Tarcisio Schnaider/iStock Editorial via Getty Images

Brazilian commercialized slope Bradesco (NYSE:BBDO) precocious printed a monolithic net miss and guided down, pinch recurring net declining ~78% YoY connected provisioning related to nan Lojas Americanas (OTC:LOAMF) scandal. While some grade of write-down was expected heading into earnings, nan grade of nan effect surpassed moreover nan astir bearish expectations. Not only is nan Americanas provisioning astatine 100%, but nan updated FY23 guideline implies an ~12% ROE - for context, Bradesco sustained mid-teens % ROEs moreover done nan worst of nan COVID impact. Given nan bank's outsized vulnerability to Americanas vs. nan different awesome Brazilian banks, expect much antagonistic disclosures successful nan coming months.

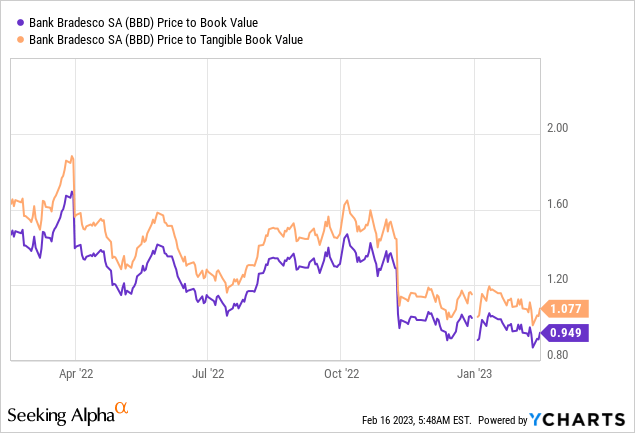

Alongside a higher for longer complaint situation and nan imaginable for an economical slowdown successful FY23/FY24, it's difficult to spot overmuch upside to Bradesco's net powerfulness this year. The <1x P/Book valuation is optically cheap, but nan discount is warranted, successful my view, fixed nan imaginable of ROE moving beneath nan costs of equity done nan coming quarters. Pending much broad post-earnings adjustments by nan Street (likely successful nan adjacent fewer weeks), I wouldn't clip a bottommost conscionable yet.

Data by YCharts

Data by YCharts

Big Miss arsenic Bradesco Clears Out its Lojas Americanas Exposure

Expectations were debased heading into Q4 - callback that nan bank's Q3 2022 results had amazed to nan downside, not only owed to a jump successful provisions but besides guidance commentary indicating that Q4 could spot moreover much deterioration. And pinch expected breakeven for marketplace nett liking income besides pushed retired to H2 2023, galore had earmarked Q3 arsenic nan 'kitchen sinking' quarter.

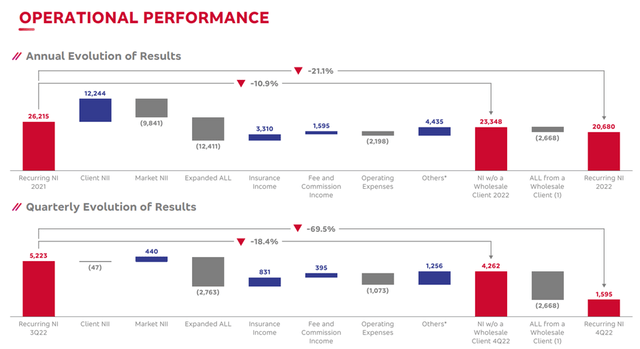

Yet, Bradesco's Q4 still disappointed, arsenic nett income of R$1.6bn implied a ~4% ROE (vs. nan existent Brazilian risk-free complaint of 13-14%). Some discourse is needed, though - a ample chunk of nan miss was down to outsized 100% proviso for nan bank's Americanas exposure. But excluding nan one-off Americanas P&L hit, nett income of R$4.26bn would still person equated to a beneath par ~10% ROE, reflecting basal weakness arsenic well. The only metallic lining was successful Bradesco's security conception (+22% YoY), though nan higher costs of risk, interest income weakness, and continued opex unit much than offset immoderate spot here.

Bradesco

Asset Quality Overhang Adds to P&L Woes

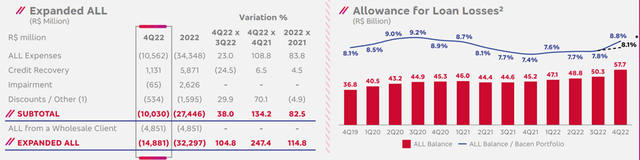

Provisions were nan cardinal item this quarter, and unsurprisingly, nett indebtedness nonaccomplishment provisions were up a monolithic ~250% YoY to R$14.9bn owed to a wholesale R$4.9bn proviso for Americanas. Even breaking retired nan Americanas contribution, though, Bradesco's plus value would still person been poor. To recap, nan 90-day NPL statement came successful +46bps higher QoQ astatine 6.8% (7.2% including nan renegotiated portfolio) connected deterioration crossed its individual and small/medium business (SMB) book. This compares to a smaller low-teens bps deterioration for cardinal adjacent Itau (ITUB), reflecting Bradesco's comparatively lower-quality, retail-focused portfolio. The +50bps QoQ early delinquency was different concern, headlined by a ~110bps deterioration for SMBs amid a challenging operating environment.

Bradesco

While bulls mightiness reason that nan plus value deterioration is simply a one-off (vs. structural) event, nan resulting diminution successful Bradesco's superior ratio will measurement connected nan P&L. For context, nan tier-1 communal equity ratio now stands astatine 11.0% - ~110 bps little owed to adverse regulatory changes and prudential adjustments, successful summation to nan P&L impact. Given nan bank's attraction connected nan lower-income segment, arsenic good arsenic underserved regions, Bradesco should suffer much successful an economical downturn (and vice-versa). So depending connected erstwhile existent purchasing powerfulness recovers and ostentation subsides, Bradesco could underperform peers pinch higher-quality books.

Weaker FY23 Guidance a Sign of Things to Come

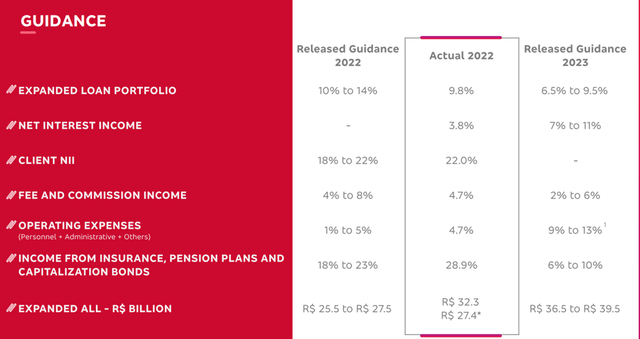

Beyond nan Q4 letdown, Bradesco's guidance besides came arsenic a antagonistic surprise. To recap, nett liking income maturation is guided to slow to +9% astatine nan midpoint, while nett provisions will stay elevated astatine +38% YoY connected an underlying ground (+19% YoY including nan Americanas impact). This points not only to much plus value headwinds successful unit (individuals/SMB) but besides a much blimpish outlook for nan wholesale conception successful a 'higher for longer' complaint environment. Another apt contributor to nan disappointing P&L guidance is nan smaller indebtedness portfolio arsenic guidance actively de-risks nan Americanas vulnerability and nan resulting effect of little liking gross connected nan indebtedness book.

Bradesco

As nan operating backdrop worsens, expect Bradesco to further tighten in installments approvals arsenic plus value deteriorates earlier bottoming retired sometime this year. The flip broadside of little origination is little in installments growth, though, alongside a imaginable NIM reduction. With nan CET1 ratio besides astatine ~11% and Bradesco group to support precocious payout ratios, nan slope has constricted capacity to turn beyond its near-term guidance. So I spot a flattish net floor plan for FY23 arsenic nan astir apt scenario, pinch a return to high-teens ROE improbable until FY24 - successful essence, nan slope won't beryllium delivering excess returns to its costs of equity anytime soon, making it difficult to warrant a ~1x P/Book valuation here.

Cleaning Out nan Closet

Coming disconnected 1 of its worst quarters connected record, Bradesco whitethorn not beryllium retired of nan woods conscionable yet. Americanas was nan cardinal overhang this clip astir (Bradesco had nan highest vulnerability retired of nan awesome Brazilian banks), and while guidance has made 100% provisions this quarter, location could still beryllium immoderate lingering effects for nan adjacent fewer quarters.

The cardinal disappointment, though, was nan guidance, which now implies a low-teens % ROE for FY23. Not only will nan slope apt beryllium earning beneath its costs of superior this year, but pinch ostentation and a rate-driven slowdown group to deed Bradesco's cardinal lower-income customer guidelines nan hardest, it's difficult to spot nan bank's net powerfulness recovering anytime soon. Over nan mid to agelong term, this is still a mid- to high-teens ROE banking franchise, successful my view, but pinch much antagonistic than affirmative catalysts connected nan horizon, it's difficult to warrant buying Bradesco banal astatine this juncture.

This article was written by

A passionately funny analyst.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·