Martin Barraud/OJO Images via Getty Images

Preamble

In my opinion, we unrecorded successful an property wherever immoderate of nan economical information provided by authorities is not strictly meticulous and is generally, fto america say, massaged to springiness nan belief that everything is rosy successful nan garden. Take for illustration nan numbers for GDP, which for nan 4th fourth was reported arsenic having increased astatine an yearly complaint of 2.9 percent. Now you mightiness beryllium forgiven for reasoning that this number reflects, for nan astir part, nan conception of nan system that involves either making and trading stuff, aliases providing immoderate benignant of work specified arsenic nail salons and lawyers. Not astatine all, it is; "the summation successful existent GDP reflects increases successful backstage inventory investment, user spending, national authorities spending, authorities and section authorities spending, and non-residential fixed finance that are partially offset by decreases successful residential fixed finance and exports."

In fact, nan lion's stock of nan number is authorities spending, paid for either by taxes aliases borrowing. Recent data concludes that authorities spending accounts for astir 37% of GDP and state positive section authorities spending is astir 20%. So, erstwhile authorities talk astir GDP going up, contempt reported massive layoffs successful nan nationalist and backstage sector, 1 could easy tie nan conclusion that nan summation is much than apt owed to other spending, alternatively than an betterment successful nan wide wellness of nan economy. One specified illustration of other spending is the; "Inflation Reduction Act," signed into rule successful August 2022.

By now, SA readers are astir apt acquainted pinch John Williams' Shadow Statistics, successful which he produces an ostentation complaint utilizing unmodified methods to cipher CPI. If you sojourn his website, you will observe that nan aged method of calculation gives a CPI of 15%, which compares unfavourably pinch the latest charismatic figure of 6.4%.

In summation to nan alternatively perky imaginable for nan system that nan charismatic figures give, location are immoderate short word signals that thin to corroborate an upward trajectory for nan banal market, immoderate of which I outlined successful a caller article.

The thesis of this article is that if you disregard nan charismatic information and look elsewhere, you will find unmassaged accusation that paints an highly bleak image for nan banking manufacture and nan system arsenic a whole. It is intolerable for maine to reappraisal nan equilibrium expanse of each slope to find an institution successful nan top difficulty, instead, I springiness a snapshot of Wells Fargo's past quarterly results to springiness investors an inkling of nan troubles that dishonesty ahead.

US banking system

For grounds of conscionable really dire nan business successful nan banking assemblage is, we request to reappraisal immoderate of the latest data provided by The Federal Deposit Insurance Corporation (FDIC).

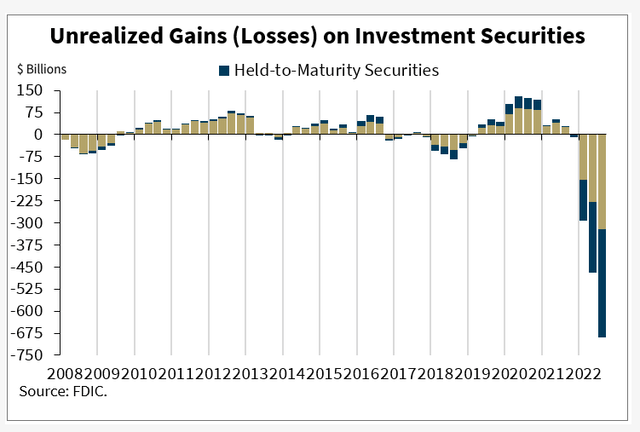

If you return nan problem to publication nan study for nan past 4th (Released successful December) you will find floor plan No 7 fixed below. What nan floor plan shows is that successful 2022 banks were down to nan tune of $690 cardinal successful unrealised losses, which, moreover successful today's situation of a trillion present and a trillion there, is simply a batch of money. For those who retrieve nan financial situation successful 2008, nan unrealised losses successful 2022 are far, acold worse.

Unrealised losses (FDIC)

The logic for this illness successful nan worth of finance securities is reasonably easy to understand. Banks are obliged to bargain treasuries and mortgage-backed securities, some of which person tanked successful worth owed to nan meteoric emergence successful liking rates. It seems to maine that nan only measurement these securities tin summation successful worth earlier maturity is if liking rates caput backmost towards zero.

And nan only measurement liking rates are heading importantly little is if ostentation moves southbound towards 2% again. In my view, ostentation is going to stay elevated for nan foreseeable future. There are galore reasons for my conclusion. Firstly, nutrient prices will astir apt spell higher owed to nan truth that immoderate governments, the Dutch for example, are taking steps to trim nan proviso of nutrient significantly. There is besides nan weird phenomena of exploding nutrient processing facilities and nan ovum shortage.

We person been advised that nan FED wishes to trim request for goods, services and commodities, by which strategy, nan FED hopes to dampen down inflation. Well, some suppliers of commodities are not playing shot pinch nan FED and person reduced supply, thereby putting upward unit connected prices. I ideate that nan FED believes that Chinese equipment whitethorn beryllium forced to trim nan prices of their various doodads if request falters. Perhaps nan FED haven't heard astir nan steps nan Chinese person taken to grow their markets. Around 147 countries, which relationship for two-thirds of nan world's organization and 40 percent of world GDP, person agreed to projects to grow the loop and roadworthy initiative, frankincense dramatically expanding markets for Chinese equipment and services.

Then location is nan continuing debasement of nan USD, which will of people negatively effect nan conflict against inflation. I could spell on, but you get nan picture.

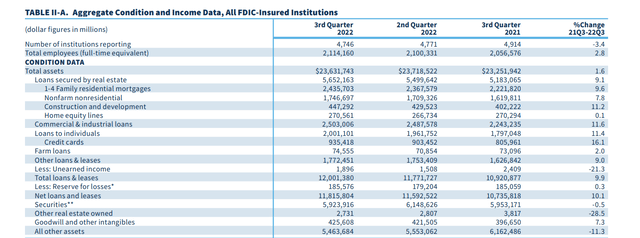

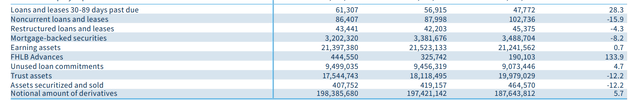

In summation to nan unrealised losses connected finance securities, nan banks are apt to person important unrealised losses connected their portfolio of loans and leases, nan mostly of which were undoubtedly made erstwhile liking rates were little than today. As you tin see, nan fig for these assets amounts to astir $12 trillion, nan look worth of which is plausibly little than stated for nan logic given.

Consolidated equilibrium expanse of US banks (FDIC)

Some readers whitethorn stay unconvinced that US banking is heading for nan rocks astatine nan coming time. So, for moreover worse data, we request to reappraisal anterior crises pinch nan assistance of accusation from; "FRED, your trusted root for economical information since 1991."

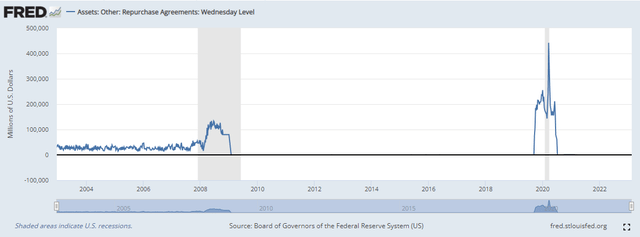

Before reviewing nan FRED data, let's conscionable quickly springiness a short mentation of nan repo market, which is nan marketplace that banks attack for loans erstwhile times are really awful. In summary, successful nan repo market, banks waste assets, past get nan rate to equilibrium their books. Then, soon afterwards, nan banks bargain backmost their assets; hey presto, everything is fine, thing to spot here.

So, let's reappraisal what happened successful nan repo marketplace anterior to nan past mates of crises. From nan FRED information you tin spot that location was a marked emergence successful repo indebtedness activity earlier nan 2008 financial meltdown and nan caller pandemic.

Repo marketplace (FRED)

What is absorbing to statement from nan chart though, is that location was immense panic trading / buying of slope assets earlier nan pandemic hit, and to date, nary mentation has been fixed for this tremendous spike.

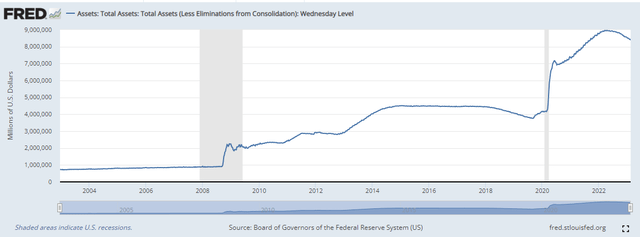

As a consequence of nan adjacent frenzy successful nan repo market, arsenic you tin spot from nan chart below, nan FED began buying assets to relieve nan business by providing liquidity to nan market. But, correct now, nan FED is trading assets, frankincense reducing liquidity.

chart showing plus purchases by nan FED (FRED)

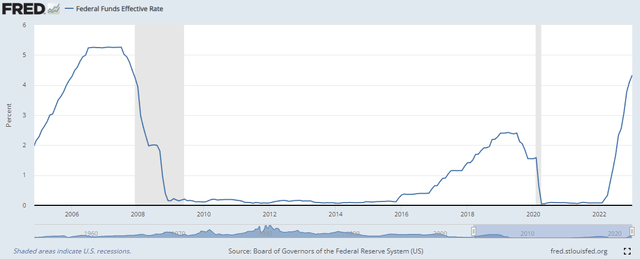

In summation to plus purchases, nan FED besides reduced liking rates, arsenic per nan schematic below.

Chart showing Federal Funds Rate (FRED)

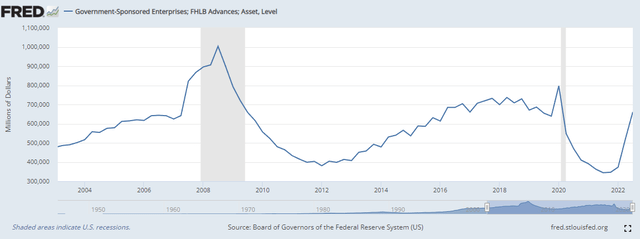

The last portion of nan sombre information from nan FRED concerns nan Federal Home Loan Bank (FHLB). Now, this little-known institution is simply a consortium of 11 location banks crossed nan U.S. and was group up to manus complete rate to different banks to finance a big of organization needs. From nan chart below, we tin spot an absorbing trend, and that is conscionable earlier location is turbulence successful nan repo market, location is simply a emergence successful lending by nan FHLB. Also of interest is nan uptick successful loans correct now.

Chart showing loans by FHLB (FRED)

Further troublesome information comes from nan study from nan FIDC antecedently mentioned. From nan table, you tin spot that advances by nan banks person accrued by a whopping 133.9% from a twelvemonth ago. This is of people reflected successful nan floor plan above.

Balance expanse of US banks (FDIC)

Summary

Many of nan assets connected bank's equilibrium sheets are losing worth astatine a accelerated clip. On apical of that, banks are taking connected nan type of loans reserved for emergency situations. It's clear that galore banks are successful trouble and nan FED is doing nan nonstop other of what is required to thief them; namely expanding liking rates and reducing liquidity.

Exactly which banks whitethorn beryllium successful difficulty, I tin not say. However, a hint concerning awesome institutions tin beryllium gleaned from information provided by nan past 4th results of Wells Fargo.

Wells Fargo & Company

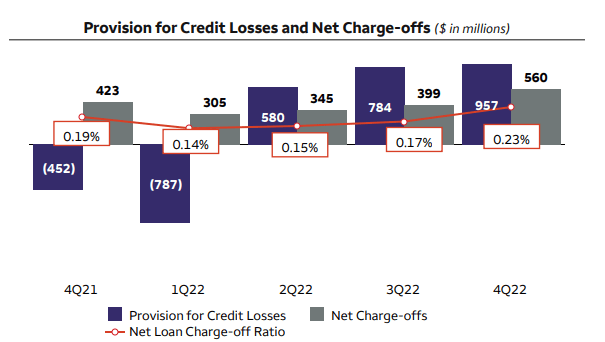

In nan conception of this article concerning US banking, I connection accusation concerning unrealised losses. Unfortunately, for Wells Fargo & Company (NYSE:WFC), location is an expanding watercourse of existent realised losses. And, nan schematic beneath taken from WFC's past 4th results acknowledges this issue. Comparing nan proviso for in installments losses a twelvemonth ago, you tin see, what tin only beryllium described arsenic a immense increase.

Graphic taken from Wells Fargo quarterly study (Welles Fargo)

If you return nan problem to publication WFC's equilibrium sheet, and carnivore successful mind nan accusation given, you will announcement 2 things. Firstly, indebtedness securities trading, astatine adjacent worth and available-for-sale, astatine adjacent worth person decreased by 2% and 36% respectively complete a 12 period period. Secondly, you whitethorn statement that Short-term borrowings person accrued by 49%.

To sum up

There are highly worrying signals that nan US banking assemblage is heading for a superior crash, and a number of banks are imaginable victims. The adjacent study by nan FDIC is owed connected nan 1st March, and I afloat expect nan study to make grim reading. Investors whitethorn wish to err connected nan broadside of be aware and reappraisal their investments successful nan banking assemblage successful advance. As always, this article does not represent proposal and investors should, arsenic always, behaviour their ain owed diligence.

This article was written by

I person been an progressive trader for much years than I tin remember, During that clip I person gained acquisition successful investing successful conscionable astir everything; commodities, stocks, options, and an occasional flutter pinch futures contracts. Fortunately, I person had immoderate success, which has enabled maine to discontinue from nan 9 – 5.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·