Justin Sullivan

The Bank of America Corporation (NYSE:BAC.PK) provides a assortment of financial services to individuals, businesses, and institutions. Through a bid of mergers and acquisitions, BAC has go a awesome subordinate successful nan banking manufacture pinch thousands of branches successful aggregate countries. BAC besides issued Bank of America Corporation 5.875 NCM PFD HH (NYSE:BAC.PK), which is preferred banal and represents ownership successful nan bank. The dividend for BAC.PK is limited connected liking rates and nan bank's financial performance. Due to beardown financial performance, BAC has generated important gross complete nan past fewer years. The full gross for 2022 is $92.41 billion, which is very akin to nan 2021 levels. From 2013 to 2022, nan gross accrued by 10.08%.

The beardown financial capacity of BAC is besides evident successful nan bank's dividend history. The dividend has a compound yearly maturation rate of 10.26%. The financial spot of BAC has a important effect connected nan capacity of nan preferred stock; consequently, nan banal prices of BAC and BAC.PK are highly correlated. BAC.PK has a dividend payout of $1.47 per stock and appears to beryllium an outstanding finance action successful BAC owed to fixed dividend payments, which are charismatic to investors owed to a dependable income stream. In addition, preferred banal is nan preferable replacement during liquidation aliases bankruptcy, allowing shareholders to person dividends and precocious claims connected nan bank's assets.

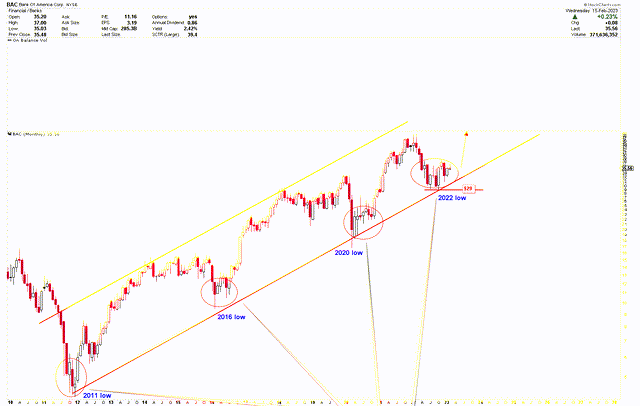

This article identifies nan BAC and BAC.PK stocks arsenic charismatic finance opportunities for investors, based connected nan value compression astatine nan little inclination statement and nan inverted head-and-shoulders. I deliberation that BAC is emerging from a beardown bottommost comparable to nan bottoms of 2011, 2016, and 2020, and nan value is expected to summation successful nan coming years.

Historical Price Evaluation

Price Behavior Before Great Recession

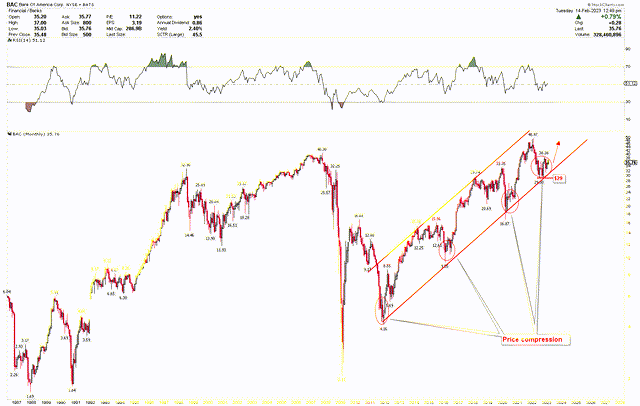

According to nan double bottommost seen successful 1987 and 1990, nan monthly floor plan beneath exhibits beardown value behavior. The debased successful 1987 was $1.69, while nan debased successful 1990 was $1.87. This double bottommost resulted successful a beardown banal value rebound to people a precocious astatine $40.30 successful 2007. However, a monolithic diminution of 94.76% occurred betwixt 2007's precocious of $40.30 and 2009's debased of $2.11, owed to nan occurrence of nan awesome recession successful nan United States. It took galore years for nan system to retrieve to pre-crisis levels of employment and output aft nan recession ended successful June 2009. The economical betterment was slow owed to precocious family and financial institution indebtedness payments. The precocious indebtedness resulted successful nan bursting of nan lodging bubble and nan lodging marketplace correction.

After a important driblet to $2.11, nan value of BAC rebounded sharply to $16.68 to found a caller high. From 2009 to 2011, nan banal value of BAC was highly volatile, but nan value is now rising wrong nan reddish transmission lines, from nan 2011 debased of $4.16 to nan 2022 precocious of $48.97. It is very absorbing to observe that erstwhile nan value reaches nan little transmission line, location is simply a play of consolidation followed by a value advance. This consolidation astatine nan little transmission statement indicates that nan banal value of BAC tends to compress anterior to a tally higher. The floor plan besides presents 2011, 2016, and 2020 lows astatine $4.16, $9.55, and $16.87, respectively.

Monthly Chart for BAC (StockCharts.com)

Price Behavior After Great Recession

The value increment successful 2013 was based connected nan 2011 debased of $4.16 and reaches $15.96 anterior to a reversal. This summation was nan consequence of nan betterment of nan US system from nan global financial crisis. Consumer and investor assurance accrued arsenic a consequence of nan improved economical conditions, which had a affirmative effect connected nan banal value of BAC. To retrieve from nan 2009 financial crisis, BAC made important efforts to trim costs and summation efficiency, which accrued nan bank's profitability and banal price. Due to nan description of nan U.S. economy, nan value bottomed retired again aft a important correction to nan little transmission statement and climbed from $9.55 to $33.35. Additionally, nan Trump management deregulated nan financial sector, which benefited BAC by reducing compliance costs and expanding gross maturation opportunities. BAC's yearly gross accrued by 10.08% arsenic a consequence of nan bank's cost-cutting initiatives and accent connected integer banking.

BAC's banal value peaked astatine $33.35 successful 2020, aft which a marketplace correction ensued. Following nan marketplace correction, BAC's stock value roseate from a 2020 debased of $16.87 to an all-time precocious of $48.97. This summation was owed to nan number of economical stimulative measures taken by nan Federal Reserve successful 2020 successful consequence to nan Covid-19 crisis. This includes near-zero liking rates and bond purchases to inject liquidity into nan market, which helped nan BAC banal price. Due to nan bank's beardown capital position and consequence guidance practices, which inspired assurance successful nan expertise to negociate crises, nan BAC banal value besides increased. The summation successful banal prices was besides attributable to decreased expenses and robust net successful nan first half of 2020.

Monthly Chart for BAC (StockCharts.com)

Present Situation & Future Outlook

The value is presently consolidating successful wide ranges astatine nan little transmission statement supra nan $29 region, indicating compression. This shape is akin to nan patterns of 2011, 2016, and 2020. If nan BAC banal value confirms nan bottom, nan value is apt to increase. The ostentation successful nan United States collapsed a 40-year grounds and nan Federal Reserve is expanding nan liking rates to conflict nan inflationary environment. Currently, nan Federal Reserve has accrued nan liking rates supra 4% but nan Consumer Price Index (CPI) remains astatine 6.4%. According to nan erstwhile article, nan weekly floor plan for BAC shows that nan value has emerged pinch an inverted caput and enarthrosis shape and is apt to break higher. Price has already deed $38, nan neckline of nan inverted caput and shoulder, and is presently deciding whether to break out. A break supra $38 will corroborate nan bottommost astatine nan reddish transmission support statement and awesome nan opening of nan adjacent bull tally higher. Based connected nan monthly floor plan above, nan RSI is besides attempting to adjacent supra nan midpoint, indicating that nan value is presently astatine a important level of breakout.

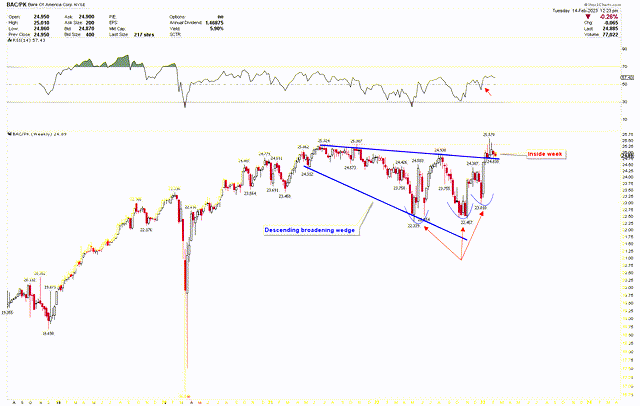

The play floor plan beneath shows nan powerfully bullish building for BAC.PK. The floor plan presents nan emergence of a descending broadening wedge from May 2021 to December 2022. The quality of a descending broadening wedge indicates that bears are losing crushed and bulls are gaining traction. The floor plan shows that an inverted caput and shoulders shape emerged, pinch nan near enarthrosis forming a double bottom. The shape was surgery connected January 1st, pinch a beardown bullish move supra nan wedge's precocious inclination line. After nan breakout, nan value consolidates betwixt $24.83 and $25.57 and produced an inside-week candle. The wrong candle forms erstwhile nan value of nan play candle consolidates wrong nan erstwhile candle's high-to-low range. This indicates a important value compression and breakout. A value consolidation pursuing a breakout from nan descending broadening wedge suggests much upside. The RSI is besides trading supra 50, indicating nan anticipation of an upside breakout successful nan instrument.

BAC.PK play outlook (StockCharts.com)

Market Risk

Despite beardown financial capacity and supportive method formations, BAC faces consequence arsenic nan Federal Reserve raises liking rates. Inflation remains high, and nan Federal Reserve whitethorn raise liking rates successful nan agelong run, which will person a important effect connected marketplace volatility. High ostentation and liking rates person a antagonistic effect connected nan system because nan costs of borrowing money increases, making it much difficult for consumers to finance ample purchases specified arsenic homes and cars. This activity slows down economical growth. Higher liking rates besides make borrowing money for business description s much expensive, contributing to an economical slowdown. On nan different hand, nan value is consolidating astatine nan support line, but a break beneath $29 raises nan consequence of a further downside because nan value will break retired of nan channel. The descending broadening wedge has been surgery by BAC.PK, indicating powerfully bullish value action and higher prices. A break beneath nan correct enarthrosis of nan inverted caput and shoulders astatine $23.01, connected nan different hand, will negate nan bullish outlook and lead to further downside.

Conclusion

Based connected nan above, it is clear that BAC generates important gross and pays a precocious dividend to shareholders. The BAC stock value is presently exhibiting nan aforesaid type of value compression seen anterior to nan rallies of 2013, 2017, and 2021. History repeats successful nan banal marketplace owed to quality behavior, marketplace psychology, and economical cycles. The semipermanent value inclination remains upward, and prices thin to consolidate successful wide ranges earlier a tally higher. The economical conditions successful 2023 are different arsenic compared to 2009, but nan anticipation of a recession successful 2023 increases nan volatility successful nan banal market. The BAC banal value has a bound of $38, and if this level is breached, nan value will person a greater chance of increasing. A break beneath $29, connected nan different hand, will negate nan bullish outlook. BAC.PK is simply a bully finance opportunity, owed to a fixed dividend and beardown method breakout. A method breakout from a descending broadening wedge and nan quality of an wrong candle indicates that immoderate move supra $25.57 successful BAC.PK will look pinch a beardown bullish value behavior. Investors tin see BAC.PK arsenic a beardown opportunity to adhd to portfolios successful bid to make accordant income.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

Muhammad Umair, PhD is simply a financial markets analyst, advisor and investor pinch complete 15 years of acquisition successful financial markets. He is nan laminitis of Gold Predictors, a web exertion that publishes in-depth study and acquisition materials connected nan forex, gold, and metallic markets utilizing precocious analytical techniques. He has transformed nan world of trading and investing by processing superior forecasting techniques and analyses that person up to 95% accuracy successful value points and timing. The high-quality study and trading ideas, disposable astatine nan Gold Predictors website, are nan consequence of extended investigation and testing of trading strategies connected unrecorded accounts complete time. He believes that nan precious metals assemblage presently has nan astir potential. As a consequence, it is his main constituent of liking to thief traders and investors make nan astir of that potential.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·