Pgiam/iStock via Getty Images

Investment summary

After extensively reviewing its Q4 results, our appraisal connected Amedisys, Inc.'s (NASDAQ:AMED) equity remains a hold. Since our past publication, nan banal has caught a bid, yet, our observations of nan company's financials stay unchanged. As noted last time, nan "dominance of goodwill 'assets' connected nan equilibrium sheet" still remains a concern, arsenic we noted goodwill still comprised ~116% of nan company's book worth astatine nan extremity of Q4. Added to that, sequential economical losses (i.e., ROIC<cost of capital) eroded shareholder worth complete nan 12 months, coupled pinch nan company's antagonistic maturation rates.

Reiterate clasp astatine 19x P/E, successful statement pinch assemblage multiple.

Fig. (1)

Data: AMED Q4 8-K

AMED Q4 results analysis

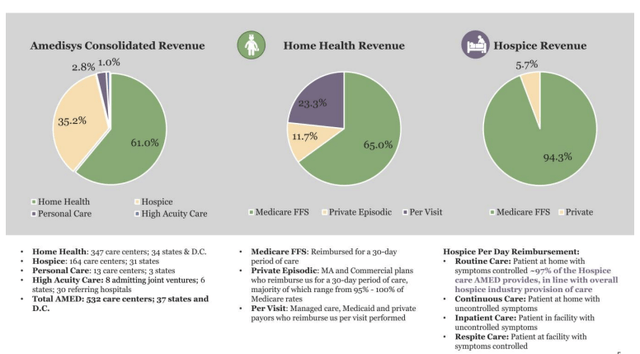

Turning instantly to the numbers. Top-line gross maturation of 50bps YoY came into $562mm connected adj. EBITDA of ~$60mm, down 830bps YoY. It pulled this down to net of $31.7mm, aliases $0.97 per share, some numbers besides down connected nan aforesaid clip past year. Having reviewed nan divisional and operational highlights, our cardinal takeaways are arsenic follows:

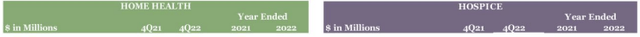

- Top-line income attributed to its location wellness ("HH") segment, contributing 61% of full turnover, lifted to $342mm, underlined by maturation successful non-Medicare revenues. HH gross per section gained 130bps YoY from a 3.2% complaint increase, balanced by a 2% sequestration headwind. Total admissions were up 8.3% YoY to 94,365, connected full volumes of ~138,000. Looking deeper, nan costs per sojourn gained 6.5% YoY to $114, driven by raises successful objective head and clinician costs per visit. In total, location were ~1.7mm visits, down 480bps YoY.

- Related to 1), HH same-store maturation came into 5%, pushed up by nan Medicare gross per episode, pinch nan medicare recertification complaint down 200bps YoY. Related to nan HH G&A line, firm expenses were $89mm aliases 26% of turnover, excluding acquisitions of $3mm.

- Hospice conception revenues pared backmost $7mm YoY to $197mm connected a 48% gross margin, a decompression of ~100bps from Q4 FY21'. The bolus of hospice gross stemmed from Medicare FFS. It recognized quarterly halfway hospice EBITDA of $44mm astatine a 22% margin. For nan afloat year, nan division's EBITDA clipped backmost 325bps to $166mm.

- Same-store admissions for nan hospice business were down 8% YoY coupled pinch a 4-day summation successful nan mean discharge magnitude of stay. Subsequently, nett gross per time was down ~$2mm to $166mm connected an $87 costs per day.

- Perhaps nan cardinal item from nan 4th was nan firm's decision to divest its individual attraction section to HouseWorks LLC. HouseWorks provides individual attraction services to ~75 location attraction agencies crossed respective jurisdictions successful nan U.S. Financials of nan transaction weren't instantly disclosed, but it is expected to adjacent successful Q2 this year.

- In extension, from 5), AMED besides advised it signed a business pinch BlueCross BlueShield successful Tennessee to supply at-home palliative attraction services, leveraging its recently acquired Contessa level successful nan process.

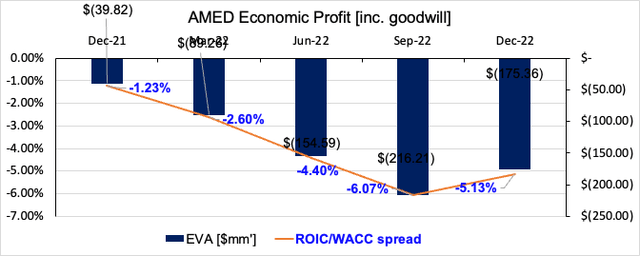

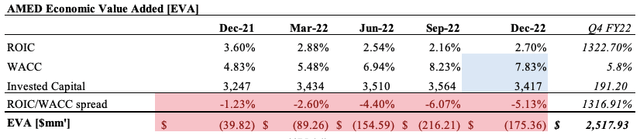

Fig. (2)

Data: AMED Q4 8-K

Returns connected capital, profitability

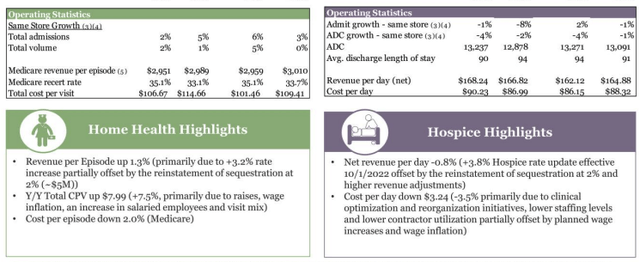

Key risks for worth seekers are identified here. Intelligent investors will cognize that a patient creates early worth (both firm worth and for its shareholders) erstwhile its ROIC is affirmative and exceeds nan costs of superior - i.e., an economical profit. In that vein, AMED had a destructive play to worth complete nan 12 months to Q4 FY22. It generated $204mm successful cumulative sequential NOPAT, connected a $9.3mm YoY diminution successful Q4 NOPAT. It invested a nett $128.8mm successful superior to make these figures. The aforesaid study for net is observed successful nan bottommost correct of Figure 3. Three cardinal findings outpouring to light:

- The incremental ROIC from Q4 FY21'-Q4 FY22' was antagonistic 7.2% (a corresponding antagonistic 6.5% net ROIIC).

- It reinvested ~63% of post-tax net to make this antagonistic complaint of return.

- Alas, some NOPAT and net declined 4.5% and ~7% respectively.

Fig. (3)

Data: Author, AMED SEC Filings

Added to that, it booked ~$32mm successful quarterly nett income, but this is an accounting reality. The economical reality tells a different story. In fact, since Q4 FY21', AMED recognized sequential economical losses, astir precocious astatine $175mm, aliases a antagonistic 5.13% ROIC/WACC dispersed successful nan past quarter. In detail, this represents an erosion of worth for equity holders and illustrates nan hurdle AMED must flooded into nan consequent periods to reverse nan situation. There are nary awesome catalysts to admit different than nan individual attraction divestiture that whitethorn lend to a reversal here. The institution besides guides $2.27Bn successful top-line income for FY23, down a $2.36Bn consensus, connected adj. EBITDA of $240mm astatine nan precocious range. Management besides guided beneath statement FY23 EPS astatine $4.36. However, if nan economical losses deepen, we estimate this will clamp AMED's propensity for valuation upside looking down nan line. Alas, AMED has immoderate activity to do to beryllium its sturdiness for nan intelligent investor to adhd nan banal into their equity consequence budget.

Fig. (4)

Data: Author, utilizing information from AMED SEC Filings

Fig. (5)

Data: Author, utilizing information from AMED SEC Filings

Valuation and conclusion

In an inflationary and high-yield environment, paying >26x trailing net to bargain AMED for nary dividend income and tightening residual rate flows is an unattractive prospect, by estimate. This is besides a premium to assemblage peers. Supporting this, nan banal trades astatine ~3x book value, and >32x trailing rate flow. We judge nan banal should waste and acquisition person to nan peer's astatine 19x earnings, implying a FY23 value target of ~$83, baking successful nan compressed maturation profile. This supports a neutral position but besides gives headroom for aggregate description this year.

Net-net, it was different play of lumpy maturation for AMED, pinch inconsistent upsides observed passim its financial statements. Looking successful much detail, ROIC and guardant guidance are cardinal hostility points investors person to navigate done pinch AMED this year. Supporting nan above, nan banal is richly priced astatine 26x net and nan quant facet system rates it a hold. Reiterate hold.

This article was written by

Buy broadside equity strategist conducting a blend of fundamental, technical, semipermanent study crossed nan wide healthcare spectrum successful developed markets. Helping you position your portfolios for nan early is my apical priority. Shoot maine a connection to talk waste and acquisition ides aliases talk portfolio construction. Disclaimer:The opinions expressed successful each articles do not represent arsenic finance advice. Please retrieve to behaviour your ain owed diligence.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·