Torsten Asmus

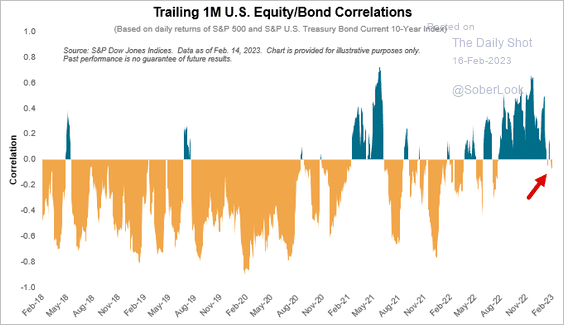

Stocks and bonds are, astatine agelong last, moving successful other directions. That is mostly a bully point for semipermanent diversified investors. Right now, though, bonds are rolling complete versus equities arsenic a super-hot labour marketplace and a caller spike successful nan Producer Price Index has yields connected nan rise.

It was conscionable a fewer weeks agone that nan 2-year Treasury complaint was nether 4.2% while nan 10-year output was beneath 3.5% (TNX is now astatine a 2023 precocious adjacent 3.85%). The crippled changed pursuing nan tight January jobs report. Rate-sensitive bonds person travel nether pressure. Let's return a look astatine a wide gauge of nan U.S. enslaved space: nan iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG).

Bonds Hedging Stocks Again

SPDJ Indices

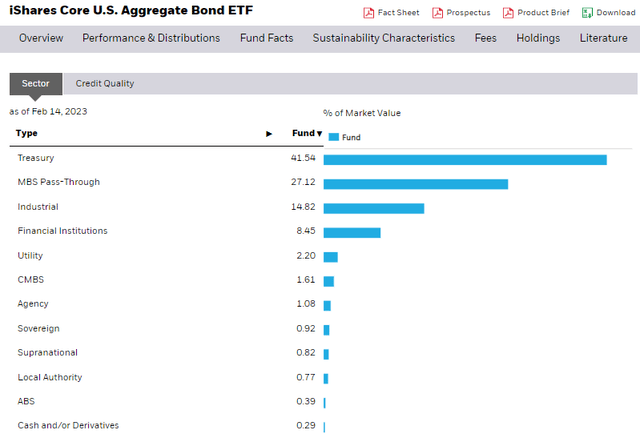

According to nan issuer, AGG seeks to way nan finance results of an scale composed of nan full U.S. investment-grade enslaved market. That includes treasuries and corporates. With an disbursal ratio of conscionable 0.03% annually, it is an easy and businesslike measurement to get vulnerability to nan alleged "40" portion of nan 60/40 portfolio. It's besides highly liquid, pinch a median 30-day bid/ask dispersed arsenic scant arsenic it gets astatine conscionable a azygous ground constituent and an mean regular measurement of much than 6 cardinal shares.

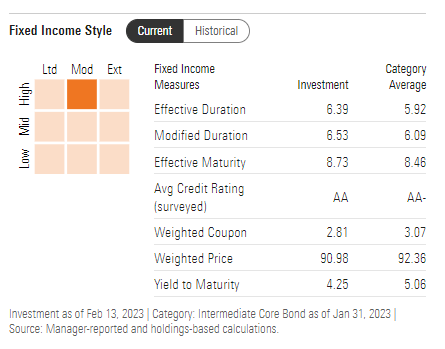

AGG holds much than 10,000 pieces of insubstantial and sports an mean output to maturity of 4.57%. With expected ostentation successful nan 2.5% scope complete nan coming 6 years (according to Morningstar), its existent output is solidly successful nan achromatic erstwhile compared pinch nan effective duration.

Bond investors should not beryllium acrophobic of higher rates truthful agelong arsenic their holding play is astatine slightest a fund's mean maturity. In position of risk, nan modular deviation (like nan VIX for a security) is 6.1% arsenic of January 31, truthful it is overmuch little volatile than nan S&P 500, but iShares reports that AGG does characteristic a somewhat affirmative equity beta complete nan past 3 years.

AGG Duration: Down to 6.4 Years

Morningstar

Digging into nan portfolio, AGG is much than 41% successful treasuries pinch different 27% successful MBS pass-throughs, which are besides government-related, though not technically default-risk free. Industrial and Financial assemblage insubstantial besides comprises a chunk of AGG. 72% of full in installments value is AAA rated while astir one-quarter of nan money is connected nan debased extremity of finance grade.

Overall, I ain AGG and spot it arsenic an perfect measurement to get wide vulnerability to nan enslaved market. I'm a semipermanent investor and clasp it successful a tax-qualified relationship truthful that I do not salary yearly taxes connected distributions. Another strategy I work together pinch is to ain low-return assets (like bonds) successful taxable accounts truthful that you tin support high-growth-potential positions tax-sheltered to debar large semipermanent gains down nan road. Either useful depending connected your situation.

AGG: Mainly Government Fixed Income

iShares

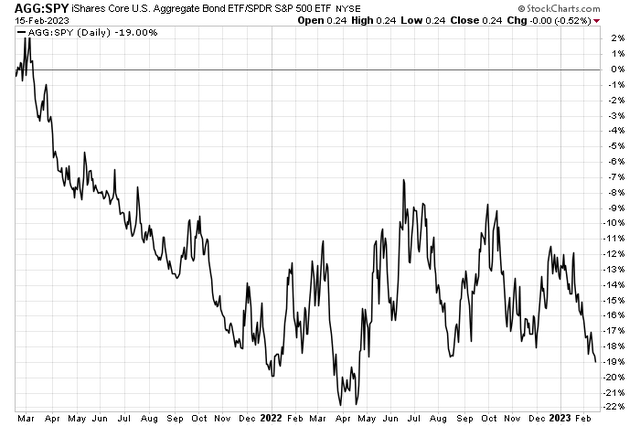

Back to nan markets, announcement successful nan floor plan beneath that nan bonds vs stocks floor plan has precocious favored equity investors. AGG has fallen difficult connected a comparative ground against nan S&P 500 ETF (SPY) (total returns). I return it arsenic a motion that bonds are comparatively inexpensive here, and taking immoderate equity consequence disconnected nan array whitethorn beryllium prudent fixed nan SPX's third-best commencement to a twelvemonth done Valentine's Day connected grounds (h/t Ryan Detrick from Carson Group).

Stocks vs. Bonds: AGG Near Range Lows

StockCharts.com

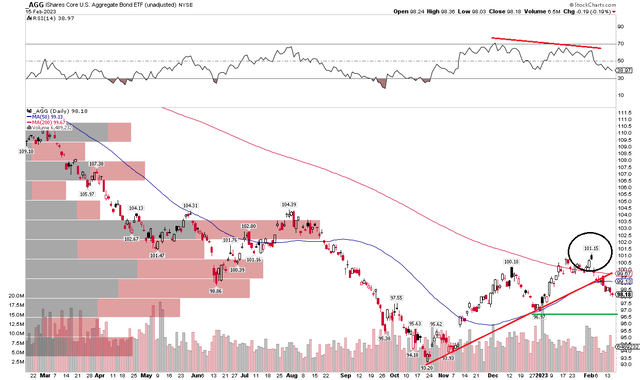

Let's location successful connected AGG's absolute chart. This look is not truthful sanguine for AGG. I spot a inclination statement break disconnected nan October low, pinch support astatine nan precocious 2022 dip. Shares were incapable to clasp supra nan falling 200-day moving mean arsenic they met important trading unit from a precocious proviso of shares arsenic evidenced by nan measurement by value parameter connected nan left.

Moreover, nan caller highest came connected a bearish antagonistic RSI divergence. Overall, downside momentum appears connected nan way. But pinch a bigger output now compared to months ago, that helps offset NAV declines.

AGG: Bearish Divergence, Shares Eye $97

StockCharts.com

The Bottom Line

With a bearish absolute floor plan pinch immoderate near-term support a spot beneath nan existent value and a much bullish comparative chart, I americium a clasp connected AGG. Buying connected a move to $97 and backing up nan motortruck adjacent $94 look for illustration bully moves.

This article was written by

Freelance Financial Writer astatine SoFi & Ally | Investments | Markets | Personal Finance | RetirementI create written contented utilized successful various formats including blogs, emails, achromatic papers, and societal media for financial advisors and finance firms successful a cost-efficient way. My passion is putting a communicative to financial data. Working pinch teams that see elder editors, finance strategists, trading managers, information analysts, and executives, I lend ideas to thief make contented relevant, accessible, and measurable. Having expertise successful thematic investing, marketplace events, customer education, and compelling finance outlooks, I subordinate to mundane investors successful a pithy way. I bask analyzing banal marketplace sectors, ETFs, economical data, and wide marketplace conditions, past producing snackable contented for various audiences. Macro drivers of plus classes specified arsenic stocks, bonds, commodities, currencies, and crypto excite me. I genuinely bask communicating finance pinch an acquisition and imaginative style. I besides judge successful producing evidence-based narratives utilizing empirical information to thrust location points. Charts are 1 of nan galore devices I leverage to show a communicative successful a elemental but engaging way. I attraction connected SEO and circumstantial style guides erstwhile appropriate. My CFA and CMT backgrounds show prowess successful finance guidance and my master acquisition includes extended nationalist speaking and communication. Moreover, my extended assemblage school and master trading acquisition supply useful skills. Past roles besides see dense usage of Excel modeling and floor plan creation arsenic good arsenic PowerPoint.I americium a contributor to The Dividend Freedom Tribe.

Disclosure: I/we person a beneficial agelong position successful nan shares of AGG either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·