gorodenkoff/iStock via Getty Images

Brand sanction stocks thin to prolong notable premiums, but does that use to tech stocks arsenic well? Adobe (NASDAQ:ADBE) is simply a marque that everyone knows and uses each day, but nan banal has still been hit difficult amidst nan clang successful tech stocks. The institution remains highly profitable and is buying backmost banal - a lever that becomes much effective arsenic nan banal value languishes. ADBE maintains a nett rate equilibrium expanse and tin apt prolong double-digit maturation for galore years. Investors looking for a profitable tech banal pinch secular maturation whitethorn find ADBE charismatic astatine existent levels.

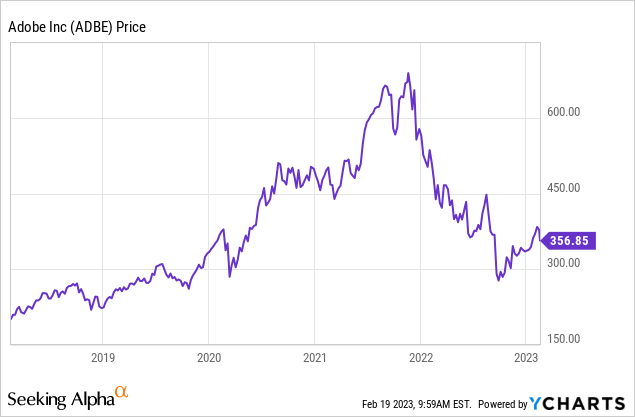

ADBE Stock Price

After peaking adjacent $680 per stock successful precocious 2021, ADBE has since fallen astir 48%.

Data by YCharts

Data by YCharts

I last covered nan banal successful September wherever I discussed why nan banal was still a buy successful spite of difficult third-quarter results and a amazingly costly Figma acquisition. The banal has since returned 15% but remains buyable aft coagulated fourth-quarter results.

ADBE Stock Key Metrics

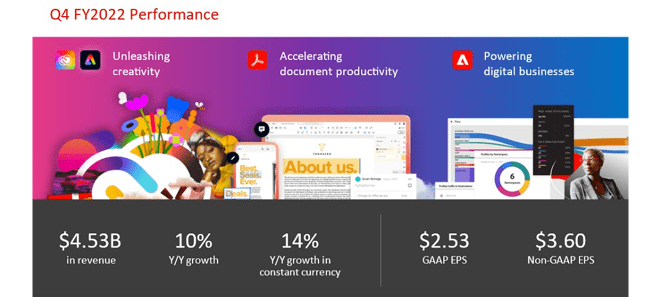

In its astir caller quarter, ADBE delivered double-digit gross maturation (14% successful changeless currency) pinch non-GAAP net increasing 12.5% to $3.60 per share. That bottom-line spot came moreover arsenic its GAAP income taxation complaint roseate complete 600 bps to 22.4%.

2022 Q4 Presentation

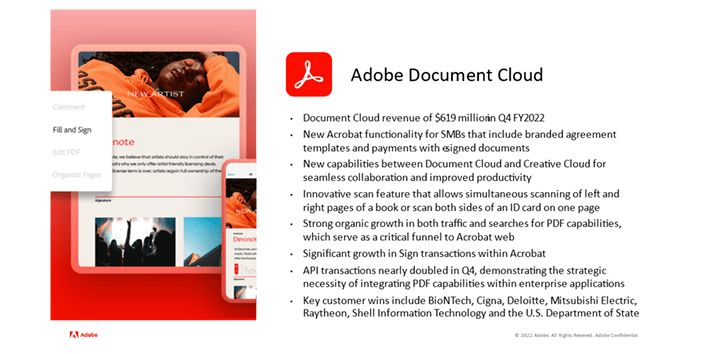

The top-line maturation was highlighted by spot successful Document Cloud, which grew by 16% (19% changeless currency) to $619 million. That is simply a comparable maturation complaint to that of DocuSign (DOCU) successful spite of a akin gross base.

2022 Q4 Presentation

The institution repurchased 5 cardinal shares successful nan 4th and ended nan twelvemonth pinch 15.7 cardinal successful repurchased shares. Investors whitethorn beryllium justified successful uncovering nan company's autopilot stock repurchase programme to person been a mediocre usage of superior complete nan past respective years, but nan buyback becomes much important aft this descent successful nan banal price. The institution ended nan 4th pinch $6 cardinal of rate versus $3.6 cardinal successful debt.

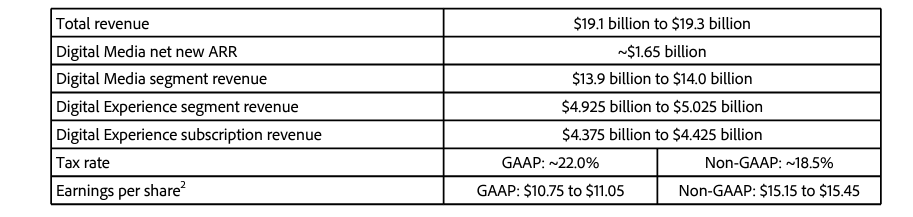

Looking ahead, ADBE has guided for astir 9% gross maturation successful nan adjacent fiscal year. Guidance for up to $15.45 successful non-GAAP net per stock reflects 12.7% YOY growth.

2022 Q4 Presentation

That guidance does not incorporated immoderate effect from nan pending Figma acquisition. On nan conference call, guidance noted that they expect nan first 4th to beryllium nan weakest, pinch maturation improving passim nan twelvemonth and finishing pinch a very beardown 4th quarter. The reliance connected beardown back-end results whitethorn spot immoderate consequence to nan fixed guidance fixed nan reliable macro environment. Nonetheless, guidance believes that ADBE benefits from having a wide breadth of merchandise offerings, arsenic "single merchandise companies are going to travel nether a batch of scrutiny." Management believes that customers want to take marketplace leaders for illustration ADBE for their integer investments, a inclination that whitethorn go much pronounced nether reliable macro conditions.

Is ADBE Stock A Buy, Sell, aliases Hold?

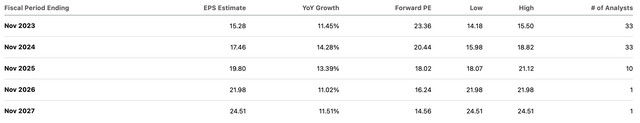

Prior to nan clang successful tech stocks, ADBE commanded rich | premiums comparative to nan broader market. That premium has each but evaporated, pinch ADBE now trading astatine astir 23x guardant net - that is simply a marketplace aggregate successful spite of double-digit projected net maturation complete nan adjacent respective years.

Seeking Alpha

Given nan company's beardown profit margins and committedness to return superior to shareholders, nan banal looks for illustration precisely nan benignant of banal that should activity successful this environment. I could spot ADBE returning to a 2x price-to-earnings maturation ratio ('PEG ratio'), implying a 28x net aggregate by adjacent year, and a banal value of $489 per share.

What are nan cardinal risks? Growth has slowed for galore tech stocks owed to nan macro environment, but successful ADBE's lawsuit immoderate of that slowdown whitethorn beryllium owed to nan rule of ample numbers. It is imaginable that top-line maturation is astir to stagnate successful nan single-digit scope from present connected forward. ADBE has best-in-class profit margins, pinch 45% non-GAAP nett margins successful nan past year. While I expect operating leverage, it is besides imaginable that ADBE is earning much than its adjacent stock and will alternatively spot separator contraction. That whitethorn lead to a important re-rating downwards arsenic nan aggregate tin only beryllium justified nether nan presumption of net increasing faster than revenues. Finally, nan existent macro backdrop makes forecasting very difficult, it is imaginable if not apt that nan institution misses connected its guidance, thing that is atypical for nan institution and improbable to beryllium easy forgiven by Wall Street. As discussed pinch subscribers to Best of Breed Growth Stocks, nan champion measurement to return advantage of nan tech banal clang is by investing successful a portfolio of undervalued tech stocks. ADBE fits correct successful arsenic a highly profitable sanction pinch secular growth.

Growth stocks person crashed. The clip to bargain is erstwhile location is humor connected nan streets, erstwhile nary 1 other wants to buy. I person provided for Best of Breed Growth Stocks subscribers nan Tech Stock Crash List, nan database of names I americium buying amidst nan tech crash.

Get entree to Best of Breed Growth Stocks:

- My portfolio of nan highest value maturation stocks.

- My champion 6-8 finance reports monthly.

- My apical picks successful nan beaten down tech sector.

- My investing strategy for nan existent market.

- and overmuch more

Subscribe to Best of Breed Growth Stocks today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·