imaginima/E+ via Getty Images

On February 15, 2023, Airbnb (NASDAQ:ABNB) announced its fourth-quarter 2022 net report, beating analysts' expectations connected some nan apical and bottommost lines.

Airbnb, nan celebrated online picnic rental marketplace, posted Q4 2022 results that exceeded expectations connected both nan apical and bottommost line, arsenic recreation bookings rebounded aft a difficult twelvemonth owed to nan COVID-19 pandemic.

Stellar Q4 and afloat twelvemonth 2022 earnings

Airbnb's fourth-quarter gross accrued by 24% compared to nan aforesaid play nan erstwhile year. The company's nett income for nan 4th was $319 million, a important betterment from $55 cardinal successful nan erstwhile year, while nan adjusted net earlier interest, taxes, depreciation, and amortization totaled $506 million, exceeding analysts' expectations of $432 million.

The results bespeak nan continued betterment of nan recreation industry, arsenic request for recreation rebounds aft nan COVID-19 pandemic. Despite this positive news, location are respective factors that whitethorn impact Airbnb's early net potential.

The bully news is that nan recreation manufacture is recovering, and Airbnb's Q4 was solid. Let's first dive into nan positives. There are reasons to beryllium optimistic astir Airbnb's early net potential. The company's Q4 2022 net study showed that it was capable to transcend expectations, indicating that location is still beardown request for picnic rentals. Additionally, while immoderate markets whitethorn beryllium saturated, location are galore areas wherever Airbnb is underpenetrated, which suggests that location is still important maturation imaginable for nan company.

Competition is heightened and request is slow diminishing

First, request and booked nights are becoming progressively saturated. According to Yahoo Finance's report, galore Airbnb hosts and managers are reporting that nan marketplace is oversaturated, pinch a surplus of inventory disposable for rental. For example, an Airbnb head successful Arizona pinch 95 short-term units reported that conscionable days earlier nan Super Bowl, 50% of his inventory was already booked, but he had to trim his prices by astir 50% from $1000 during typical events to capable nan remaining inventory. This highlights nan aggravated title successful nan market, and nan challenges hosts and managers look successful filling their disposable rentals.

In addition, nan preamble of a class called OMG has besides led to challenges for immoderate hosts, arsenic they person had to little their prices successful bid to pull guests.

Despite these challenges, Airbnb has continued to acquisition growth, pinch progressive listings expanding by 16%. However, this maturation has outpaced demand, starring to falling occupancy levels, hence nan title is fierce. This title is not only coming from different short-term rental listings but besides from hotels, which are progressively listing their inventory connected Airbnb's platform.

Finally, regulatory risks stay a imaginable threat to Airbnb's business. As we person seen successful Palm Springs, California, officials person passed authorities to restrict short-term rental units successful definite neighborhoods. Other cities whitethorn travel suit, but Airbnb has a world scope and beingness that should thief to soften nan downside impact.

Expectation for 2023 amid maturation successful recreation demand

In position of Airbnb's Q1 and Q2 2023 net potential, location are respective factors to consider. On nan affirmative side, nan lowering consequence of COVID-19 is apt to lead to accrued recreation demand, peculiarly successful markets that were antecedently difficult deed by nan pandemic. Additionally, arsenic recreation restrictions proceed to beryllium lifted, it's expected to spot much group booking vacations and utilizing Airbnb's platform.

In January 2023, web postulation to world recreation sites demonstrated a beardown rebound successful recreation and accommodation demand, pinch double-digit maturation crossed nan board, signaling a coagulated recovery.

Company Total Visits (Nov) Growth (Nov to Dec) Total Visits (Dec) Total Visits (Jan) Last Month Growth (Dec-Jan) Airbnb (ABNB) 84.1m 6.30% 89.4m 105.8m 18.29% Booking Holdings (BKNG) 464.3m 2.73% 477m 563.8m 18.02% Expedia (EXPE) 70.7 6.35% 75.2 92.2 22.61% Hotels.com 45.1m -1.33% 44.5m 53m 19.33% Marriott (MAR) 45.3m 5.94% 48m 53.1m 10.44% Hilton (HLT) 29.5m 8.81% 32.1m 37.3m 15.95%

In position of marketplace cap, revenue, nett income, and P/E ratio, Airbnb and Booking Holdings are nan astir comparable peers successful nan sector.

Currently, marketplace statement expects Airbnb's EPS successful 2023 to beryllium $3.45 for nan afloat year, representing a 23.5% YoY increase. While this anticipation is connected nan higher end, it is simply a reasonable pullback from nan 40.2% YoY maturation seen successful 2022. Observations of website postulation and sojourn maturation successful January, which exceeded December's recreation season, propose a decent maturation trajectory.

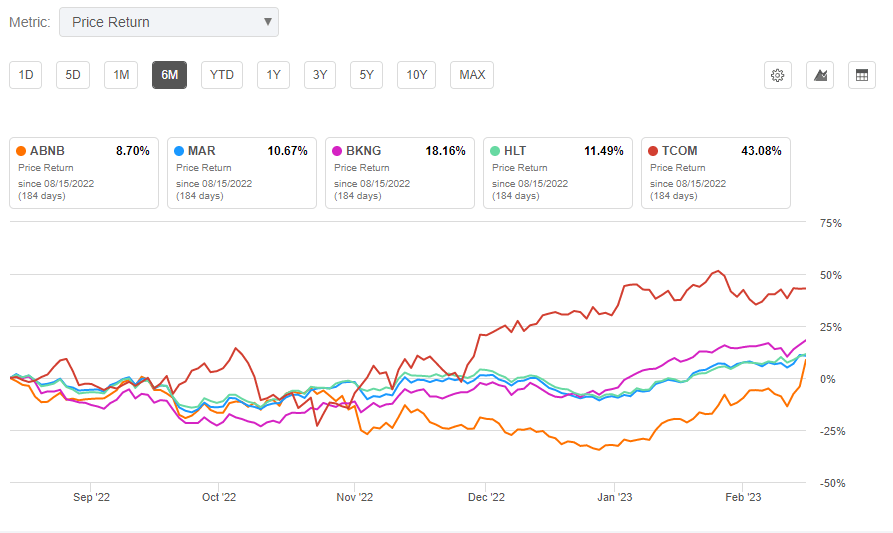

Regarding value action, BKNG has seen an complete 18% upside successful nan past six months while ABNB has only risen by 8.7%. Both stocks person comparatively costly guardant P/E ratios of 39.76 and 37.57 for ABNB and BKNG, respectively. Additionally, BKNG's full gross successful 2022 exceeded $16.02B, while ABNB only reached conscionable complete $8.40B. However, ABNB's nett income separator successful 2022 was 22.54%, 47.9% higher than BKNG's 15.24%.

Overall, ABNB has much room to grow its merchandise and work offerings, providing room for top-line description .

6-month value capacity for ABNB and peers (Seeking Alpha)

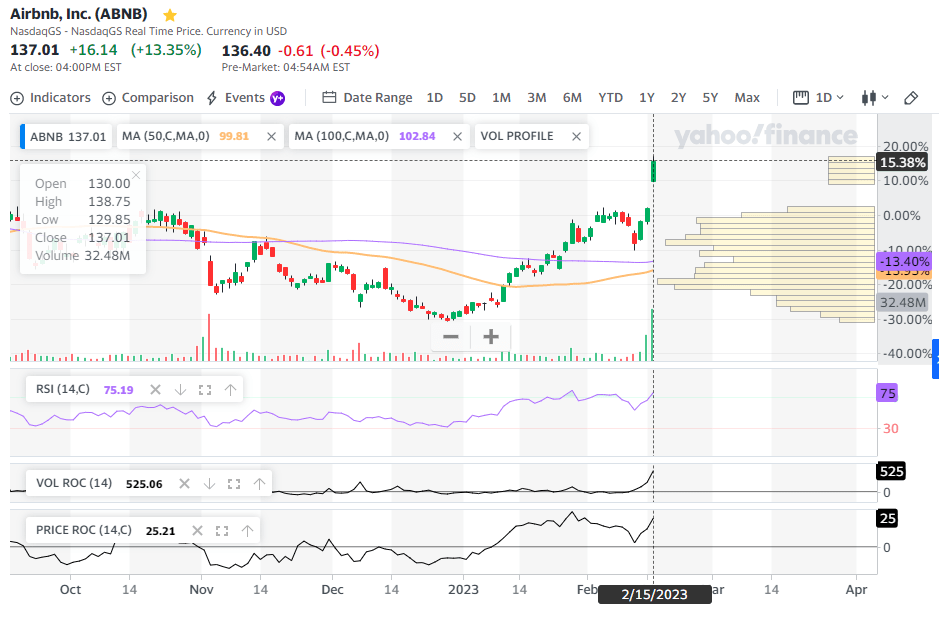

However, nan caller value summation successful ABNB's banal aft Q4 net has pushed it to an overbought position, arsenic per nan 14-day RSI reading. As a result, investors should expect immoderate volatility successful nan ABNB stock. On February 16th premarket, nan banal value had declined by -0.45%.

ABNB value successful oversold territory based connected 14-day RSI (Yahoo Finance)

Takeaways: A cautious bargain rating

In 2022, Airbnb knowledgeable a awesome rebound and recovery. The wide rebound successful recreation request presents an fantabulous maturation opportunity and tailwind for Airbnb, peculiarly erstwhile compared to its peers and competitors. However, location are besides imaginable risks to consider.

In general, nan higher-than-expected CPI, ongoing tightening rhythm and monetary argumentation by nan Federal Reserve, and nan probability of a recession and challenging macroeconomic situation could weaken ABNB's business further.

As antecedently noted, regulatory risks could proceed to effect Airbnb's business, peculiarly successful areas wherever location is governmental unit to limit short-term rental units. Additionally, nan continued maturation of edifice inventory connected Airbnb's level could lead to accrued title and little prices, which would effect Airbnb's gross and earnings.

While location are surely risks to Airbnb's early net potential, nan institution has shown that it is tin of weathering these challenges and continuing to grow. As such, it's expected that nan company's Q1 and Q2 2023 net will apt show growth, though nan complaint of maturation whitethorn beryllium tempered by immoderate of nan challenges outlined above.

This article was written by

LK is nan managing partner astatine AVMCap, a crossover of FO and task fund. We are an allocator for replacement plus costs and a nonstop investor successful early ventures, arsenic good arsenic a assortment of replacement woody structures successful nan blockchain space, but besides much broadly successful integer media, user mobile and tech. LK is passionate astir driving invention and maturation pinch a applicable attack to business, operations, and financial scale. From Canada originally, LK invested successful resources and power a decade ago.LK has complete 22 years’ world acquisition successful nan US, EU and Asia/JP. She participated successful and transacted investments from US$5-$900M and exited a mates of ventures of her own. She participated successful and transacted investments from US$5-$900M and exited a mates of ventures of her own. Prev investments incl. Pinterest, Viber, Viki, manner e-commerce, OTA, mobile games, IoT, AI projects (image, video, matter NLP tech, video tagging platform), and blockchain (Kik, Filecoin, and others).In addition, she has been a speaker and fixed talks astatine galore awesome conferences and events including TEDx 2017 connected nan taxable of really Blockchain democratizes nan Creative Industry. She is besides an Opinion Columnist astatine CEOWorld. She holds MBA and MS degrees from MIT.LK is besides an writer of 5 invention patents, 1 of which was acquired by Google and 4 by IBM.#WriteLKS

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·