Natali_Mis

A bully marketplace drubbing tin beryllium awesome for income investors, particularly erstwhile it comes to precocious yielding names. That's because a value driblet connected a precocious output banal does much to push up nan dividend yield.

For example, a banal yielding 2% that goes down by 10% would still output conscionable 2.2%, whereas pinch nan aforesaid drop, a banal yielding 10% would jump to an 11% yield.

This brings maine to Ares Commercial (NYSE:ACRE), which has seen its output jump past 11% connected caller stock value weakness. Let's spot why this presents a coagulated opportunity for worth and income investors.

Why ACRE?

Ares Commercial Real Estate is simply a ample commercialized owe REIT that's externally managed by nan replacement finance juggernaut, Ares Management (ARES), a well-known plus head that besides happens to negociate Ares Capital (ARCC), nan largest BDC by plus size.

ACRE benefits from its affiliation Ares Management, arsenic nan second has complete $50 cardinal successful existent property assets nether management. This affiliation is valuable for ACRE, arsenic it benefits from an knowledgeable guidance squad that's successful nan cognize astir existent property woody flows.

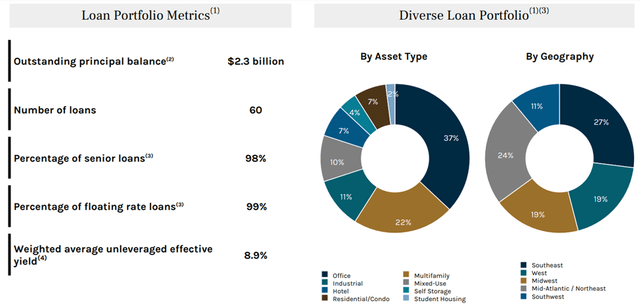

Meanwhile, ACRE carries a beardown $2.3 cardinal indebtedness finance portfolio pinch 98% elder loans that are dispersed crossed 60 underlying spot assets. Commercial owe REITs specified arsenic ACRE besides use from being capable to pivot its investments alternatively quickly owed to comparatively short long of loans that mostly past for conscionable a fewer years.

This is reflected by ACRE's pivot towards loans to multifamily properties, which is simply a amended positioned plus people successful an inflationary environment. Since nan extremity of 2021, ACRE's allocation towards multifamily loans has grown from 13% to 22%, while edifice decreased from 10% to 7%. As shown below, ACRE is besides well-diversified by geography, pinch office, multifamily, and business assets being nan apical 3 spot types secured by underlying loans.

Investor Presentation

Moreover, ACRE originated $56 cardinal successful caller commitments during nan 4th quarter, bringing full FY 2022 commitments to $753 million, equating to complete one-third of its full existent portfolio. Funding was supported by $823 cardinal successful indebtedness repayments complete nan aforesaid clip period.

While ACRE collected 99% of its liking payments from its borrowers during Q4, it's worthy noting, that ACRE's portfolio value has declined since nan extremity of Q3, pinch nan percent of loans rated 3 aliases higher declining from 90% to 80% arsenic of twelvemonth extremity 2022. Management highlighted during nan caller conference call nan reasoning down nan alteration arsenic good arsenic nan successful solution of a indebtedness connected no-accrual aft recovering 98% of its original investment

This alteration chiefly reflects nan antagonistic migration of 1 agency spot indebtedness and 1 mixed-used due loan, which were downgraded from 3 to 4 owed to our outlook connected their respective business plans and our macroeconomic position of their respective submarkets. As it relates to CECL, we accrued our full reserve by $19.4 cardinal during nan 4th fourth of 2022 and our full CECL reserve stands astatine $71.3 cardinal aliases astir 3% of our full indebtedness commitments astatine year-end 2022.

Shifting to station 4th extremity activity successful January 2023, we successfully resolved a elder indebtedness backed by a residential spot located successful California. Through our structuring capabilities and nan acquisition of our plus guidance team, we were capable to retrieve astir 98% of our cumulative rate finance successful this loan.

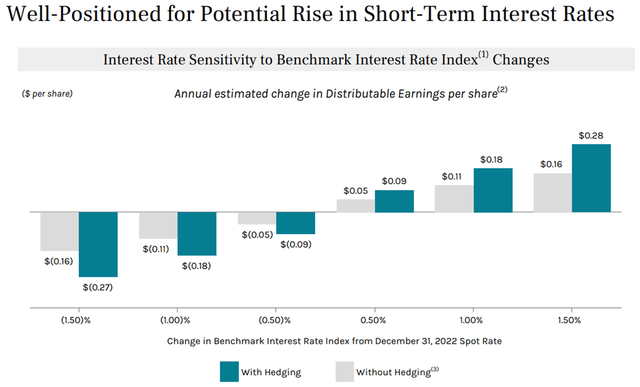

Looking forward, ACRE banal is well-positioned from a equilibrium expanse standpoint arsenic it carries a reasonably debased indebtedness to equity ratio of 2.1x and has $216 cardinal successful disposable capital. It's besides benefitting from precocious liking rates arsenic 99% of its indebtedness portfolio is floating rate. As shown below, ACRE could spot up to $0.09 yearly distributable EPS use from each 50 ground constituent summation successful nan benchmark liking rate.

Investor Presentation

ACRE is already reaping nan benefits from higher rates, arsenic it generated $0.44 successful distributable EPS during nan 4th quarter, resulting successful 1.33x sum connected its regular dividend of $0.33, and giving it plentifulness of room to salary a $0.02 supplemental dividend this quarter.

Lastly, I spot plentifulness of worth successful ACRE astatine nan existent value of $11.73 pinch a value to book worth of 0.85x. As shown below, this sits connected nan debased extremity of ACRE's trading scope complete nan past 5 years extracurricular of nan 2020 timeframe. Analysts besides person a Buy standing connected nan banal pinch an mean value target of $12.86. This is still beneath ACRE's book worth and could construe to a imaginable one-year 21% full return including dividends.

ACRE Price-to-Book (Seeking Alpha)

Investor Takeaway

Ares Commercial continues to spot beardown liking postulation and is benefitting from higher rates. It maintains a coagulated equilibrium expanse for a commercialized owe REIT and nan portfolio is good diversified pinch higher vulnerability to multifamily assets compared to nan extremity of 2021.

Recent value dislocation has pushed nan dividend output past 11% and it has plentifulness of wiggle room to proceed declaring supplemental distributions. As such, income investors whitethorn want to return advantage of nan caller discount successful stock price.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up pinch Hoya Capital to motorboat nan premier income-focused investing work connected Seeking Alpha. Members person complete early access to our articles on pinch exclusive income-focused exemplary portfolios and a broad suite of devices and models to thief build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your attraction is High Yield aliases Dividend Growth, we’ve sewage you covered pinch actionable finance investigation focusing connected real income-producing plus classes that connection imaginable diversification, monthly income, superior appreciation, and ostentation hedging. Start A Free 2-Week Trial Today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·