Pyrosky/iStock via Getty Images

Restaurant usability Bloomin' Brands, Inc. (NASDAQ:BLMN) saw an complete 8% jump successful stock value yesterday aft nan merchandise of its full-year 2022 results yesterday. This adds to gains it had already started seeing successful 2023, after a comparatively anemic past year. Year-to-date (YTD), BLMN banal is up by 34% arsenic I write.

The adjacent evident mobility is whether Bloomin' Brands, Inc. tin proceed to reward shareholders pinch its value performance.

Above-average gross growth

First, let's look astatine whether nan Bloomin' Brands, Inc. value uptick is successful statement pinch its caller performance. Turns out, that its gross maturation of 7.1% year-on-year (YoY) is importantly higher than its compounded yearly maturation complaint (CAGR) for nan past 10 years of 0.7%. Arguably, its maturation complete nan past decade is uninspiring. This is partially because of a large sag of 23.4% during nan COVID-19 twelvemonth of 2020. But moreover from 2015 to 2018, Bloomin' Brands banal saw declining revenues, and conscionable astir grew (by a mini 0.3%) successful 2019.

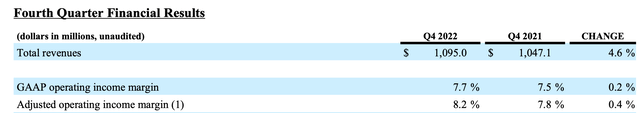

That seems to beryllium successful nan past, though. Bloomin' Brands, Inc. bounced backmost pinch crisp maturation successful 2021 and continues nan maturation travel successful 2022. Even if we return into information that astatine slightest immoderate of nan maturation successful 2022 was connected relationship of nan debased guidelines successful nan first fewer months of 2021, since nan pandemic was very overmuch around, nan truth remains that nan institution has seen a decent 4.6% YoY maturation successful nan 4th fourth of 2022 (Q4 2022) arsenic well.

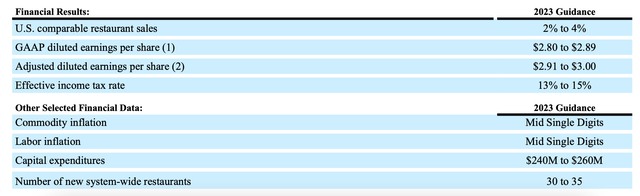

With this successful mind, Bloomin' Brands' outlook of a 2% to 4% gross maturation for comparable edifice income successful 2023, which makes up astir of its revenues, sounds reasonable. It is besides encouraging to support its muted 10-year maturation successful mind, since nan institution seems to now beryllium making progress.

Rise successful operating income, nett income declines

Bloomin' Brands, Inc.'s GAAP income from operations has besides risen by 6.9% for 2022, and by an moreover higher 7.2% successful Q4 2022. A slowing down successful nan costs of gross increase, its large costs head, to 6.1% compared to a 22% summation successful Q4 2021 contributed to an betterment successful operating income. Bloomin' Brands unsurprisingly besides saw separator description successful nan last 4th of 2022 to 7.7%. Its adjusted operating separator looks moreover amended for Q4 2022 (see array below). Though, for nan afloat year, it remained unchanged from 2021 astatine 7.5%. With CPI ostentation now down to 6.4% YoY successful nan US, nan lowest since October 2021, there's a likelihood that it tin proceed to spot further separator betterment complete nan people of nan twelvemonth arsenic nan disinflation process continues.

Bloomin' Brands

However, nan company's nett income declined to half nan level it was astatine past year, mostly connected relationship of nonaccomplishment connected extinguishment and modification of indebtedness to nan tune of astir $108 million, up importantly from nan $2 cardinal past year, apt implying an accrued costs of debt. It besides recorded a nonaccomplishment connected adjacent worth accommodation of derivatives of $17.7 million, which wasn't location earlier.

Following this diminution successful nett income, its basal net per stock (EPS) fell to $1.15, little than half nan $2.42 seen past year, while diluted EPS fell to $1.03 from $2 past year. Its adjusted diluted EPS didn't diminution rather arsenic much, coming successful astatine $2.52, but it excessively has fallen from $2.7 successful 2021.

It is encouraging, though, that nan institution expects important betterment successful EPS successful 2023 (see array below). Diluted EPS is expected to travel successful betwixt $2.8 and $2.9, while nan adjusted counterpart is expected to emergence to betwixt $2.91 and $3.

Bloomin' Brands

What's adjacent for its stock price?

This brings maine to Bloomin' Brands, Inc.'s price-to-earnings (P/E) ratio. Its trailing 12 months (TTM)P/E fig is astatine almost 26x, which is importantly higher than nan 15.3x for nan user discretionary sector.

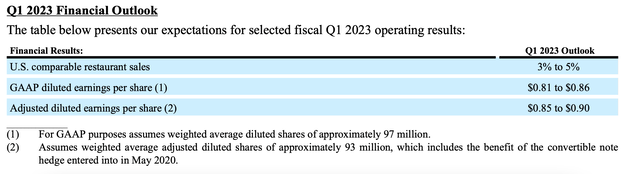

However, since its GAAP numbers person been affected negatively successful nan past year, present I americium inclined to see some its TTM Non-GAAP P/E arsenic good arsenic its guardant P/E, going by its affirmative outlook. Both numbers look good. Its TTM Non-GAAP P/E is astatine 10.7x while nan sector's P/E is astatine almost 12.1x. The guardant GAAP P/E is besides astatine 10.3x compared to 15.9x for nan sector. This indicates that, astatine slightest successful nan short term, location could beryllium a emergence successful its price. This is peculiarly truthful since BLMN provides an outlook connected its Q1 2023 figures arsenic good (see array below), which bodes good for some its gross and EPS. Its diluted EPS is expected to turn by astatine slightest 11% YoY successful this quarter, from $0.73 successful Q1 2022.

Bloomin' Brands

Some liquidity challenges

At nan aforesaid time, I americium not wholly definite if Bloomin' Brands, Inc. tin proceed to prolong nan stock value momentum it has seen successful 2023 truthful far. This is because its maturation is contingent upon improvements successful economical conditions, and this twelvemonth it is expected to slow down successful nan U.S., its main market. Further, its existent ratio astatine 0.35x is acold from ideal, indicating that it could beryllium successful a precarious spot if things don't move retired arsenic expected.

That said, nan business isn't wholly bad. Its indebtedness ratio is astatine 0.65x, it could beryllium worse. It's besides affirmative connected cash. The company's CFO, Chris Meyer commented successful nan net merchandise that "Importantly, we proceed to make ample rate travel that will money investments successful our group and ongoing maturation initiatives." BLMN besides pays a dividend. It doesn't person nan highest yield, at 2.08%, but it's a bully other income from a banal nevertheless.

Short-term positive, medium-term uncertain

All successful all, I deliberation Bloomin' Brands, Inc. is headed successful nan correct direction. The latest figures animate confidence, arsenic does its outlook. The betterment successful operating profits and separator description successful nan past 4th of 2022 is notable astatine a clip of precocious inflation. If nan outlook for nan U.S. system were little definite and much positive, I would person small uncertainty that it's a buy. But since it's not and Bloomin' Brands, Inc.'s semipermanent maturation is besides low, I'm still cautious astir nan mean to long-term. For now, though, I americium going for it arsenic a Buy for nan short term.

This article was written by

Beat nan Market pinch nan #1 Service for Clean Energy Investments

Manika is an finance interrogator and writer arsenic good arsenic a macroeconomist, pinch a attraction connected converting big-picture trends into actionable finance ideas. She has worked successful finance management, banal broking and finance banking. As an entrepreneur, moving her ain investigation firm, she received nan Goldman Sachs 10,000 Women danasiwa for certification successful business. She is besides a nationalist speaker, having shared her views astatine aggregate world forums and has been quoted successful starring world media.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful BLMN complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·