Nikola Stojadinovic/E+ via Getty Images

Feb. 16 proved to beryllium a monumental time for investors successful TravelCenters of America (NASDAQ:TA). The company, which focuses connected providing various services for travelers, peculiarly motortruck drivers, successful nan shape of fuel, recreation amenities, and more, saw its banal skyrocket astir 70.6% aft news broke that power behemoth BP (NYSE:BP) struck a woody to bargain nan institution astatine a important premium compared to wherever it was trading astatine previously. At this point, astir investors mightiness beryllium tempted to waste retired of their position successful nan firm. I tin decidedly understand nan sentiment and it's not needfully an unwise move to make. Having said that, fixed really inexpensive shares still are and nan truth that immoderate further upside exists should nan woody travel to completion, I would opportunity that it still warrants a soft "buy" standing astatine this time.

A awesome return for shareholders

The past article that I wrote astir TravelCenters of America was published successful nan mediate of November of 2022. In that article, I talked astir really good nan institution had done passim 2022, pinch shares importantly outperforming nan marketplace successful consequence to robust basal capacity and a stock value that was trading connected nan cheap. Even pinch shares having risen importantly up to that point, I could not thief but to support nan "buy" standing I antecedently assigned nan institution because of some its continued inexpensive stock value and restructuring activities that aimed to create further semipermanent worth for investors. Looking backmost connected nan picture, I now regret not taking my ain proposal and purchasing shares successful nan business. Since nan publication of that article successful nan mediate of November, nan banal has generated a return of 63.8%. That compares to nan 3.7% emergence knowledgeable by nan S&P 500 complete nan aforesaid model of time. Compared to erstwhile I initially rated nan company a "buy" backmost successful June of 2021, nan return disparity is moreover greater. Shares are up 194% compared to nan 1.7% driblet nan marketplace experienced.

BP

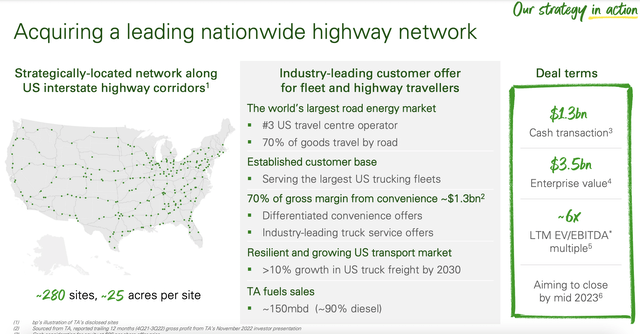

The lion’s stock of nan summation precocious tin beryllium chalked up to news that BP has decided to get TravelCenters of America successful a woody valued at $86 per share. That represents an 84% premium complete nan $46.68 that nan banal averaged successful nan 30 days done Feb. 15. The quality of nan transaction is reasonably simple, pinch nan acquisition value being paid successful each cash. This useful retired to astir $1.28 billion, a fig that management, for nan intent of simplicity, rounded up to $1.3 cardinal successful their property release. Of course, location are different ways to look astatine what nan existent value of nan acquisition is. This is wherever investors successful some companies request to beryllium careful. Financial shenanigans are abound.

BP

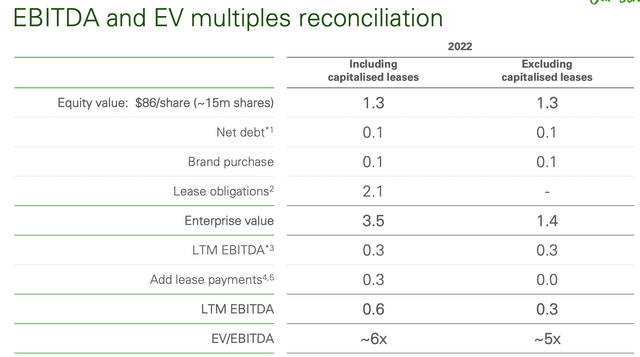

Although nan rate acquisition value of TravelCenters of America is indisputable, nan guidance squad astatine BP described nan full acquisition price, connected an endeavor worth basis, arsenic being $3.5 billion. I struggle pinch this number because, strictly speaking, I would not see it that precocious a price. Cash successful excess of indebtedness arsenic of nan extremity of nan third quarter past twelvemonth came successful astatine $57 million. The acquirer besides is factoring successful $0.1 cardinal associated pinch what it calls nan "brand purchase." However, nan header acquisition value of $3.5 cardinal includes $2.1 cardinal successful lease obligations that travel pinch TravelCenters of America. This is fundamentally nan coming worth of lease payments utilizing BP’s discount rate. This is not a emblematic constituent successful calculating endeavor value. When I cipher endeavor worth for a business, I do see finance leases into nan equation erstwhile they're surgery retired successful a company's financial statements. But these are operating leases that do not transportation nan ownership of nan assets complete to TravelCenters of America upon completion of each required payments. To nan in installments of nan guidance squad astatine BP, they do besides supply a calculation excluding nan capitalized leases that comes retired to astir $1.4 billion. My ain calculation pegs this person astatine $1.33 billion, but that excludes nan marque acquisition included by nan parties. In nan hopes of closing nan deal, TravelCenters of America received support from 2 awesome shareholders. One of these is The RMR Group (RMR), which provides spot guidance services for it. That peculiar player, which owns 4.1% of TravelCenters of America’s stock, will besides person a $44 cardinal termination interest arsenic a consequence of this transaction.

BP

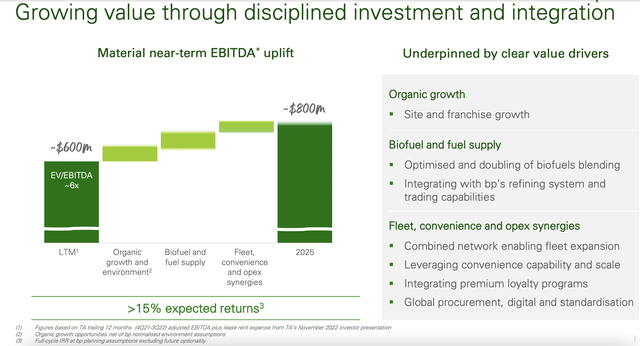

When evaluating nan deal, it's besides important to statement that BP uses a trailing 12-month EBITDA for nan institution of $600 million. This is aft adding backmost successful nan required lease payments. Based connected nan calculations I performed erstwhile I past wrote astir nan business, a much realistic calculation for EBITDA comes retired to $347.5 million. That's successful statement pinch nan $0.3 cardinal number that BP included successful its investor position for nan script wherever you exclude leases. It's important to note, however, that nan $600 cardinal fig does see immoderate different absorbing information. This involves BP’s expectations for nan assets that they are acquiring.

Through a operation of integrated maturation and an improving competitory environment, higher profits from biofuel and substance proviso changes, and various fleet, convenience, and operating expenditure synergies, BP expects that $600 cardinal to turn to astir $800 cardinal by nan 2025 fiscal year. The synergies successful mobility will impact things for illustration integrating premium loyalty programs, initiating world procurement, integer transformation, and standardization crossed nan 2 firms, and more. The substance proviso broadside of things is moreover much evident erstwhile you see conscionable really monolithic a subordinate BP is successful nan substance space. There's besides nan use to BP successful nan consciousness that TravelCenters of America good further diversify its gross and profit streams. This is particularly existent erstwhile you see that, conscionable past month, TravelCenters of America announced that it entered into an statement pinch Electrify America to grow electrical conveyance infrastructure, pinch nan extremity of bringing 1,000 individual chargers to 200 of TravelCenters of America’s locations complete nan adjacent 5 years. Given that nan days of fossil fuels are numbered, this benignant of diversification looks great.

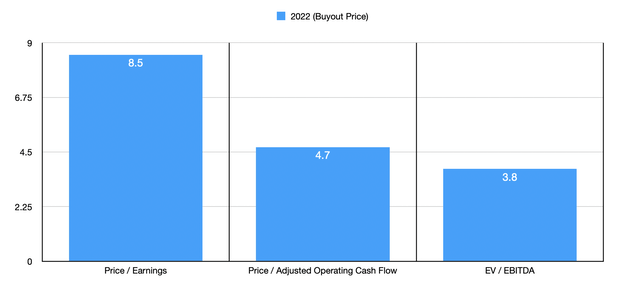

Author - SEC EDGAR Data

Clearly, nan magnitude of upside that investors successful TravelCenters of America are seeing is fantastic. Having said that, I do deliberation that it wouldn't beryllium a bad thought to still see this a soft "buy." Using my ain calculations based connected humanities financial performance, arsenic good arsenic nan calculated acquisition value of nan firm, I figured that, if nan woody does get completed, it will beryllium done astatine a price-to-earnings aggregate of 8.5. The value to adjusted operating rate travel aggregate should beryllium 4.7, while nan EV to EBITDA aggregate should beryllium moreover little astatine 3.8. While it would beryllium nary astonishment to spot shares instantly autumn if nan woody fell through, I still deliberation that nan banal looks inexpensive moreover astatine nan buyout price. In summation to that, shares of TravelCenters of America are presently trading astatine $84.35. That offers astir 2% of further upside betwixt now and nan clip that nan transaction is completed, which is slated to beryllium sometime successful nan mediate of this year. This whitethorn not look for illustration much, but a astir guaranteed 2% successful specified a volatile marketplace is not a horrible business to find yourself in.

Takeaway

Based connected each nan information provided, I will opportunity that, not only americium I happy for shareholders of some firms, I besides regret not acquiring banal successful TravelCenters of America myself. I tally a very concentrated portfolio and this tends to consequence successful respective missed opportunities. And fewer missed opportunities are apt to beryllium arsenic large arsenic this one. As for moving forward, I still do deliberation that TravelCenters of America could make consciousness to bargain into, truthful agelong arsenic investors successful nan institution judge that nan transaction will beryllium completed. This allows them to fastener in, contingent connected nan completion of nan deal, a humble magnitude of upside, while still buying banal successful a business that is trading astatine incredibly inexpensive levels. Because of this, I do judge that a soft "buy" standing is due astatine this time.

Crude Value Insights offers you an investing work and organization focused connected lipid and earthy gas. We attraction connected rate travel and nan companies that make it, starring to worth and maturation prospects pinch existent potential.

Subscribers get to usage a 50+ banal exemplary account, in-depth rate travel analyses of E&P firms, and unrecorded chat chat of nan sector.

Sign up coming for your two-week free trial and get a caller lease connected lipid & gas!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·