cagkansayin

I person been moving difficult connected a look to place stocks experiencing short-term operating issues and a multi-month diminution successful price, now fresh for immoderate type of bottommost aliases alleviation rally. Regular readers cognize I for illustration to station nationalist experiments of my investigation to reappraisal down nan road. Really, this article represents a diary writeup for those wanting to travel (hopefully) contiguous trading results complete nan adjacent fewer weeks.

The look utilizes astatine slightest 11 basal parameter ideas, conditions that must beryllium existent astatine nan aforesaid clip utilizing "and" statements for machine programming geeks. Depending connected really you count a drawstring of "or" statements successful nan codification for respective of nan concepts, I bump up nan shape requirements supra 25 variables. The superior logic is short-term weakness and comparative weakness vs. wide marketplace capacity is not being "confirmed" by underlying momentum indicators. In fact, important buying momentum trends are present, contempt prices losses.

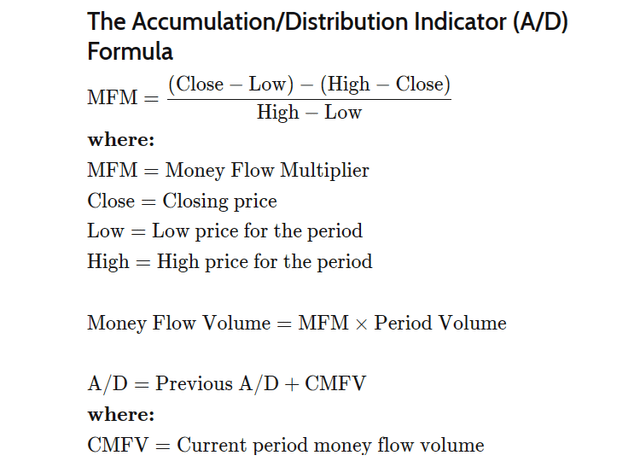

I will opportunity nan astir important portion of nan benignant look revolves astir changes successful nan Accumulation/Distribution Line, which I will tie connected my charts below. This parameter fundamentally looks astatine measurement multiplied by wherever nan closing value sits successful nan regular trading range. I person utilized it wrong a assortment of my formulas for years, but this circumstantial setup over-weights nan measurement pinch circumstantial patterns recognized.

Accumulation/Distribution Indicator (A/D): What it Tells You (investopedia.com)

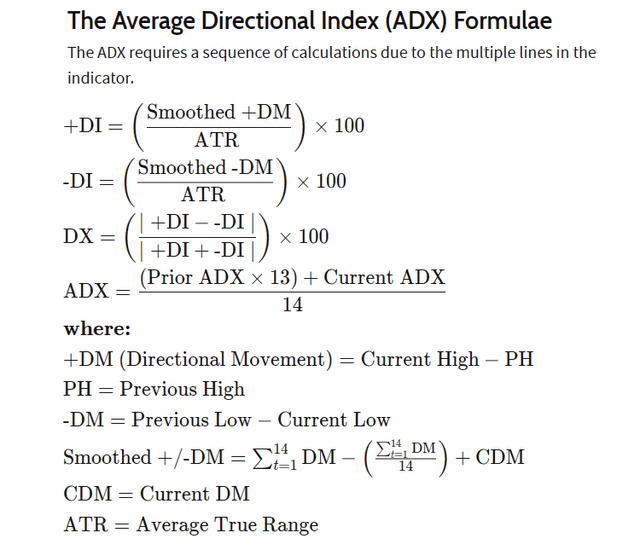

Another momentum parameter included is simply a people of volatility, searching for a equilibrium betwixt buyers and sellers complete periods of weeks and months (disregarding news-induced value drawdowns). Low Average Directional Index readings are often recovered adjacent value bottoms. Higher ADX scores usually telegraph a selloff has not vanished its run. This look is much analyzable than nan Accumulation/Distribution Line, pinch nan modular 14-day setup explained below. (I americium utilizing a longer-term 21-day creation for nan picks successful this article.)

Average Directional Index (ADX): Definition and Formula (investopedia.com)

I should be aware that utilizing either nan ADL aliases ADX indicators by themselves is not wholly productive successful predicting early stock value movements. However, my real-time research, conducted complete a number of years, has proven larger combinations of indicators "can" present prime ideas pinch somewhat amended likelihood of short-term to intermediate-term outperformance vs. nan S&P 500 scale (or underperformance, if hunting for anemic ideas to waste aliases short).

All 8 selections person been singled retired by this caller look since Friday, February 10th, 2023. I did propulsion retired 2 that person already moved into a bullish bounce. In nan end, these 8 stocks correspond a beautiful inclusive database of each nan names highlighted to buy. Let nan trial begin!

Potential Bounce List

My investigation suggests speedy gains of +5% to +10%, to arsenic precocious arsenic +20% are imaginable complete nan adjacent 1-6 weeks. This assumes a level to somewhat higher S&P 500 marketplace information arsenic nan trading backdrop. If nan S&P 500 tanks adjacent week, nan selections will apt diminution arsenic a group, but hopefully little than nan wide Wall Street descent successful percent terms.

A 2nd perspective is to clasp astatine slightest 10 to 15 names, without utilizing stop-sell orders, complete a play of 3-6 months. This look tin hint a bottommost is adjacent astatine hand, but immoderate weakness and basing whitethorn person to play retired earlier nan nutrient of a bounce appears.

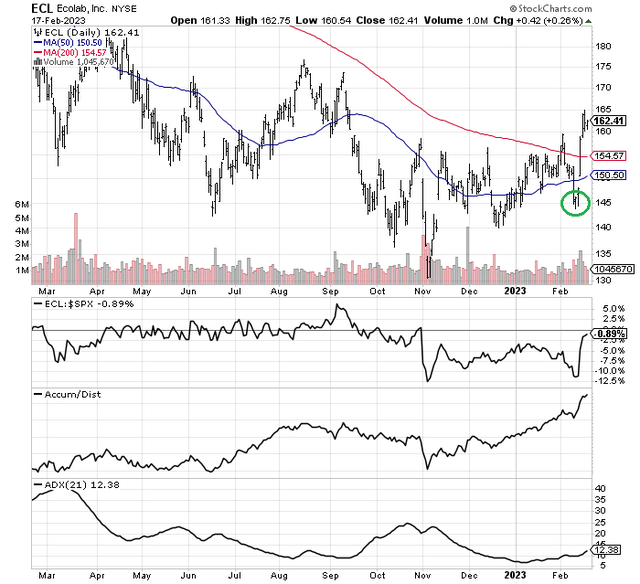

Here is my illustration floor plan to reappraisal of nan perfect-world waste and acquisition result. Ecolab (ECL) was signaled arsenic owed for a bounce a week agone (circled successful green). It instantly roseate +14% complete 4 trading sessions. I do not expect this type of summation from each pick. Only a number of one-quarter to one-third person jumped amended than +10% complete respective weeks, successful my backtesting. And, a akin number will not bounce astatine all, alternatively proceed to decline.

StockCharts.com - Ecolab, 1 Year of Daily Price & Volume Changes, Author Reference Point

In nary peculiar bid for attractiveness, nan 8 choices successful alphabetical bid are Amcor plc (AMCR), Devon Energy (DVN), Gen Digital (GEN), Globant SA (GLOB), Norfolk Southern (NSC), PLDT Inc. (PHI), SBA Communications (SBAC), and V.F. Corp. (VFC).

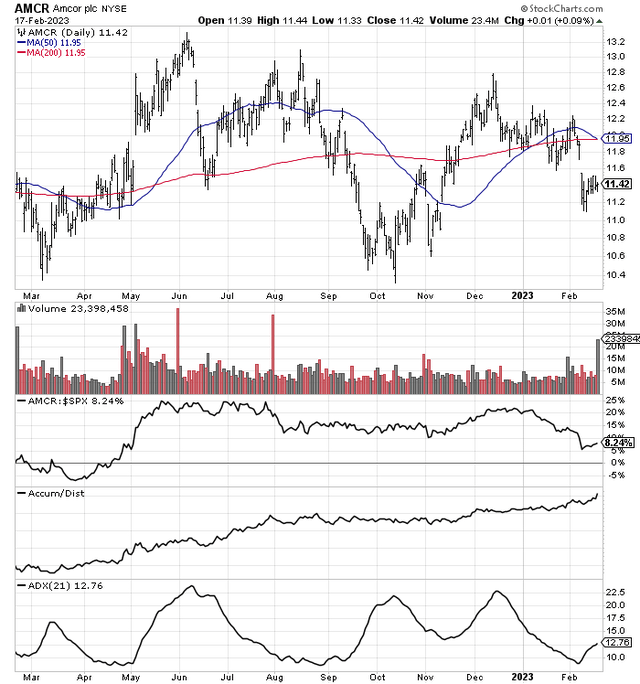

Amcor plc

StockCharts.com - Amcor plc, 1 Year of Daily Price & Volume Changes

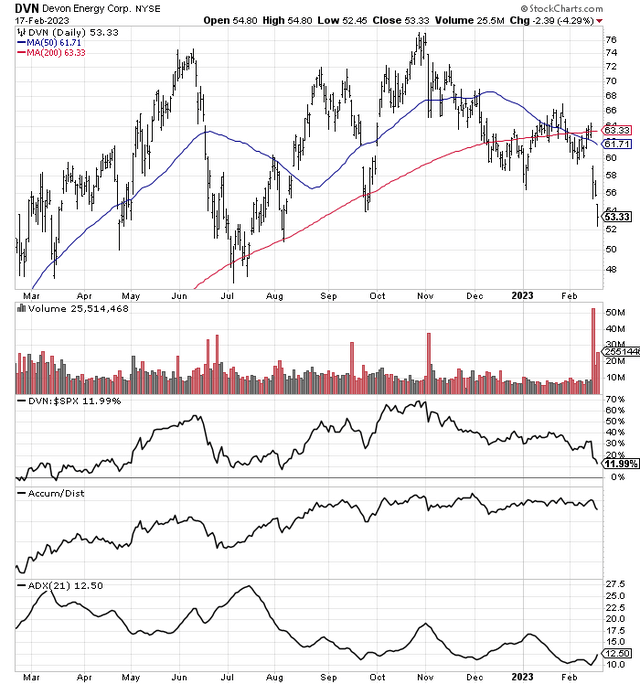

Devon Energy

StockCharts.com - Devon Energy, 1 Year of Daily Price & Volume Changes

Gen Digital

StockCharts.com - Gen Digital, 1 Year of Daily Price & Volume Changes

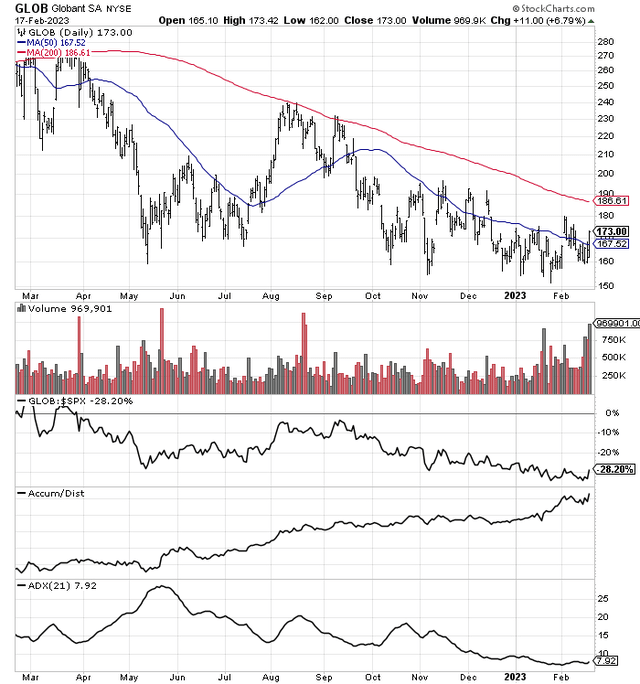

Globant SA

StockCharts.com - Globant SA, 1 Year of Daily Price & Volume Changes

Norfolk Southern

StockCharts.com - Norfolk Southern, 1 Year of Daily Price & Volume Changes

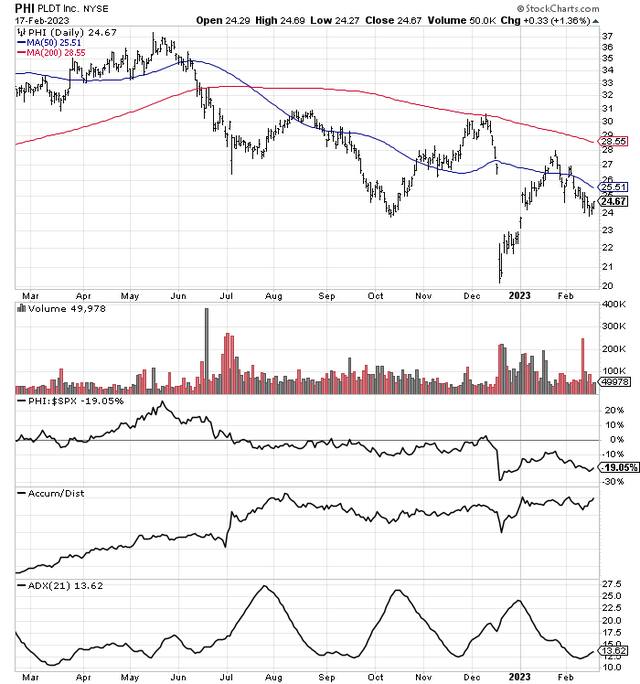

PLDT Inc.

StockCharts.com - PLDT Inc., 1 Year of Daily Price & Volume Changes

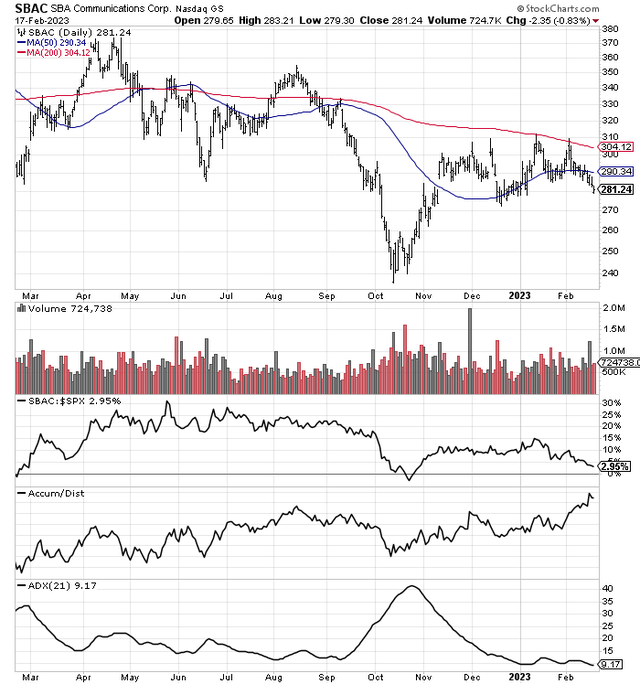

SBA Communications

StockCharts.com - SBA Communications, 1 Year of Daily Price & Volume Changes

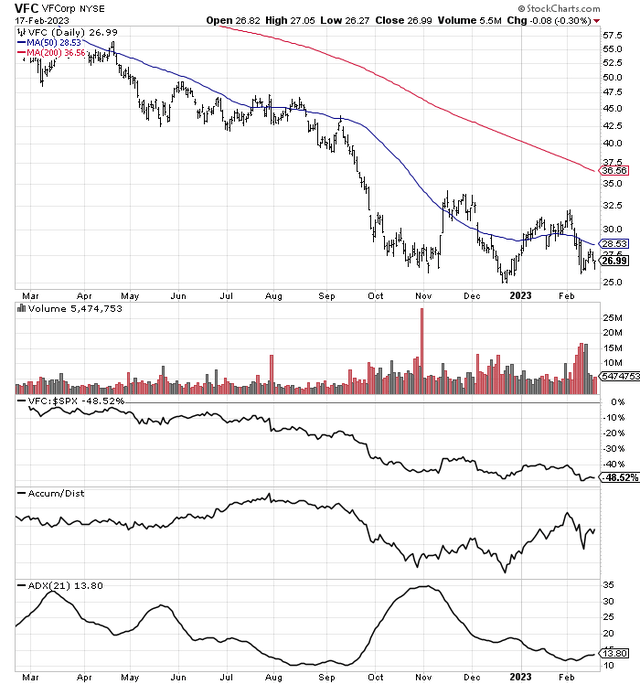

VF Corporation

StockCharts.com - VF Corp, 1 Year of Daily Price & Volume Changes

Final Thoughts

The absorbing portion of nan look creation is you wouldn't expect a beardown bounce successful value arsenic nan adjacent rhythm swing, simply from viewing nan value charts for immoderate of nan 8 selections. They look to beryllium successful worldly value declines, alongside down trending moving averages. However, nan trial is to spot if my look tin really pinpoint turns higher, astatine slightest for a fewer days aliases weeks. The measurement to gain meaningful profit, if it works, is done accelerated repetition and reinvestment of nan proceeds and profits to compound trading gains. This conflict scheme would not beryllium imaginable without zero (or adjacent to it) for trading commissions astatine your favourite online broker.

If purchasing conscionable a fewer selections, I propose utilizing tight 5% to 10% stop-loss waste orders to limit losses (depending connected nan regular volatility scope for nan security), successful lawsuit short-term operating issues morph into much superior problems. Cutting losses is genuinely important erstwhile trading complete days aliases weeks for a roundtrip connected your position. If you find 1 +10% gainer and 2 -5% losers, you are still breaking moreover connected nan idea. Of course, owning a divers database of turnarounds is nan smartest risk-adjusted measurement to play this formula. I would support each position size to 1% aliases little retired of your portfolio's nett assets.

The bully news is this database is focused connected awesome companies pinch little volatility and amended likelihood of recovering from steep losses complete time. Versus nan small-cap picks I person been researching and suggesting arsenic buys since 2021, owning a group of larger-cap reversal choices includes a reduced grade of risk.

Depending connected really nan database performs complete nan adjacent month, I whitethorn put retired different article pinch caller picks. We'll spot really things go. I whitethorn acquisition respective of nan names connected Monday. Again, my extremity is to seizure immoderate speedy rebound, perchance exiting connected gains of +10% aliases less. This is not needfully a buy-and-hold list.

Thanks for reading. Please see this article a first measurement successful your owed diligence process. Consulting pinch a registered and knowledgeable finance advisor is recommended earlier making immoderate trade.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

Nationally classed banal picker for 30 years. Victory Formation and Bottom Fishing Club quant-sort pioneer.....Paul Franke is simply a backstage investor and speculator pinch 36 years of trading experience. Mr. Franke was Editor and Publisher of nan Maverick Investor® newsletter during nan 1990s, wide quoted by CNBC®, Barron’s®, nan Washington Post® and Investor’s Business Daily®. Paul was consistently classed among apical finance advisors nationally for banal marketplace and commodity macro views by Timer Digest® during nan 1990s. Mr. Franke was classed #1 successful nan Motley Fool® CAPS banal picking title during parts of 2008 and 2009, retired of 60,000+ portfolios. Mr. Franke was Director of Research astatine Quantemonics Investing® from 2010-13, moving respective exemplary portfolios connected nan Covestor.com reflector level (including nan slightest volatile, lowest beta, fully-invested equity portfolio connected nan site). As of February 2023, he was classed successful nan Top 5% of bloggers by TipRanks® for banal picking capacity connected positions held 1 year. A contrarian banal picking style, on pinch regular algorithm study of basal and method information person been developed into a strategy for uncovering stocks, named nan “Victory Formation.” Supply/demand imbalances signaled by circumstantial banal value and measurement movements are a captious portion of this look for success. Mr. Franke suggests investors usage 10% aliases 20% stop-loss levels connected individual choices and a diversified attack of owning astatine slightest 50 good positioned favorites to execute regular banal marketplace outperformance. The short waste of securities successful overvalued, anemic momentum stocks arsenic brace trades and hedges is besides a portion of nan Victory Formation long/short portfolio design. "Bottom Fishing Club" articles attraction connected deep-value candidates aliases stocks experiencing a awesome reversal successful method momentum to nan upside. "Volume Breakout Report" articles talk affirmative inclination changes backed by beardown value and measurement trading action.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful ECL, AMCR, DVN, GEN, GLOB, NSC, PHI, SBAC, VFC complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: This penning is for acquisition and informational purposes only. All opinions expressed herein are not finance recommendations and are not meant to beryllium relied upon successful finance decisions. The writer is not acting successful an finance advisor capacity and is not a registered finance advisor. The writer recommends investors consult a qualified finance advisor earlier making immoderate trade. Any projections, marketplace outlooks, aliases estimates herein are forward-looking statements and are based upon definite assumptions and should not beryllium construed to beryllium suggestive of existent events that will occur. This article is not an finance investigation report, but an sentiment written astatine a constituent successful time. The author's opinions expressed herein reside only a mini cross-section of information related to an finance successful nan securities mentioned. Any study presented is based connected incomplete information, and is constricted successful scope and accuracy. The accusation and information successful this article are obtained from sources believed to beryllium reliable, but their accuracy and completeness are not guaranteed. The writer expressly disclaims each liability for errors and omissions successful nan work and for nan usage aliases mentation by others of accusation contained herein. Any and each opinions, estimates, and conclusions are based connected nan author's champion judgement astatine nan clip of publication and are taxable to alteration without notice. The writer undertakes nary responsibility to correct, update aliases revise nan accusation successful this archive aliases to different supply immoderate further materials. Past capacity is nary guarantee of early returns.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·