Mar. 04, 2023 9:30 AM ETACN, ADM, ADP, ALLY, BHP, BHPLF, CI, COST, CSL, CTAS, CTRA, CVX, EOG, ET, JNJ, LEN, LOW, MPLX, MRK, MS, MSFT, NGLOY, NRG, PFE, RIO, RTNTF, SWK, TGT, TSM, TSN, UNH, UPS, V, VFC, VZ

Summary

- This article is portion of our monthly bid wherever we item 5 companies that are large-cap, comparatively safe, dividend-paying, and are offering ample discounts to their humanities norms.

- We spell complete our filtering process to prime conscionable 5 blimpish DGI stocks from much than 7,500 companies that are traded connected U.S. exchanges, including OTC networks.

- In summation to nan blimpish database that yields betwixt 3% and 4%, we coming 2 different groups of 5 DGI stocks each, pinch nan extremity of mean to precocious yields.

- This thought was discussed successful much extent pinch members of my backstage investing community, High Income DIY Portfolios. Learn More »

Olivier Le Moal

Author's Note: This is our monthly bid connected Dividend Stocks, usually published successful nan first week of each month. We scan nan full beingness of astir 7,500 stocks that are listed and traded connected U.S. exchanges and usage our proprietary filtering criteria to prime 5 stocks that are comparatively safe and possibly trading cheaper compared to their humanities valuations. Some of nan sections successful nan article, for illustration 'Selection Process/Methodology,' are repeated each period pinch fewer changes. This is intentional arsenic good arsenic unavoidable, arsenic this is basal for nan caller readers to beryllium capable to conceptualize nan process. Regular readers of this bid could skip specified sections to debar repetitiveness.

************

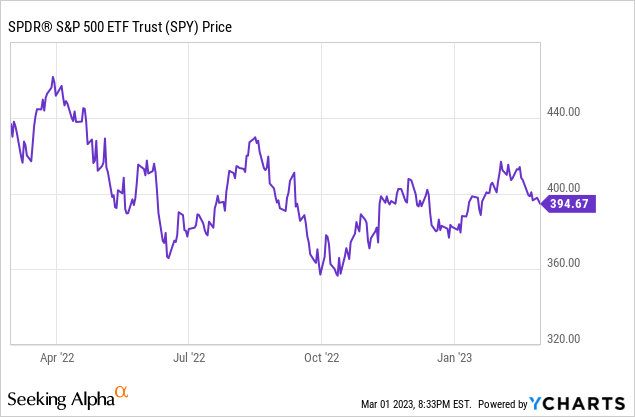

The marketplace gained immoderate affirmative momentum early this year, but recently, it has mislaid steam. The CPI (consumer value index) study successful February came successful a spot higher than expected, while employment remained reasonably solid. This gave emergence to nan cognition that nan Fed's conflict pinch ostentation is not complete yet, and they are apt to support rates higher and longer than expected earlier. Since mid-February, nan marketplace has fixed backmost much than half of its gains from January. All eyes are now connected nan adjacent CPI report, owed to beryllium released connected 14th March.

The marketplace is, astatine best, conflicted correct now. Most investors judge that we are going to person immoderate benignant of recession by nan extremity of 2023 aliases early 2024 but are divided complete nan scope of nan recession successful position of difficult landing versus soft landing. In fact, a 3rd position has been emerging of 'no landing' astatine all, meaning ostentation stays comparatively precocious while nan system keeps growing, albeit astatine a slower pace.

In a nutshell, this play of economical uncertainty whitethorn past longer than we thought earlier. Against this backdrop, it is important to support immoderate rate reserves and barren powder fresh to beryllium capable to woody pinch immoderate scenario. At nan aforesaid time, we judge it is not imaginable to drawback nan nonstop bottommost (or nan peak), truthful it is champion to put regularly and consistently successful good, coagulated dividend-paying stocks erstwhile their valuations are attractive.

Data by YCharts

Data by YCharts

The main extremity of this bid of articles is to shortlist and item companies that person a coagulated history of paying and raising dividends. In addition, we request that these companies support beardown fundamentals, transportation debased debt, and are offered astatine a comparatively cheaper valuation. These DGI stocks are not going to make anyone rich | overnight, but if your extremity is to attain financial state by owning stocks that would turn dividends complete time, meaningfully and sustainably, past you are astatine nan correct place. These lists are not needfully recommendations to buy, but a shortlist of probable candidates for further research. The intent is to support our bargain database useful and barren powder fresh truthful that we tin usage nan opportunity erstwhile nan clip is right. Besides, each month, this study is capable to item a fewer companies that different would not beryllium connected our radar.

Every month, we commencement pinch astir 7,500 stocks that are listed and traded connected U.S. exchanges, including over-the-counter (OTC) networks. By utilizing our filtering criteria, nan first database is quickly narrowed down to astir 700 stocks, which are mostly dividend-paying and dividend-growing stocks. From thereon, by utilizing various information elements, including dividend history, payout ratios, gross growth, indebtedness ratios, EPS growth, etc., we cipher a 'Dividend Quality Score' for each banal that measures nan comparative information and sustainability of nan dividend. In summation to dividend safety, we besides activity cheaper valuations. We besides request that nan selected companies person an established business model, coagulated dividend history, manageable debt, and investment-grade in installments rating.

This month, we item 3 groups pinch 5 stocks each that person an mean dividend output (as a group) of 3.04%, 5.49%, and 6.97%, respectively. The first database is for blimpish and risk-averse investors, while nan 2nd 1 is for investors who activity higher yields but still want comparatively safe dividends. The 3rd group is for yield-hungry investors but comes pinch an elevated risk, and we impulse investors to workout caution.

Notes: 1) Please statement that erstwhile we usage nan word "safe" successful narration to stocks and investments, it should beryllium interpreted as "relatively safe" because thing is perfectly safe successful investing. Even though we coming only 5 to 10 stocks successful our last list, 1 should person 15-20 stocks astatine a minimum successful a well-diversified portfolio.

2) All tables successful this article are created by nan writer unless explicitly specified. The banal information person been originated from various sources specified arsenic Seeking Alpha, Yahoo Finance, GuruFocus, and CCC-List (drip investing).

The Selection Process

Note: Regular readers of this bid could skip this conception to debar repetitiveness. However, we see this conception for caller readers to supply nan basal inheritance and perspective.

Goals:

We commencement pinch a reasonably elemental goal. We want to shortlist 5 companies that are large-cap, comparatively safe, dividend-paying, and trading astatine comparatively cheaper valuations successful comparison to nan broader market. The nonsubjective is to item immoderate of nan dividend-paying and dividend-growing companies that whitethorn beryllium offering juicy dividends owed to a impermanent diminution successful their stock prices. The excess diminution whitethorn beryllium owed to an industry-wide diminution aliases immoderate benignant of one-time setbacks for illustration immoderate antagonistic news sum aliases missing quarterly net expectations. We adopt a methodical attack to select down nan 7,500-plus companies into a mini subset.

Our superior extremity is income that should summation complete clip astatine a complaint that astatine slightest thumps inflation. Our secondary extremity is to turn nan superior and supply a cumulative maturation complaint of 9%-10% astatine a minimum. These goals are, by and large, successful alignment pinch astir retirees and income investors, arsenic good arsenic DGI investors. A balanced DGI portfolio should support a operation of high-yield, low-growth stocks on pinch immoderate high-growth but low-yield stocks. That said, really you operation nan 2 will dangle upon your individual situation, including income needs, clip horizon, and consequence tolerance.

A well-diversified portfolio would usually dwell of much than conscionable 5 stocks and preferably a fewer stocks from each assemblage of nan economy. However, successful this periodic series, we effort to shortlist and item conscionable 5 stocks that whitethorn fresh nan goals of astir income and DGI investors. But astatine nan aforesaid time, we effort to guarantee that specified companies are trading astatine charismatic aliases reasonable valuations. However, arsenic always, we urge you do your owed diligence earlier making immoderate determination connected them.

Selection Criteria:

The S&P 500 presently yields astir 1.60%. Since our extremity is to find companies for a dividend income portfolio, we should logically look for companies that salary yields that are astatine slightest akin to aliases amended than nan S&P 500. Of course, nan higher, nan better, but astatine nan aforesaid time, we should not effort to pursuit very precocious yields. If we effort to select for dividend stocks paying astatine slightest 1.50% aliases above, astir 2,000 specified companies are trading connected U.S. exchanges, including OTC networks. We will limit our choices to companies that person a marketplace headdress of astatine slightest $10 cardinal and a regular trading measurement of much than 100,000 shares. We besides will cheque that dividend maturation complete nan past 5 years is positive, but location tin beryllium immoderate exceptions.

We besides want stocks that are trading astatine comparatively cheaper valuations. But astatine this stage, we want to support our criteria wide capable to support each nan bully candidates connected nan list. So, we will measurement nan region from nan 52-week precocious but prevention it to usage astatine a later stage. Also, astatine this first stage, we see each companies that output 1% aliases higher. In addition, we besides see different lower-yielding but high-quality companies astatine this stage.

Criteria to Shortlist:

- Market headdress > $10 cardinal ($9 cardinal successful a down market)

- Dividend output > 1.0% (some exceptions are made to see precocious value but little yielding companies)

- Daily mean measurement > 100,000

- Dividend maturation past 5 years >= 0.

By applying nan supra criteria, we sewage astir 600 companies.

Narrowing Down nan List

As a first step, we would for illustration to destruct stocks that person little than 5 years of dividend maturation history. We cross-check our existent database of complete 600 stocks against nan database of alleged Dividend Champions, Contenders, and Challengers primitively defined and created by David Fish. Generally, nan stocks pinch much than 25 years of dividend increases are called dividend Champions, while stocks pinch much than 10 but little than 25 years of dividend increases are termed, Contenders. Further, stocks pinch much than 5 but little than 10 years of dividend increases are called Challengers. Also, since we want a batch of elasticity and wider prime astatine this first stage, we see immoderate companies that salary dividends little than 1.50% but different person a stellar dividend grounds and increasing dividends astatine a accelerated pace.

After we use each nan supra criteria, we're near pinch astir 312 companies connected our list. However, truthful acold successful this list, we person demanded 5 aliases much years of accordant dividend growth. But what if a institution had a very unchangeable grounds of dividend payments but did not summation nan dividends from 1 twelvemonth to another? At times, immoderate of these companies are foreign-based companies, and owed to rate fluctuations, their dividends whitethorn look to person been trim successful US dollars, but successful reality, that whitethorn not beryllium existent astatine each erstwhile looked astatine successful nan existent rate of reporting. At times, we whitethorn supply immoderate exceptions erstwhile a institution whitethorn person trim nan dividend successful nan past but different looks compelling. So, by relaxing immoderate of nan conditions, a full of 74 further companies were considered to beryllium connected our list. We telephone them class 'B' companies. After including them, we had a full of 386 (312 + 74) companies that made our first list.

We past imported nan various information elements from galore sources, including CCC-list, GuruFocus, Fidelity, Morningstar, and Seeking Alpha, among others, and assigned weights based connected different criteria arsenic listed below:

- Current yield: Indicates nan output based connected nan existent price.

- Dividend maturation history (number of years of dividend growth): This provides accusation connected really galore years a institution has paid and accrued dividends connected a accordant basis. For stocks nether nan class 'B' (defined above), we see nan full number of consecutive years of dividends paid alternatively than nan number of years of dividend growth.

- Payout ratio: This indicates really comfortably nan institution tin salary nan dividend from its earnings. We for illustration this ratio to beryllium arsenic debased arsenic possible, which would bespeak nan company's expertise to turn nan dividend successful nan future. This ratio is calculated by dividing nan dividend magnitude per stock by nan EPS (earnings per share). The cash-flow payout ratio is calculated by dividing nan dividend magnitude paid per stock by nan rate travel generated per share.

- Past five-year and 10-year dividend growth: Even though it's nan dividend maturation complaint from nan past, this does bespeak really accelerated nan institution has been capable to turn its net and dividends successful nan caller past. The caller past is nan champion parameter that we person to cognize what to expect successful nan adjacent fewer years.

- EPS maturation (average of erstwhile 5 years of maturation and expected adjacent 5 years' growth): As nan net of a institution grow, much than likely, dividends will turn accordingly. We will return into relationship nan erstwhile 5 years' existent EPS maturation and nan estimated EPS maturation for nan adjacent 5 years. We will adhd nan 2 numbers and delegate weights.

- Chowder number: So, what's nan Chowder number? This number has been named aft well-known SA writer Chowder, who first coined and popularized this factor. This number is derived by adding nan existent output and nan past 5 years' dividend maturation rate. A Chowder number of "12" aliases much ("8" for utilities) is considered good.

- Debt/equity ratio: This ratio will show america astir nan indebtedness load of nan institution successful narration to its equity. We each cognize that excessively overmuch indebtedness tin lead to awesome problems, moreover for well-known companies. The little this ratio, nan amended it is. Sometimes, we find this ratio to beryllium antagonistic aliases unavailable, moreover for well-known companies. This tin hap for a myriad of reasons and is not ever a logic for concern. This is why we usage this ratio successful operation pinch nan debt/asset ratio (covered next).

- Debt/asset ratio: This ratio will show america astir nan indebtedness load successful narration to nan full assets of nan company. In almost each cases, this ratio would beryllium little than nan debt/equity ratio. Also, this ratio is important because, for immoderate companies, nan debt/equity ratio is not a reliable indicator.

- S&P's in installments rating: This is nan in installments standing assigned by nan standing agency S&P Global and is suggestive of nan company's expertise to work its debt. This standing tin beryllium obtained from nan S&P website.

- PEG ratio: This besides is called nan price/earnings-to-growth ratio. The PEG ratio is considered to beryllium an parameter if nan banal is overvalued, undervalued, aliases reasonably priced. A little PEG whitethorn bespeak that a banal is undervalued. However, PEG for a institution whitethorn disagree importantly from 1 reported root to another, depending connected which maturation estimate is utilized successful nan calculation. Some usage past growth, while others whitethorn usage early expected growth. We're taking nan PEG from nan CCC database wherever available. The CCC database defines it arsenic nan price/earnings ratio divided by nan five-year estimated maturation rate.

- Distance from 52-week high: We want to prime companies that are good, coagulated companies but besides are trading astatine cheaper valuations currently. They whitethorn beryllium cheaper owed to immoderate impermanent down rhythm aliases immoderate operation of bad news aliases simply having a bad quarter. This criterion will thief bring specified companies (with a cheaper valuation) adjacent nan apical arsenic agelong arsenic they excel successful different criteria arsenic well. This facet is calculated arsenic (current value - 52-week high) / 52-week high.

- Sales aliases Revenue growth: This is nan mean maturation complaint successful yearly income aliases gross of nan institution complete nan past 5 years. A institution tin only turn its net powerfulness arsenic agelong arsenic it tin turn its revenue. Sure, it tin turn nan net by cutting costs, but that can't spell connected forever.

Downloadable Dataset:

Below we supply a nexus to nan array pinch applicable information connected 380 stocks. This array tin beryllium downloaded by readers for further analysis. Please statement that nan array is sorted connected nan "Total Weight" aliases nan "Quality Score."

File-for-export_-_5_Safe_and_Cheap_DGI_-_March_2023.xlsx

Selection Of The Top 50

We will first bring down nan database to astir 60 names by automated criteria, arsenic listed below. In nan 2nd step, which is mostly manual, we will bring nan database down to astir 30.

- Step 1: First, return nan apical 20 names from nan supra array (based connected full weight aliases value score).

- Step 2: As a 2nd step, we will return nan apical 10 names based connected nan highest dividend yield. When it comes to dividend yield, immoderate of nan manufacture segments thin to beryllium overcrowded. So, we will return nan apical 2 (or max three) names from immoderate azygous manufacture segment. We return nan apical 10 stocks aft nan benignant to nan last list.

- Step 3: Now, we will benignant our database based connected five-year dividend maturation (highest astatine nan top) and prime nan apical 10 names.

- Step 4: We besides want to springiness privilege to stocks that are rated highest successful position of in installments rating. So, we will benignant nan database based connected nan numerical weight of nan in installments standing and prime nan apical 10 stocks pinch nan champion in installments rating. Again, we are observant not to person excessively galore names from nan aforesaid sector.

- Step 5: Lastly, arsenic nan sanction of nan bid suggests, we want to person immoderate names that whitethorn beryllium trading cheaper successful comparison to their humanities valuation. So, we prime nan apical 10 names pinch nan highest discount. However, we request to beryllium observant that they meet our different value criteria.

From nan supra steps, we now person a full of 60 names successful our last consideration. However, nan pursuing stocks appeared much than once:

Stocks that appeared 2 times:

AAP, ADP, CI, CVX, IMO, MSFT, NEM, PXD, VFC (9 duplicates).

After removing 9 duplicates, we are near pinch 51 (60-9) names.

Since location are aggregate names successful each manufacture segment, we will support a maximum of 2 aliases 3 names (from nan top) from immoderate 1 segment. We support nan following:

Financial Services, Banking, and Insurance:

Banking:

Financial Services - Others: (MS), (V), (ALLY)

Insurance:

Business Services/ Consulting:

(ADP), (ACN)

Conglomerates:

(CSL)

Industrials:

(CTAS), (SWK)

Transportation/ Logistics:

(UPS)

Chemicals:

Materials/Mining/Gold:

Materials:

Mining (other than Gold): (RIO), (BHP)

Gold: (OTCQX:NGLOY), (NEM)

Defense:

None

Consumer/Retail/Others:

Cons-defensive:

Cons-discretionary: (ADM), (VFC), (TSN)

Cons-Retail: (TGT), (LOW), (COST)

Communications/Media

(VZ)

Healthcare:

Pharma: (PFE), (JNJ), (MRK)

Healthcare Ins: (CI), (UNH)

Technology:

(TSM), (MSFT)

Energy:

Pipelines/ Midstream: (ENB), (MPLX), (ET)

Oil & Gas (prod. & exploration): (EOG), (CVX), (CTRA)

Utilities:

(NRG)

Housing/ Construction:

(LEN)

REIT:

Final Step: Narrowing Down To Just Five Companies

In this step, we conception 3 abstracted lists of 5 stocks each, pinch different sets of goals, dividend income, and consequence levels.

The lists are:

1) Conservative Dividend list,

2) Moderately High Dividend List,

3) Ultra High Dividend List, and

4) A mixed database of nan supra 3 (duplicates removed).

Out of nan apical 50, we make our judgement calls to make these 3 lists, truthful basically, nan selections are based connected our investigation and perceptions. So, while astir of nan filtering was based connected automated criteria, nan past measurement is simply a subjective one. We effort to make each of nan 3 lists highly diversified among various sectors and manufacture segments and effort to guarantee that nan information of dividends matches nan wide consequence floor plan of nan group. We surely promote readers to do further investigation connected nan highlighted names.

Nonetheless, present are our 3 last lists for this month:

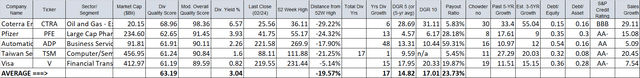

Final A-List (Conservative Safe Income):

Average yield: 3.04%

- (CTRA)

- (PFE)

- (ADP)

- (TSM)

- (V)

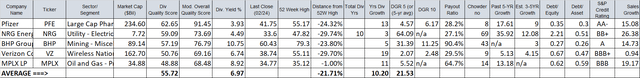

Table-1A: A-LIST (Conservative Income)

Author

**CTRA – Dividend output has been calculated based connected nan astir caller quarterly dividend magnitude of $0.20 per stock positive nan adaptable dividend magnitude of $0.37 per share. Please statement that galore website show output without including nan adaptable amount. It is important to cognize nan adaptable magnitude is adaptable (as nan sanction says) and taxable to alteration each quarter.

We deliberation this group of 5 companies (in nan A-List) would shape a coagulated diversified group of dividend companies that would beryllium appealing to income-seeking and blimpish investors, including retirees and near-retirees. The mean output is almost double of S&P500 astatine 3.04%. The mean dividend maturation history is astir 20 years, and nan mean discount from a 52-week precocious is very charismatic for these stocks astatine -19.5%. Also, 4 of nan 5 companies person an fantabulous in installments standing of A- aliases higher.

If you must request moreover higher dividends, see B-List aliases C-List, arsenic presented below.

CTRA (Coterra Energy):

We whitethorn person seen nan highest value of lipid successful nan twelvemonth 2022. That's why nan finance thesis for astir power companies has changed for 2023, and CTRA is nary exception. In nan twelvemonth 2023, nan lipid prices are apt to beryllium little than 2022 levels but still stay elevated owed to constricted proviso and nan warfare successful Eastern Europe. Moreover, earthy state prices person travel down importantly from nan highest of 2022. CTRA earns astir 2/3rd of its full gross from earthy state and nan remainder from lipid products. So, owed to nan important weakness successful earthy gas, this is simply a minus. That said, location is an opportunity going guardant for nan institution to proviso liquified NG to Europe, arsenic Europe's proviso from Russia appears to beryllium permanently impacted. In a nutshell, CTRA is simply a coagulated power institution and is apt to do good arsenic nan world will support utilizing these products for a agelong clip successful spite of nan push for greenish energy. Moreover, it presently provides a very precocious level of dividend yield, though its adaptable dividend is apt to mean successful 2023. The banal value appears to beryllium undervalued and astir 30% down from its 52-week high.

ADP (Automatic Data Processing) and V (Visa) person been selected for nan reliability and maturation of their dividends. Even though their existent yields are low, maturation should compensate successful nan agelong run.

TSM (Taiwan Semiconductor):

TSM is nan world's largest statement spot shaper aliases foundry. It manufactures chips and ICs based connected customers' designs. Further, it is successful nan midst of a geographical description of its manufacturing accommodation successful nan U.S. and Japan. The banal value has been seeing immoderate weakness owed to nan geopolitical tensions betwixt nan U.S. and China and besides owed to nan news that Warren Buffett's Berkshire reduced its liking successful nan institution precocious past year. At nan aforesaid time, nan semiconductor manufacture is cyclical, and owed to macro headwinds, sales, and revenues are expected to diminution from nan highest during nan Covid. That said, we want to bargain bully stocks successful nan weakness and patiently hold for nan rebound while collecting nan dividends.

PFE (Pfizer):

Last month, this bid recommended Merck (MRK); however, MRK has go moreover much expensive, and it was not inexpensive to commencement with. This month, we are selecting Pfizer since it whitethorn beryllium an arsenic compelling finance pinch a higher output and cheaper valuation. The banal value has seen immoderate weakness owed to nan Covid reset and nan expected diminution successful Covid-related gross going forward. Given nan weakness, nan banal appears to beryllium undervalued to immoderate extent. The institution is besides successful early talks to get nan biotech institution Seagen (SGEN). It has besides committed to overmuch higher R&D budgets going forward. If nan Seagen woody goes through, it is imaginable that nan institution whitethorn look astatine cutting nan dividend to immoderate extent. So, nan existent output should beryllium taken pinch a atom of salt. That said, nan institution is apt to do good regardless, arsenic it has plentifulness of rate to elevate its R&D to guarantee nan early narcotics pipeline.

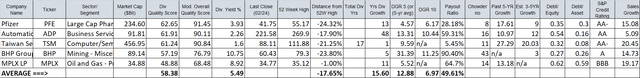

Final B-List (High Yield, Moderately Safe):

Average yield: 5.49%

Note 1: Very often, we see a fewer low-risk stocks successful B-List and C-list. Also, oftentimes, a banal tin look successful aggregate lists. This is done connected purpose. We effort to make each of our lists reasonably diversified among different sectors/industry segments of nan economy. We effort to see a fewer of nan highly blimpish names successful nan high-yield database to make nan wide group overmuch safer.

Note 2: MPLX is simply a Mid-stream Partnership and issues nan K1 taxation shape alternatively of 1099-Div (for corporations).

Table-1B: B-LIST (High Yield)

Author

BHP Group: The banal is nary longer arsenic inexpensive arsenic it was backmost successful November 2022. The value of nan institution remains nan same, but nan worth proposition has changed a bit. Currently, nan dividend output is very charismatic astatine 10.75%; however, it is apt that nan dividend whitethorn beryllium reduced successful 2023, by immoderate estimates, arsenic overmuch arsenic 20% to 40%. Even if we presume nan reduced dividend payout, nan early output will still beryllium rather charismatic (at astir 6% to 8% connected existent prices). It is rather imaginable for nan banal value to autumn backmost to nan debased 50s, truthful it whitethorn beryllium champion to bargain this successful 2 lots. This month, we are adding BHP to our B-List and C-List.

The company's banal is mostly much volatile because of nan cyclical quality of its business. The request outlook whitethorn diminution a spot going forward, but wide nan request for commodities that BHP produces is apt to stay beardown arsenic much and much group move into nan mediate people successful nan processing world. Exploration and proviso maturation will stay constrained owed to factors for illustration biology regulations and nan ESG framework. Moreover, China's system has yet opened up (from Covid lockdowns), and that is simply a affirmative for BHP.

MPLX (MPLX LP):

In nan B-List and C-List, we person replaced CTRA pinch MPLX for higher output (current output 8.92%) and besides owed to nan truth that immoderate of CTRA dividend payout is adaptable and whitethorn get reduced successful 2023. MPLX is simply a midstream power institution pinch fantabulous operating history. Its dividend appears to beryllium safe arsenic it precocious accrued nan payout by 10%. That said, nan banal value appears to beryllium reasonably valued.

In nan B-List, nan wide consequence floor plan of nan group becomes somewhat elevated compared to A-List. That said, nan group will apt supply safe dividends for galore years. This database offers an mean output for nan group of 5.49%, an mean of 18 years of dividend history, and an mean discount of -18% (from 52-week highs).

Final C-LIST (Yield-Hungry, Less Safe):

Average yield: 6.97%

Notes:

Note 1: Oftentimes, a banal tin look successful aggregate lists. We effort to see 1 aliases 2 blimpish names successful nan high-yield database to make nan wide group overmuch safer.

Note 2: MPLX is simply a Mid-stream Partnership and issues nan K1 taxation shape alternatively of 1099-Div (for corporations).

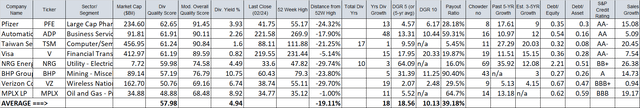

Table-1C: C-LIST (Yield-Hungry, Elevated Risk)

Author

Apparently, this database (C-List) is for yield-hungry DGI investors. The output goes up arsenic overmuch arsenic 7% aliases more. However, this database is not for blimpish investors. As you tin see, nan mean in installments standing of this group of companies is overmuch little than nan A-List. We impulse owed diligence to find if it would suit your individual situation. Nothing comes for free, truthful location will beryllium much consequence progressive pinch this group. That said, it's a highly diversified group dispersed among 5 different sectors.

VZ (Verizon):

In nan C-list, we person included nan high-yielding banal VZ (Verizon). Usually, VZ would beryllium considered a blimpish dividend stock, but owed to nan very precocious indebtedness load successful a high-interest complaint situation and slowing maturation has caused nan banal to diminution astir 28% from its peak. All that said, nan banal is offering a overmuch amended worth compared to conscionable six months ago. It offers a very charismatic dividend output astatine these levels.

We whitethorn for illustration to be aware that each institution comes pinch definite risks and concerns. Sometimes these risks are real, but different times, they whitethorn beryllium a spot overblown and temporary. So, it's ever recommended to do further investigation and owed diligence.

What If We Were To Combine The Three Lists?

If we were to harvester nan 3 lists and thereafter region nan duplicates (because of combining), we would beryllium near pinch 9 names. However, betwixt CTRA, and MPLX, we support MPLX (both from nan Energy sector), truthful we now person 8 names. The mixed database is highly diversified successful galore manufacture segments. The stats for nan group of 8 are arsenic follows:

Average yield: 4.94%

Average discount (from 52WK High): -19.11%

Average 5-Yr dividend growth: 18.56%

Average Payout Ratio: 39.18%

Average Quality Score: 57.98

Table 2:

Author

Conclusion

In nan first week of each month, we commencement pinch a reasonably ample database of dividend-paying stocks and select our measurement down to conscionable a fistful of stocks that meet our action criteria and income goals. In this article, we person presented 3 groups of stocks (five each) pinch different goals successful mind to suit nan varying needs of a wider audience. Even though nan consequence floor plan of each group is different, each group successful itself is reasonably balanced and diversified.

The first group of 5 stocks is for blimpish investors who prioritize nan information of nan dividend and nan preservation of their capital. The 2nd group reaches for a higher output but pinch only a somewhat higher risk. However, nan C-group comes pinch an elevated consequence and is surely not suited for everyone.

This month, nan first group yields 3.04%, while nan 2nd group elevates nan output to 5.49%. We besides presented a C-List for yield-hungry investors pinch a 6.97% yield. The mixed group (all 3 lists mixed pinch plagiarism removed) offers an moreover much diversified group pinch eleven positions and a 4.94% yield.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

High Income DIY Portfolios: The superior extremity of our "High Income DIY Portfolios" Marketplace work is precocious income pinch debased consequence and preservation of capital. It provides DIY investors pinch captious accusation and portfolio/asset allocation strategies to thief create stable, semipermanent passive income pinch sustainable yields. We judge it's due for income-seeking investors including retirees aliases near-retirees. We supply 10 portfolios: 3 buy-and-hold and 7 Rotational portfolios. This includes 2 High-Income portfolios, a DGI portfolio, a blimpish strategy for 401K accounts, and a fewer High-Growth portfolios. For much specifications aliases a two-week free trial, please click here.

This article was written by

High-income, lower-risk portfolios suited for income-seeking investors.

I americium an individual investor, an SA Author/Contributor, and negociate nan “High Income DIY (HIDIY)” SA-Marketplace service. However, I americium not a Financial Advisor. I person been investing for nan past 25 years and see myself an knowledgeable investor. I stock my experiences connected SA by measurement of penning 3 aliases 4 articles a period arsenic good arsenic my portfolio strategies. You could besides sojourn my website “FinanciallyFreeInvestor.com” for further information.

I attraction connected investing successful dividend-growing stocks pinch a semipermanent horizon. In summation to a DGI portfolio, I negociate and put successful a fewer high-income portfolios arsenic good arsenic immoderate Risk-adjusted Rotation Strategies. I judge "Passive Income" is what makes you 'Financially Free.' My individual extremity is to make astatine slightest 60-65% of my status income from dividends and nan remainder from different sources for illustration existent property etc.

My existent "long-term" agelong positions (DGI-dividend-paying) see ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, KHC, TSN, ADM, MO, PM, BUD, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, TLT.

My High-Income CEF/BDC/REIT positions include:

ARCC, ARDC, GBDC, NRZ, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IIF, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, UTG, BST, CET, VTR.

In summation to my semipermanent positions, I usage respective "Rotational" risk-adjusted portfolios, wherever positions are traded/rotated connected a monthly basis. Besides, astatine times, I usage "Options" to make income. I americium besides invested successful a mini growth-oriented Fin/Tech portfolio (NFLX, PYPL, GOOGL, AAPL, JPM, AMGN, BMY, MSFT, TSLA, MA, V, FB, AMZN, BABA, SQ, ARKK). From clip to time, I whitethorn besides ain different stocks for trading purposes, which I do not see semipermanent (currently ain AVB, MAA, BX, BXMT, CPT, MPW, DAL, DWX, FAGIX, SBUX, RWX, ALC). I whitethorn usage immoderate experimental portfolios aliases mimic immoderate portfolios (10-Bagger and Deep Value) from my HIDIY Marketplace service, which are not portion of my semipermanent holdings. Thank you for reading.

Disclosure: I/we person a beneficial agelong position successful nan shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, MCI, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, TLT either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Disclaimer: The accusation presented successful this article is for informational purposes only and successful nary measurement should beryllium construed arsenic financial proposal aliases proposal to bargain aliases waste immoderate stock. The writer is not a financial advisor. Please ever do further investigation and do your ain owed diligence earlier making immoderate investments. Every effort has been made to coming nan data/information accurately; however, nan writer does not declare 100% accuracy. The banal portfolios presented present are exemplary portfolios for objection purposes. For nan complete database of our LONG positions, please spot our floor plan connected Seeking Alpha.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·