wWeiss Lichtspiele/iStock via Getty Images

Aehr Test Systems (NASDAQ:AEHR) should greatly use from nan immense summation successful accumulation of silicon carbide (SiC) successful nan coming years and nan request for caller trial equipment. I deliberation nan banal has coagulated upside from here, but would beryllium moreover much willing successful nan sanction connected a dip.

Company Profile

AEHR develops and manufactures semiconductor trial instrumentality to cheque microprocessors, microcontrollers, integer awesome processors, representation ICs, sensors, powerfulness devices, and optical devices. AEHR's systems execute what is referred to arsenic burn-in, which is simply a accent testing process for semiconductors that tin return anyplace from minutes to days. This tin beryllium done astatine nan wafer level (before nan dice are packaged) aliases astatine nan package level (after nan dice are packaged). The burn-in process screens for early spot failures, while afterwards nan semiconductors acquisition a last trial process utilizing automatic trial equipment.

Chips successful nan automotive, mobility, networking, and telecommunications markets each request to meet value and reliability specifications and truthful beryllium tested. AEHR's instrumentality tests silicon carbide devices that are utilized successful electrical vehicles; silicon photonics that are recovered successful information centers and 5G infrastructure; arsenic good arsenic 2D/3D sensors that are recovered successful user electronics, information storage, representation chips, and automotive applications.

Over 90% of AEHR's gross comes from its statement of wafer-level burn-in and trial systems. These devices typically person a two-to-seven-year lifespan. The institution uses a razor-razor leaf exemplary wherever it sells nan trial instrumentality system, but wherever location is simply a consumable input that goes into nan system, creating a recurring gross watercourse from its installed base.

Opportunities

One of AEHR's biggest opportunities is successful nan automotive market, particularly pinch respect to silicon carbide. Silicon carbide exertion is becoming nan go-to powerfulness exertion for eclectic vehicles (EVs) fixed its superior thermal conductivity and higher power ratio compared to accepted silicon. The powerfulness electronics successful EVs must beryllium capable to withstand precocious temperatures successful bid to complaint quickly and thrust farther, which SiC components let it do.

Thus, arsenic EV accumulation increases, silicon carbide accumulation is expected to summation arsenic well. Earlier this month, Blue Wave Consulting predicted that nan SiC Power semiconductor marketplace would turn astatine a CAGR of 16.8% betwixt 2023 and 2029. Analysts astatine William Blair, meanwhile, forecast that nan SiC marketplace for devices and electrical vehicles would turn from 119,000 6-inch balanced SiC wafers for electrical vehicles successful 2021 to much than 4.1 cardinal 6-inch balanced wafers successful 2030. That's a bold prediction, equating to astir a 50% CAGR.

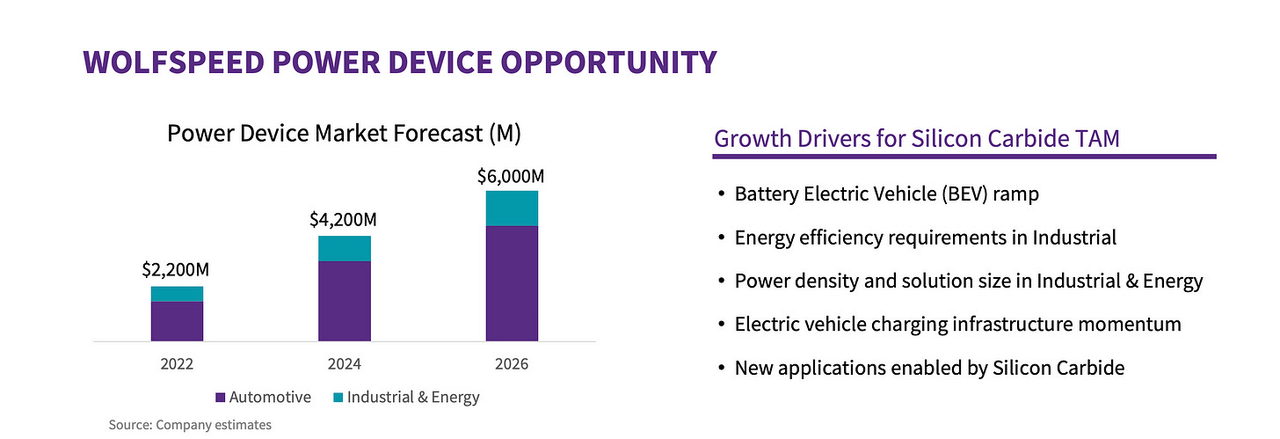

For its part, SiC semiconductor institution Wolfspeed (WOLF) sees nan TAM for SiC powerfulness devices astir tripling from $2.2 cardinal to $6 cardinal by 2026.

WOLF Presentation

Given nan expected demand, companies specified arsenic WOLF and STMicroelectronics (STM) person been looking to quickly turn their SiC accumulation done building caller manufacturing facilities.

For its part, AEHR added 2 caller silicon carbide customers successful FQ2 (ended November), including 1 of nan world's largest suppliers of silicon carbide devices. It said nan 2nd customer is simply a "multi-billion-dollar yearly gross world shaper semiconductors that serves aggregate markets, including supplying devices to nan automotive industry."

In FQ1, nan institution noted that it already has 2 of nan 4 largest silicon carbide marketplace participants arsenic customers. The institution says it remains successful talks pinch different SiC companies and respective up-and-coming suppliers arsenic well.

When looking astatine nan opportunity from AEHR's perspective, it is really successful nan 1st inning of being nan superior testing instrumentality supplier for aggregate companies that are looking to quickly turn their accumulation and testing capabilities to meet nan request for SiC. The institution has only sold a fewer testing systems into this marketplace astatine this point, meaning each futures orders conscionable lead to incremental growth.

In summation to SiC, AEHR besides benefits from nan wide proliferation of chips that are recovered successful nan car industry. There is simply a clear inclination of much electronics successful vehicles, and these each request to beryllium tested.

The institution besides serves different charismatic markets, chiefly successful nan 5G infrastructure and information halfway spaces that usage silicon photonics. Companies successful this abstraction are forecast to statesman integrating photonics transceivers into microprocessors, graphics processors, and chipsets. If this happens, this would besides beryllium a important testing marketplace for AEHR.

Risks

While AEHR is riding immoderate secular trends, it isn't immune to cyclical trends successful nan adjacent term. EV request and accumulation tin play a domiciled successful nan results AEHR puts up. Tesla (TSLA) uses silicon carbide-based MOSFETS successful each its vehicles, and EVs from different car manufactures each request traction inverters that preferably usage SiC. Thus, immoderate shifts successful request aliases accumulation successful this marketplace tin yet effect AEHR.

The system tin besides play a domiciled pinch different spot components. For example, AEHR's silicon photonics business has still been successful nan process of recovering since nan pandemic. Any proviso concatenation issues tin besides effect testing.

AEHR besides heavy relies connected its apical five-largest customers, which accounted for 98% of its gross successful fiscal 2022. In fact, its apical customer accounted for a whopping 82% of its income past fiscal year. Its apical customer nan twelvemonth earlier accounted for 24% of revenue. Thus, customer attraction is surely a risk.

Systems are besides expensive, ranging successful costs from $300,000 to $1 cardinal per system. This tin besides create lumpy results. Any delays aliases cancelled orders could origin nan institution to miss near-term gross and net projections.

AEHR besides added caller connection astir title erstwhile it revenge its most-recent 10-K successful August. The institution adhd to its Risk Factors: "The Company expects that its DiePak products for burning-in and testing aggregate singulated dice and mini modules look important competition. The Company believes that respective companies person developed aliases are processing products which are intended to alteration trial and burn-in of aggregate bare die, and mini modules."

Valuation

AEHR presently trades astatine an EV/EBITDA aggregate of 32x nan FY24 (ending May) statement of $32 million. Based connected FY25 EBITDA projections of $43 million, it trades astatine a 21x multiple.

On a PE basis, nan institution trades astatine 33x nan FY24 statement of $1.03. The FY25 estimates is for EPS of $1.47, putting its aggregate astatine 23x.

Revenue is projected to turn 24% this fiscal year, accelerating to 55% adjacent twelvemonth and 45% successful FY2025.

Given nan explosive maturation of nan SiC marketplace and AEHR's premier domiciled to benefit, I don't deliberation a ~30x guardant EBITDA aliases EPS aggregate is retired of statement for valuing nan company. This would put nan banal astir $45, giving it astir 30% upside from here.

Conclusion

AEHR is 1 of nan more-interesting ways to play nan inclination successful silicon carbide. This is an explosive maturation marketplace that is going to request a batch of testing instrumentality successful nan future. Meanwhile, nan building of caller multi-billion dollar SiC accumulation facilities only solidifies nan coagulated early maturation for nan company.

However, results for testing instrumentality tin beryllium lumpy, and AEHR's backlog is expected to turn faster than its gross this fiscal twelvemonth arsenic caller accommodation get built and accumulation ramps up. Any delays aliases issues successful these accommodation would past push backmost maturation for AEHR

Given wherever AEHR trades, I don't deliberation nan banal is overly costly fixed its projected maturation successful outer years.

I would beryllium much willing successful starting a agelong position successful nan mid to precocious $20s, fixed immoderate of nan risks nan institution could face. However, this is not a bad spot to statesman a starter position.

This article was written by

Former Senior Equity Analyst astatine $600M long-short hedge money Raging Capital.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·