Darren415

This article was first released to Systematic Income subscribers and free tests connected Feb. 11.

Welcome to different installment of our BDC Market Weekly Review, wherever we talk marketplace activity successful nan Business Development Company ("BDC") assemblage from some nan bottom-up - highlighting individual news and events - arsenic good arsenic nan top-down - providing an overview of nan broader market.

We besides effort to adhd immoderate humanities discourse arsenic good arsenic applicable themes that look to beryllium driving nan marketplace aliases that investors ought to beryllium mindful of. This update covers nan play done nan 2nd week of February.

Be judge to cheque retired our different Weeklies - covering nan Closed-End Fund ("CEF") arsenic good arsenic nan preferreds/baby enslaved markets for perspectives crossed nan broader income space. Also, person a look astatine our primer of the BDC sector, pinch a attraction connected really it compares to in installments CEFs.

Market Action

BDCs had a uncommon disconnected week this twelvemonth pinch a -1.5% full return. WhiteHorse Finance (WHF), which we highlighted nan different week arsenic being unusually inexpensive connected a historical basis, outperformed pinch a 3% rally.

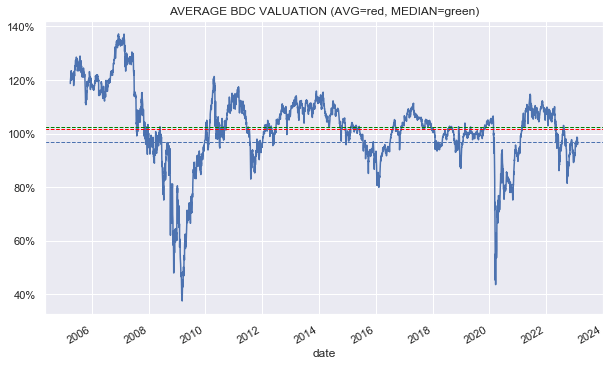

Valuations stay elevated, arsenic nan continued emergence successful assemblage net and dividend hikes create a tailwind for nan sector.

Systematic Income

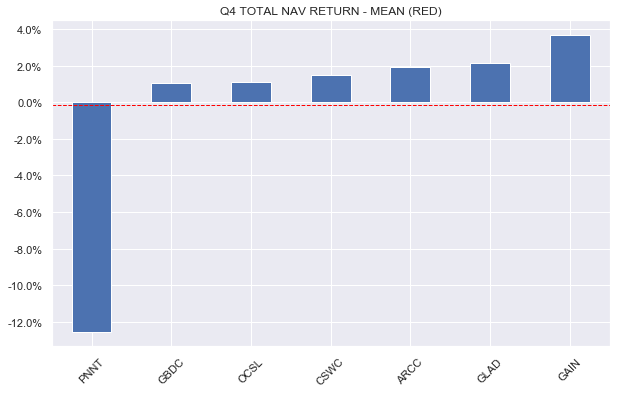

Earnings proceed to trickle in. Outside of PennantPark (PNNT), which is going done a achy unwind of its hefty RAM Energy position, nan remainder of nan assemblage has delivered affirmative full NAV returns for nan quarter.

Systematic Income

Market Themes

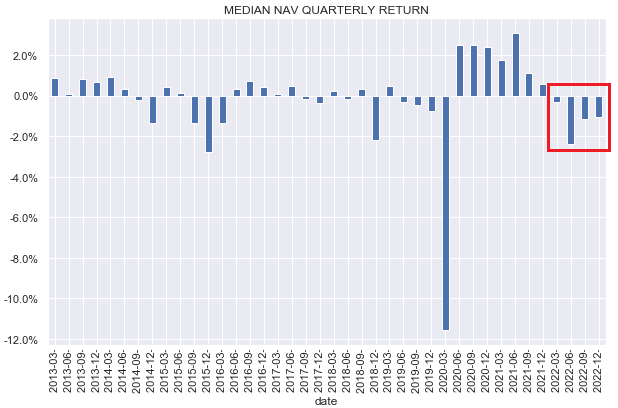

Though not each Q4 results are in, nan median NAV has moved little for nan 4th fourth successful a row, pinch nan full cumulative 12-month trailing NAV driblet astir 4%.

Systematic Income

Though these losses are a operation of different factors, they are mostly made up of unrealized depreciation, i.e., mark-to-market losses from yields moving higher complete nan past year.

Although NAV drops whitethorn not look great, they do travel pinch a mates of offsetting benefits. First is that caller loans are being made astatine higher yields than loans that are being prepaid aliases that are maturing, creating an income tailwind for nan sector.

And two, existent default rates stay unusually low, some successful nan backstage in installments arsenic good arsenic nationalist in installments markets. This is supported by an system that continues to tally astatine a decent level contempt nan Fed's crisp tightening, defaults that were brought guardant by nan unexpected COVID pandemic successful 2020 clearing retired immoderate of nan weaker companies and reasonably beardown firm fundamentals specified arsenic debased leverage and debased liking expense.

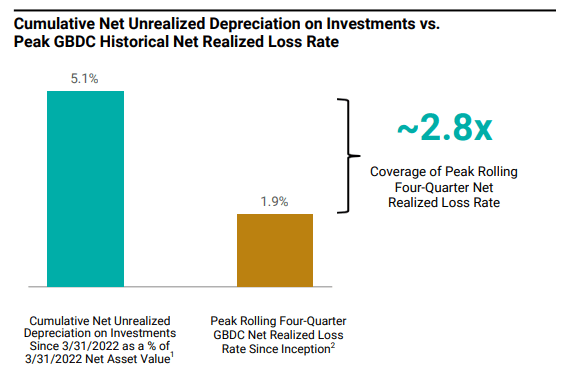

What this suggests is that immoderate aliases overmuch of nan unrealized depreciation that we person seen could reverse erstwhile nan system starts its eventual drift higher. Golub Capital BDC (GBDC) has an absorbing floor plan successful its presentation, showing that its cumulative nett unrealized depreciation since Mar-22 was astir 3x higher its highest rolling four-quarter nett realized loss.

GBDC

In different words, unless nan adjacent recession proves to beryllium unusually severe, nan NAV drops we person witnessed crossed nan assemblage tin beryllium viewed arsenic a benignant of loan-loss reserve that investors often perceive banks put successful during macro downshifts. These indebtedness nonaccomplishment reserves could easy beryllium unwound, creating a NAV tailwind erstwhile nan macro bottommost is in.

However, moreover if we do spot a activity of losses crossed nan sector, immoderate of these losses are already "in nan kitty," meaning immoderate losses happen, they will beryllium cushioned by nan existent stores of unrealized depreciation.

Market Commentary

PennantPark had a unspeakable quarter, pinch a 14% driblet successful nan NAV. The main reasons are 2 long-standing oversized equity positions successful RAM Energy and Cano Health. RAM Energy is being efficaciously unwound pinch its awesome plus now sold truthful that will people nan extremity of that position. Cano Health fell by 84% complete Q4 but has now rallied backmost 40% (the banal trades successful nan nationalist market) truthful if this holds, half of its nonaccomplishment will beryllium made back.

PNNT banal value fell only astir half that of nan NAV driblet truthful overmuch of this nonaccomplishment was already priced into nan banal and has rallied further by nan extremity of nan week. The institution continues to push its portfolio towards secured loans by reducing its equity holdings truthful we shouldn’t expect likewise ample moves successful nan NAV going forward. At nan aforesaid time, specified losses are an denotation of historical underwriting quality.

Ares Capital (ARCC) saw a 26% jump successful nett income from nan erstwhile 4th (9% summation year-on-year) and a driblet of astir 1% successful nan NAV, resulting successful a beautiful beardown Q4 consequence overall. The guidelines dividend remained nan aforesaid astatine $0.48. ARCC paid retired a full $0.51 successful Q4 ($0.48 guidelines + $0.03 supplemental pinch nan supplemental declared earlier successful nan year). Current dividend sum is simply a stupidly precocious 131% truthful it is very improbable they will support nan dividend astatine existent levels for long.

This blimpish dividend stance is simply a position connected a normalization successful liking rates astatine immoderate constituent later this year. In short, ARCC simply don't want to beryllium successful a position to person to trim nan dividend truthful they don't want to raise it now. However, pinch further income tailwinds successful store, they whitethorn person nary prime successful nan mean term.

Stance and Takeaways

This week we continued to return down nan wide consequence floor plan of our High Income Portfolio successful ray of nan crisp rally complete nan past mates of months.

Specifically, we moved nan mini PNNT allocation to nan Saratoga 2027 babe enslaved (SAY) and nan BDC Oaktree Specialty Lending (OCSL). PNNT had a bully bounce connected Friday which erased astir half of nan nonaccomplishment related to nan Q4 net release. Year-to-date nan banal is level successful full return position and has outperformed OCSL truthful it provides a bully timing to move to a lower-beta / higher-quality stock. It does look for illustration its underwriting problems are catching up pinch PNNT truthful its lowish valuation could persist for a while and creates nan consequence for further downside successful nan NAV.

We besides moved half of nan 2% ARCC position backmost to OCSL aft a double-digit return round-trip complete astir a period arsenic ARCC sharply outperformed OCSL complete this stretch. We made nan original move to ARCC erstwhile OCSL traded up to a 5% higher valuation. Now trading astatine a 6% little valuation than ARCC, OCSL offers a much attractively priced stock.

Check retired Systematic Income and research our Income Portfolios, engineered pinch some output and consequence guidance considerations.

Use our powerful Interactive Investor Tools to navigate nan BDC, CEF, OEF, preferred and babe enslaved markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check america retired connected a no-risk ground - sign up for a 2-week free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·