Feb. 17, 2023 5:16 AM ETACTV, AFMC, AFSM, ARKK, AVUV, BAPR, IVOO, IVOV, IVV, IVW, IWC, IWM, IWN, IWO, IWP, IWR, IWS, IYY, QQQ, SPLV, SPLX, SPMD, SPMO, SPMV, SPSM, SPUS, SPUU, SPVM, SPVU, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SPYD, SPYG, SPYV, SPYX, SQEW, SQLV, SSLY, SSO, SSPY, STLV, SVAL, SYLD, TMDV, TPHD, TPLC, TPSC, UAUG, UJAN, UMAR, UMAY, UOCT, UPRO, USEQ, USLB, USMC, USMF, USVM

Summary

- We analyse nan 2022 and 2023 year-to-date capacity of nan awesome plus classes.

- Many of nan successful "smart-money" trades of 2022 are underperforming successful 2023.

- The underweights from 2022 are having a bully year.

- The 2022 smart-money trades still consciousness for illustration nan correct ones, but investor positioning is not contributing to their 2023 success.

William_Potter

What a quality a twelvemonth makes

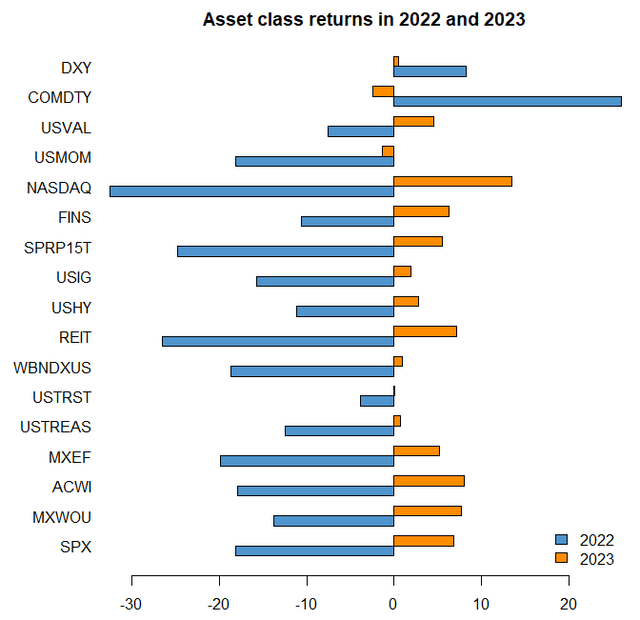

The floor plan beneath shows nan 2022 and 2023 (so far) returns crossed immoderate awesome plus classes.

Asset people returns, successful percent, successful 2022 and frankincense acold successful 2023. (QuantStreet, Bloomberg)

A cardinal for nan information names is fixed below.

A fewer observations:

- After taking a little region precocious successful 2022, dollar spot has continued, though connected nan backmost of higher than expected ostentation successful nan U.S. and revisions upward for nan way of nan Fed's monetary policy.

- Commodities -- nan only plus people too nan dollar that was up successful 2022 -- is down somewhat truthful acold this twelvemonth (probably because it is simply a very crowded waste and acquisition because nan fundamentals look to favour commodity exposure).

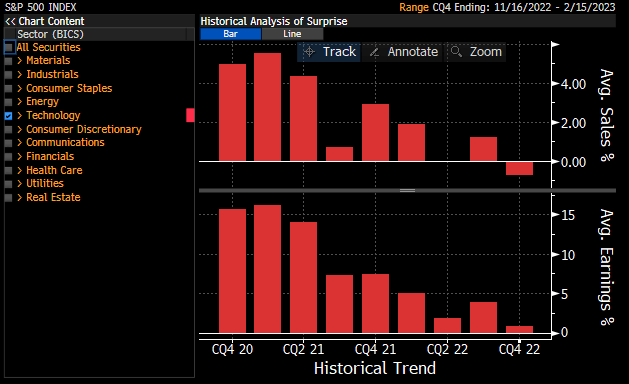

- Tech stocks are up large aft having a very bad twelvemonth successful 2022. Not clear what nan basal backdrop present is. Tech net weren't awesome (see below). Maybe anticipation of AI-driven transformation?

- Bonds (USIG, USHY, WBNDXUS, USTRST, USTREAS) were having a bully twelvemonth up until nan past week aliases 2 erstwhile ostentation fears started to travel back.

- The late-2022 outperformance of world stocks (MXWOU) comparative to nan US has not continued into 2023.

- The S&P consequence parity locator (SPRP15T) really had a beautiful bad twelvemonth successful 2022 aft doing good early connected successful nan year. It's up this year, though it's trailing wide equity markets.

- Momentum stocks successful nan US (USMOM) are down this year. This is (currently) a very energy- and staples-heavy basket.

- Not connected nan floor plan because it throws disconnected nan standard of everything is Bitcoin which was down 63% successful 2022 and is up adjacent to 50% (!) this year. This is contempt an onslaught of caller regulation. No words for this one.

Tech assemblage earnings. (Bloomberg)

Investor takeaways

Thus far, 2023 feels for illustration a twelvemonth that's crushed immoderate of nan celebrated "smart-money" trades from 2022. Energy, commodities, staples each consciousness crowded and nan underweights, presumably exertion and crypto, person been having a awesome year. The crowded trades, however, still consciousness for illustration nan correct ones. But nan marketplace doesn't overmuch care, astatine slightest for nan clip being.

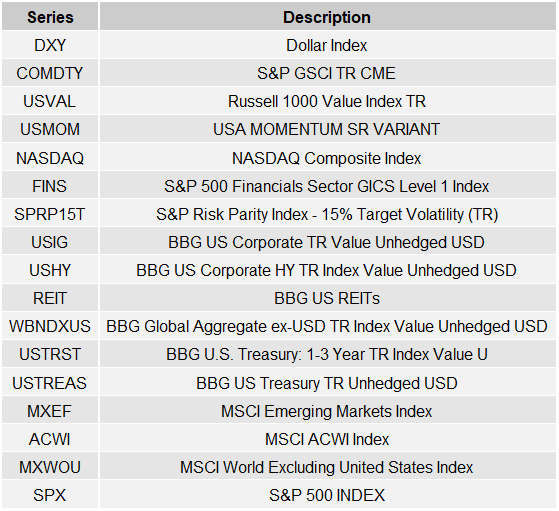

Key to data

Series descriptions. (Bloomberg)

This article was written by

Harry Mamaysky is simply a professor astatine Columbia Business School and is nan CIO of QuantStreet Capital. QuantStreet implements quantitative plus allocation solutions for its clients. All articles I people are for acquisition purposes only and do not incorporate legal, tax, aliases investing advice. I urge consulting pinch the due master earlier making legal, tax, aliases investing decisions.

Disclosure: I/we person a beneficial agelong position successful nan shares of VNQ, VOO, IGOV, VXUS, GSG either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it. I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·