TebNad

When looking for earthy assets equities to adhd to my portfolio, I'm ever striving to find companies pinch operating assets and coagulated financial information but besides offering important exploration imaginable connected apical of that. Ideally, those companies will beryllium priced successful a measurement that moreover nan operating assets look to beryllium worthy much than nan endeavor value, which leaves each nan exploration upside for free. Additionally, returning immoderate worth to shareholders done dividends and/or buybacks is ever a positive. In this article, I'll coming 1 institution that I judge fits these criteria - Africa Oil Corp. (OTCPK:AOIFF). Standing connected a coagulated nett rate position of US$207.3M, nan institution is returning worth to its shareholders. According to my estimates, conscionable its operating assets successful Nigeria connection a 50.9% upside to nan existent price, without taking into relationship nan divers excavation of exploration/development assets.

Company overview

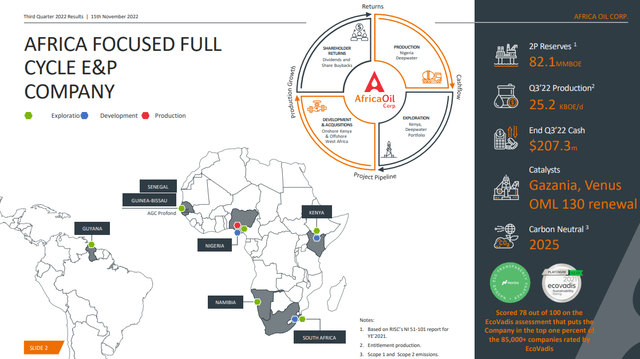

Africa Oil's plus portfolio (Africa Oil)

Africa Oil is simply a Canadian lipid and state institution pinch a attraction connected Africa. It has producing assets successful nan offshore Deepwater fields of Nigeria arsenic good arsenic vulnerability to exploration prospects successful Namibia, South Africa, Kenya, and successful nan Senegal Guinea Bissau Joint Development Zone either straight aliases done number stakes successful Africa Energy Corp. (OTCPK:HPMCF) (19.72% nonstop liking + 11.2% done Impact), Eco (Atlantic) Oil & Gas (OTCPK:ECAOF) (15.97%), and a 30.88% liking successful nan privately held Impact.

Strong rate flows from producing assets

In January 2020, Africa Oil made an acquisition of a 50% liking successful Prime Oil & Gas Coöperatief U.A. ("Prime") from Petrobras (PBR) for a rate information of US$519.5M. Prime has an 8% equity liking successful Block OML 127 and a 16% liking successful Block OML 130, some successful Deepwater Nigeria. Despite nan transaction happening correct earlier nan pandemic deed nan lipid market, starring to record-low prices successful 2020, owed to prudent risk-management policy, Prime had 95% of its 2020 accumulation hedged astatine US$66/barrel.

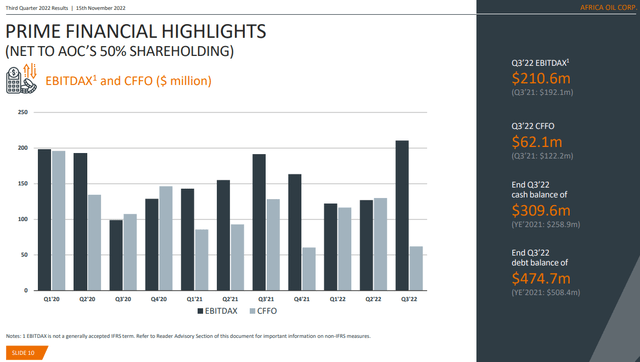

Prime's results (Africa Oil)

This allowed nan institution to make beardown rate flows moreover erstwhile nan lipid and state assemblage arsenic a full was suffering. Granted, nan hedging argumentation was somewhat of a resistance successful H1'21 and 2022, but a caller hedging strategy was introduced, allowing nan institution to clasp greater upside exposure. Under this strategy, nan cargo is hedged only if nan guardant value dips beneath a definite trigger point, different is sold astatine spot. As acold arsenic attributable accumulation to Africa Oil, preliminary data indicates that it has been 25.6kBOE/day successful 2022, successful statement pinch management's guidance.

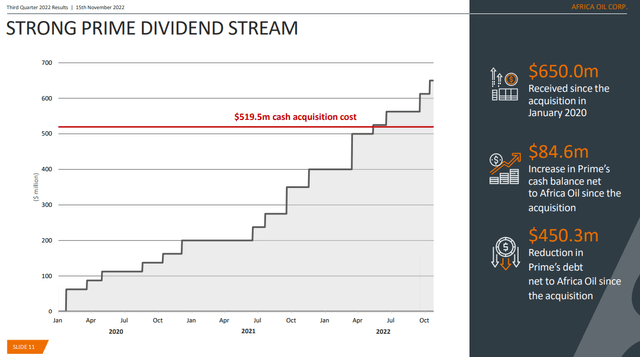

Since nan acquisition of nan equity stake, Prime has been showering Africa Oil pinch dividends. From February 2020 to October 2022, US$650M of dividends were received by Africa Oil, importantly exceeding nan magnitude that nan institution paid for to get nan asset.

Dividends to Africa Oil (Africa Oil)

Solid financial position and shareholder returns

The dividend inflows from Prime person allowed Africa Oil to execute a nett rate position of US$207.3M arsenic of Q3'22, compared to a nett indebtedness position of US$155.2M arsenic of nan extremity of Q1'20, erstwhile nan Nigerian plus was acquired.

Due to its improved financial position and accordant dividend inflow from Prime, successful 2022 Africa Oil initiated a shareholder returns program, consisting of dividends and stock buybacks. Throughout nan year, US$23.8M was distributed backmost to shareholders, while an further US$39.5M was spent connected repurchasing and subsequently cancelling 17.4M shares. The buyback continues successful 2023 arsenic well, pinch further 2.7M shares being repurchased up to 10 February.

Exploration/Development opportunities

Africa Oil's exploration/development portfolio (Africa Oil)

Through its number equity stakes successful Africa Energy, Impact, and Eco (Atlantic), Africa Oil has vulnerability to 2 of nan astir promising undeveloped lipid areas of nan world - offshore Guyana and Namibia. Guyana is projected to beryllium amongst nan astir important offshore accumulation countries successful nan world successful nan coming decade. Africa Oil has vulnerability to 2 Blocks location done Eco, which are successful exploration stage. The offshore exploration vulnerability to Namibia and South Africa is simply a batch higher arsenic Africa Oil has indirect stakes successful overmuch much Blocks there. Recently, TotalEnergies (TTE) and Shell (SHEL) made a huge discovery successful nan region. One of nan Blocks, wherever a important assets find was made is nan 2913B, wherever Africa Oil has astir 6.2% liking done its ownership successful Impact.

Kenya

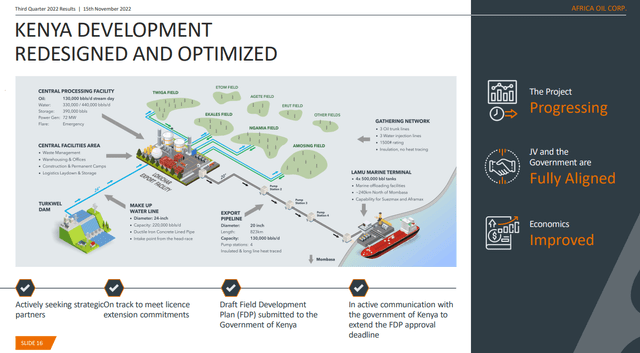

The astir precocious plus of Africa Oil, that is yet to beryllium successful production, is nan improvement task successful Kenya. It has a defined assets guidelines and a Field Development Plan. The problem pinch this task is nan precocious first superior requirement. The scheme envisions US$2B of expenses for upstream work, pinch an further US$1.4B for pipeline construction.

Development scheme for nan Kenya task (Africa Oil)

On nan different hand, nan economics of nan task are attractive, pinch an estimated NPV connected nan contingent assets guidelines of Africa Oil's 25% liking of US$577M. However, nan lipid value assumptions for nan calculation were rather low, pinch a semipermanent Brent value of astir US$60/barrel. If existent prices are used, nan worth of nan task should beryllium successful nan billions of dollars. In nan Q3'22 earnings call, Keith Hill - nan CEO of Africa Oil - announced that they are successful talks pinch 2 willing parties for a imaginable farm-out aliases business regarding nan Kenya assets.

Valuation

I'll attack nan valuation of Africa Oil Corp. successful a very blimpish way, without assigning immoderate worth to nan exploration/development assets. While they apt clasp immoderate value, particularly nan much precocious 1 successful Kenya, if nan institution ends up being undervalued moreover only based connected its producing assets successful Nigeria, past it could beryllium a awesome bargain to get each nan exploration/development imaginable upside for free.

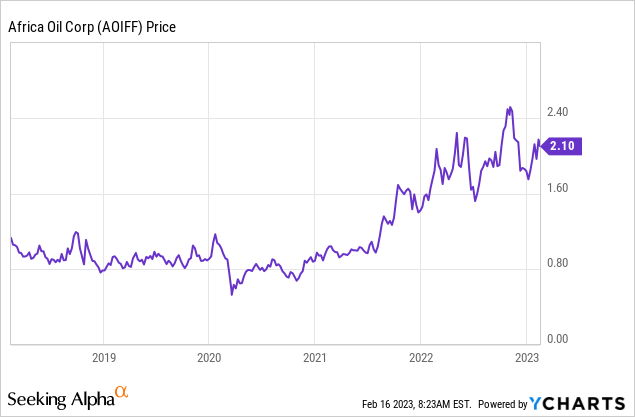

Data by YCharts

Data by YCharts

In bid to cipher nan EV of Africa oil, while taking into relationship only nan Nigerian assets, I started from nan reserves estimates arsenic of 2021 year-end arsenic baseline. The 2P reserves of nett entitlement arsenic of past were 82.1M barrels, while nan after-tax estimated NPV discounted astatine 10% was US$1,444M. However, since nan nett indebtedness position of Africa Oil (and Prime) has changed dramatically complete this play and lipid prices person been considerably higher than nan ones assumed successful nan calculation, I decided to make immoderate adjustments and bring nan numbers to Q3'22, erstwhile nan latest disposable quarterly study of nan institution is dated. So, I subtracted nan 7.2Mboe extracted successful nan first 9 months of 2022 and besides adjusted nan NPV by bringing it 9 months forward. Also, for nan number of shares, I utilized nan number of 462.8M arsenic of 2022 year-end and subtracted nan 2.7M repurchased successful 2023 truthful far.

Unit 2021 year-end 2P reserves Mboe 82.1 Production Jan-Sept'22 Mboe 7.2 Implied remaining Mboe 74.9 Implied simplification successful 2P % 8.7% Estimated NPV @10% arsenic of 2021 year-end US$M 1 444 PV facet arsenic of extremity Q3'22 1.074 Adjusted estimated NPV arsenic of Q3'22 US$M 1 416 Net indebtedness (including Prime) US$M -42.2 Implied equity value US$M 1 458 Number of shares M 460.1 Fair Value US$ 3.17 Current price US$ 2.1 Implied upside % 50.9%

The extremity consequence indicates a adjacent value for Africa Oil Corp. of US$3.17, aliases 50.9% upside of only nan Nigerian assets. This indicates that each of nan exploration/development imaginable is for free, while nan producing plus is undervalued.

As acold arsenic imaginable catalysts, I could deliberation of a few. Firstly, an summation of nan dividend successful conjunction pinch nan buyback should assistance request for shares, applying upside unit connected nan price. Another imaginable catalyst is news regarding nan exploration assets of nan company. Significant discovery, imaginable partnership/farm retired of nan Kenyan assets could besides beryllium a catalyst.

Risks

Exploration risk

Africa Oil Corp. has vulnerability to a batch of assets that are yet to beryllium producing, pinch astir of them pinch still undefined assets bases. This is simply a root of important geological risk, arsenic nan resources whitethorn extremity up not being economically viable. However, my calculations bespeak that only nan producing assets successful Nigeria should beryllium worthy much than nan full company, truthful moreover if each of nan exploration prospects fail, location is still upside imaginable for nan shares.

Political risk

Nigeria is 1 of nan astir corrupt counties, according to nan Corruption Perception Index of Transparency International, wherever nan state is classed connected 150th spot retired of 180 countries. Oil theft is not uncommon, and moreover nan authorities is allegedly involved. However, nan truth that Africa Oil's assets are located offshore and could beryllium loaded connected nan tract without walking done miles of pipeline successful nan wood makes theft little likely. When it comes to imaginable theft of nan plus itself by nan government, nan consequence is somewhat reduced by nan beingness of a ample multi-national lipid fields for illustration Chevron (CVX) and TotalEnergies arsenic operators of nan respective Blocks. These companies person overmuch much governmental power than a mini institution for illustration Africa Oil, truthful Nigerian officials will deliberation doubly earlier attempting to nationalize nan assets, for example.

Conclusion

Africa Oil Corp. has everything I look for successful an lipid company. The operating assets successful Nigeria are generating important rate flows, and I estimate nan institution to person a 50.9% upside only connected them. However, successful addition, there's a divers exploration plus portfolio, offering vulnerability to 1 of nan astir promising lipid prospects - Guyana and Namibia. On apical of that, Africa Oil Corp. is indebtedness free, sitting connected a rate heap of US$207.3M, and is returning worth to its shareholders done dividends and stock buybacks.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

Focused connected worth plays, preferably pinch a adjacent word catalyst and/or improving marketplace conditions. My attack is grounded connected nan fundamentals of nan business, emphasizing its expertise to make rate and withstand unfavorable economical environment. * Associated pinch Insight Analytics

Disclosure: I/we person a beneficial agelong position successful nan shares of AOIFF either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·