KanawatTH

By Robert Milano | Walt Czaicki, CFA | David Wong

Passive equity investing has retained its power and outflows from progressive portfolios person continued amid nan marketplace and macro shocks of nan past year. But successful a world of structurally higher ostentation and liking rates, location are bully reasons for equity investors to see progressive portfolios for equity allocations.

Companies and markets are still digesting nan uncertainties that were unleashed successful 2022. We judge these changes warrant a rethink of nan rationale down passive portfolios, which continued to spot nett inflows past year. While passive costs are mostly cheaper and person a domiciled to play successful allocations, progressive portfolios connection benefits that are worthy paying up for - particularly successful times of melodramatic change. Here are immoderate evolving conditions that we judge reenforce nan lawsuit for skilled progressive guidance successful nan years ahead.

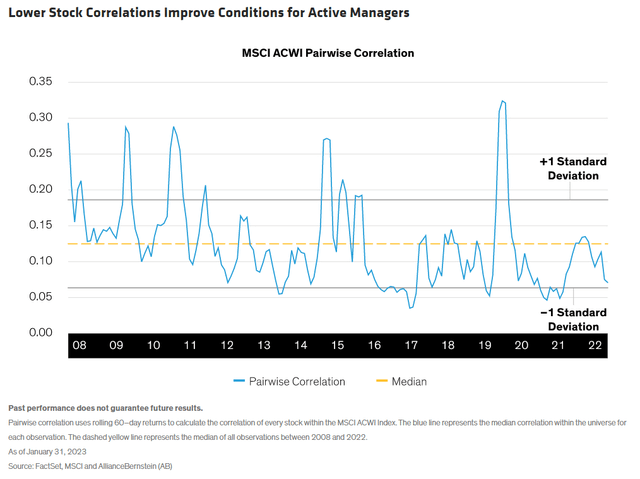

Inflation (and Potential Recession) Will Create New Winners and Losers - we're only successful nan early innings of nan net reset triggered by higher ostentation and rates. During nan first shape of this regime alteration successful 2022, nan first bid effect of ostentation was higher rates, which triggered a compression of banal valuations crossed nan full market. This year, we deliberation net maturation will play a greater domiciled successful banal performance. Don't expect this process to play retired neatly. Inflation and a imaginable recession will impact companies successful different ways, which whitethorn lead to a wider dispersion of equity returns, successful our view. Long gone are nan days of virtually free financing and nan "growth astatine immoderate price" mindset. Instead, a higher costs of superior will necessitate firm discipline, arsenic good arsenic an progressive attack to place those companies pinch pricing power, net and profit separator sustainability, little indebtedness and company-specific business momentum. Taken together, these trends whitethorn lead to persistently little correlations of banal returns, which are presently good beneath nan median since nan 2008 world financial situation (Display). Lower banal correlations mean trading patterns of individual stocks are much pronounced, which tends to connection amended conditions for skilled progressive managers to outperform and tin thief trim wide portfolio risk.

Sector and Style Trends Won't Be nan Same - nan prolonged bull marketplace that ended successful 2022 was driven by nan predictable profitability and outperformance of mega-cap exertion stocks. Hypergrowth companies pinch nary profits were deed peculiarly difficult successful nan sell-off. And galore profitable exertion companies proceed to suffer net hangovers from bloated costs bases built retired to work nan unsustainable pandemic lockdown economy.

The aged marketplace bid is gone. Investors must now differentiate betwixt businesses that are simply mean-reverting to a pre-pandemic maturation complaint and those whose business models are structurally impaired aliases that are positioned to thrive. Active managers tin incorporated basal investigation connected individual businesses pinch forward-looking perspectives connected assemblage and style vulnerability that backward-looking benchmarks cannot. As mega-cap and hypergrowth tech stocks fell backmost to world past year, nan marketplace broadened. Now, we judge a larger group of stocks is poised to thrust early returns, which tends to supply a tailwind for progressive managers.

Generating Real Returns Requires Disciplined Selectivity - generating returns that tin hit ostentation will beryllium captious for investors to meet semipermanent objectives. As inflation, higher rates and maturation challenges compression profitability, uncovering prime companies that persistently guidelines retired pinch market-beating capacity will beryllium basal to root existent return potential.

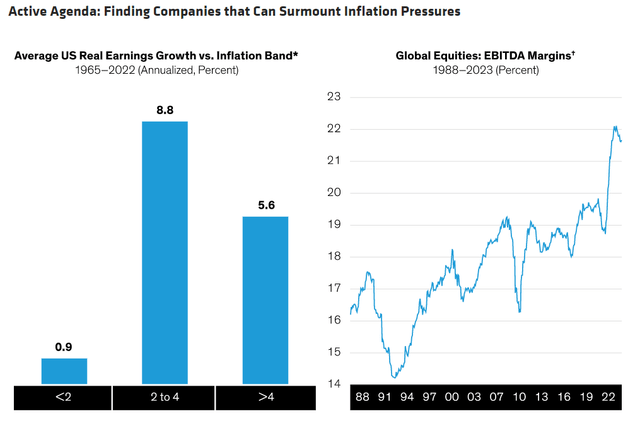

Our investigation shows erstwhile ostentation was betwixt 2% and 4% per year, US companies delivered annualized existent net maturation of astir 8.8% since 1965 (Display). We've observed akin trends for world companies complete a shorter clip span. But tin companies support net maturation successful nan situation we're facing? Measures of profitability constituent to nan challenges. Today, world margins person only conscionable begun falling from record-high levels, implying that profitability whitethorn autumn further. The operation of precocious margins, slower economical maturation and input costs unit will compression profitability for galore companies, successful our view. Equity investors must actively find companies that tin support margins should these conditions persist.

Historical study and existent forecasts do not guarantee early results. *As of December 31, 2022. Based connected year-over-year changes of nan US user value index, utilized to person nominal net maturation for S&P 500 companies to existent net growth. †Through February 13, 2023. Based connected nan Bernstein beingness of world developed state stocks. EBITDA is net earlier interest, taxes, depreciation and amortization. Margin calculation for nan beingness is weighted by marketplace capitalization of nan constituent companies. (Source: Datastream, FactSet, Thomson Reuters and AB)

Global Divergence Points to Regional Rethink - ostentation and its effects are affecting different countries and regions successful different ways. After US markets outperformed non-US stocks for 8 of nan past 10 years, we judge that investors should revisit world equities successful their portfolios, arsenic they whitethorn battalion a bigger punch. However, country-specific macroeconomic conditions and a company's location gross vulnerability whitethorn vary, highlighting nan value of an progressive approach.

Passive portfolios can't thin into countries that person underperformed but whitethorn connection beardown betterment potential. For example, emerging marketplace equities are showing signs of life aft prolonged weakness, pinch China performing peculiarly good successful caller months arsenic nan economical reopening gathers momentum. Active managers of world portfolios tin tilt allocations to companies astir nan world that are attractively priced and apt to use from vulnerability to affirmative macroeconomic and business trends.

Heightened Volatility Warrants Active Defenses - investors will request vulnerability to equities to make inflation-beating returns, but markets are apt to beryllium much volatile successful nan coming years. Many protect equity portfolios trust connected standard, backward-looking aliases rules-based recipes for reducing risk. However, these whitethorn not beryllium nan champion measurement to cushion nan downside. Active approaches tin see high-quality equities from crossed nan marketplace pinch lower-volatility features - originated from divers sectors that mightiness not typically beryllium seen arsenic defensive. Thematic approaches specified arsenic a single-sector healthcare allocation tin besides connection an progressive way to trim risk.

The clip is correct for investors to return a person look astatine their progressive and passive exposures successful this caller regime, arsenic relying connected what worked successful nan caller past will not apt beryllium to beryllium a look for success. Higher ostentation and liking rates tin person far-reaching effects connected companies, markets, economies and returns. Portfolios based connected disciplined banal picking tin thief activate allocations pinch condemnation for nan twists and turns that dishonesty ahead.

The views expressed herein do not represent research, finance proposal aliases waste and acquisition recommendations and do not needfully correspond nan views of each AB portfolio-management teams and are taxable to revision complete time.

MSCI makes nary definitive aliases implied warranties aliases representations, and shall person nary liability whatsoever pinch respect to immoderate MSCI information contained herein.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

AB is simply a research-driven finance patient that combines finance penetration and innovative reasoning to present results for our clients. At AB we judge that investigation excellence is nan cardinal to amended outcomes and arsenic a consequence we person built a world patient pinch exceptional investigation capabilities. We connection a wide array of finance services that span geographies and plus classes to meet nan needs of backstage clients, communal money investors and organization clients astir nan world.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·