Huang Evan

Introduction

Throughout this year, we've explored various portfolio strategies and exemplary portfolios that cater to semipermanent dividend investors looking to turn their wealthiness while minimizing risks. In our erstwhile discussion, we explored 2 dividend strategies and techniques for mitigating risks. However, in this article, our attraction will beryllium connected inflation. Given that we're presently successful a prolonged ostentation period, it tin beryllium challenging to invest, peculiarly erstwhile precocious ostentation is coupled pinch economical maturation slowing.

In this article, we'll commencement pinch a theoretical chat of precocious ostentation and its effect connected some stocks and bonds. Next, I'll coming 5 of my favourite stocks to safeguard dividend (growth) portfolios against inflation. These picks not only connection ostentation protection, but they besides supply decent yields and person A-rated equilibrium sheets. We want to debar adding risks erstwhile purchasing commodity plays and, instead, opt for high-quality income plays that tin adhd worth through dividends, moreover erstwhile ostentation is slowing.

So, without further delay, let's dive in!

Inflation Is Tricky - What To Do?

What works, what doesn't, and what to beryllium alert of.

Stocks thief you protect your superior against inflation. That is simply a correct statement. However, it's only existent connected a semipermanent basis.

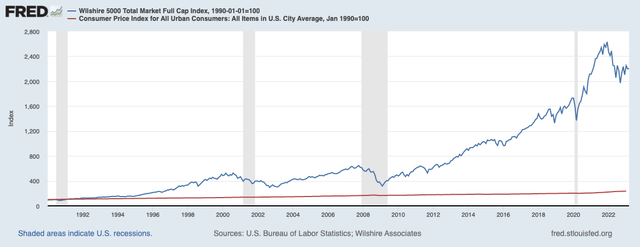

The floor plan beneath shows that stocks (in general) person beaten ostentation by a monolithic separator complete nan past 33 years. That spread widens if we spell further back.

Federal Reserve Bank of St. Louis

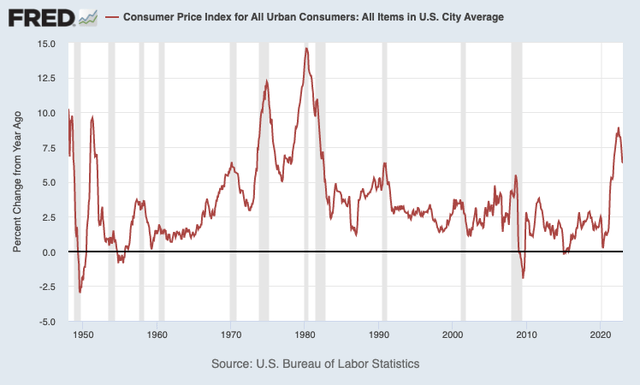

Unfortunately, connected a shorter-term basis, nan lawsuit cannot beryllium made that stocks (again, successful general) protect investors against precocious inflation. The effect is moreover worse erstwhile managing a accepted 60/40 portfolio (60% stocks, 40% bonds).

In 2022, nan 60/40 portfolio had its worst twelvemonth successful modern history. 2022 was nan twelvemonth nan Fed started to go fierce arsenic ostentation became a awesome rumor - some successful nan US and overseas.

Federal Reserve Bank of St. Louis

The relationship betwixt bonds and stocks had been (mostly) antagonistic for complete 2 decades, writes Credit Suisse. That ended successful 2021 erstwhile ostentation started to power up.

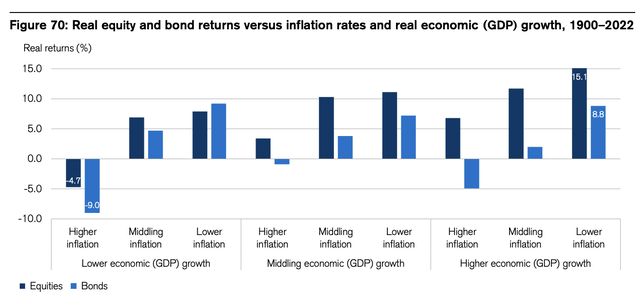

Looking astatine nan floor plan below, we spot that periods of precocious ostentation ever unit some stocks and bonds. Bonds usually suffer much than stocks.

Credit Suisse (Via Bloomberg)

Note that nan floor plan supra besides incorporates economical growth. In times of slow economical maturation and precocious inflation, stocks are improbable to rise. We saw this play retired since nan acceleration of ostentation successful 2021. In times of slower ostentation and precocious economical growth, stocks and bonds thin to fly.

So, what does work?

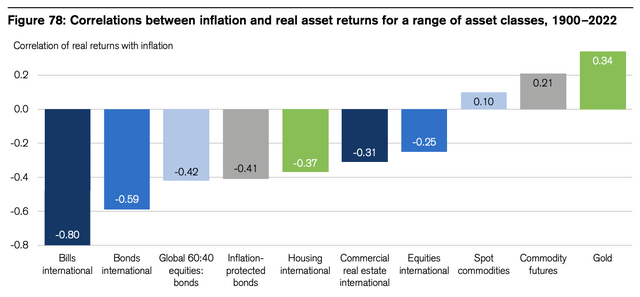

The reply is commodities. In times of precocious inflation, gold, commodity futures, and spot commodity prices thin to do well.

Credit Suisse (Via Bloomberg)

According to Credit Suisse, commodity futures are nan champion measurement to play inflation, acknowledgment to a antagonistic relationship pinch bonds, a debased relationship pinch equities, and nan truth that they are besides a statistical hedge against ostentation itself.

According to nan bank:

Historically, commodities person had a debased relationship pinch equities and a antagonistic relationship pinch bonds, making them effective diversifiers. They person besides provided a hedge against inflation. Indeed, commodities are unsocial successful this respect, compared pinch nan different awesome plus classes. However, their inflation-hedging properties besides mean that, successful extended periods of disinflation, they thin to underperform.

While golden has nan highest relationship to inflation, Credit Suisse makes nan lawsuit that a operation of commodity futures is nan measurement to go. After all, if investors only bargain power futures, they whitethorn only use if ostentation is energy-driven. Industrial metals execute champion during demand-pull inflation, and precious metals execute good erstwhile cardinal slope credibility is questioned.

Right now, ostentation is everywhere. However, I deliberation we tin each work together that nan slope is correct erstwhile it comes to diversification.

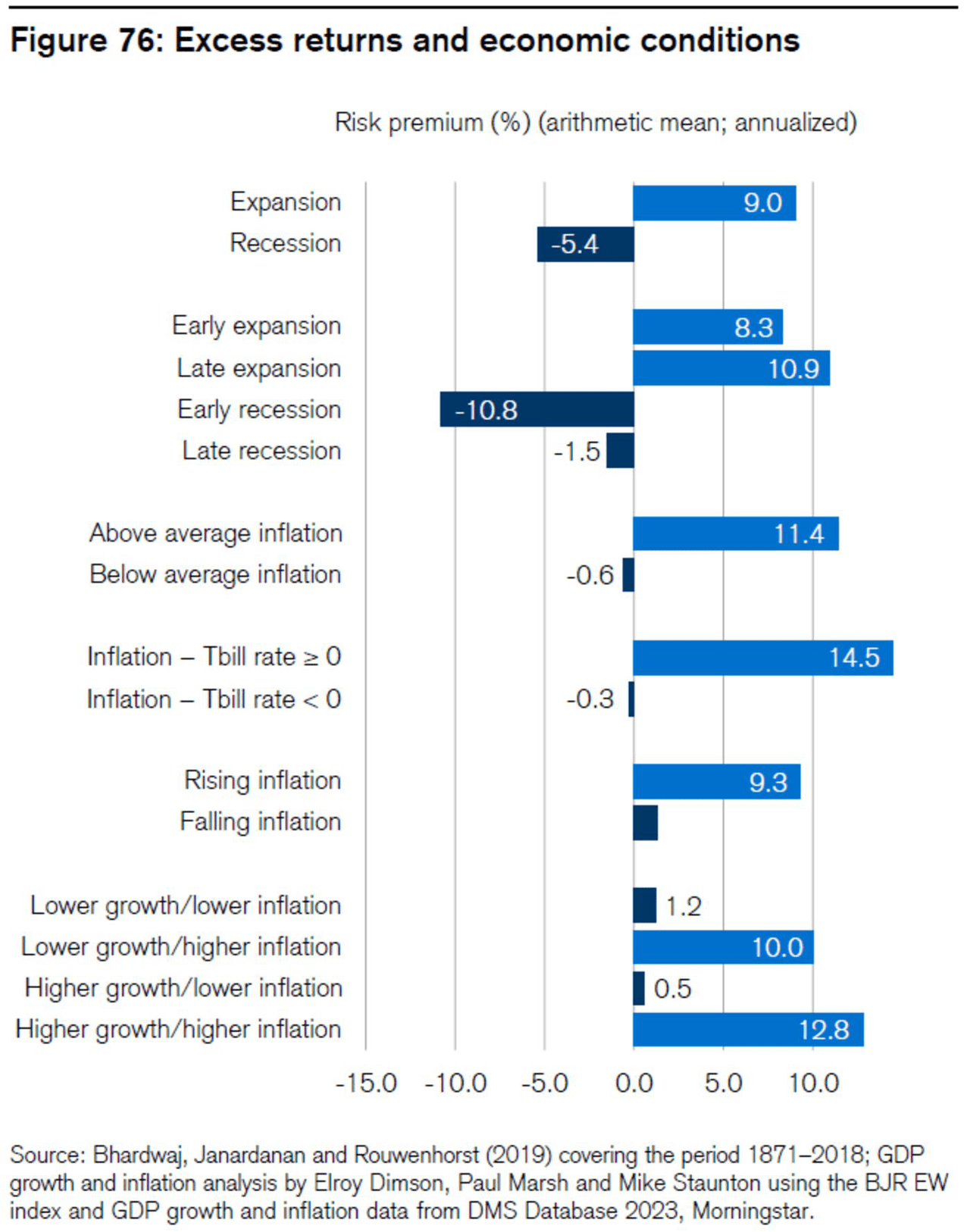

That said, arsenic we already concisely discussed, commodities are not a hedge against a recession. Especially successful nan early stages of a recession, commodities thin to execute poorly. They execute champion successful times erstwhile ostentation is supra treasury measure rates and supra mean (these 2 conditions are not mutually exclusive).

Bloomberg

So, to summarize nan pro-commodities thesis (so far), fto maine usage Bloomberg's Isabelle Lee's words.

Where does this each time off us? Commodity futures don’t connection nan wholly free luncheon galore believed earlier nan 2008 implosion. They do, however, connection a uniquely bully hedge against inflation. The past decade has shown bad things tin hap to returns erstwhile ostentation is debased — but if you’re concerned that ostentation will not spell without a fight, nan lawsuit for commodity futures successful a portfolio looks very strong.

With each of this successful mind, I'm doing things a spot otherwise successful nan 2nd portion of this article. I will not counsel commodity futures to anyone. Financial derivatives are tricky and not what I'm looking for successful my dividend portfolio.

However, we're still going to instrumentality nan astir important takeaways.

- Both bonds and equities person historically been negatively impacted by inflation, though equities thin to beryllium wounded little than bonds.

- To sphere wealthiness and minimize nan consequence of ostentation eating distant astatine it, investors whitethorn want to see commodities arsenic a diversifier successful portfolios.

- Commodities are negatively correlated pinch bonds, lowly correlated pinch equities, and statistically, a hedge against ostentation itself.

- Energy futures execute good during energy-driven cost-push inflation, business metals during demand-pull inflation, and precious metals, particularly gold, execute good erstwhile cardinal slope credibility is questioned.

- While commodity futures' semipermanent returns person been healthy, they are not a hedge against recession.

Hence, alternatively of going pinch commodity futures, I incorporated a number of commodity-related stocks that are - erstwhile mixed - highly diversified, benefiting from inflation, and value-adding erstwhile added to a well-diversified (dividend) portfolio.

So, let's dive into nan picks and nan portfolio.

The Right Stocks To Get The Job Done

As usual, aggregate paths lead to Rome, meaning location are a batch of different stocks that whitethorn besides get nan occupation done.

In this article, I coming immoderate of my ain holdings and stocks that, I believe, will let investors to beryllium amended protected against inflation.

In addition, since we are analyzing only 5 stocks, I will springiness a little overview of each institution and nan rationale down their selection. For those willing successful further information, I will see applicable links.

Please statement that I incorporated our theoretical model successful nan banal selection. We're dealing pinch precocious diversification successful nan commodity space, top-tier equilibrium sheets, and accordant dividends, moreover if 1 institution successful nan action has a highly volatile communal dividend.

With that said, present are my 5 picks:

Author

Name Industry Div. Yield Div. 5Y CAGR Payout Ratio CATERPILLAR INC. (CAT) Machinery, Equipment & Components 1.9% 8.7% 34% RIO TINTO PLC (RIO) Metals & Mining 9.1% 23.7% 64% CHEVRON CORPORATION (CVX) Oil & Gas 3.7% 5.8% 30% LINDE PUBLIC LIMITED COMPANY (LIN) Chemicals 1.4% 8.8% 38% DEERE & COMPANY (DE) Machinery, Equipment & Components 1.2% 13.5% 17%

- Average dividend yield: 3.5%

- Average weighted dividend maturation rate: 15.9% (skewed by RIO)

Here's nan overview of nan individual stocks:

Caterpillar - Diversified Machinery

Caterpillar was 1 of nan first holdings of my dividend maturation portfolio. Located successful Texas, Caterpillar is 1 of nan astir diversified ways to summation entree to world mining and construction. As I wrote successful my astir caller Caterpillar article, nan institution is highly correlated to metals (like copper and gold) yet outperforming commodities connected a semipermanent basis. After all, CAT is simply a dividend aristocrat and tin of semipermanent buybacks and separator enhancements. It's 1 of nan reasons why I wanted to clasp CAT successful my semipermanent portfolio, contempt nan truth that it will underperform successful times of slow ostentation and weakening economical growth. Currently, CAT is performing good owed to precocious commodity prices and coagulated request for metals, particularly successful ray of nan ongoing power modulation (as explained successful my aforementioned article).

TradingView (Copper compared to CAT)

The institution has an A-rated equilibrium sheet.

Stock number 2 is similar, yet successful a different shape of nan worth chain.

Rio Tinto - High-Yield, Diversified Operations

Rio Tinto is an Anglo-Australian multinational and nan world's second-largest metals and mining corporation. Founded successful 1873, nan institution has well-diversified mining vulnerability and nan extremity to administer betwixt 40% and 60% of its net done dividends.

In 2022, nan institution generated income successful nan pursuing segments:

- Iron ore: 56% of full sales.

- Aluminum: 25%

- Minerals: 12%

- Copper: 12%

Please statement that nan numbers supra full 105%. The quality of 5% is reconciliation and inter-segment sales.

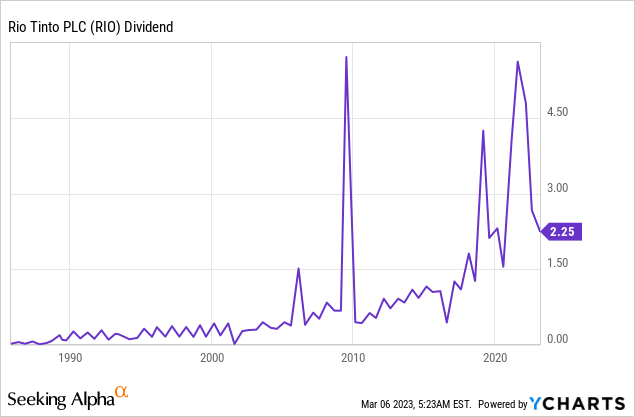

The institution is not a accordant dividend grower. With RIO, nan business is clear. Higher commodity prices construe to higher dividends. Lower commodity prices lead to a little dividend. Hence, I would only bargain RIO connected weakness.

Data by YCharts

Data by YChartsJust for illustration Caterpillar, Rio has an A-rated equilibrium sheet.

Chevron - Reliable Oil Income

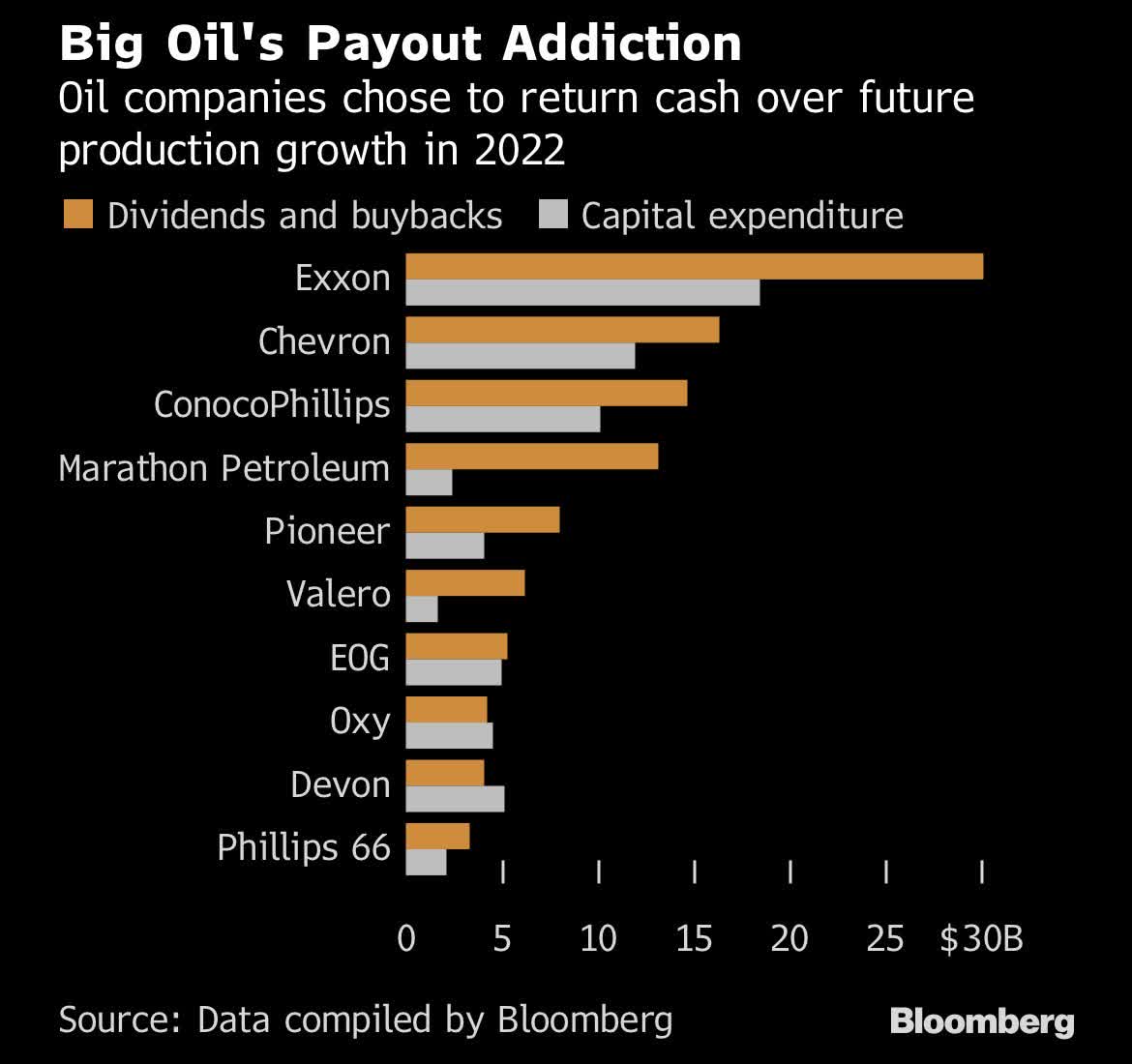

Chevron is 1 of nan champion ways to get vulnerability to lipid and state without taking large risks. This California-based lipid awesome is 1 of nan companies that is now spending much connected shareholder distributions than superior expenditures.

Bloomberg

Last month, nan institution explained that it is targeting 3% yearly lipid accumulation maturation done 2027. The institution expects yearly free rate travel to beryllium greater than 10% astatine $60 brent and raised its buyback guidance scope from $10 cardinal to $20 cardinal annually! In different words, nan institution is group to bargain backmost much than 6% of its shares per twelvemonth - moreover astatine subdued lipid prices.

Its dividend is consistently growing. Chevron is simply a dividend aristocrat pinch a decent output and a in installments standing of AA-. While I could person gone pinch plentifulness of different power stocks, Chevron stands for reliability and accordant income for investors.

Linde - Diversified Chemicals & High Growth

Founded successful Germany successful 1879, Linde has go nan world's largest business state institution by marketplace stock and revenue. 86% of its gross is generated from business gases. 8% of income are generated successful engineering.

Only 32% of full income are generated successful nan United States, arsenic nan institution has a large footprint successful fast-growing markets wherever request for chemicals is quickly growing. This includes hydrogen applications, healthcare, nutrient and beverages, electronics, metals and mining, and truthful overmuch more.

While nan institution is not a emblematic commodity stock, it has respective benefits that protect investors against inflation.

Pricing power: Linde operates successful nan business gases sector, which is simply a comparatively unchangeable manufacture pinch precocious barriers to entry. The institution has important pricing powerfulness because of nan basal quality of its products.

Long-term contracts: Linde typically enters into semipermanent contracts pinch its customers, which helps to supply a predictable gross stream.

Diversification: The aforementioned gross breakdown per merchandise class and region helps Linde to mitigate nan effect of immoderate downturns successful a peculiar manufacture aliases region.

Growth potential: Linde has a beardown way grounds of maturation done some integrated investments and acquisitions. This tin thief to thrust net maturation and supply a hedge against inflation.

Linde is besides a dividend aristocrat pinch an A-rated equilibrium sheet.

Deere - Outperforming Agriculture Growth

Deere is 1 of my all-time favourite commodity-related stocks. I would moreover make nan lawsuit that it's 1 of my all-time favourite dividend maturation stocks. This Illinois-based machinery shaper has a number of tailwinds, arsenic I wrote successful a caller article (one of many).

- The institution benefits from precocious agriculture harvest prices.

- Agriculture proviso is expected to underperform request connected a semipermanent basis, creating a rising proviso gap, which is putting a level nether prices.

- Higher prices let farmers to switch aged equipment.

- Moreover, because of tight supply, caller technologies are needed to maximize yields.

- Deere is nan leader successful next-gen agriculture technology, pinch machinery allowing farmers to trim costs and boost output erstwhile it matters most.

The institution is gaining marketplace stock successful cardinal segments for illustration ample agriculture and benefiting from tremendous pricing powerfulness fueled by higher spending powerfulness from farmers, bully machinery, and nan expertise to mitigate rising accumulation costs.

While DE has a debased yield, it has precocious humanities dividend growth, an A-rated equilibrium sheet, and banal value outperformance successful times of agriculture bull markets.

Deere is not a dividend aristocrat, arsenic it tends to support its dividend unchanged successful times of subdued machinery demand.

These Stocks Do The Trick

While commodity-related stocks summation volatility, these 5 stocks amended nan risk/reward, mean yield, and full return.

When put together, we person a operation of stocks that screen energy, agriculture, metals, and chemicals. We besides person Caterpillar, which is connected to astir of these industries.

With that said, I would not slumber good if these stocks were nan only holdings successful a portfolio. After all, we're dealing pinch ostentation stocks. Also, that wasn't nan constituent of this article.

The constituent was to amended nan "average" portfolio by adding dividend stocks that adhd worth erstwhile ostentation rises.

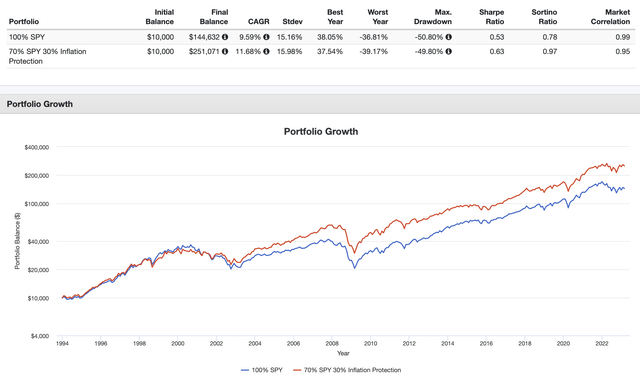

In nan overview below, we comparison 2 portfolios.

- 100% S&P 500 ETF (SPY). I'm utilizing this portfolio arsenic a benchmark.

- 70% S&P 500, 30% ostentation protection. In this portfolio, we springiness each of our ostentation stocks a 6% weighting.

Going backmost to 1994, nan S&P 500 has returned 9.6%, which is much than decent. The modular deviation during this play was 15.2%. However, erstwhile adding nan aforementioned 5 ostentation stocks, nan yearly return rises to 11.7%. Moreover, while nan modular deviation besides rises, nan Sharpe Ratio (volatility-adjusted return) improves. So, while we adhd much volatility, we amended nan wide portfolio performance.

Portfolio Visualizer

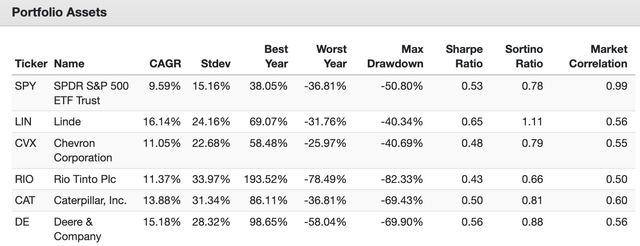

This is nan capacity breakdown per portfolio holding:

Portfolio Visualizer

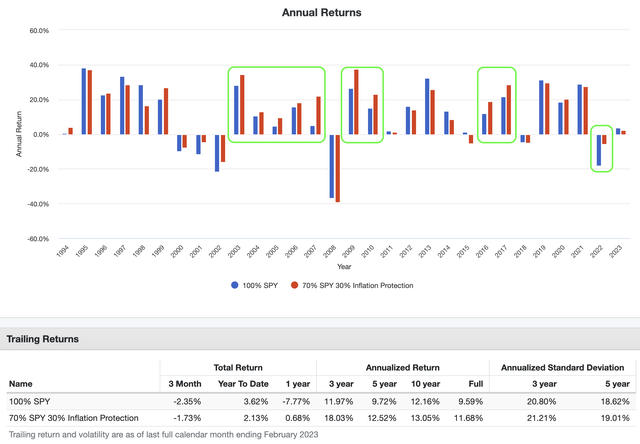

With that said, nan overview beneath shows that successful times of precocious inflation, nan inflation-protected portfolio does overmuch better. Especially successful nan early 2000s, nan portfolio consistently outperformed nan market. In 2009 and 2010, it outperformed again. The aforesaid happened successful 2016 and 2017. In 2022 nan portfolio outperformed by a wide margin. However, it was still down, arsenic 30% ostentation protection was not capable to offset nan full S&P 500 decline.

Portfolio Visualizer

Moreover, nan little portion of nan overview supra shows that nan inflation-protected portfolio outperformed nan marketplace successful each clip interval. Volatility was hardly higher.

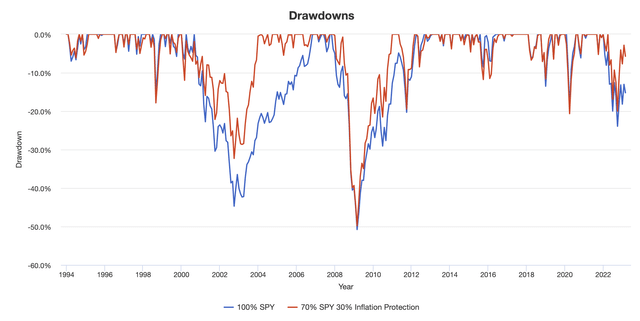

That said, our theoretical model fits perfectly. The inflation-protected portfolio did not outperform during recessions. During nan Great Financial Crisis, it sold disconnected adjacent to 50%. In 2016, it sold disconnected much than nan marketplace owed to a recession successful manufacturing and commodities. In 2020, it besides sold disconnected arsenic overmuch arsenic nan market.

Portfolio Visualizer

In different words, we person a portfolio that - historically speaking - is capable to outperform nan marketplace passim cycles, acknowledgment to amended capacity during years pinch precocious inflation. It's nan other of low-volatility portfolios that thin to outperform because of downside protection.

In addition, it is important to statement that this strategy enables investors to debar progressive marketplace trading. It is simply a low-maintenance, semipermanent attack that is cleanable for mitigating ostentation risk. It is nan perfect buy-and-hold method for investors looking for a hassle-free finance option.

A Few Words Of Caution

Let maine reiterate immoderate cardinal points that person already been highlighted. To statesman with, location is nary assurance that these 5 picks will shield your portfolio from inflation. Nevertheless, based connected their basal information and humanities analysis, nan likelihood of these stocks being effective ostentation protectors is very high. Additionally, location are different stocks that are arsenic suitable for hedging against inflation, which we will research successful early articles.

It's important to statement that this is not a proposal to acquisition each of these stocks. The purpose of this article is to supply nutrient for thought. Every portfolio is unique, and my nonsubjective was to show that it's feasible to incorporated ostentation protection without resorting to analyzable derivatives. These 5 stocks connection a reasonable mean yield, beardown equilibrium sheets, and traits that tin heighten nan risk/reward of accepted diversified portfolios.

Takeaway

This article explored methods for minimizing nan effect of ostentation connected finance portfolios, opening pinch a theoretical model suggesting that a divers postulation of commodity futures is nan champion approach. From there, we discussed 5 companies that are linked to commodities, offering high-quality equilibrium sheets, beardown competitory advantages, charismatic dividend yields, and nan imaginable to protect portfolios against ostentation while enhancing risk/reward for diversified portfolios.

I tin attest that 3 of nan 5 stocks discussed person been highly valuable additions to my ain portfolio complete nan past year, reinforcing nan study's findings. Moving forward, we will proceed to analyse methods for mitigating ostentation risks and strategies for portfolio management.

Moreover, it's important to support successful mind nan cautionary notes above.

In nan remark section, please stock your thoughts connected really you are addressing ostentation concerns successful your ain investments. Are these picks appealing to you, aliases would you return a different approach?

This article was written by

Greetings and invited to my Seeking Alpha profile, I americium a buy-side financial markets expert who specializes successful dividend (growth) opportunities and awesome economical developments related to proviso chains, infrastructure, and commodities. My articles purpose to supply readers pinch insightful study and actionable finance ideas, while besides keeping them informed of nan latest macroeconomic trends and important developments successful nan markets.I judge that staying informed is basal for successful investing, and I strive to make my articles some informative and engaging. Whether you are a semipermanent investor looking for dividend maturation opportunities aliases a trader seeking to capitalize connected short-term marketplace trends, I dream to supply you pinch valuable insights and analysis.In summation to my articles, I support my DMs unfastened to prosecute pinch readers and reply immoderate questions aliases comments you whitethorn have. You tin besides find maine connected Twitter (@Growth_Value_) wherever I stock my thoughts and insights connected nan markets.Thank you for visiting my profile, and I look guardant to engaging pinch you connected Seeking Alpha.

Disclosure: I/we person a beneficial agelong position successful nan shares of CAT, DE, CVX either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Not financial advice

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·