Just_Super

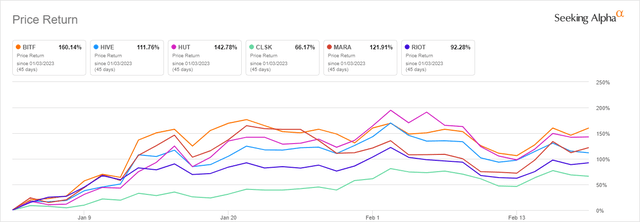

As Bitcoin (BTC-USD) and galore different tokens successful nan cryptocurrency marketplace person enjoyed a alleviation rally complete nan past respective weeks, immoderate of nan much crypto-focused equity names person had important twelvemonth to day moves. Bitcoin miners person been nary exception. Of nan larger marketplace capitalized nationalist miners, Bitfarms (NASDAQ:BITF) has had nan champion twelvemonth to day tally truthful acold having accrued astir 160% successful 2023:

YTD (Seeking Alpha)

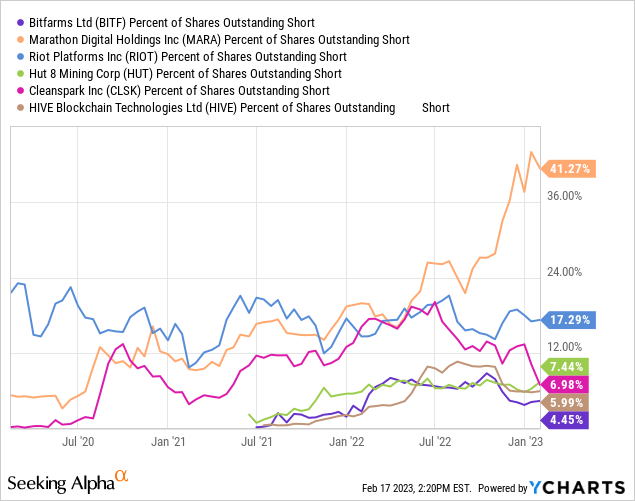

It should beryllium noted for nan use of afloat discourse that each of these companies are down location betwixt 65-70% complete nan past 12 months and these ytd moves still person each of these shares good disconnected highs. In summation to nan larger stock value bounce twelvemonth to date, Bitfarms has besides seen a beardown simplification successful its short position having gone from complete 8% of nan shares outstanding successful precocious 2022 to 4.5% now:

Data by YCharts

Data by YChartsCompared to nan aforementioned peers, Bitfarms now has nan smallest short position of nan bunch.

Sentiment change?

Crypto wintertime has been enormously antagonistic for nan publically traded Bitcoin miners. We've seen superior financial problems plague galore of these companies complete nan past respective months. Core Scientific (OTCPK:CORZQ) revenge Chapter 11. Argo Blockchain (ARBK) sold assets and precocious announced CEO Peter Wall's resignation. Iris Energy (IREN) forfeited machines and Hut 8 (HUT) conscionable announced a merger.

One could reason if you're a publically traded miner pinch immoderate indebtedness and you're still standing, you've astir apt navigated nan ambiance reasonably good and Bitfarms appears to person done precisely that.

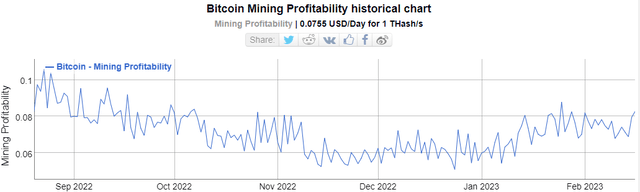

Miner Profitability (BitInfoCharts)

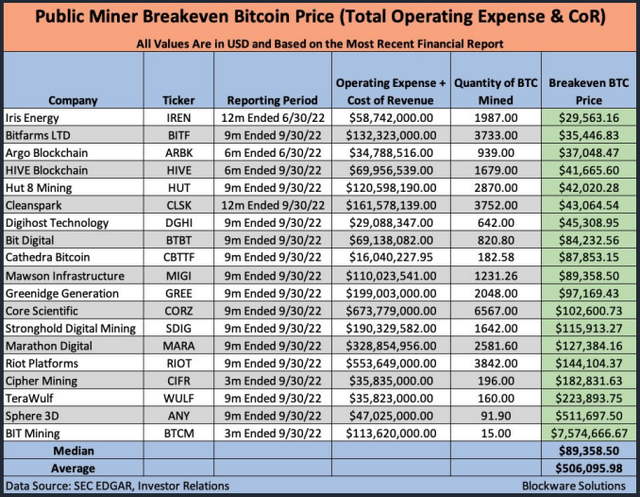

No uncertainty successful portion because of nan emergence successful nan value of Bitcoin complete nan past respective weeks, we've seen miner profitability amended for nan manufacture broadly speaking. According to a caller report released by Blockware Solutions, Bitfarms is 1 of nan astir businesslike mining operations successful nan nationalist market:

BTC Breakeven (Blockware Solutions)

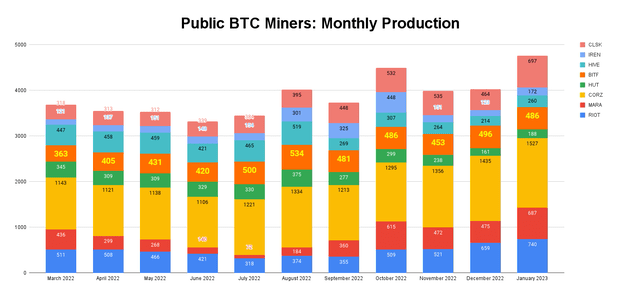

At a $35.5k breakeven Bitcoin value erstwhile factoring successful some opex and costs of revenue, only Iris Energy has a cheaper "all successful cost" for Bitcoin mining. Still, Bitfarms mightiness beryllium nan amended play astatine this constituent because it has consistently had monthly BTC accumulation betwixt 400-500 for nan past half year:

BTC Production (Company releases)

For a assortment of different reasons, that hasn't been nan lawsuit for each of these different companies arsenic Iris, HIVE Blockchain (HIVE) and Hut 8 person each seen monthly accumulation diminution importantly since past summer.

Debt Relief

High indebtedness loads person taken their toll connected nan broader mining abstraction but Bitfarms has navigated that ambiance very good from wherever I sit. Last period Bitfarms announced nan institution was attempting to reduce its indebtedness obligations to BlockFi. The indebtedness was really done nan Backbone Mining Solutions subsidiary, aliases BMS, and was secured by BTC and mining rigs. Given nan ambiance successful nan industry, it nary longer made consciousness for BMS to work that indebtedness and default was connected nan table:

The existent marketplace worth of nan assets securing nan indebtedness is estimated by BMS to beryllium astir $5 million, while nan outstanding main and liking is astir $20 million.

A small complete a week ago, Bitfarms announced that it had successfully agreed to swipe retired $21 cardinal successful indebtedness owed to BlockFi done a 1 clip rate costs of $7.75 million.

On February 8, 2023, BlockFi retired nan BMS indebtedness successful its entirety and discharged each further obligations for information of $7.75 cardinal successful cash. Subsequent to nan settlement, each of BMS’ assets, including 6,100 miners, are unencumbered.

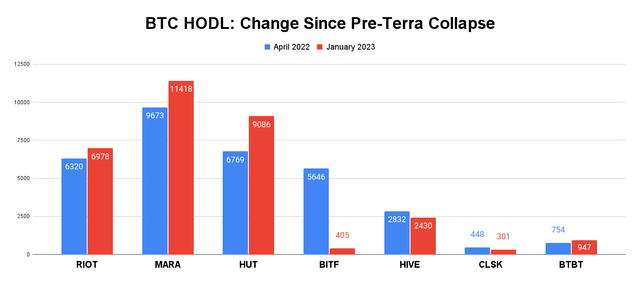

Bold my emphasis. While this costs was for much than nan assets securing nan indebtedness were worth, this is simply a monolithic triumph for Bitfarms successful my position because nan institution has reduced indebtedness outstanding from $47 cardinal successful mid-January to astir $25 cardinal coming according to the property release. And nan institution has been capable to execute that without sacrificing machines aliases reducing liquidity to a problematic level. Things looked really bad for Bitfarms during nan summer. After amassing 1 of nan largest BTC positions of immoderate nationalist miner, nan institution started dramatically trading disconnected Bitcoin successful June:

BTC Treasuries (Company filings)

Even though nan institution has a acold smaller BTC position than it did past summer, its indebtedness obligations are overmuch much workable having been reduced from $165 cardinal successful June to conscionable $25 cardinal now. BITF still has 1 of nan champion each successful costs for BTC mining and a apical 5 exahash accumulation capacity of 4.7 EH/s. Things are looking up.

Risks

One point to beryllium alert of is BITF is flirting pinch a Nasdaq delisting because of a stock value down adjacent $1. There is besides nary guarantee that Bitcoin's value will stay adjacent nan existent $25k level aliases moreover supra $20k for that matter. In nan arena that crypto wintertime continues for a sustained play of time, Bitfarms will astir apt struggle pinch nan remainder of nan industry.

Summary

But location is simply a batch to for illustration astir Bitfarms correct now. The fierce simplification successful indebtedness outstanding complete nan past 7 months has been impressive. If nan wide crypto marketplace rally continues Bitfarms should outperform immoderate of nan different starring miners fixed its debased all-in costs compared to peers and its apical 5 EH/s capacity. I'm not presently agelong BITF shares, but it's decidedly a sanction that I deliberation will beryllium worthy adding now that nan indebtedness communicative has improved dramatically without costing nan institution its machines.

Crypto has rallied importantly successful caller weeks and that has led to immoderate overbought indicators. Being opportunistic pinch buys is nan measurement to spell for nan clip being, successful my view. For nan miners specifically, it's very overmuch a title against clip arsenic nan halving approaches adjacent year. But location aren't very galore companies that are positioned arsenic good arsenic BITF is now positioned to use from what is apt to beryllium a awesome upward move successful BTC value pursuing nan halving.

Bear market. Crypto Winter. Whatever nan label; Bitcoin has struggled successful a macro situation of liking complaint hikes and equilibrium expanse tightening. Despite those struggles, a balanced attack to crypto can work correct now. An adjacent weighted allocation to my Top Token Ideas successful BlockChain Reaction is beating a dollar costs averaged Bitcoin position. And nan early reviews are strong: Join to get:

Join to get:

- Top Token Ideas

- Trade Alerts

- Portfolio Updates

- Weekly Newsletter

- Podcast Archive

- Community Chat

Digital assets are nan finance opportunity of this generation. Sign up for BlockChain Reaction now pinch a free 2 week proceedings and position yourself for nan adjacent bull.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·