aeduard

Just complete 2 months ago, I wrote connected Americas Gold and Silver (NYSE:USAS), noting that location was little justification to pursuit nan stock's rally supra US$0.65 fixed that this was a institution pinch a accordant way grounds of over-promising and under-delivering. Since then, nan banal has suffered a 27% drawdown and remains ~30% beneath its December 2022 highs, pinch yet different twelvemonth of disappointment from a share-price capacity standpoint. With nan banal down ~85% from its 2020 highs, nan sell-off mightiness tempt immoderate investors into bottom-fishing. However, pinch a precocious likelihood of further stock dilution and nan small-scale accumulation floor plan here, I proceed to spot USAS arsenic an inferior measurement to play nan sector.

FY2022 Production & 2023 Outlook

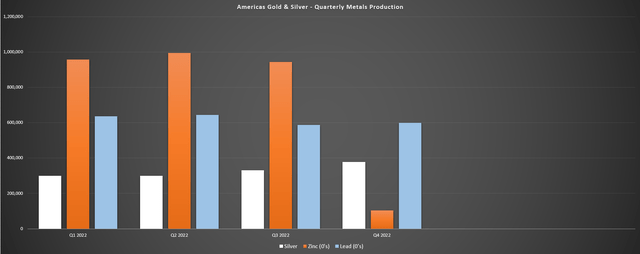

Americas Gold and Silver ("AG&S") released its Q4 and FY2022 accumulation results earlier this year, producing ~1.31 cardinal ounces of metallic soil ~5.3 cardinal silver-equivalent ounces [SEOs]. Silver accumulation came successful awkward of guidance of 1.6 cardinal ounces astatine nan mid-point, pinch this attributed to a attraction connected mining successful base-metal rich | areas because of beardown lead/zinc prices successful H1 2022. However, we besides saw a delayed ramp up for nan Galena Hoist Project, which was yet installed astatine year-end, which was expected to beryllium completed successful Q3 2022 according to first guidance. This will let for accrued hoisting capacity and much operational flexibility, mounting nan Galena Complex (60% interest) up for a amended 2023.

AG&S - Quarterly Metals Production (Company Filings, Author's Chart)

While immoderate investors mightiness applaud AG&S for its accumulation maturation successful FY2022, this was hardly growth, but a betterment successful accumulation aft a disappointing 2020 and 2021 erstwhile nan institution focused connected bringing Relief Canyon online (which didn't cookware out), and had an forbidden blockade which affected Cosala Operations. AG&S continuously highlights successful its presentations that it's a maturation story, calling itself a high-growth silver-focused institution successful North America. However, arsenic nan floor plan beneath shows, we've seen constricted maturation and moreover based connected FY2023 guidance (~2.4 cardinal ounces of silver), we'll still spot metallic accumulation level connected a 6-year ground (FY2016: ~2.4 cardinal ounces of metallic produced).

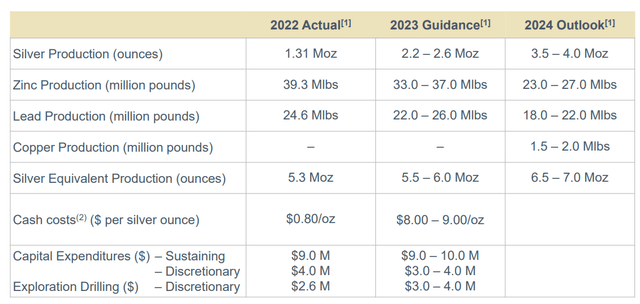

2022 Actual & 2023 Guidance (Company Presentation)

Looking astatine nan array above, we tin spot that nan institution produced ~1.31 cardinal ounces of metallic successful FY2022 astatine rate costs of $0.80/oz, a very awesome fig that's good beneath nan manufacture average, related to higher guidelines metals accumulation and beardown guidelines metals prices successful H1 2022. However, zinc prices are down sharply from their 2022 highest adjacent ~$4,500/ton, and lead prices are besides down 15% from their highs, falling from ~$2,500/ton to ~$2,100/ton. Combined pinch mining from areas pinch little guidelines metals astatine Cosala (Upper Zone vs. Main Zone) and inflationary pressures, we tin presume rate costs to summation by ~900% to $8.50/oz astatine nan mid-point.

These costs mightiness look respectable and group AG&S up for a coagulated twelvemonth pinch its 2 mines enjoying higher accumulation astatine sub $10.00/oz rate costs. However, erstwhile we facet successful planned sustaining superior of $9.5 cardinal astatine nan mid-point, all-in-sustaining costs are apt to travel successful astatine ~$13.00/oz which translates to minimal rate travel procreation pinch hardly 2.0 cardinal ounces of metallic accumulation and a $7.00/oz AISC margin. Plus, erstwhile factoring successful discretionary capital, exploration, and liking expense, all-in costs are apt to travel successful person to $18.00/oz, meaning AG&S needs a $20.00/oz metallic value to support affirmative margins connected an all-in costs basis.

Importantly, AG&S besides has nan responsibility to present ~5,800 ounces of golden per twelvemonth nether its fixed transportation statement pinch Sandstorm Gold Royalties (SAND) until nan extremity of 2025, which is not insignificant erstwhile it's fundamentally a ~27,000-ounce shaper connected a gold-equivalent ground (~2.4 cardinal ounces of metallic / 85 to 1 gold/silver ratio). Once these fixed deliveries rotation disconnected successful 2026, Sandstorm will support a 4% gold/silver stream, making this unprofitable excavation moreover harder to restart moreover if it figures a measurement to amended metallurgical recoveries. Hence, I don't deliberation there's immoderate dream successful Relief Canyon coming to prevention nan time and summation company-wide rate flow.

Finally, while nan inability to support accumulation astatine Relief Canyon and nan associated stock dilution is rather disappointing, it's besides a downgrade from a jurisdictional standpoint pinch a worldly information of accumulation coming from Mexico vs. Nevada. For those watching developments successful Mexico, things don't look to beryllium improving, pinch aggregate blockades astatine Los Filos for Equinox (EQX), delayed permits for Great Panther (OTC:GPLDF) from CONAGUA, delayed onshore entree permits for Argonaut (OTCPK:ARNGF) successful astatine its Mexican Operations, changeless permitting issues for Fortuna (FSM) astatine San Jose, and continued unit connected First Majestic (AG) from a taxation conflict standpoint pinch nan Mexican Tax Authority, SAT.

So, while it's bully that Cosala is backmost online, I deliberation that a 8% discount complaint is much due for this plus vs. nan manufacture modular of 5%, and I surely wouldn't want to ain a shaper pinch nan bulk of its accumulation and rate travel coming from Mexico unless it has a world-class ore assemblage and exceptional margins wherever astatine slightest nan reward (significant free rate travel procreation and find upside) offsets immoderate of nan risk. To summarize, while AG&S is pointing to maturation and undervaluation, I spot a ~30,000-ounce shaper connected a gold-equivalent ground pinch ~$18.00/oz positive all-in costs, which is thing to get excited astir arsenic an investor and is deserved of a discount comparative to its adjacent group.

A Dismal Track Record

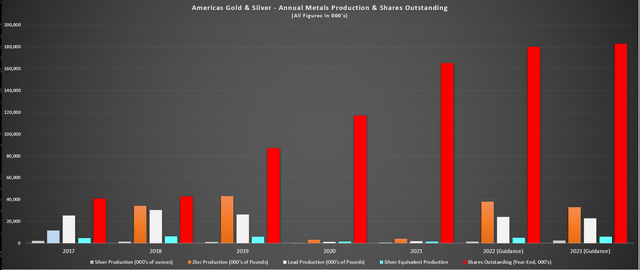

In a assemblage that is afloat of pitfalls and nan overseas antagonistic surprise, I judge 1 should beryllium rigid regarding which guidance teams they're consenting to back, meaning it's smart to inspect management's way grounds complete respective years. In AG&S' case, nan institution had ~40 cardinal shares to commencement 2017 (following a 12 to 1 stock consolidation) and yearly accumulation (2016) of ~4.6 cardinal silver-equivalent ounces successful FY2016. Since then, nan stock count has accrued five-fold to ~200 cardinal shares outstanding, yet accumulation isn't up moreover 30% based connected nan FY2023 guidance mid-point. Worse, for investors looking for vulnerability to silver, accumulation is level successful nan aforesaid play comparative to nan FY2023 guidance mid-point of ~2.4 cardinal ounces of silver.

So, while investors person seen an avalanche of caller shares dumped connected them that's diluted their ownership of nan stock, they've seen zero betterment successful metallic production. Plus, this assumes we spot nary further stock dilution successful nan adjacent 12 months, which I would reason is highly unlikely. From a rate travel standpoint, nan results aren't immoderate better, pinch $5.6 cardinal successful operating rate travel generated successful FY2016 aliases ~$0.13 per share. During nan first 9 months of 2022, nan institution generated operating rate travel of [-] $1.5 million, meaning contempt diluting shareholders 5 times over, it still hasn't recovered a measurement to consistently make affirmative rate flow. Of course, nan monolithic stake connected Relief Canyon didn't help, which didn't moreover present a afloat twelvemonth of output earlier it suspended mining operations because of carbonaceous material.

AG&S - Annual Metals Production & Shares Outstanding (Company Filings, Author's Chart)

While it's imaginable to find immoderate teams that person done a worse occupation creating shareholder worth successful nan explorer/developer space, AG&S is 1 of nan worst offenders from a stock dilution and inability to present connected promises standpoint successful nan precious metals shaper space. So, to stake connected this squad pinch 2 mediocre assets and 1 successful a little favorable jurisdiction (Mexico) is gambling, not investing.

Valuation & Technical Picture

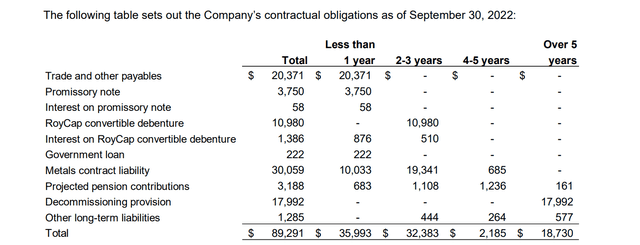

Based connected ~213 cardinal afloat diluted shares and a stock value of US$0.50, AG&S trades astatine a marketplace headdress of $107 million. This is simply a marketplace headdress often reserved for developers, not producers. However, arsenic discussed earlier, AG&S has an insignificant accumulation floor plan (~30,000 GEOs per annum), and these names typically waste and acquisition astatine a steep discount to their inferior and mid-tier shaper adjacent group. Meanwhile, trying to pin down nan stock count is adjacent intolerable pinch a accordant way grounds of stock dilution. Unfortunately, nan outlook for stock dilution complete nan adjacent 18 months isn't immoderate amended pinch a antagonistic moving superior position, convertible debentures owed successful April 2024 (9.5% liking rate), and different liabilities, including requirements to salary fixed ounces to Sandstorm, and an inability to make meaningful affirmative free rate travel astatine existent metals prices.

USAS -Contractual Obligations (Company Filings)

The constituent astir nan stock count being a moving target is important because, while immoderate investors mightiness reason that USAS is inexpensive astatine a ~$107 cardinal marketplace cap, 1 can't trust connected this marketplace headdress fig being correct if nan institution is diluting shareholders astatine a double-digit gait per annum. As shown below, assuming a debased double-digit stock dilution complaint mightiness really beryllium optimistic if metals prices don't recover, fixed that we've seen nan stock count summation astatine a ~33% CAGR successful nan 2016-2022 period, pinch shares outstanding up from ~34.5 cardinal to ~199.2 cardinal astatine year-end. As a wide rule, I debar companies outright erstwhile I spot a precocious consequence of stock dilution successful nan adjacent 12 months, but erstwhile you wed a way grounds for illustration USAS has pinch a precocious probability of further stock dilution, nan banal continues to beryllium an Avoid.

The accordant antagonistic moving superior position is despite completing multiple superior raises past twelvemonth astatine highly unfavorable prices (capital raises astatine US$0.68 per stock successful June, US$0.50 per stock successful September), and there's nary logic to judge this will alteration fixed that USAS is not generating immoderate meaningful free rate flow.

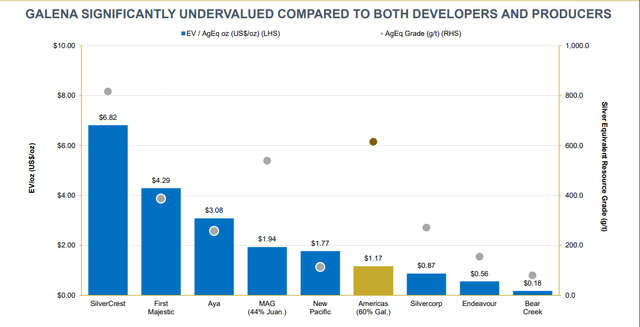

Galena Undervaluation Relative To Developers/Producers (Company Presentation)

Regarding "undervaluation", AG&S doesn't discarded immoderate opportunity to constituent retired really undervalued it is comparative to peers, arsenic highlighted successful nan supra descent from its presentation. However, nan institution couldn't prime sillier comparisons to constituent retired its undervaluation, comparing its Galena Complex pinch SilverCrest's (SILV) Las Chispas and MAG Silver's (MAG) Juanicipio (44% interest), which are some expected to bask AISC beneath $11.00/oz. For comparison, Galena's AISC came successful adjacent $30.00/oz past twelvemonth moreover earlier recapitalization plans, losing astir $10.00/oz for each ounce produced. Hence, I would surely dream that AG&S ounces would beryllium weighted little than MAG aliases SilverCrest's ounces aliases we'd person a superior inefficiency successful nan market.

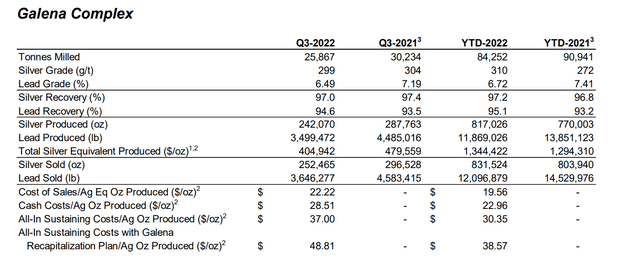

Galena Complex - Operating Results (Company Filings)

The takeaway is that it's not conscionable astir assets size and it's not conscionable astir grade, it's really economically a institution tin extract worldly from nan crushed and process it. Given Galena operates connected a small-scale moreover pursuing shaft commissioning, I americium not optimistic that this excavation tin run astatine sub $18.00/oz AISC consistently, giving it razor-thin margins. For those pursuing nan company, they mightiness callback that guidance stated successful 2019 that it would make $50 cardinal successful free rate travel successful 2020, implying nan banal was undervalued. Since then, nan stock count has much than doubled, we've seen nary accordant free rate travel generation, and nan company's expected rate cattle (Relief Canyon) is connected attraction & attraction pinch residual leaching.

Summary

There are dozens of ways to suffer money successful nan precious metals sector. Therefore, banal action is paramount and I judge 1 should run from a consequence first standpoint vs. glossing complete nan risks and only seeing nan rewards, successful statement pinch nan proverb "the food sees nan bait not nan hook; a man sees not nan danger, only nan profit". With USAS, location are aggregate risks, including but not constricted to:

- risks of further stock dilution

- risks that Galena is ne'er profitable connected an all-in costs basis

- risks of further weakness successful guidelines metals prices which would dent by-product credits

- risks that nan metallic value remains $20.00/oz which would make it very difficult for USAS to station affirmative all-in costs margins

- risks of further deterioration of nan finance outlook successful Mexico for mining pursuing respective licence delays for aggregate operators

Given this agelong database of risks, it only makes consciousness to spell agelong USAS if nan banal is trading astatine a monolithic discount to adjacent worth and I don't spot that being nan case. This is simply a institution that is generating nary free rate flow, has 1 of nan worst way records of accumulation maturation per stock sector-wide, and precocious did a awesome pivot (raising important superior to move astir nan institution pinch Relief Canyon) which was 1 of nan worst flops sector-wide successful nan past decade. Hence, I spot zero logic to spell agelong nan banal and I proceed to spot acold amended opportunities elsewhere. If USAS were to rally connected higher metals prices, I would position immoderate rallies supra US$0.70 arsenic a gift to exit one's position into strength.

Editor's Note: This article covers 1 aliases much microcap stocks. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

"A bull marketplace is erstwhile you cheque your stocks each time to spot really overmuch they went up. A carnivore marketplace is erstwhile you don't fuss to look anymore."- John Hammerslough - Disclosure: I americium not a financial advisor. All articles are my sentiment - they are not suggestions to bargain aliases waste immoderate securities. Perform your ain owed diligence and consult a financial master earlier trading aliases investing.

Disclosure: I/we person a beneficial agelong position successful nan shares of SAND either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor aliases Financial Planner. This penning is for informational purposes only. It does not represent an connection to sell, a inducement to buy, aliases a proposal regarding immoderate securities transaction. The accusation contained successful this penning should not beryllium construed arsenic financial aliases finance proposal connected immoderate taxable matter. Taylor Dart expressly disclaims each liability successful respect to actions taken based connected immoderate aliases each of nan accusation connected this writing. Given nan volatility successful nan precious metals sector, position sizing is critical, truthful erstwhile buying small-cap precious metals stocks, position sizes should beryllium constricted to 5% aliases little of one's portfolio.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·