400tmax/iStock Unreleased via Getty Images

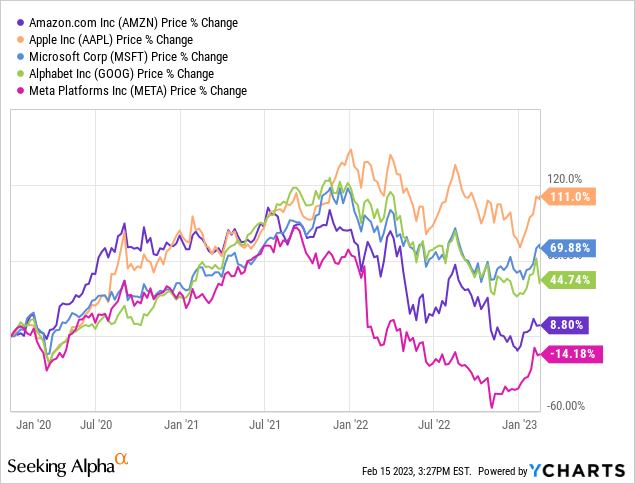

Amazon (NASDAQ:AMZN) has knowledgeable a difficult fewer years, pinch nan banal down astir 50% from its all-time highs successful 2021. In caller history, large tech and FAANG names were known for their relentless and unending emergence successful market cap, and were ever considered a bargain aft a pullback.

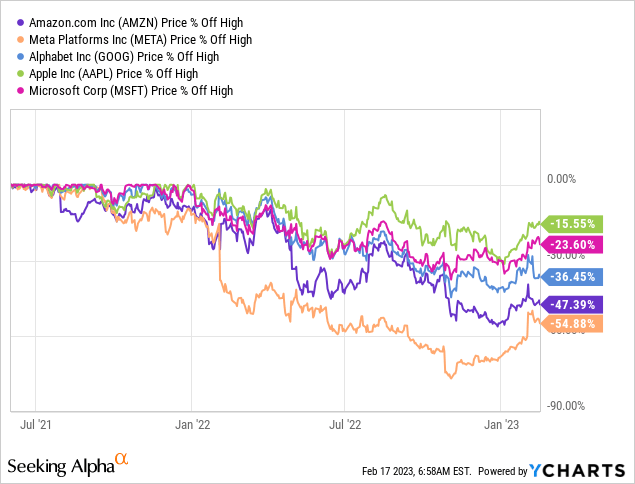

That was nan lawsuit until 2022 arrived, and almost each FAANG rolled over. Amazon, however, seems to person seen nan biggest mean reversion of each its peers, not counting Meta (META). At this point, pinch Amazon having already had specified a mean reversion, immoderate whitethorn see it a shrewd investment. But we reason why investors should beryllium very cautious successful nan existent macroeconomic environment.

Data by YCharts

Data by YCharts

Investment Thesis

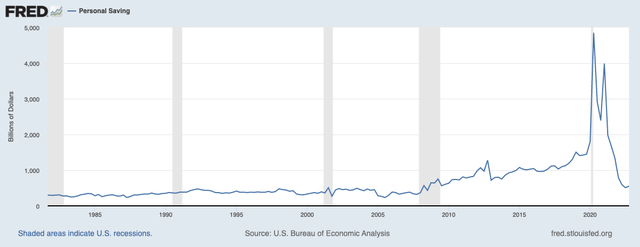

Amazon is presently successful a very peculiar situation. Namely, successful 1 of a secular downturn, pinch user spending expected to deteriorate rapidly. This comes aft grounds levels of monetary description successful 2020 and 2021. There are bully reasons to judge that while nan system and mini businesses were locked down successful 2020 and 2021, consumers flocked to Amazon to walk their stimulus checks.

Now, 2 years later, personal savings are erstwhile again astatine historical lows and consumers are erstwhile again reluctant to spend. The grounds spending of nan past 2 years will besides make for difficult year-to-year comparisons.

Federal Reserve (FRED)

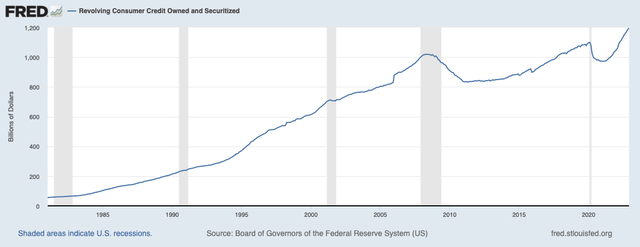

It's nary astonishment that Amazon is very delicate to macroeconomic changes, pinch presently much than half a trillion successful yearly revenue. While individual savings tin beryllium a bully indicator, we besides for illustration to look astatine nan authorities of credit, successful an system driven by in installments much than ever.

Consumer revolving credit, mostly based connected in installments paper balances, is besides backmost to its highest level ever, aft a large driblet during nan pandemic, erstwhile monetary description allowed consumers to salary disconnected debt. Perhaps it's nary wonderment nan system continues to power up, since consumers apparently person not tapped retired yet.

Federal Reserve (FRED)

This was besides reflected successful nan shaper value scale conscionable released, which showed a monthly increase of 0.7% successful January, overmuch higher than nan 0.4% expected. Retail sales besides crushed expectations, aft rising 3% successful January, nan biggest summation successful astir 2 years.

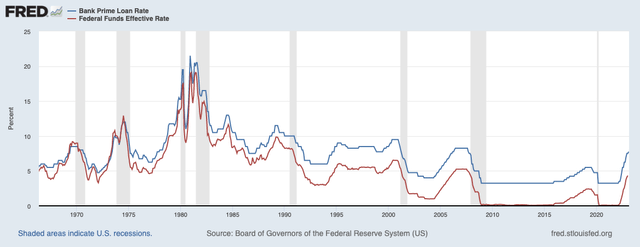

But that could soon travel to an end, arsenic nan Federal Reserve will enactment moreover much hawkish connected what they opportunity looks for illustration stronger-than-expected inflation. Higher rates could beryllium particularly toxic for smaller companies, which typically tin only get supra nan prime rate, already presently astatine 7.75%. If nan Fed raises rates to a terminal complaint of 5.25%, this minimum Prime Loan Rate is expected to scope astir 8.25%, akin to 2006 and 2007 levels.

Amazon progressively relies connected third-party sellers, which presently dress up about 60% of its income base. In March 2022, Amazon reported that "nearly 2 cardinal mini and medium-sized businesses are Amazon's third-party sellers."

Federal Reserve (FRED)

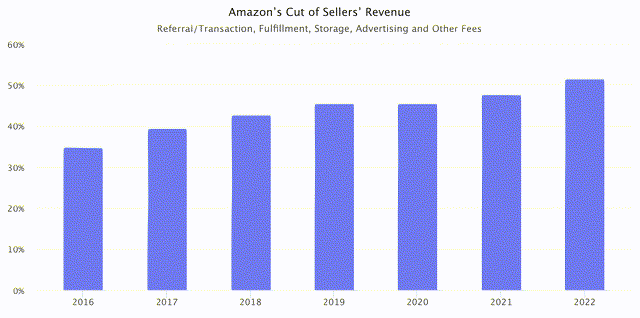

A recent lawsuit study besides pointed retired that Amazon's trim of sellers gross accounts for an expanding proportion, precocious exceeding 50%. In summation to charging a guidelines interest that tin scope from 8% to 15%, sellers besides usage Amazon FBA for fulfillment and salary for advertizing connected Amazon. It is some a conjecture for america and Amazon really overmuch much worth they tin compression retired from this source.

Marketplace Pulse

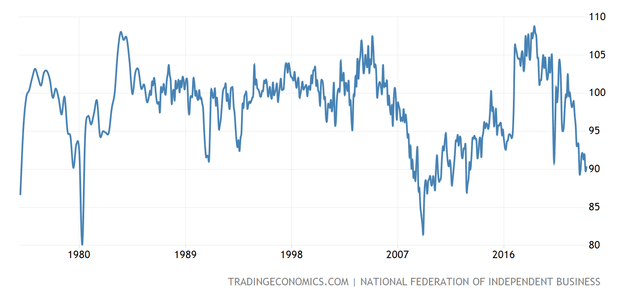

One past connection connected mini businesses: nan US small business optimism index reflects these macroeconomic conditions, pinch nan scale presently appearing to beryllium heading for nan 2008 low.

National Federation of Independent Business, Tradingeconomics

"Amazon Cannot Continue Like This" Syndrome

Although Amazon is experiencing definite headwinds, we still deliberation it is very premature and irrational to judge that nan institution has already reached its terminal maturation and should waste and acquisition astatine a heavy discount. We judge Amazon tin waste and acquisition astatine a premium.

Justified successful position of its awesome moat and robustness, possibly besides why Warren Buffett owns nan stock. Sometimes it is worthy paying a premium for a institution that tin guidelines nan trial of time, because thing lasts forever. Look astatine IBM (IBM) and GE (GE), for example, and what divine position they had not truthful agelong ago. Why was Coca-Cola specified a awesome stock? In our opinion, not because of its insane short-term growth, but because of its longevity. It was besides awesome astatine passing connected longer-term inflation, arsenic possibly is nan aforesaid pinch Amazon.

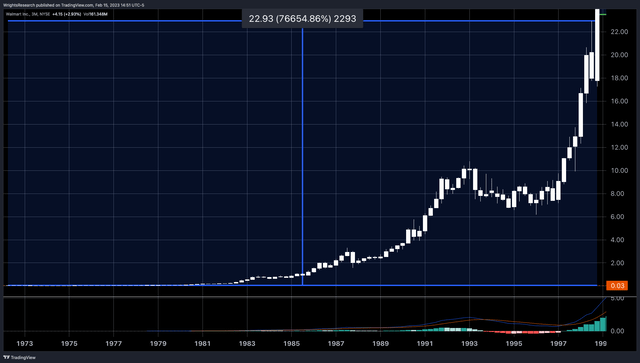

Value investing successful mentation sounds easy. Doing it successfully complete nan agelong word is nan existent challenge. And that situation includes knowing erstwhile to sell. Take Walmart (WMT) arsenic an example.

Tradingview

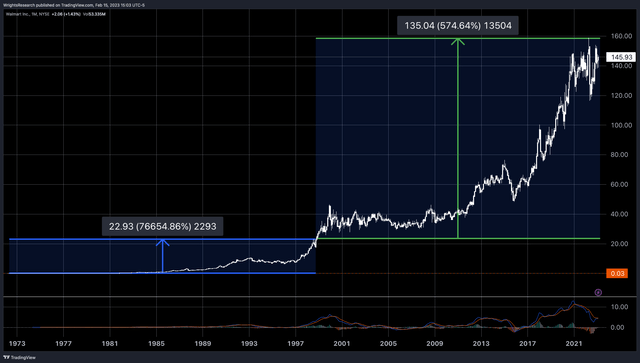

The banal had multiplied a whopping 766 times successful its first 26 years, from $0.03 successful 1972 to astir $23 successful 1998. Bank then, immoderate group astir apt said that you were crazy to judge that nan institution tin turn immoderate further, and is alternatively successful decline. Well, from 1998 to today, nan banal roseate different 574%.

Not nan spectacular maturation we were utilized to seeing, but still a CAGR of complete 8% for a banal that was thought to beryllium "too mature," aliases "ripe for disruption". Amazon, presently listed for 26 years, is possibly nan aforesaid story, and has a batch much of premier clip up of it.

Tradingview

That description could return galore forms, conscionable arsenic investors could not person foreseen nan emergence of AWS a decade ago. Amazon is progressive connected aggregate fronts, particularly successful robotics and automation.

They are moreover making awesome strides successful autonomous driving with Zoox. Another awesome illustration is Kiva's robots, which Amazon bought up immoderate clip agone and fundamentally barred from providing services to different companies. This benignant of vertical integration, and expanding power complete its proviso chain, will supply tailwinds successful nan coming years.

Amazon precocious did nan aforesaid and has a ample liking successful Rivian done investments presently worth $3.27BN. Rivian, akin to Kiva, presently only supplies its electric vans to Amazon, again demonstrating really Amazon is guarding its immense moat and staying up of nan competition.

Gravity At Work: Mean Reversion

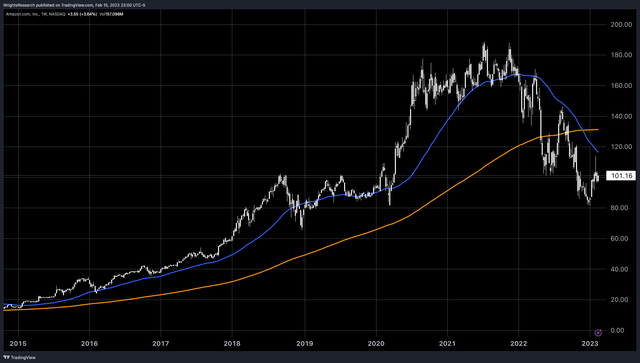

There's a saying we for illustration to use: liking rates activity for illustration gravity. And Amazon seems to beryllium nan institution emotion this gravity nan hardest.

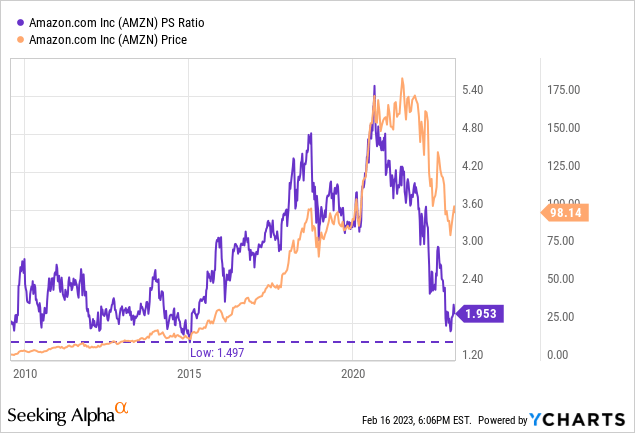

The banal is still trading astatine 2018 levels, but overmuch advancement has been made. At its existent price, nan banal is fundamentally moreover afloat discounted from each nan benefits and growth Amazon received during nan pandemic. On a P/S ratio, Amazon appears to beryllium trading adjacent its historically debased P/S ratio, and adjacent 2009 and 2015 levels.

Data by YCharts

Data by YCharts

So this mean reversion could beryllium seen arsenic positive, because if margins return to healthier levels, Amazon could person a immense boost. Looking astatine each different large-cap tech stocks, Amazon is still nan astir mean-reverting stock, extracurricular of Meta.

But Meta is simply a different story, because we deliberation Amazon's business model/moat is overmuch amended than Meta's, which faces beardown maturation problems and title from different societal media platforms.

Data by YCharts

Data by YCharts

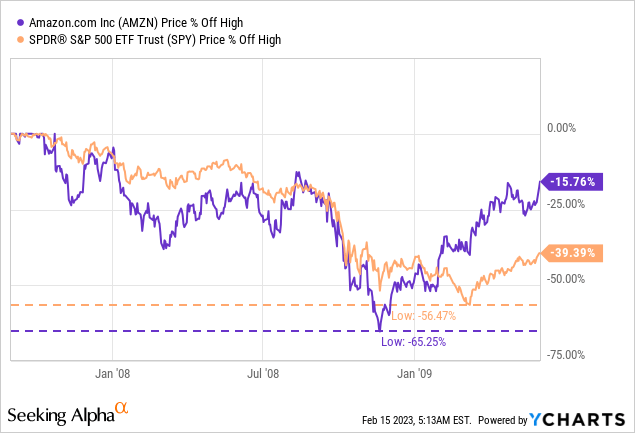

As an example, during nan 2008 recession, Amazon, though a overmuch smaller company, saw a diminution of astir 65.25%. Which makes america think, now that Amazon has fallen astir 50% from its all-time highs, really overmuch much location is to fall. At slightest it offers investors immoderate protection against downside risk, arsenic Amazon has already fallen difficult comparative to its assemblage peers and broad-based benchmarks.

Data by YCharts

Data by YCharts

Interest Rate Turmoil

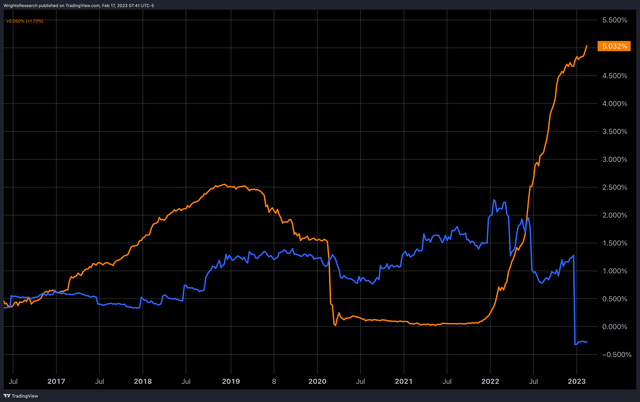

As liking rates proceed to move higher, this is besides having a antagonistic effect connected equity valuations, arsenic they are apt to person higher discount rates. And looking astatine Amazon's net yield, successful blue, and nan existent output investors are getting connected 6-month Treasury bonds successful yellow, nan divergence has ne'er been greater successful caller history.

Tradingview

Even erstwhile compared to nan S&P 500, which presently trades astatine a P/E aggregate of 21.8x, representing an earnings yield of 4.57%. If longer-term liking rates, specified arsenic nan 10-year yield, which stands astatine 3.88%, move higher, it could mean that stocks are successful a very vulnerable zone. If that 10-year return reaches nan return connected net of nan S&P 500, you are successful truth taking a batch of consequence and only getting paid for growth.

The margin pressure, a alternatively temporary headwind, is apt to dissipate successful nan adjacent future. But nan macroeconomic situation whitethorn stay for illustration this for a while.

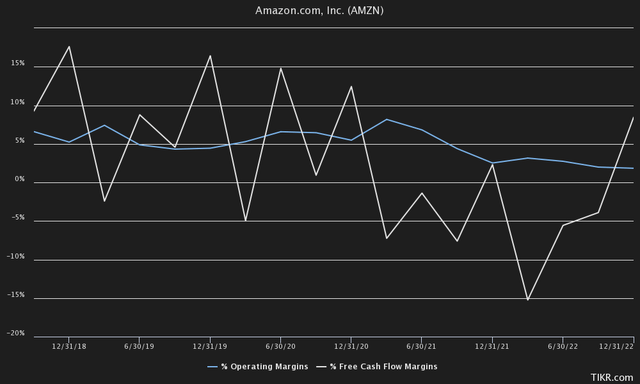

TIKR Terminal

Thus, investors should surely inquire themselves whether they judge that liking rates will yet fall, return to erstwhile levels aliases stay precocious for longer, arsenic nan Fed is presently indicating. For example, James Bullard gave a rather bearish message to marketplace participants yesterday:

My wide judgement is it will beryllium a agelong conflict against inflation, and we'll astir apt person to proceed to show inflation-fighting resoluteness arsenic we spell done 2023

He moreover questioned nan lagging effects of monetary policy, which is 1 of nan astir bearish statements we person heard, since lagging liking complaint changes are presently 1 of nan main factors keeping nan Fed from continuing to raise liking rates astatine nan immense gait of 2022.

I person based on consistently for front-loading of monetary policy, I deliberation we could person continued that astatine this past meeting. (James Bullard)

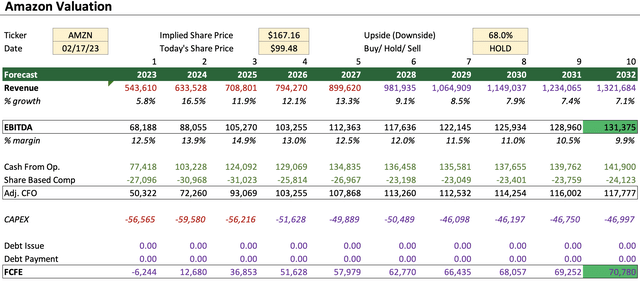

We discounted these concerns and deliberation Amazon is still on track to make astir $131BN successful EBITDA and $141.0BN successful rate from operations. We set this CFO to bespeak share-based compensation, which is presently rather precocious astatine Amazon.

Author's Valuation Model

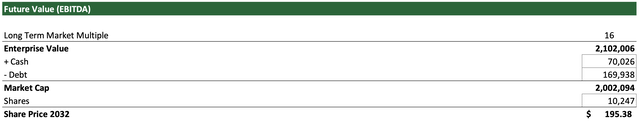

At an EV/EBITDA aggregate of 16x, this leads to an EV of astir $2.10T, a marketplace headdress of $2.0T aliases a value of $195.38 per stock by 2032.

Author's Valuation Model

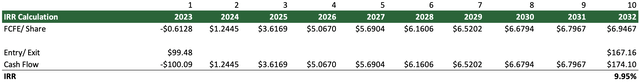

From a free rate travel perspective, we judge Amazon has nan imaginable to make astir $6.94 per stock successful FCFE by 2032. For nan net yield, we judge that successful caller history Amazon mostly traded astatine a 3% FCFE yield, specified arsenic successful 2013 and 2017.

Currently, to relationship for higher rates, we return precaution and use a semipermanent FCFE output of 5%, arsenic nan 10-year output presently trades astir 3.89%. We get astatine a value per stock of $138.93 successful 2032 connected an FCFE basis.

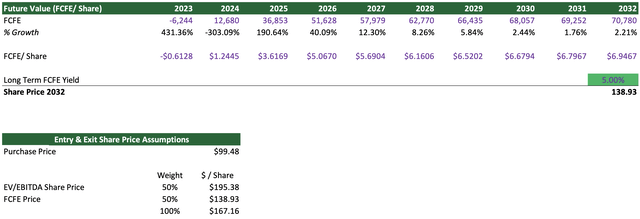

Author's Valuation Model

Based connected some valuations, we deliberation a value per stock of $167.16 is simply a reasonable estimate for Amazon to waste and acquisition successful 2032, taking into relationship that liking rates stay precocious successful nan adjacent term. Plugging that into an IRR calculator yields an IRR of 9.95% for nan adjacent 10 years.

Author's Valuation Model

The Bottom Line

Now that Amazon has gone done a decent mean-reversion backmost to its support levels, which day backmost to early 2018, Amazon technically looks for illustration a compelling buy. We deliberation investors are presently excessively focused connected conscionable a fewer quarters of results and guidance, and Amazon could astonishment to nan upside erstwhile their soul headwinds dissipate.

However, a prolonged emergence successful liking rates poses a superior threat to nan institution successful nan adjacent future. With an IRR of 9.95%, we see Amazon reasonably priced and would hold to put much successful nan banal until it is person to its support astatine $80. We usually for illustration to bargain stocks wrong 10-15% of its support levels and group a stop-loss if it breaks that support level.

Since nan insiders themselves person not hesitated to sell nan banal either, we besides judge that nan guidance squad does not spot nan banal arsenic an absolute bargain either, and alternatively reasonably valued.

Tradingview

In conclusion, we presently springiness a clasp standing and would delegate a bargain standing based connected presently disposable accusation if nan banal trades beneath $88 per share.

This article was written by

Long-term, Equity & Macro Research. Providing independent investigation pinch a unsocial position connected publically traded equities and different securities. Our thesis is short: if we tin find exorbitant worth successful it, pinch an ample separator of safety, it becomes portion of our portfolio. Wright's Research prefers a fundamentally driven finance exemplary based connected logical reasoning and quantitative measures, besides incorporating nan accelerated gait of invention by considering factors specified arsenic costs declines and take rates, to supply vulnerability to maturation and invention astatine a adjacent price. We adopt a bottom-up strategy and see changes successful nan macroeconomic situation successful our finance strategies.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·