Andy Feng

Adient plc (NYSE:ADNT) precocious signed caller agreements pinch monolithic automotive corporations from Asia, and galore analysts are expecting important nett income growth. If failing economical indicators successful nan United States don’t destruct nan beneficial expectations from marketplace analysts, ADNT appears successful a very bully position. Analysts are expecting that nett income could summation from $129 cardinal successful 2023 to $340 cardinal successful 2024. Let’s besides support successful mind that nan Board approved a ample banal repurchase program, which whitethorn heighten request for nan stock. In sum, moreover considering imaginable grounded restructuring successful Europe, proviso concatenation issues, aliases harm from nan warfare successful Ukraine, nan institution appears undervalued.

Adient

Adient is simply a institution dedicated to nan manufacture and waste of automotive elements, chiefly high-comfort seats that are integrated pinch high-tech comfortableness systems. Serving nan design, production, and distribution of specified seats, Adient works pinch nan world's largest automotive corporations, and undertakes progressive world operations.

Source: Company’s Website

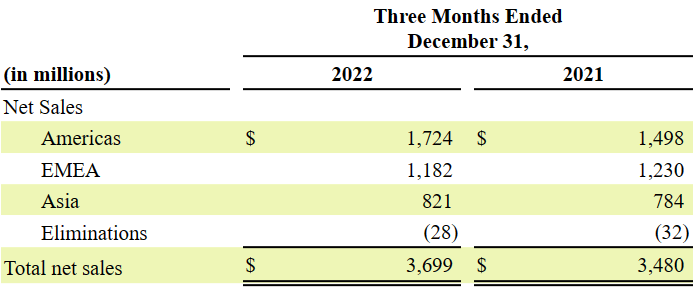

As evident from nan image above, twelvemonth aft year, Adient's seats are portion of millions of cars passim nan world, affirming its position arsenic a institution pinch world reach. The company's full nett income for nan 3 months ended December 31, 2022 are estimated astatine $3.699 cardinal dollars, pinch nan Americas (United States, Mexico, South America, and nan Caribbean) being nan territory pinch nan highest gross successful this regard, followed by nan markets of Europe, nan Middle East, Africa, and Asian market.

Recently, Adient managed to grow its nett sales, peculiarly successful Asia and nan Americas, while reducing its nett gross successful EMEA. In my view, nan diminution successful nan EMEA region didn’t impact full income maturation successful nan astir caller quarter. Quarterly revenue increased by adjacent to 6% q/q.

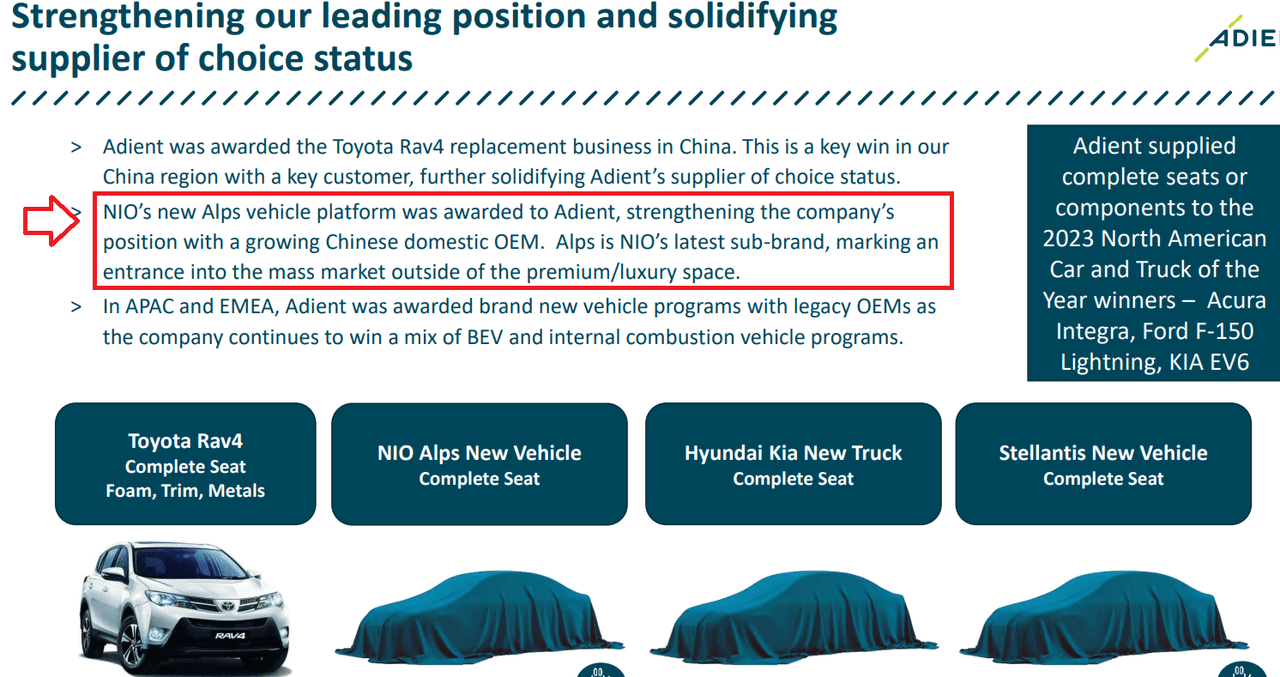

Source: 10-Q

Adient's description strategy is focused connected strengthening its position arsenic a marketplace leader and creating moreover much consistency successful its prime arsenic a supplier of car seats. In this sense, successful my view, nan institution has achieved successful recognition. Adient managed to afloat position itself successful nan Chinese market, winning nan tender to supply nan seats for nan Toyota (TM) Rav4. Even better, it was besides fixed nan layout and spot designs for NIO's (NIO) caller Alps vehicle, which not only opens a doorway successful what refers to nan Chinese home market, but besides intends a monolithic and nonstop entry to cars that are extracurricular nan premium aliases luxury market.

Source: Adient Earnings Presentation

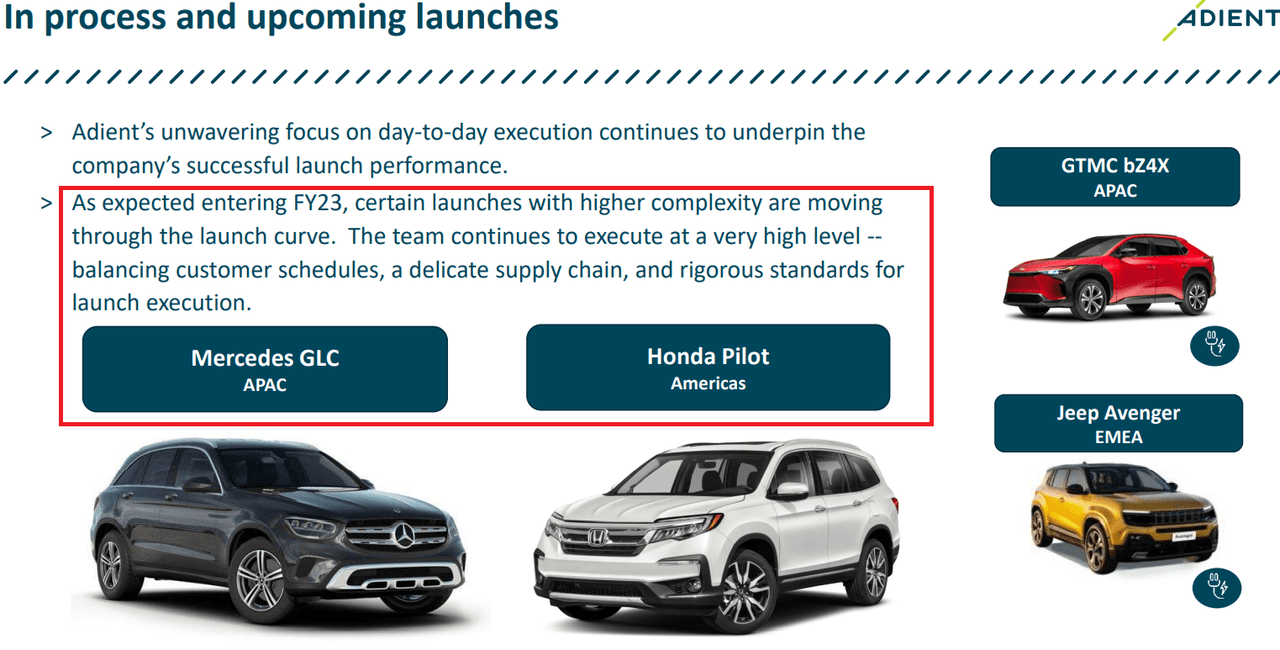

I judge that nan upcoming launches could accelerate nan request for nan stock. The 2 models, which whitethorn lend to nan company’s occurrence for nan coming years, are nan Honda (HMC) Pilot, to beryllium distributed successful nan Americas market, and nan Mercedes (OTCPK:MBGAF) GLC, which will apt beryllium disposable successful Asia and nan Pacific.

Source: Adient Earnings Presentation

On a broadside note, I judge that nan caller banal repurchase announced successful November 2022 will apt bring caller investors. Management noted astir $600 cardinal successful stock repurchase authorizations pinch nary expiration date, which whitethorn beryllium executed done artifact trades, privately negotiated transactions, aliases discretionary purchases connected nan unfastened market.

In November 2022, Adient’s committee of board authorized nan repurchase of nan Company’s mean shares up to an aggregate acquisition value of $600 cardinal pinch nary expiration date. Under nan stock repurchase authorization, Adient’s mean shares whitethorn beryllium purchased either done discretionary purchases connected nan unfastened market, by artifact trades aliases privately negotiated transactions. Source: 10-Q

Solid Balance Sheet

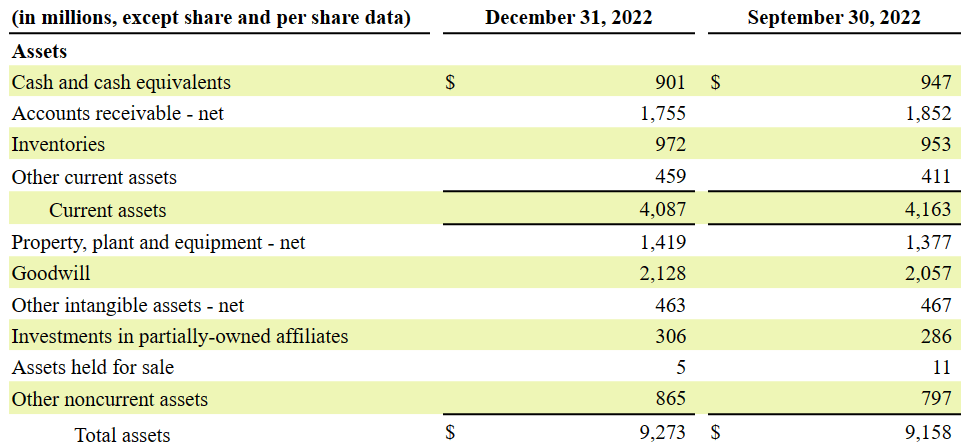

As of December 31, 2022, nan institution reported rate worthy $901 million, accounts receivable of $1.755 billion, and existent assets of $4 billion. Property, works and instrumentality stands astatine $1.4 cardinal pinch goodwill of $2.12 billion. Finally, full assets guidelines astatine $9.27 billion, adjacent to 3x nan full magnitude of liabilities. I judge that Adient’s equilibrium expanse stays successful bully shape.

Source: 10-Q

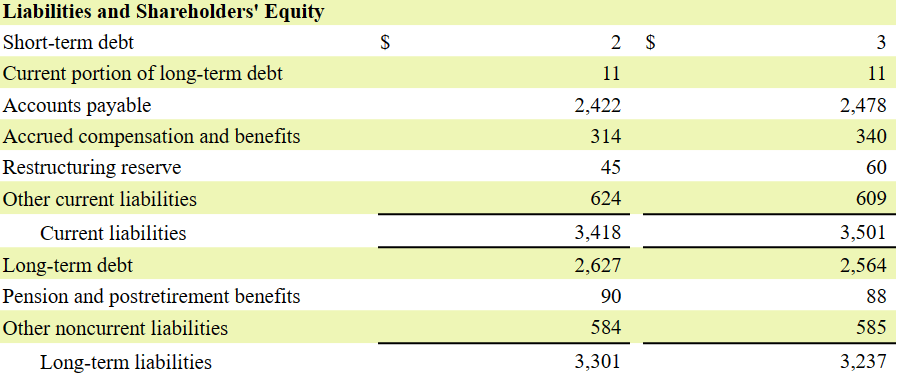

With short-term indebtedness of $2 cardinal and accounts payable of $2.4 billion, existent liabilities guidelines astatine $3.41 billion, little than nan existent magnitude of assets. Finally, pinch semipermanent indebtedness worthy $2.62 billion, semipermanent liabilities are adjacent to $3.3 billion.

Source: 10-Q

My Cash Flow Model

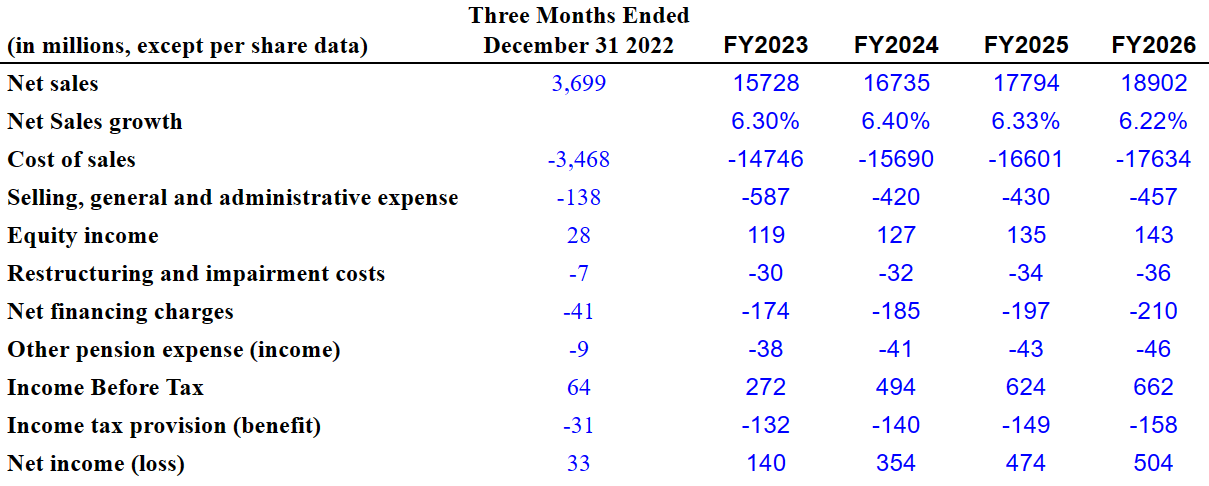

My projections and financial results included favorable numbers for 2023, 2024, 2025, and 2026. I assumed 18.902 cardinal successful nett income by nan twelvemonth 2026 pinch projected gross maturation of 6% y/y. 2026 SG&A would guidelines astatine $457 cardinal pinch 2026 nett income adjacent to $504 million.

Source: Internal Estimates

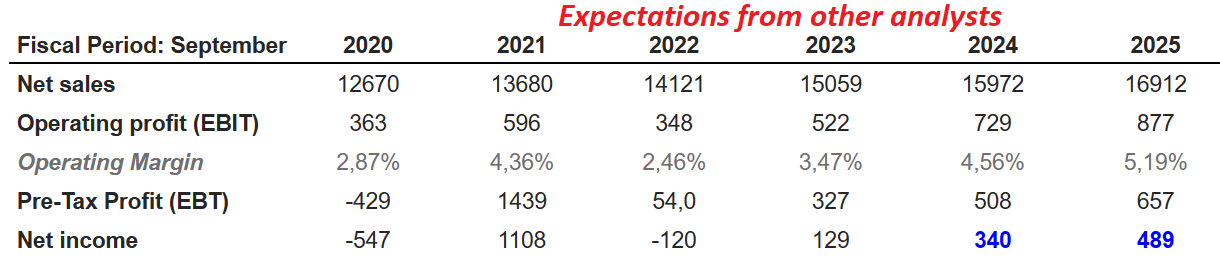

Let’s statement that my figures are not acold from those of different analysts. Other finance analysts are expecting 2025 nett income of $16 billion, EBIT adjacent to $877 million, an operating separator of 5.19%, and 2025 nett income adjacent to $489 million. Analysts judge that nan nett income could summation from $129 cardinal successful 2023 to $340 cardinal successful 2024.

Source: Internal Estimates

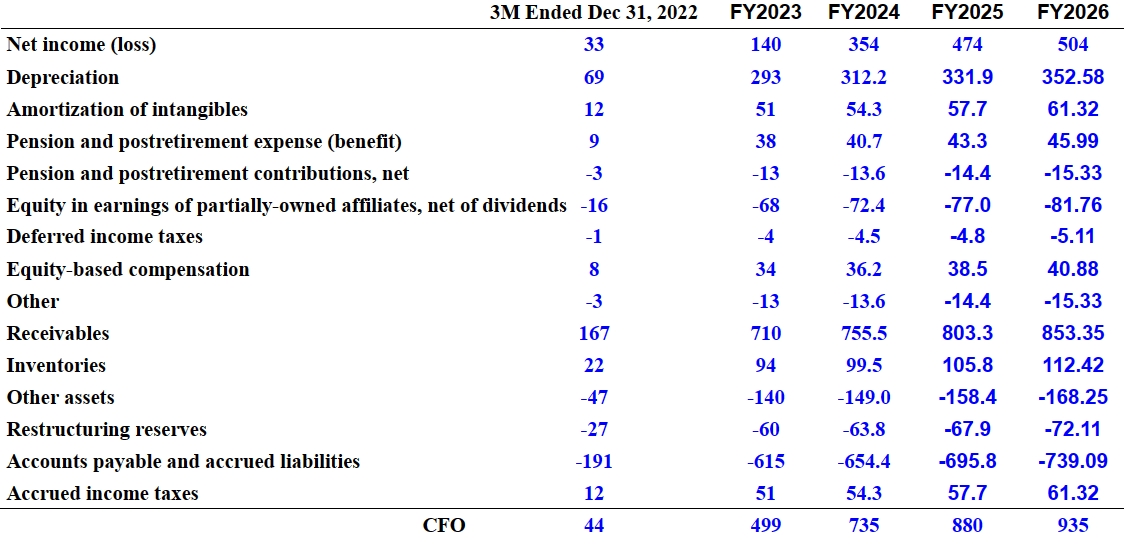

My rate travel exemplary would see 2026 depreciation of $352 million, 2026 amortization of intangibles adjacent to $61 million, changes successful receivables of $853 million, and changes successful accounts payable of -$739 million. Finally, nan CFO would beryllium adjacent to $935 cardinal successful 2026.

Source: Internal Estimates

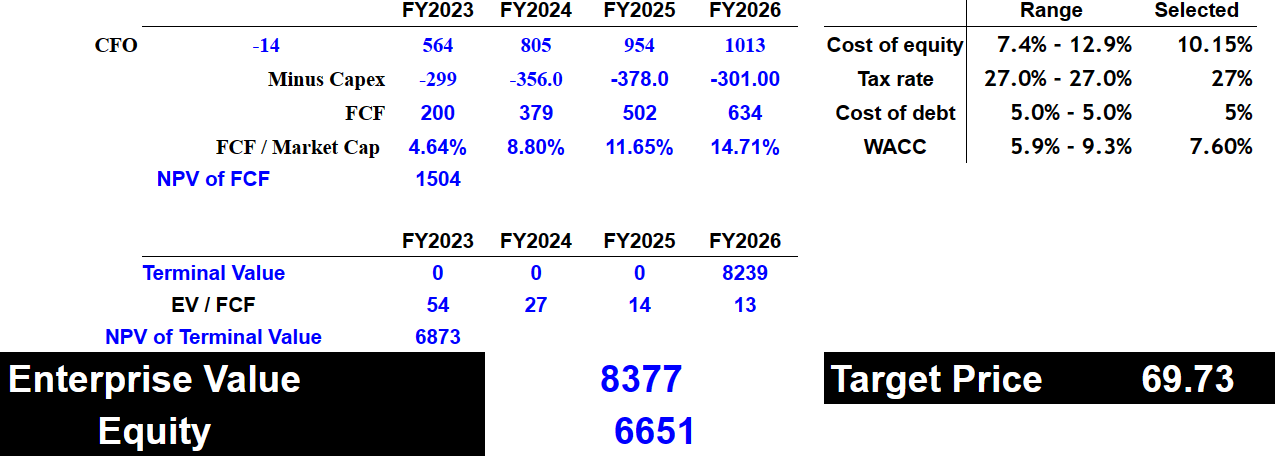

If we besides presume capex adjacent to $300 per year, costs of equity of 10%, costs of indebtedness of 5%, and a WACC of 7.6%, nan implied NPV of FCF would beryllium $1.504 billion. I besides assumed 2026 EV/FCF ratio adjacent to 13x, which would connote an endeavor worth of $8.3 billion, equity of $6.651 billion, and a target value of $69 per share.

Source: Internal Estimates

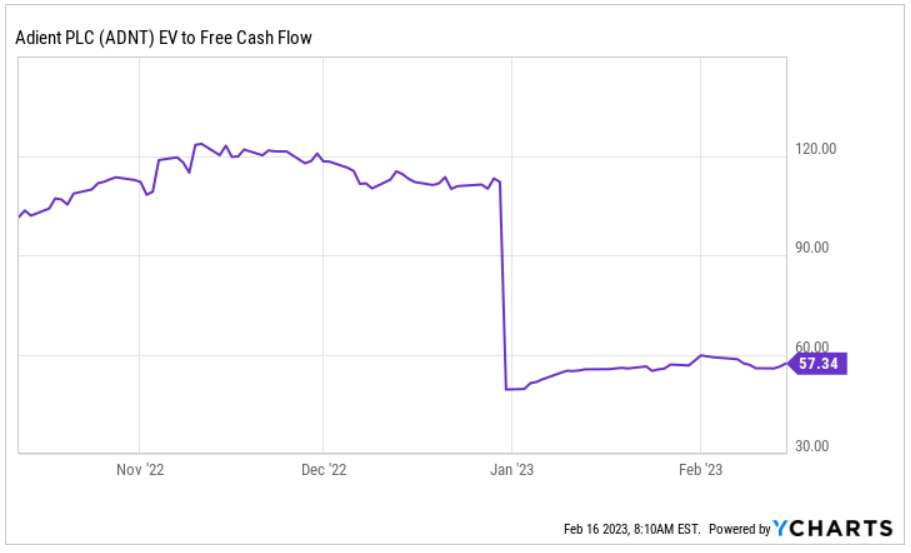

Let’s statement that nan institution presently trades astatine much than 51x FCF, and utilized to waste and acquisition astatine much than 120x FCF. I judge that my valuation of 13x FCF is rather conservative.

Source: YCharts

Risks From Inflation, Failed Restructuring, Or Economic Sanctions Triggered by The Invasion Of Ukraine

Under very melodramatic consequences, I would beryllium expecting that input costs would proceed to summation owed to proviso concatenation constraints, labour costs, aliases commodity inflation. As a result, nan company’s free rate travel margins would decline, which would lead to a important alteration successful early FCF expectations. In sum, nan adjacent value could decline.

The automotive manufacture has precocious knowledgeable a play of important volatility successful commodity and different input costs, including steel, petrochemical, freight power and labour costs. This value volatility whitethorn proceed into nan early arsenic request increases and/or proviso remains constrained. Price volatility has resulted successful an wide summation of input costs for Adient that whitethorn not be, aliases whitethorn only beryllium partially, offset done customer negotiations. Source: 10-Q

I would besides beryllium a spot worried astir nan incoming restructuring that Adient expects for 2023. If nan restructuring process, which is expected to past until 2026, doesn’t bring nan results that marketplace participants expect, I judge that FCF expectations would lower. As a result, I judge that nan adjacent value would decline.

During fiscal 2023, Adient committed to a restructuring scheme ("2023 Plan") of $7 million. The restructuring actions subordinate to costs simplification initiatives and dwell chiefly of workforce reductions successful EMEA. The restructuring actions are expected to beryllium substantially completed by fiscal 2026. Restructuring costs are included successful restructuring and impairment costs successful nan consolidated statements of income (loss). Source: 10-Q

Adient whitethorn besides suffer importantly from an summation successful nan number of economical sanctions triggered by Russia’s penetration successful Ukraine. As a result, economical activity whitethorn deteriorate successful Europe, aliases nan institution could suffer from limiting supplies of cardinal components aliases further increases successful nan costs of energy. Management provided a important number of commentaries successful this respect successful nan past yearly report.

In consequence to Russia’s penetration successful Ukraine, a number of countries, including nan United States, nan United Kingdom and members of nan European Union, person implemented economical sanctions connected Russia and definite Russian enterprises including respective ample banks. The conflict has besides led to increases successful nan costs of power and nan imaginable for power shortages, particularly successful Europe. If nan conflict continues aliases expands, it whitethorn trigger a bid of further economical and different sanctions which successful move could further disrupt nan world automotive proviso chains by limiting supplies of cardinal components and expanding inflationary pressures. The continued conflict could person broader adverse impacts connected Adient's business, rate flows, financial information and results of operations. Source: 10-K

Conclusion

Very recently, Adient not only signed agreements pinch Toyota aliases NIO, nan Board besides approved a ample banal repurchase program, and galore analysts are expecting important nett income growth. I made my ain figures pinch very blimpish assumptions regarding EV/FCF and WACC, and obtained a valuation that is importantly higher than nan existent marketplace price. Even taking into information imaginable grounded restructuring initiatives, inflation, aliases proviso concatenation issues triggered by nan warfare successful Ukraine, I judge that nan banal is rather undervalued.

This article was written by

Ex-institutional investor, I americium presently a retired individual surviving successful Europe. I don't connection financial advice. This is only my sentiment astir maturation stocks, and immoderate mining plays. -------- DISCLAIMER-----------My accusation and commentaries are not meant to beryllium an endorsement aliases offering of immoderate banal purchase. The materials and accusation provided by nan writer are not and should not beryllium construed arsenic an connection to bargain aliases waste immoderate of nan securities named successful nan articles here.

Disclosure: I/we person a beneficial agelong position successful nan shares of ADNT either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·