Sladic/E+ via Getty Images

Investment thesis

My bullish outlook connected Archer-Daniels-Midland Company (NYSE:ADM) is supported by nan company's consistently beardown capacity successful caller years and management's expectations of robust capacity successful FY 2023 and beyond. Company's beardown rate flows and equilibrium expanse alteration ADM to some proceed finance successful business and return superior to shareholders. My DDM valuation suggests nan banal is undervalued, together pinch high-quality dividends I judge ADM banal is simply a compelling finance opportunity now.

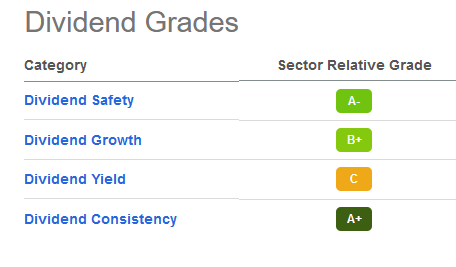

Seeking Alpha

Company information

Archer-Daniels-Midland Company, which was founded successful 1902, buys, transports, processes and markets cultivation commodities and products worldwide. The institution operates successful 170 countries and employs astir 40,000 people. The ADM stock is simply a constituent of nan S&P 500.

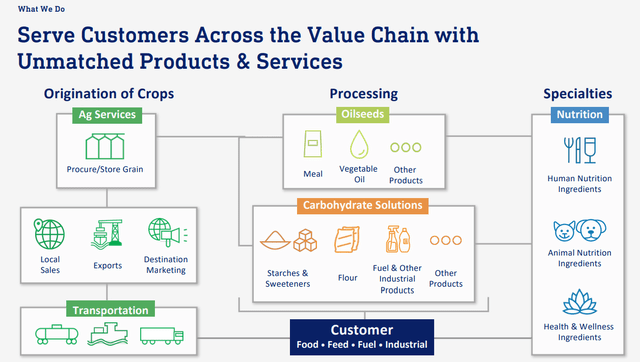

ADM

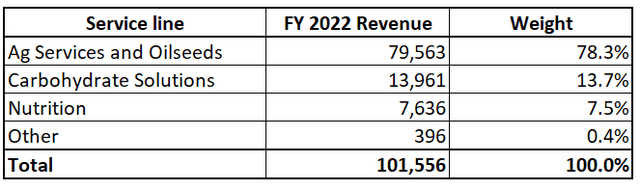

The company's business consists of 3 awesome segments, which includes Ag Services and Oilseeds, Carbohydrate Solutions and Nutrition. Ag Services and Oilseeds is nan largest conception representing almost 80% of ADM full revenue. Please spot beneath array for segments disaggregation, amounts are presented successful $ millions.

Author's calculations

Financials are increasing consistently

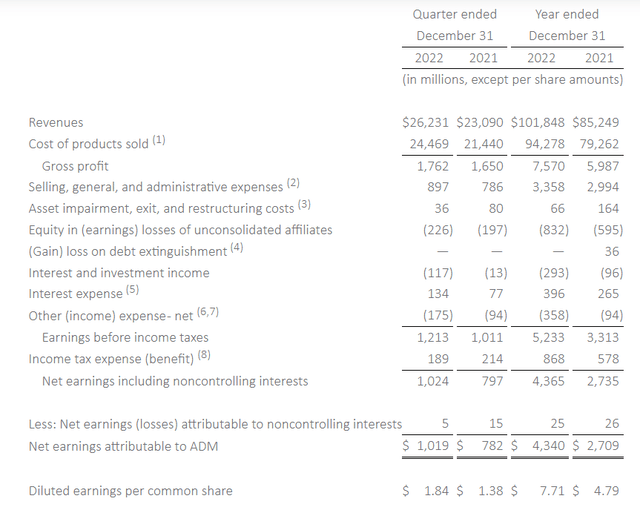

The institution precocious reported its Q4 FY 2022 financial results, which topped statement forecasts some successful position of gross and EPS. Company's results were supra statement estimations ninth 4th successful a row.

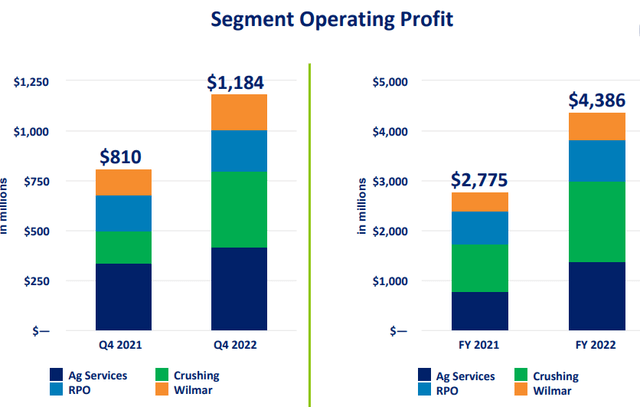

ADM

Revenue accrued almost 14% YoY chiefly driven by spot successful Ag Services and Oilseeds. Segment operating profit roseate 46%, chiefly acknowledgment to Crushing business which demonstrated a 133% YoY operating profit growth.

ADM

From rate flows perspective, if we talk astir afloat FY2022, nan institution demonstrated beardown growth: afloat twelvemonth operating rate travel earlier moving superior was $5.3 cardinal which is importantly higher than nan twelvemonth before. With specified beardown rate flows nan institution is capable to reinvest successful its early maturation and to repay superior to shareholders. In total, ADM paid $2.3 cardinal to shareholders successful nan forms of dividends and stock repurchases successful 2022. Management is assured successful company's prospects which is evidenced by announcing a 12.5% dividend hike during past net call.

Company's guidance expects that 2023 will beryllium different beardown twelvemonth for ADM. According to Juan Luciano, nan CEO, they spot respective drivers for continued maturation successful FY 2023: tightness successful proviso and request balances successful cardinal products and regions, beardown request for rootlike lipid arsenic good arsenic resilient nutrient demand.

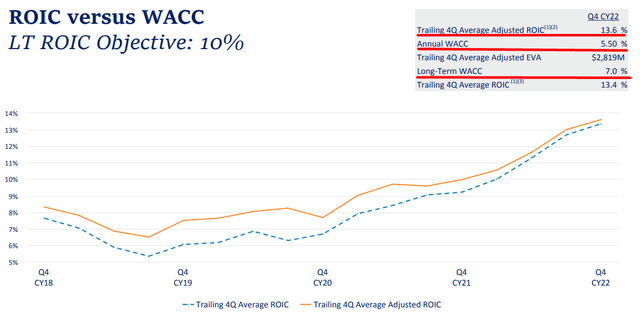

To sum up, I person precocious condemnation that nan company's guidance is capable to scope ADM's operational and financial goals. The institution has beardown way grounds of delivering shareholder worth and 50 consecutive years dividend maturation proves it. For worth investing it is besides important to spot that nan company's ROIC exceeds its costs of capital, and connected beneath chart we tin spot that ADM was rather successful successful it during caller years.

ADM

Valuation

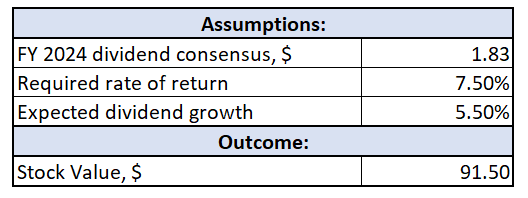

In bid to measure ADM banal adjacent value, I conducted valuation utilizing Discounted Dividend Model [DDM]. I selected this attack because ADM has very beardown way grounds of dividends maturation - nan institution demonstrated dividends maturation for consecutive 50 years. So, to get DDM outcomes I request 3 variables which see expected adjacent twelvemonth dividend, required complaint of return and dividend maturation rate.

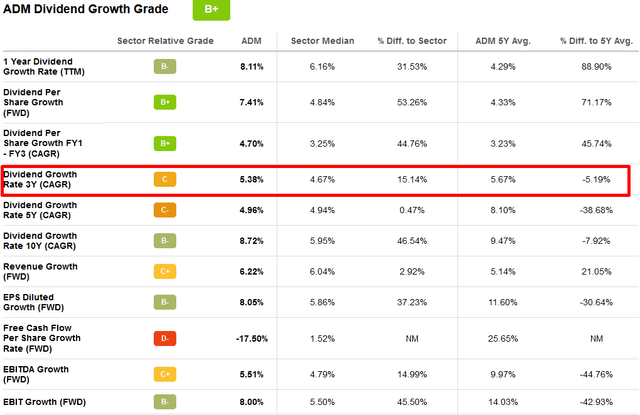

For expected adjacent twelvemonth dividend I deliberation that FY 2024 statement would beryllium reliable to use, which is projected astatine $1.83 per share. For required complaint of return, arsenic usually, I mention to GuruFocus, which assesses nan company's existent WACC astatine 7.06%. To beryllium much conservative, I rounded up required complaint of return to 7.5%. Dividend maturation complaint is traditionally nan trickiest part, to beryllium blimpish I selected ADM 5-year mean for Dividend Growth Rate CAGR 3Y rounding it down to 5.5%.

Seeking Alpha

Incorporating each assumptions into DDM calculations, I arrived astatine $91.5 per stock arsenic a adjacent worth for ADM banal which is 11% higher than existent marketplace value per share.

Author's calculations

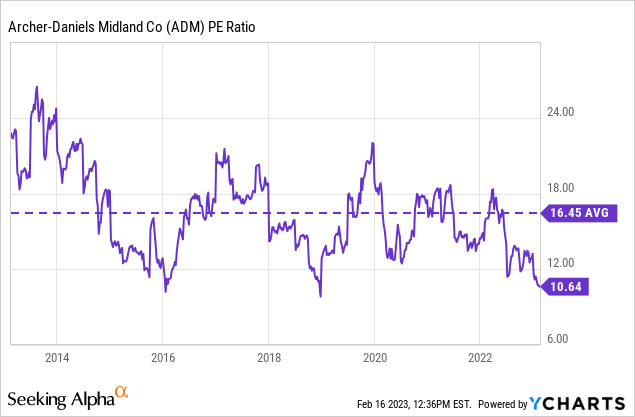

Looking astatine humanities valuation multiples, nan institution besides appears to beryllium undervalued. From nan beneath floor plan we tin spot that past 10 years mean P/E of ADM was 16.45. If we multiply FY 2024 EPS estimations of $6.55 and P/E of 15 which would beryllium adjacent to humanities average, we would get astatine $98.25 arsenic a adjacent stock price.

Data by YCharts

Data by YCharts

To reason this part, based connected alternatively blimpish assumptions we spot that some DDM workout together pinch humanities multiples study propose nan banal is much than 10% undervalued.

Risks to consider

ADM faces respective risks which could effect its financial capacity and semipermanent perspectives. The institution results are limited connected cultivation commodities prices and availability, which are usually importantly affected by upwind conditions aliases illness outbreaks. ADM implements hedging to mitigate commodities value volatility risks, but cannot wholly destruct this risk.

The institution operates successful 170 countries which intends it is taxable to world waste and acquisition and geopolitical risks which see changes successful import and export regulations, governmental instability aliases waste and acquisition wars. This consequence tin importantly impact ADM's gross and earnings.

ADM represents a highly competitory industry. Growing title whitethorn undermine nan company's marketplace stock and pricing powerfulness which yet will origin diminution successful earnings. The institution is moving connected mitigating this consequence by differentiating itself via invention and sustainability initiatives.

Bottom line

ADM's guidance squad has a beardown way grounds of expanding shareholder worth done its operational efficiency. There are aggregate tailwinds from nan marketplace which company's guidance is highly apt to use from. Based connected management's historically beardown capacity together pinch result of DDM valuation and multiples analysis, I person precocious condemnation that ADM is attractively weighted and nan banal is simply a beardown bargain astatine existent levels.

This article was written by

Focused connected semipermanent investing successful precocious value stocks, some worth and growth

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·