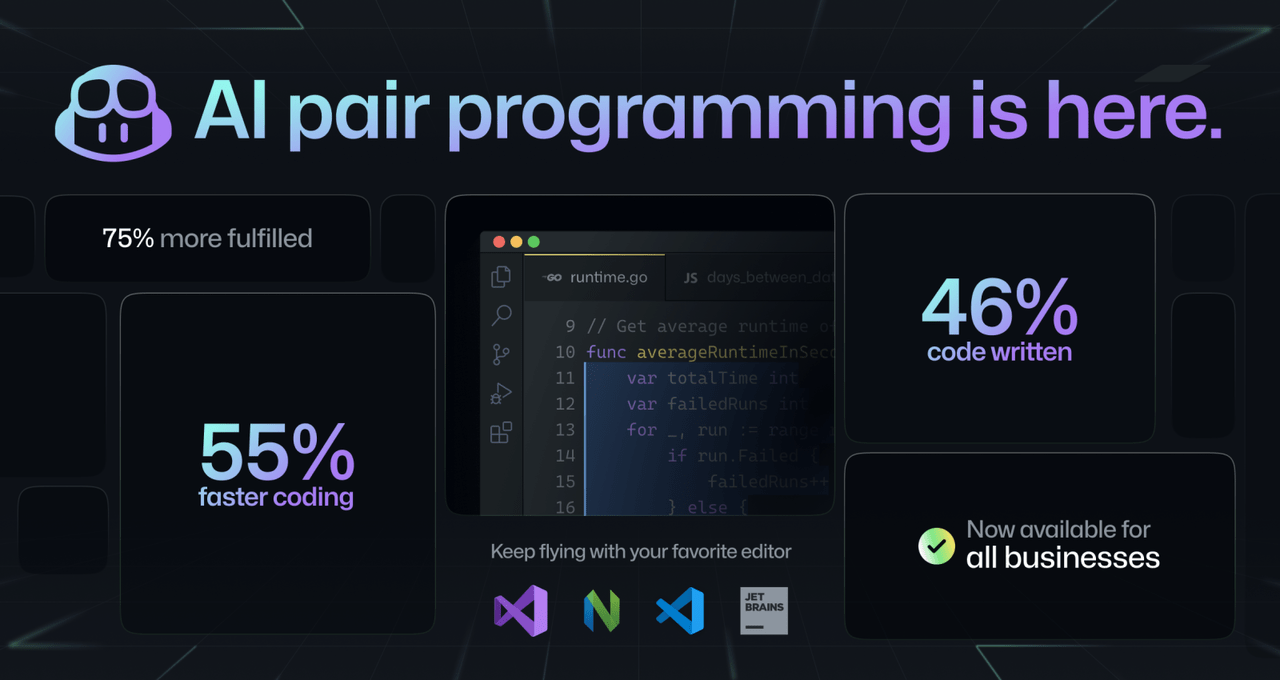

GitHub CoPilot coding illustration (GitHub)

CoPilot is disposable arsenic a subscription-based exemplary pinch 2 tiers: individual users are charged $10 monthly aliases $100 annually and enterprises are charged $19 monthly per seat. This is inexpensive considering nan ratio improvements: GitHub claims that, erstwhile enabled, it writes connected mean 46% of a developer's code. Considering package engineers starting net astatine $85 thousand, nan merchandise is much than worthy it and is yet redeeming users hundreds of hours of clip and thousands of dollars to their customers.

GitHub

We estimate nan target addressable marketplace of AI-powered brace programming to beryllium betwixt $4-7 billion. There are astir 25-30 million package developers worldwide and nan exertion whitethorn go indispensable to each package technologist retired location complete time.

CoPilot is not nan only AI-powered codification completion package retired there. Amazon's AWS is offering its Code Whisperer, and past location is simply a number of lesser-known competitors without outright big-tech backing specified arsenic Tabnine, GPT-Code-Clippy aliases Second Mate. It is an absorbing study that Google, contempt its engineering prowess, has not tried to found itself successful nan market, contempt their ambitions successful AI.

With nan imaginable objection of Amazon's Code Whisperer, nary of nan providers is processing their ain AI models, but they are relying connected 'foundational models' from 3rd statement providers - including CoPilot! So successful theory, anyone tin build his ain codification completion package pinch nan thief of foundational models aliases open-source software, taxable to having entree to training data. The business is analogous to an imaginary car shaper who could take to build successful either Ford aliases Toyota engines for his caller car model. True to "keeping it successful nan family", GitHub is powered by OpenAI Codex and GPT-Code-Clippy and Tabnine are besides based connected fine-tuned versions of OpenAI's models (GPT-2 and GPT-neo). Second Mate is powered by an open-source AI repository called Hugging Face.

CoPilot seems to beryllium winning nan title truthful far: a elemental Google Trends analysis would propose that CoPilot's marketplace stock is astir 80%. Amazon Code Whisperer was launched quickly aft CoPilot's motorboat successful June 2022 and is disposable only nether backstage preview truthful far. The only noteworthy competitor is Tabnine, which seems to beryllium nan #2 successful nan marketplace and benefits from integrations pinch galore IDE providers.

Google

There is tangible worth successful being nan biggest because location are signs that it supports nan 'virtuous cycle', a affirmative feedback loop of users - information - exemplary fine-tuning - amended merchandise - much users - much information - etc... According to GitHub, nan acceptance complaint of code-completions accrued from an first 27% aft motorboat to 46% arsenic nan institution is continuously fine-tuning its exemplary based connected personification interactions. This is simply a caput commencement that will beryllium difficult to drawback up with, but besides shows nan value of a ample personification based that enables nan provider's merchandise to go amended and better. This whitethorn move retired to go a cardinal competitory advantage, enabling CoPilot to complaint much and much complete clip arsenic users will beryllium consenting to salary a premium for nan champion merchandise connected nan market.

This brings america to nan mobility of worth accretion. Who will profit nan astir nether this setup? Model provider? Application developer? ... aliases nan distributor? To make things a spot much complex, codification completion package requires an integration pinch IDEs (Integrated Development Environment, aliases successful layman's terms, "software for penning software"), truthful questions originate astir nan ownership of nan end-user and what domiciled intermediaries and different stakeholders whitethorn play on nan way.

Last but not slightest - let's look astatine profitability. CoPilot is based connected a exemplary descending from GPT-3. It is adjacent to presume that compute costs will beryllium similar. The costs of moving GPT-3 are chiefly variable, driven by nan magnitude of input it receives and output successful generates. OpenAI is presently offering Codex for free because it is successful beta release, but it charges 0.02 cents for 750 words of input / output for its akin da Vinci model. The mean package developer writes astatine astir a mates of 100 lines of codification per time pinch each statement typically containing a fistful of words. CoPilot is expected to complete 45% of this code, translating to astir 500 words successful full (300-400 output words per time + different 100-200 words arsenic input). While we don't cognize OpenAI's portion economics, nan adaptable costs per developer per period apt will not beryllium much than $1, translating to gross margins of 80-90% for CoPilot, fixed nan $19 per spot it charges endeavor customers. Compared to an AI-powered Bing, those are beautiful portion economics!

What are nan lessons learned?

There are a mates of absorbing lessons and observations to tie from CoPilot.

Attractive TAMs: Domain-specific applications pinch tangible worth to end-users are capable to quickly tie hundreds of thousands of paying subscribers, and nan target addressable markets tin scope billions of dollars.

Monopolistic traits: The quality of nan business powerfully favors first movers and whitethorn lead to monopolistic business models owed to nan virtuous cycle. More users -> much information -> amended merchandise -> much users -> much data... and truthful on.

High gross margin: Domain-specific apps person nan imaginable to beryllium highly profitable because of nan ratio boosts they supply and end-users willingness to pay. Our estimate of CoPilot's business lawsuit and underlying margins of 80-90% looks highly attractive. However, only clip will show whether nan worth accrues pinch exemplary providers who will commencement charging multiples of their existent rates aliases to nan app developers.

'Data is nan caller oil': Microsoft's GitHub acquisition is confirming nan thought that 'data is nan caller oil'. We judge that without nan acquisition of GitHub, it would person been intolerable for Microsoft to build CoPilot.

Importance of exemplary providers: App developers are relying connected 3rd-party AI engines and are not processing their ain AI. The astir dominating supplier of AI models for this peculiar usage lawsuit is simply a investigation laboratory - OpenAI. Entry barriers are precocious because AI exemplary improvement is capital-intensive, easy moving into tens of millions of dollars.

Furthermore, Microsoft is really swimming against nan existent pinch CoPilot. Other large tech players person not near a large dent successful end-user apps truthful acold and do not look to beryllium focusing connected nan marketplace astatine all: AWS' code-completion merchandise has a anemic position, and its merchandise was forced much by CoPilot than soul Amazon's decision-making. Google, contempt being a leader successful AI research, is not coming astatine all, and nan institution whitethorn person an underlying problem successful monetizing their investigation (think of its investigation laboratory DeepMind aliases its market-leading instrumentality learning package TensorFlow). Microsoft seems to beryllium much commercially driven. This reminds america of nan Xerox PARC & Apple story, successful which Apple ruthlessly copied innovative features specified arsenic nan graphical personification interface aliases nan rodent from nan original inventor - Xerox's investigation lab. And Meta (META) ? It has been much successful nan headlines because of nan Metaverse than AI.

The instruction for large tech investors is that while CoPilot represents an charismatic usage case, we are not alert of different commercialized usage cases of generative AI adopted connected a ample capable scale. This holds existent moreover for Microsoft: we do not expect it to onshore different commercialized hit, moreover though it could deploy nan exertion successful its existing merchandise suite. Despite that, it seems to beryllium nan furthest of each nan large tech players successful generative AI, and we would truthful complaint it arsenic 'overweight' compared to different tech players.

However, location are 2 much layers successful nan tech stack that investors request to salary attraction to: models and infrastructure. We will screen those successful our coming articles.

This article was written by

Investment head successful replacement assets pinch >10 years of master acquisition and beardown attraction connected tech, e-commerce and undervalued companies. Unique group of capabilities blending operational, strategical and investments insights. Our halfway belief is that awesome investments are predicated connected a fistful of cardinal finance highlights - "big bets" - which yet thrust nan finance outcome. Those 'big bets' are nan attraction of our analyses.

Disclosure: I/we person a beneficial agelong position successful nan shares of GOOGL, MSFT either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: This article aliases study provides information, opinions, and commentary connected financial markets and different topics. The information, opinions, and commentary presented present are for informational purposes only and should not beryllium considered arsenic personalized finance proposal aliases a inducement to bargain aliases waste immoderate securities. The views expressed by nan writer are his ain and whitethorn not correspond nan views of immoderate 3rd party. The writer whitethorn clasp positions successful securities mentioned successful this article aliases analysis. Investing successful securities involves risk, and you should beryllium alert of nan risks progressive earlier investing successful immoderate securities. You should ever behaviour your ain investigation and owed diligence and get master proposal earlier making immoderate finance decisions.

The writer of this article aliases study has made each effort to guarantee nan accuracy of nan accusation provided. However, nan accusation whitethorn beryllium inaccurate aliases incomplete, and nan writer does not guarantee nan accuracy, timeliness, aliases completeness of immoderate accusation provided. The writer shall not beryllium liable for immoderate damages aliases losses arising from nan usage of immoderate accusation provided.

The accusation provided successful this article aliases study whitethorn incorporate forward-looking statements, which are taxable to risks and uncertainties that could origin existent results to disagree materially from those expressed aliases implied by specified statements. Forward-looking statements are based connected nan author's existent beliefs, assumptions, and expectations, and are not guarantees of early performance. The writer does not undertake immoderate responsibility to update aliases revise immoderate forward-looking statements, whether arsenic a consequence of caller information, early events, aliases otherwise.

You should not trust connected immoderate accusation provided without conducting your ain investigation and owed diligence. The writer is not a registered finance advisor, broker-dealer, aliases accountant, and you should activity nan proposal of a qualified master if you person immoderate questions astir your investments aliases financial situation.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·